- 46% of office properties sold in 2025 so far have traded at a discount, up from 20% in 2021, driven by persistent vacancies and interest rate pressure.

- Premium office buildings in urban cores are seeing the steepest drops, with over 70% of A-rated assets selling below prior valuations.

- Top markets for discounted sales include Houston, San Francisco, Manhattan, and Washington, DC—all experiencing above 60% discounted sales rates.

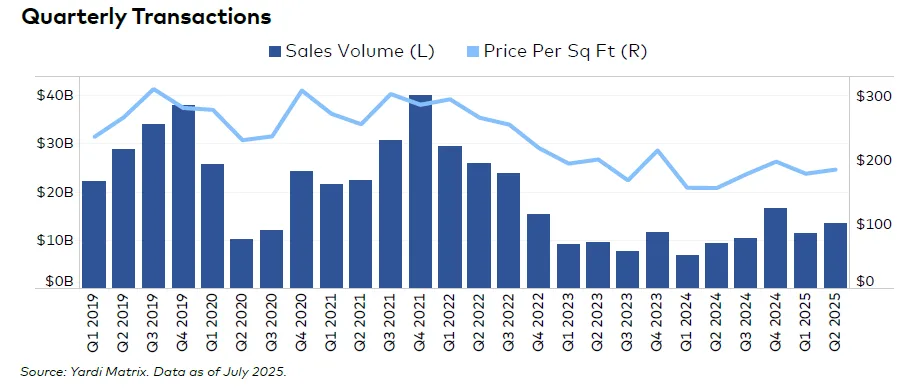

With interest rates holding firm and office demand still under strain, US office properties are trading at increasing discounts, reports yardi matrix. According to an August 2025 report, 46% of all office transactions this year have closed at a lower price than their previous sale. This marks a significant increase from just 20% in 2021.

A Sharp Turn In Valuations

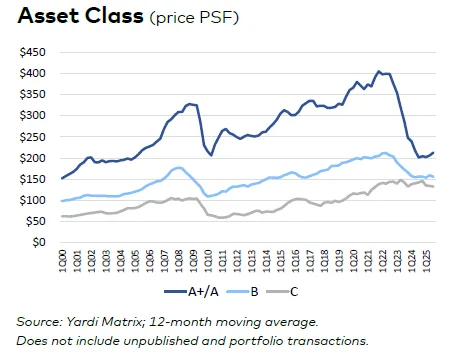

Among more than 3,200 office buildings tracked with prior sales history, 42% have sold for less than their previous purchase price since 2023. High-end properties are being hit the hardest. About 71% of A or A+ buildings have sold at a discount. In comparison, only 38% of B-rated and 19% of C-rated buildings traded below previous values.

In urban markets, central business districts (CBDs) have taken the biggest hit. Since 2023, 70% of cbd office assets have sold below previous valuations. Chicago saw a dramatic example in June when 311 S. Wacker Drive sold for just $45M—an 85% drop from its $302M purchase in 2014.

Suburbs Outperform Urban Cores

While urban cores continue to face the brunt of remote work and hybrid trends, suburban offices have proven more resilient. Only 39% of suburban buildings sold at a discount, with select metros like Charlotte maintaining stronger fundamentals.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

A Market In Transition

Without a rate cut and with loan maturities peaking, distressed sales may intensify. Lenders are growing wary of extending underperforming loans, putting further downward pressure on valuations. This distressed cycle is also creating entry points for investors focused on conversions and value-add strategies.

Why It Matters

The discount trend underscores a market recalibration. With physical office utilization still trailing pre-pandemic norms and high vacancies locking in, the office sector may be on a prolonged trajectory of repricing. Investors with capital on the sidelines may see this as a pivotal moment to acquire prime assets at distressed values.

What’s Next

Expect continued discounting across US markets, especially in A-class and CBD properties. As lenders pull back and leasing demand struggles to rebound, prices may have further to fall—especially in top-tier markets like Manhattan and San Francisco.