- CRE lending rebounded in H1 2025, with loan volumes up across most lender types and market-average LTVs rising to 64.4%, driven by aggressive investor-driven and national bank activity.rn

- $300B in loans are set to mature in H2 2025, with apartments and offices facing the greatest refinancing risk—especially those originated during the 2021–22 low-rate window.rn

- Leverage is losing its impact as higher borrowing costs erode the return boost it once provided, shifting the focus toward asset-level performance.rn

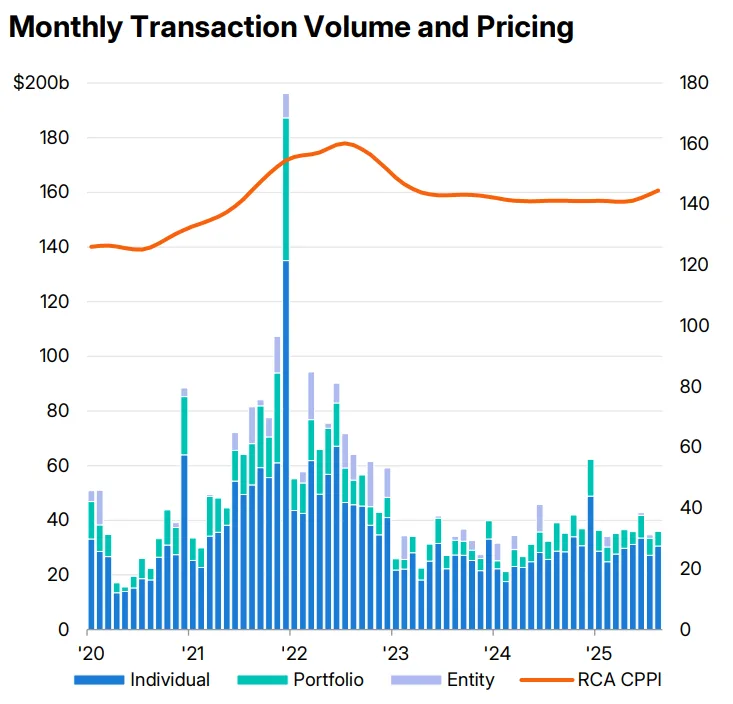

- Individual asset sales rose 6% in August, signaling resilient investor interest despite overall transaction volume being down 8% year-over-year.rnrnrn

Lending Market Rebounds, Led by Aggressive Lenders

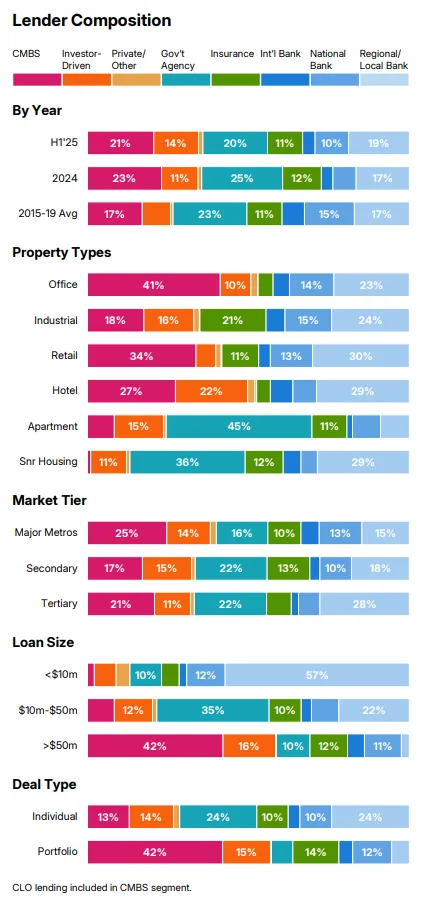

According to MSCI’s report, commercial property debt markets showed signs of strength in the first half of 2025. Market-wide average LTVs rose to 64.4%, up 170 basis points from a year ago. National banks nearly doubled their lending volume YOY without raising LTVs, while investor-driven lenders offered the highest leverage in the market (68.6%), pushing deeper into the apartment and industrial sectors.

Banks reclaimed 33% of overall market share, up from 27% in 2024, as national and regional banks re-entered the space. Government agencies and CMBS lenders both lost market share amid increased private capital activity.

Maturing Loans Pose Refinancing Risk, Especially for Multifamily and Office

Roughly $300B in CRE loans are due in the second half of 2025. An additional $600B appears to have been extended past original maturity dates. Multifamily assets account for 35% of upcoming maturities, with 60% tied to low-interest 2021–22 originations, raising the likelihood of refinancing challenges.

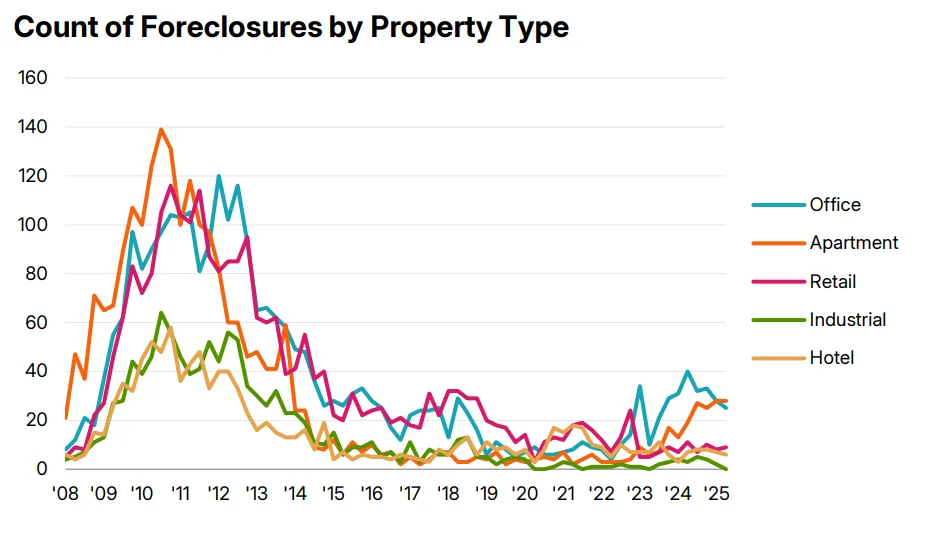

Office loans are disproportionately represented in the pool of extended debt, suggesting lingering stress in the sector. Banks—especially regional and local ones—hold the largest share of both upcoming maturities and likely extensions.

Price Growth Holds, But Leverage Benefits Diminish

Prices, as tracked by the rca cppi, rose 2.4% YOY in August 2025, with a 9.7% annualized growth rate over the past three months. However, the benefit of leverage has sharply declined: leveraged apartment returns have dropped to just 4% in 2025, nearly mirroring unleveraged gains.

This marks a major shift from the early 2020s, when cheap debt amplified price appreciation. Rising mortgage rates have eroded the spread between borrowing costs and asset performance, undermining the traditional value proposition of leverage.

Construction Lending Remains Below Pre-Pandemic Norms

Investor-driven lenders continued to lead construction financing, accounting for 30% of originations in H1 2025. Their presence was even higher in large loans and major metros. National banks regained some ground, while regional banks continued to pull back. Construction starts remained muted: new apartment deliveries fell 5% and office starts were down nearly 20% YOY.

Cross-Border Lenders Play Bigger Role in High-Value Deals

Foreign lenders increased their share of CRE financing in the US, especially for institutional-grade assets. In H1 2025, foreign lenders accounted for 18% of conventional loans, with average loan sizes of $25M —nearly double the domestic average. Canada remained the top source, followed by Germany, Japan, and the U.K.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Why It Matters

CRE debt markets are no longer solely driven by cheap capital. With leverage offering diminishing returns, investor focus is shifting toward asset fundamentals and operational performance. Still, rising origination volumes and foreign lender engagement suggest that capital is available—just on tighter, more cautious terms.

What to Watch

- Refinancing Pressure: With $900B+ in combined scheduled and extended maturities, the second half of 2025 will test liquidity—particularly in office and apartment sectors.

- Cap Rate Stability: With cap rates now exceeding mortgage rates in many cases, positive leverage could return—but interest rate direction remains critical.

- Distress Pipeline: Apartment and office foreclosures are trending higher; watch for potential upticks in forced sales.

- Lender Shifts: Expect further competition between investor-driven lenders and banks, particularly in construction and value-add loans.