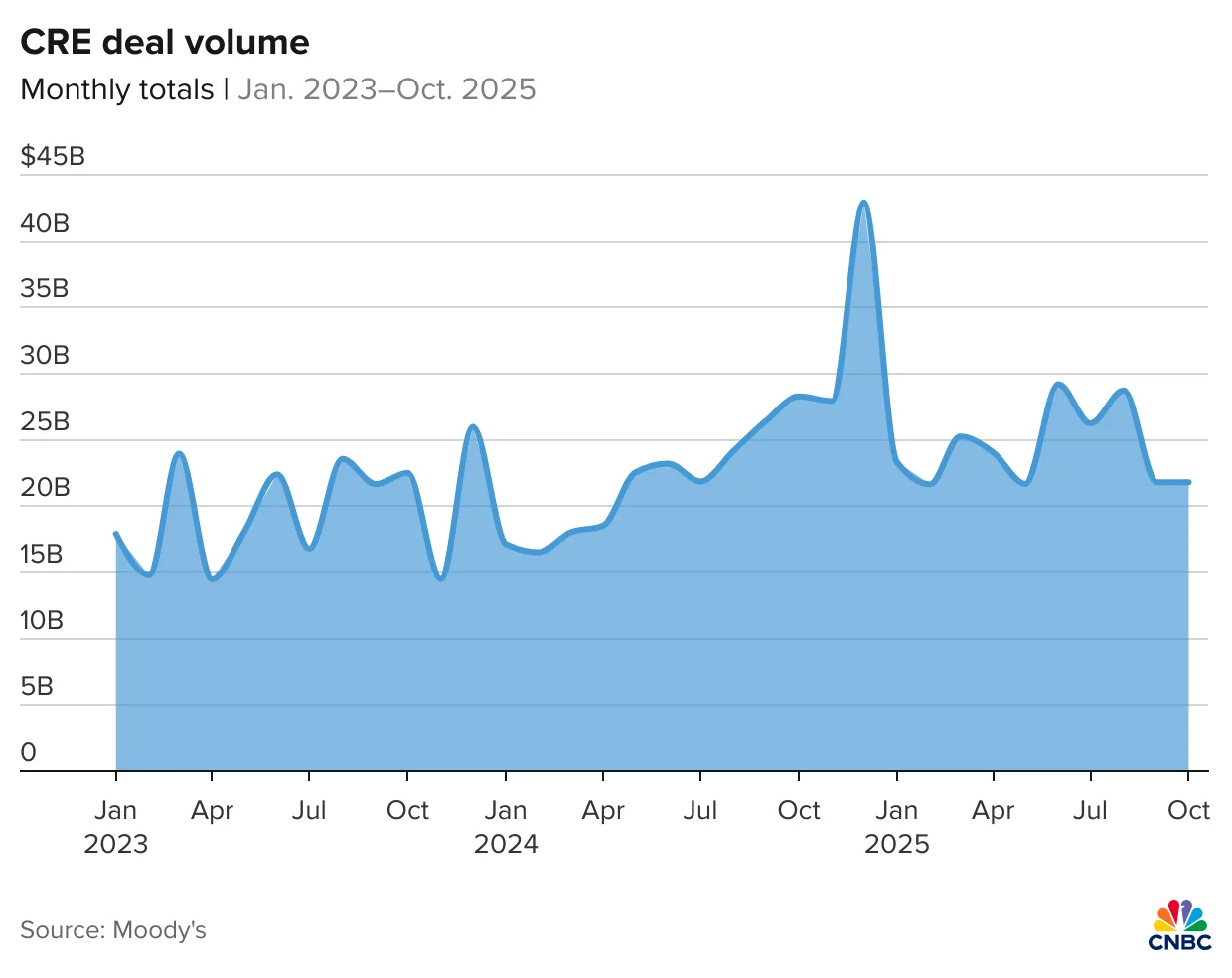

- October’s CRE deal volume fell year-over-year for the first time since early 2024, signaling a slowdown after months of recovery from pandemic-era lows.

- Persistent high interest rates and market uncertainty have caused a standoff between buyers and sellers, stretching the U-shaped recovery.

- Despite the slowdown, October still saw $24.4B in sales, with industrial, hotel, and multifamily deals leading activity.

Momentum Stalls After Strong Recovery

After building momentum throughout 2024, the CRE market hit a speed bump in October. According to Moody’s data provided exclusively to CNBC’s Property Play, transaction volume turned negative year-over-year for the first time in nearly two years. Analysts attribute the decline to market uncertainty and a stalemate between buyers and sellers, fueled by high interest rates and mixed economic signals.

October in Focus

Total transaction volume in October hit $24.4B —about 70% of the sector’s 2019 levels. While 2025 deal totals remain ahead of 2024’s, growth has clearly decelerated.

The multifamily sector led the pullback, with volume down 27% from a year ago, despite recent months showing strong, above-pre-COVID activity. Office, meanwhile, continued its uneven path to recovery, with recent sales data offering a mixed picture of demand and investor strategy. Conversely, the hotel sector stood out as the only asset class to post positive growth in October, up 6% after a slow third quarter.

High-Profile Deals

Notable transactions included the $231.2M sale of the New York Edition Hotel at 5 Madison Avenue, purchased by Kam Sang Company from the Abu Dhabi Investment Authority. Originally known as the MetLife Clock Tower, the property was once the tallest building in the world and has transitioned from an office building to a luxury hotel—part of a broader trend in adaptive reuse.

The top deal in October was the sale of Sotheby’s headquarters to Weill Cornell, likely for conversion to healthcare use. Meanwhile, New York Life acquired a distressed Manhattan office asset at nearly a 50% discount from its 2015 valuation, highlighting both ongoing distress in the office market and institutional interest at the right price.

Outlook

While the fundamentals for select CRE sectors remain intact, the market is showing signs of fatigue as it wrestles with high borrowing costs and uncertain policy direction. Still, strategic buyers—particularly those with long-term outlooks—are active in identifying discounted opportunities, especially in distressed office and hospitality assets.

CRE investors should expect continued volatility heading into 2026, with deal activity likely concentrated in opportunistic and adaptive reuse plays.

What’s Next

The coming months will test the resilience of CRE markets as the Federal Reserve’s interest rate path and broader economic outlook remain unclear. Adaptive reuse, especially in office-to-hotel or residential conversions, is expected to remain a key strategy in navigating the evolving landscape.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes