- DC capital in private real estate reached $45.3B at the end of 2024. That includes $37.5B in dedicated DC vehicles and $7.8B in institutional open-end funds.

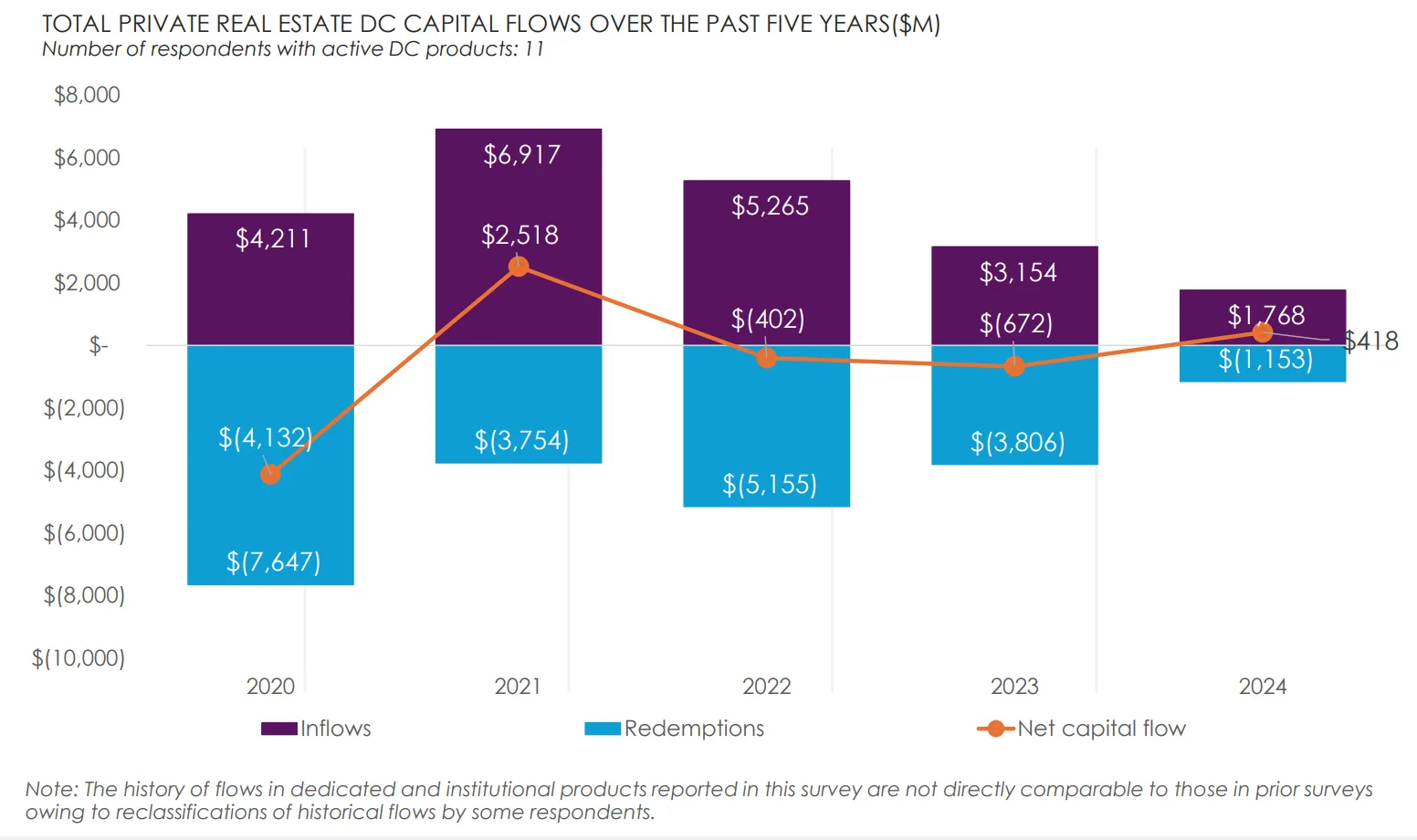

- Inflows totaled $1.8B but were largely offset by $1.2B in redemptions.

- In 2024, 88% of DC inflows went into dedicated vehicles, continuing a strong five-year trend.

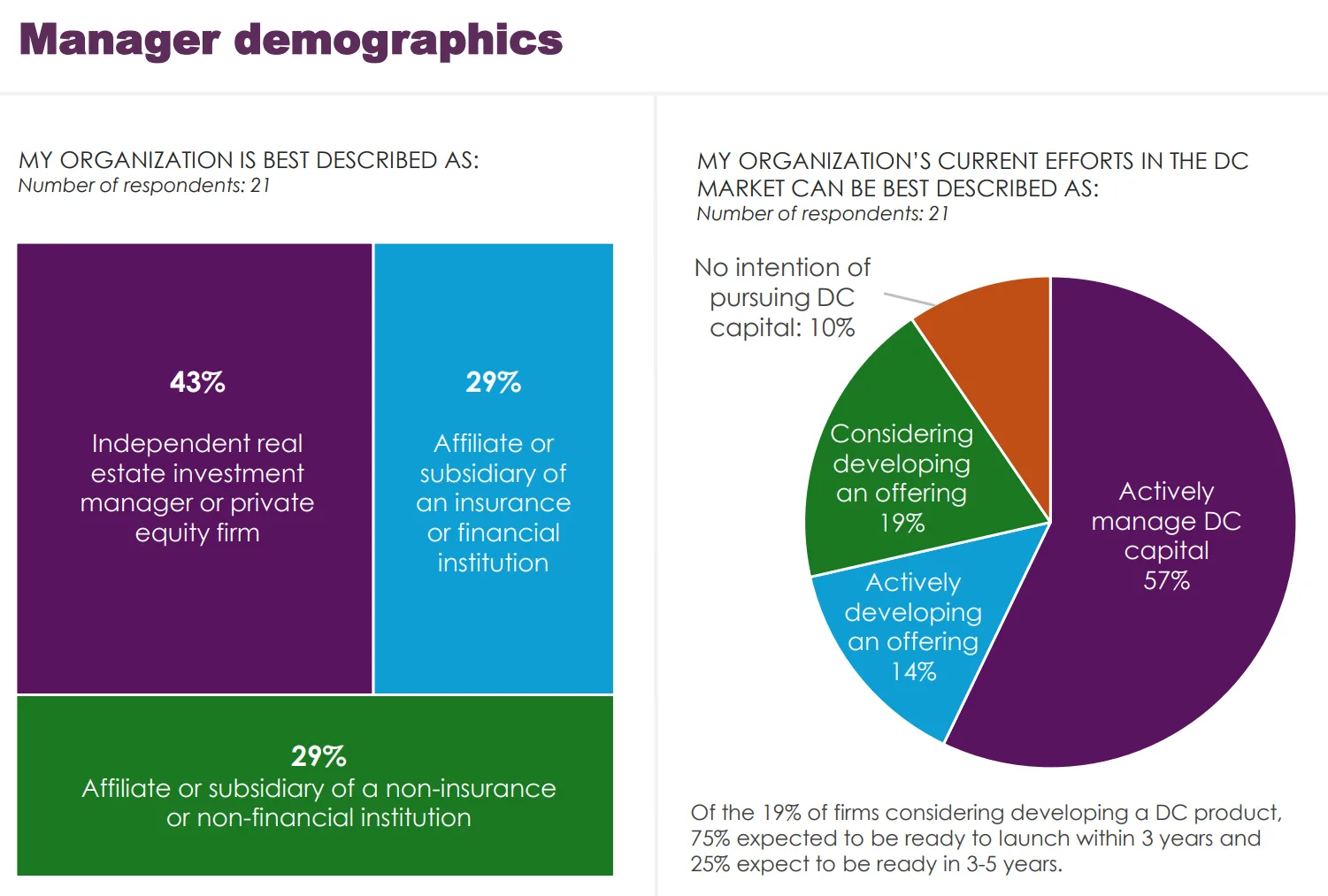

- Most firms had fewer than two DC-dedicated professionals. Just 27% plan to grow headcount in 2025.

DC Capital’s Real Estate Footprint Expands

Defined contribution capital is playing a larger role in private real estate. As of December 2024, DC assets in the space totaled $45.3B. The figures come from the Private Real Estate in Defined Contribution Survey 2025, a report published in partnership with DCREC, NAREIM, NCREIF, and PREA.

Now in its fifth year, the survey captures how managers raise capital, structure products, and build internal teams for DC strategies.

Net Flows Slowed in 2024

Although total AUM rose, net flows slowed in 2024. New capital totaled $1.8B, down from $3.2B in 2023. Redemptions were $1.2B, resulting in only modest growth.

Most of that new capital—88%—went into dedicated DC real estate vehicles. Just 12% flowed into DC capital within institutional open-end funds. Retail fund activity remained negligible.

New Investor Activity Picked Up

Managers saw more first-time DC clients in 2024. New investors accounted for 13.6% of total DC inflows, a sharp rise from 0.2% in 2023. Most of that capital entered dedicated DC vehicles.

Liquidity and Structure Continue to Evolve

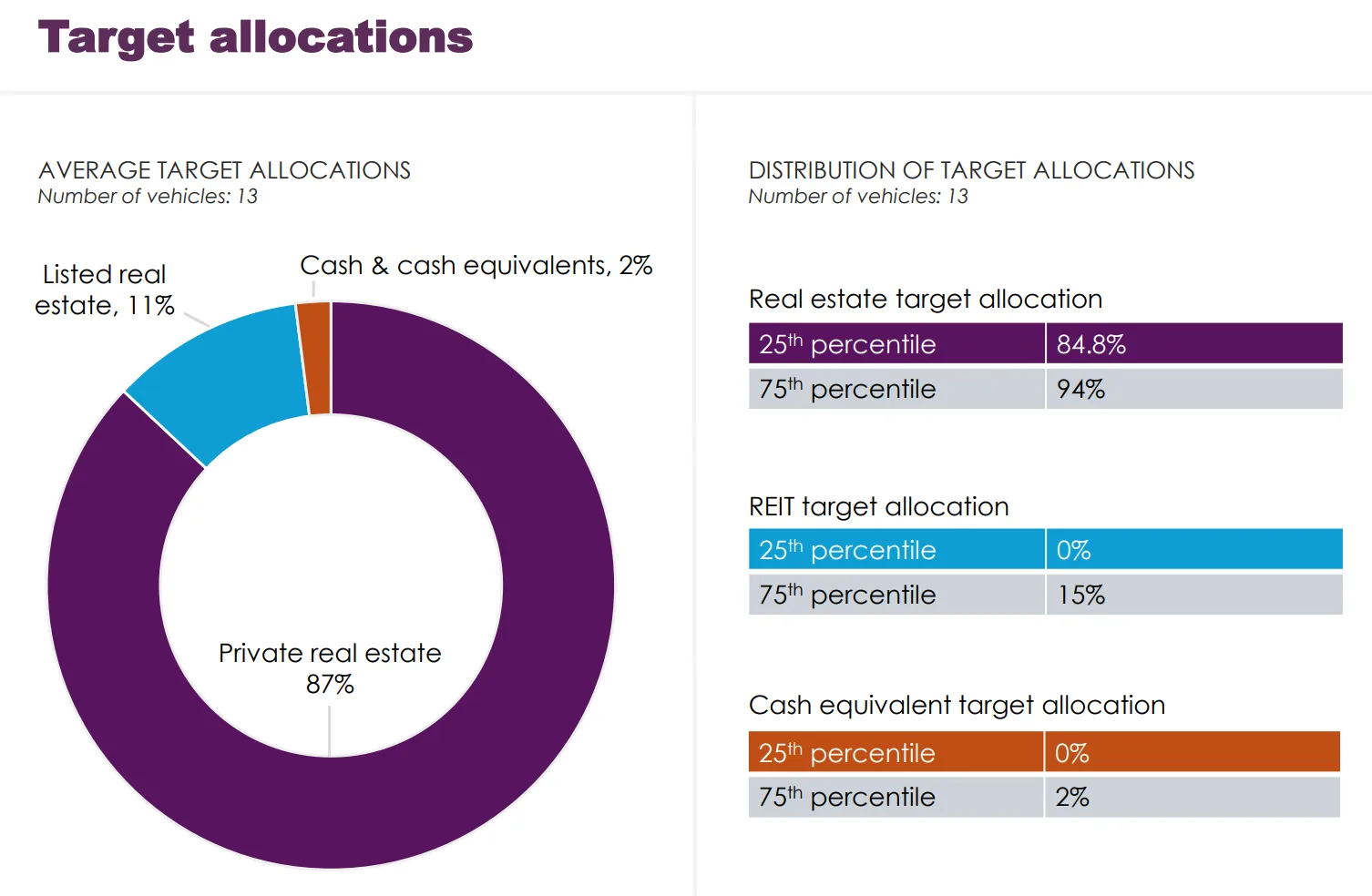

Product structure plays a growing role in DC success. Most inflows went to dedicated DC vehicles, which are now the preferred option. Roughly 67% of those vehicles impose a liquidity cap, with a 10% quarterly average.

Asset allocations continue to skew toward private real estate. On average, vehicles allocated 87% to private real estate, 11% to listed REITs, and 2% to cash.

DC Staffing Is Still Limited

Despite asset growth, firms remain under-resourced on the DC side. The median number of dedicated DC professionals is just 1.2 per firm. Only 27% plan to hire more in 2025, with each adding just one new staffer.

About half of DC professionals come from real estate backgrounds. Just 30% have prior DC-specific experience.

Why It Matters: DC Plans Are Driving Private Real Estate Growth

Defined contribution plans are no longer a fringe source of capital for private real estate. With $45B in assets and a clear preference for dedicated structures, the market is maturing. But inflows have slowed, suggesting managers must shift their focus.

To stay competitive, firms may need to improve client service, develop more flexible products, and build stronger internal teams.

What’s Next: Building for Scale and Differentiation

Future success will depend on how well managers scale operations and differentiate offerings. Liquidity, transparency, and investor education will be key. Regulatory clarity could also accelerate growth in the DC real estate market.

As capital flows stabilize, product performance and operational readiness will become primary differentiators.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes