- Data scientists are the fastest-growing office occupation in the US, with a 551% increase in workers since 2019.

- Retail salespeople remain the most common office-related role, employing nearly 3.3M people despite low average pay.

- Labor relations specialists saw the highest salary growth (45%) from 2019 to 2024, reflecting rising demand for workplace dispute expertise.

- Roles like insurance appraisers and computer programmers are declining due to automation and outsourcing.

The Rise Of Data-Driven Roles In A Post-Pandemic Workforce

The American office landscape is undergoing a major transformation, as reported by Yardi Kube. This shift is driven by a post-pandemic reassessment of workplace needs, rapid technological disruption, and evolving worker preferences. Traditional occupations like retail sales and operations management still make up a large portion of the workforce. However, the fastest growth is now happening in high-skill, tech-enabled roles.

Leading the pack are data scientists, who saw a 551% increase in employment from 2019 to 2024, according to the latest labor market data. This rapid growth reflects how businesses, governments, and healthcare institutions have embraced data analytics as a core function.

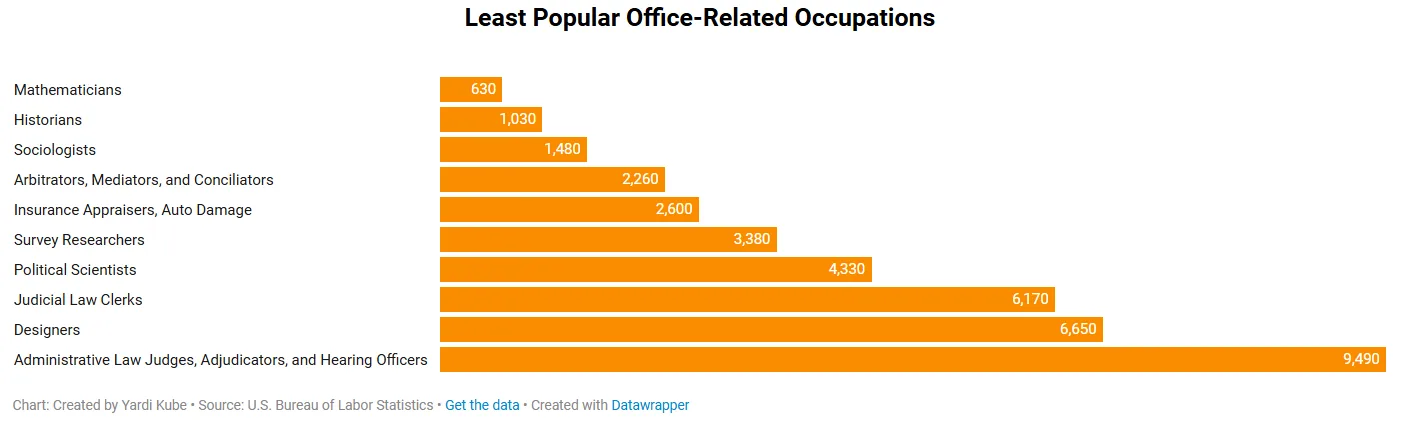

Most Common And Least Common Office Occupations

Despite the boom in data-centric roles, retail salespeople still dominate in terms of raw numbers, with nearly 3.3M workers. They’re followed closely by general and operations managers (~3M), project management specialists (1.8M), and software developers (1.5M).

At the other end of the spectrum, mathematicians remain the smallest office-based occupation, with only 630 workers nationwide. Other rare roles include historians (1,030), sociologists (1,480), and insurance appraisers (2,600) — all of which are highly specialized and less in demand at scale.

Which Roles Are Shrinking?

Not every office job is growing. In fact, some roles are shrinking rapidly. Insurance appraisers for auto damage saw a 66% decrease, driven by automation in claims processing. Computer programmers also declined by 40%, largely due to outsourcing and the rise of low-code platforms.

Other declining roles include survey researchers (-31%), advertising sales agents, and statisticians — all facing pressures from digital disruption or industry consolidation.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

The Income Landscape

In terms of pay, chief executives far outpace all other office workers, earning $243,147 on average. They’re followed by architectural/engineering managers ($158,556), IT managers ($153,503), and financial managers ($149,438).

Conversely, the lowest-paid office roles include:

- Retail salespeople – $35,498

- Travel agents – $50,015

- Tax preparers – $54,037

While critical to certain sectors, these jobs often lack the specialized technical skills that command higher salaries.

Wage Growth Leaders

Over the last five years, labor relations specialists have seen the biggest salary increase, up 45%. This growth is likely due to rising union activity, more frequent labor disputes, and a renewed focus on equitable workplace practices. Meanwhile, postsecondary education administrators saw only a 5.2% income bump, signaling stagnation in the academic sector amid budget cuts and declining enrollment.

Regional Trends: Data Science Boom is Nationwide

From Boston to Los Angeles, Chicago to Dallas, data scientists are now the fastest-growing occupation in nearly every major metro. Here are a few standouts:

- Boston, MA: 1,487% growth, now employing 8,250 data scientists

- Los Angeles, CA: 945% growth, 10,030 data scientists — the highest in the West

- Dallas, TX: 992% growth, 8,630 data scientists

- Chicago, IL: 369% growth, 7,370 data scientists

Supporting roles in logistics, social services, and media also saw gains, but none matched the pace or scale of data-related positions.

Why It Matters

These trends paint a clear picture: the US office workforce is tilting hard toward technology, analytics, and strategic management. Roles requiring repetitive or easily automated tasks — like insurance appraisal or basic programming — are losing ground. Meanwhile, adaptable, high-skill professionals are in growing demand, and employers are paying a premium for them.

What’s Next

With technology continuing to reshape industries, reskilling and upskilling will be vital to navigating the future of work. Policymakers and business leaders will need to support this shift through training, education, and equitable job creation.

While not all office jobs can (or should) be tech roles, the data makes one thing clear: in a post-pandemic economy, data fluency is becoming the new business literacy.