- Data center investment accounted for 92% of GDP growth in the first half of 2025, despite representing just 4% of total US GDP, according to Harvard economist Jason Furman.

- Without tech infrastructure investment, annualized GDP growth would have been just 0.1%, suggesting a near-stagnant economy outside the AI boom.rn

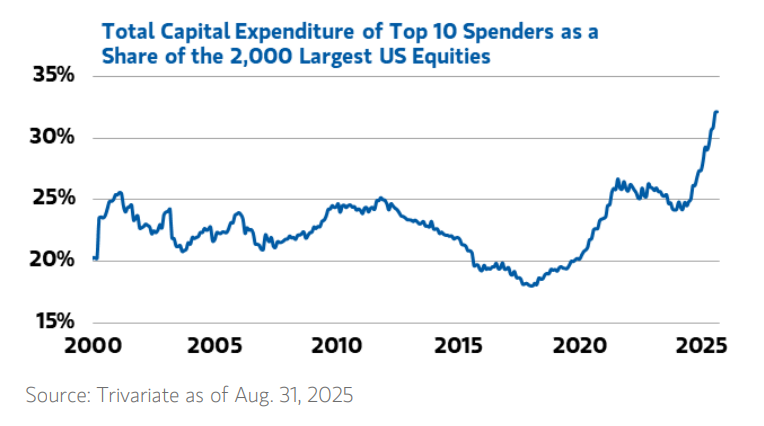

- “Hyperscaler” capital spending is nearing $400B annually, led by tech giants like Amazon, Google, Microsoft, Meta, and Nvidia, dramatically skewing the overall economic picture.

- Other sectors such as manufacturing, real estate, and retail saw weak or negative contributions, raising concerns about the sustainability of tech-led growth.

The AI Boom’s Outsized Economic Role

According to Furman’s analysis, GDP growth in the first half of 2025 was driven almost entirely by investment in information processing equipment and software. This spending was largely tied to the rapid expansion of AI infrastructure and data centers, reports Fortune. While these tech sectors only made up 4% of total GDP, they contributed a staggering 92% of growth.

Absent this investment, Furman estimates GDP growth would have hovered around 0.1% on an annualized basis—barely above zero.

Furman notes that without the AI boom, lower interest rates and energy costs might have provided a modest boost to other sectors. Still, the core message is clear. The US economy is becoming increasingly reliant on high-tech infrastructure.

$400B Annual Spending By Tech Giants

Tech firms—especially the so-called “hyperscalers”—are at the center of this economic shift. Microsoft, Amazon, Meta, Google, and Nvidia are collectively spending tens of billions to expand and modernize their data center footprints to meet exploding AI demand.

Lisa Shallet, CIO at Morgan Stanley Wealth Management, highlighted that hyperscaler capex has quadrupled in recent years, nearing $400B annually. She estimates that data-center-related investment is now adding 100 basis points (1 percentage point) to US GDP growth.

Other Sectors Lag Behind

Despite strong headline GDP numbers, other areas of the economy are showing signs of weakness. Manufacturing, retail, and real estate have either stalled or declined. Job creation has also slowed. Without the surge in tech spending, economists suggest the US economy might have slipped into a mild recession.

Some experts, including Morgan Stanley Chief Economist Michael Gapen, argue that productivity gains have helped cushion the economy. Corporations have also absorbed rising costs, which has helped offset broader macroeconomic challenges. However, this doesn’t negate the growing dependence on tech infrastructure to sustain growth.

Is It A Bubble—Or A Foundation?

While the data center boom is fueling optimism, concerns are rising over whether this is a sustainable trend or the beginning of an “industrial bubble.” Even Amazon founder Jeff Bezos has described the AI infrastructure wave as such—though he believes the long-term benefits of this computing power will be enormous.

For now, the data is clear: without AI infrastructure, 2025’s economy would look drastically different. Whether it’s a one-off surge or a new economic foundation remains to be seen.

Why It Matters

The data center boom isn’t just a tech story—it’s the engine behind almost all recent US economic growth. With other sectors lagging and bubble concerns rising, the question now is whether this wave of investment is building something sustainable or simply buying time.