- Data centers investment is set to surpass office construction, marking a major shift in US commercial real estate.

- Returns for data centers reached 11.2% last year, second only to manufactured housing.

- Heavy reliance on AI demand makes data centers a riskier, more specialized asset class.

- Lease structures offer some protection for investors, but operational risks remain substantial.

AI Drives Real Estate Shift

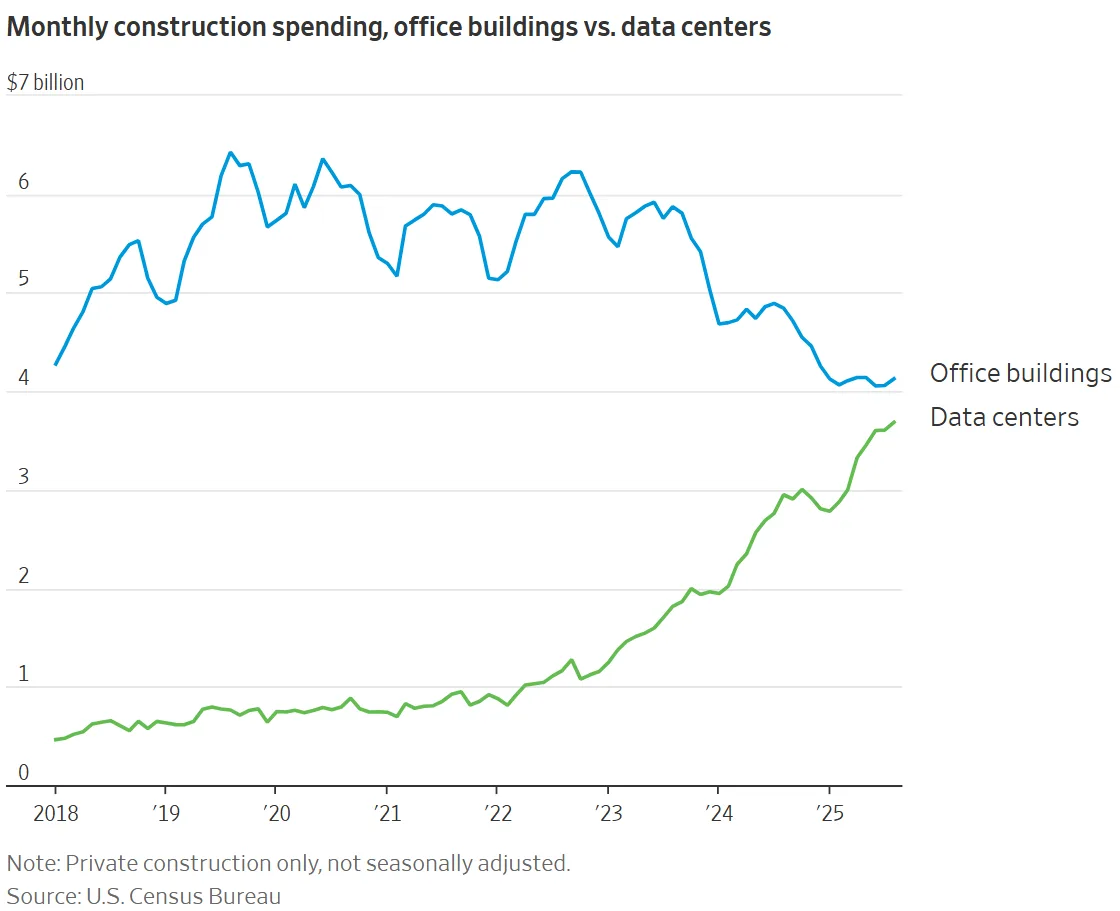

According to The WSJ, investors are increasingly turning to data centers, as surging demand for AI and digital infrastructure transforms the commercial real estate landscape. According to US Census Bureau data, spending on data centers is expected to outpace office-building construction as soon as next year. Tech giants like Meta, Amazon, and Oracle are fueling this growth by leasing more data center capacity from property owners rather than building their own.

Industry analysts estimate North America could see $1T in new data centers investment between 2025 and 2030. In 2024, 40% of hyperscaler data center capacity in the US was leased, up from 35% in 2023. Public and private funds are increasingly prioritizing data centers, with 95% of major institutional investors planning to raise allocations, according to CBRE.

Returns and Risks Rise

Data centers delivered an 11.2% return in the last year, outperforming most traditional sectors. Still, this niche sector’s heavy dependence on AI adoption brings new risks. Compared to offices or multifamily assets, data centers often rely on a small number of specialized tenants—primarily hyperscalers operating long-term leases but whose future profitability hinges on rapidly evolving technology. As data centers become more integral to AI infrastructure, their influence on real estate strategy is growing—not just in tech hubs, but across diverse property types nationally.

Industry experts note that many real estate investors may not fully grasp the technical and operational risks unique to data centers. Lease agreements often include penalty and termination clauses tied to delays, power failures, or connectivity issues that can result in significant financial exposure.

Challenges for Investors and Developers

Despite investor momentum, data centers construction faces hurdles. Delays in construction or failures to secure critical infrastructure like power can trigger lease termination. Labor shortages, supply chain disruptions, and regulatory barriers further complicate the landscape. Some investors remain hesitant due to the technical complexity and operational demands of the sector.

As more capital flows into data centers investment, market participants are structuring deals with enhanced risk mitigation—such as staged leases and compensatory clauses—to balance opportunity with exposure. The sector’s future will depend on sustained AI demand and developers’ ability to deliver projects on time and within technical specifications.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes