- Power supply issues are delaying data center development in core markets, prompting growth in secondary cities worldwide.

- Global demand from hyperscale and AI workloads is driving record-high preleasing and absorption, especially in North America and Asia-Pacific.

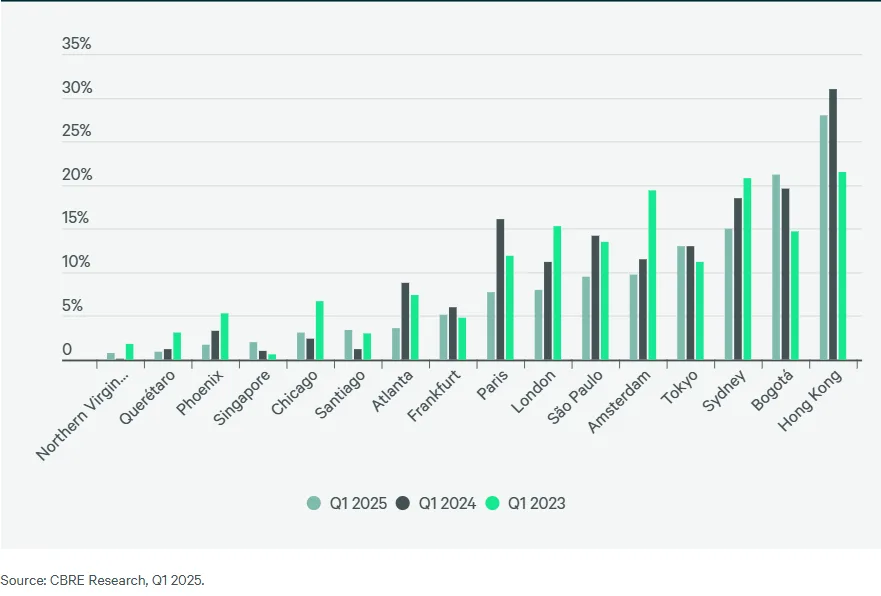

- Data center vacancy rates continue to fall across regions, while pricing trends vary, with key markets like Northern Virginia seeing double-digit increases.

- Emerging hubs such as Richmond, Johor, and Santiago are gaining momentum due to land availability, power access, and lower costs.rn

A Global Power Struggle

Despite soaring demand, insufficient data center power infrastructure is delaying delivery timelines and driving preleasing into 2027 and beyond, reports CBRE. Hyperscale users, AI developers, and cloud service providers are locking in capacity early, even as land and power shortages push development farther from legacy hubs.

In Northern Virginia, the world’s largest data center market, persistent power constraints kept vacancy under 1%, with projects now being preleased for delivery as far out as 2028. Across Europe, availability fell by more than 25% YoY as operators moved to the outskirts of cities like Frankfurt and London in search of scalable power.

Hyperscale Demand Spurs New Market Leaders

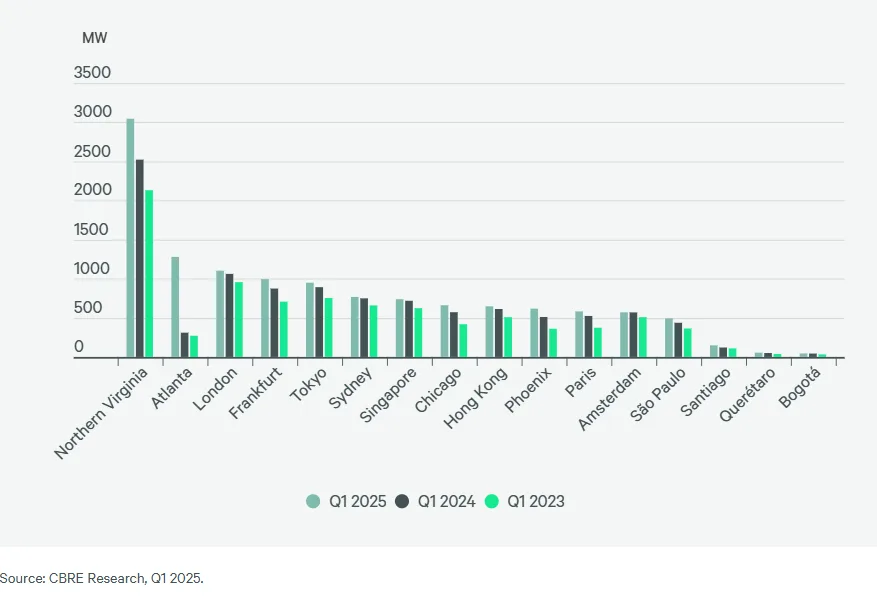

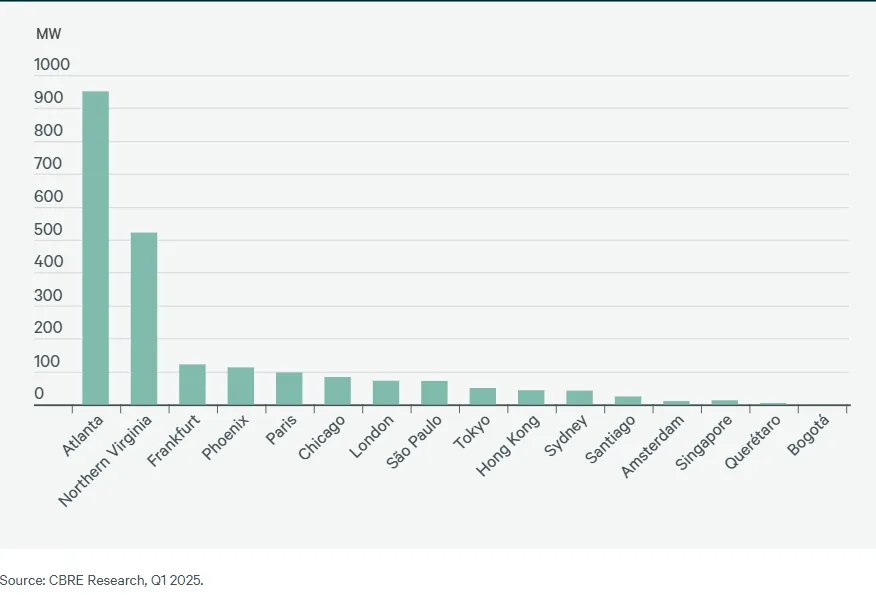

North America continues to lead global growth and absorption. Atlanta’s inventory tripled to 1,279 MW, with a nation-leading 951 MW absorbed in Q1 2025. Phoenix also surged past Dallas-Ft. Worth, while Des Moines and Richmond emerged as promising new hyperscale data center destinations.

Europe is seeing mixed results: Paris and Frankfurt posted double-digit inventory growth amid tight supply, while Amsterdam remained flat due to an ongoing moratorium on large-scale data center projects. Brussels and Zurich are now drawing investment thanks to their access to scalable data center power capacity.

Asia-Pacific is shifting toward secondary markets like Johor and Melbourne as land and power constraints slow development in Singapore and Tokyo. Still, Tokyo led the region in data center absorption with 49.8 MW.

Latin America is gaining traction, particularly in Santiago, where data center inventory rose 23% year-over-year and vacancy dropped below 5%. São Paulo continues to dominate the region in both scale and demand, though ongoing power constraints are prompting developers to secure land closer to substations.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Moderate Gains In Major Markets

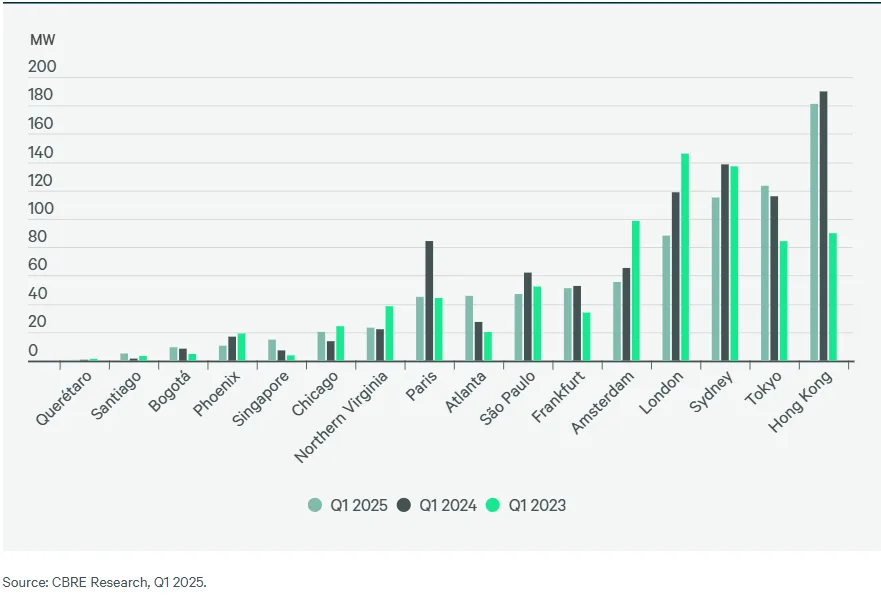

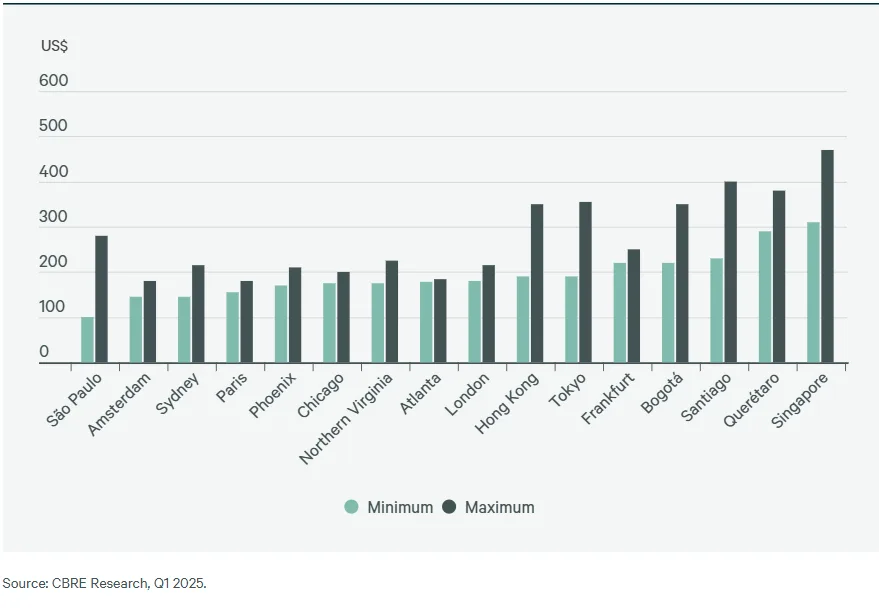

Data center pricing rose globally by 3.3% year-over-year. Northern Virginia (+17.6%), Amsterdam (+18%), and Chicago (+17.2%) saw the sharpest increases. Latin American markets such as São Paulo and Santiago experienced pricing declines as new inventory came online. Meanwhile, Singapore held its spot as one of the world’s priciest markets at $310–$470/kW/month.

AI And Cloud Drive Surge

Global net absorption surged in Q1 2025 as AI workloads and cloud deployments fueled multi-megawatt leasing. North America absorbed over 1,668 MW, led by Atlanta and Northern Virginia. Tokyo and São Paulo topped absorption in Asia-Pacific and Latin America, respectively, with strong interest from both enterprise and hyperscale tenants.

Vacancy Falls As Operators Struggle To Keep Up

Vacancy rates for data centers dropped globally in Q1, falling to record lows in many markets:

- North America: 0.76% in Northern Virginia, 3.6% in Atlanta

- Europe: Down to 7.4% overall, with Paris leading the decline

- Asia-Pacific: Stable at 14%, but Singapore remains ultra-tight at 2%

- Latin America: São Paulo dropped to 9.5%, while Bogotá saw a modest increase due to infrastructure constraints

What’s Next

- Hyperscale demand is pushing into new regions, with Des Moines, Richmond, and Johor becoming hotspots due to affordable land, power availability, and proximity to fiber routes.

- AI workloads will continue to drive multi-MW deployments, especially in Tokyo, Sydney, and Frankfurt.

- Developers must navigate complex power planning, rising land costs, and regulatory hurdles, particularly in Europe and Latin America.

As power constraints delay deliveries and core hubs hit saturation, the global data center map is rapidly redrawing—with hyperscale, AI, and cloud players leading the way into the next generation of growth.