- Despite strong returns, data centers remain underrepresented in real estate portfolios. The sector offers stable cash flow, low correlation to economic cycles, and long-term demand driven by AI and cloud computing.

- Cloud and AI inference workloads are driving growth, while generative AI facilities remain more speculative. Inference centers and retrofitted edge computing facilities show the strongest risk-adjusted return profiles.

- Top markets must offer reliable, low-cost energy, strong connectivity, and low disaster risk. AI is pushing development into power-rich, non-traditional markets across the US and Europe.

- Liquid cooling is becoming essential for high-density AI workloads. Sustainability is now a competitive advantage, as regulation and tenant preferences push for greener, more efficient infrastructure.

A Growing Sector, Still Underweight

Institutional investors remain slow to adopt data centers despite strong, consistent market returns, reports PrincipalAM. With digital infrastructure demand exploding, particularly from AI and cloud computing, data centers now offer a compelling combination of durable cash flows, long-term growth, and low economic sensitivity.

JLL reports the US colocation market doubled between 2020 and 2024. Meanwhile, Michael Dell predicts AI could boost global data center demand by up to 100x in the next decade.

From Metro Clusters To Power-Rich Outposts

Traditional hubs—like Northern Virginia, Dallas, Phoenix, and Chicago—remain dominant thanks to connectivity and scale. But AI workloads, which require massive power and land, are pushing expansion into non-traditional markets like Umatilla, OR; Kuna, ID; and Council Bluffs, IA.

In Europe, the FLAP-D markets (Frankfurt, London, Amsterdam, Paris, Dublin) continue to lead, with emerging activity in power-abundant areas like Northern England and Hamina, Finland.

Location choices now prioritize energy access, regulation, climate risk, and renewable power in low-disaster areas.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Cloud, Inference, And Generative AI

The old definitions—hyperscale, colocation, enterprise—are giving way to workload-based categorization:

- Cloud & AI inference centers: Offer the most attractive and reliable returns due to well-established demand. These facilities support everyday AI applications like recommendation engines and automation tools.

- Generative AI data centers: Speculative and power-hungry, these sites support AI training models (like GPT-4) and are driving today’s overbuild concerns.

- Edge computing: An emerging opportunity as AI and IoT adoption push workloads closer to end users. Retrofitting existing sites for edge use could unlock value.

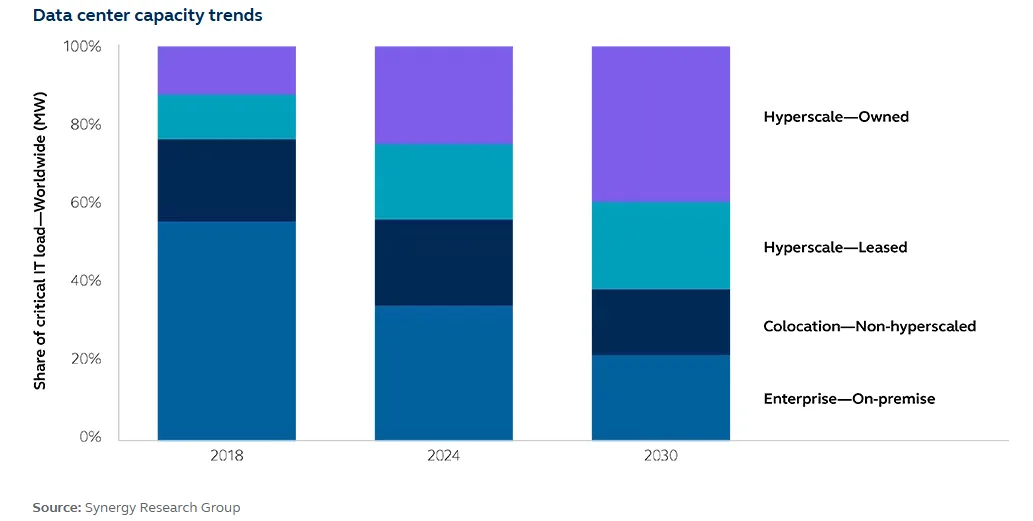

Investor interest is focused on leased hyperscale and colocation assets, particularly those serving inference workloads. Green Street reports that third-party landlords own 50% of US data center capacity, 65% in Europe, and 80% in Asia-Pacific.

The Infrastructure Arms Race

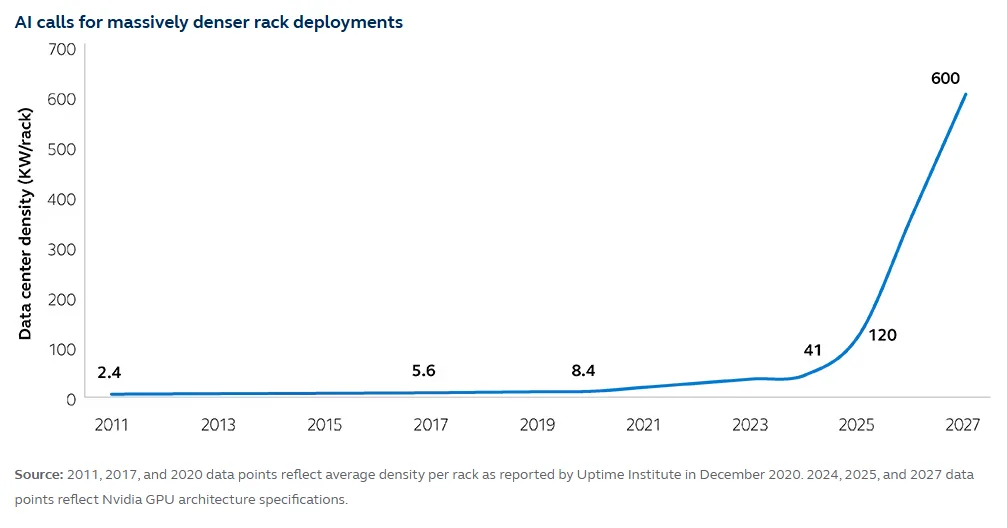

AI workloads are pushing power densities into uncharted territory. Nvidia’s latest server racks demand up to 120 kW today, with projections of 600 kW per rack by 2027. That’s making traditional air cooling insufficient.

- Liquid cooling is fast becoming the standard for handling dense, AI-powered workloads.

- Sustainability is non-negotiable, driven by tenant expectations and tightening regulation. Renewable integration and efficient design also help control costs.

With sustainability top of mind, average PUE (power usage effectiveness) has improved significantly—from ~2.5 in 2007 to ~1.5 in 2024.

Flexibility Is the New Imperative

As workloads evolve and energy constraints intensify, data center design is shifting toward future-proofing:

- New builds are designed with flexibility in power, cooling, and layout, supporting long asset lifecycles and adaptable workloads.

- Older assets are being redeveloped to meet higher-density requirements, providing an entry point for value-add strategies.

- Edge facilities and secondary market sites present new avenues for growth amid power and land scarcity in Tier 1 markets.

Bottom Line

Data centers are no longer a niche—they’re becoming essential infrastructure for the digital economy. As cloud and AI adoption accelerates, investor focus is turning to durable inference centers, flexible infrastructure, and power-secure locations.

For real estate portfolios, the opportunity is clear: invest in the right locations, prioritize sustainability and adaptability, and avoid speculative bets on generative AI until demand proves more durable.