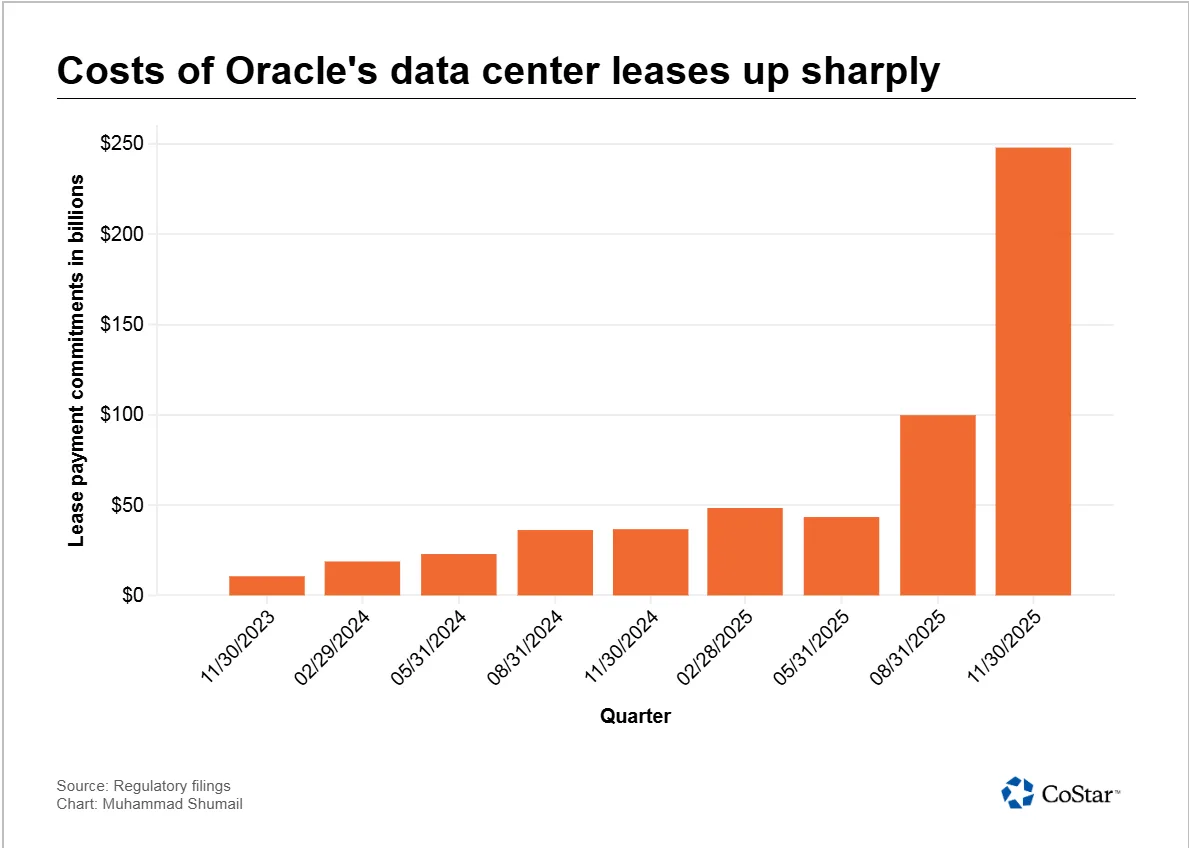

- Oracle has committed to $248B in data center leases — a 2,200%+ increase over two years — as it races to scale cloud infrastructure amid the AI surge.

- Analysts warn that the long-term lease obligations (15–19 years) could become liabilities if customer demand falters, especially given Oracle’s short-term client contracts.

- The tech giant’s aggressive growth contrasts with more diversified peers like Microsoft and Google, who are better insulated from market shifts.

- Oracle’s current leasing model could strain profitability if the AI demand cools, as some analysts warn of a potential AI bubble.

Oracle’s AI-Fueled Real Estate Gamble

Oracle is making a massive real estate bet with $248B in future data center lease obligations as of November, reports CoStar. The staggering $248B figure marks a 2,239% year-over-year increase and a 148% rise in just the past quarter.

The 15- to 19-year leases begin between fiscal 2026 and 2028, giving Oracle time to expand its customer base. However, the long-term nature of these commitments — without equivalent long-term contracts from clients — is drawing scrutiny from analysts.

The Risk Equation

S&P Global says Oracle’s cloud clients sign five-year deals, creating a gap between short-term revenue and long-term lease obligations. If demand dips or clients churn, Oracle could be left paying billions in rent for unused space.

S&P’s Kelly Morgan warned this “timing mismatch” could become a drag on Oracle’s bottom line if its AI clients — many of them startups — fail to scale or survive.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Not All Tech Giants Face The Same Pressure

Microsoft and Google lease or own major data center space but use more internally and serve stable, long-term enterprise customers. That gives them flexibility and protection from sudden market changes.

Oracle is more dependent on external AI demand. If its initial customer base falters, it risks lower returns or weaker replacement tenants.

Defensive Positioning

Oracle executives said in December that lease payments won’t begin until data centers are operational, providing some financial cushion. Still, analysts point out that termination fees on early exits could be steep if Oracle misjudges future demand.

The company hasn’t disclosed the landlords or locations tied to most of the $248B in commitments. However, Digital Realty Trust identified Oracle as its second-largest customer, generating $266.6M annually, or 6.4% of its revenue.

Why It Matters

Oracle aims to grow in the AI cloud race, but its strategy may be outpacing its customer base and available cash flow. Oracle is partnering on high-profile projects like Stargate in Abilene, TX, and leasing from providers in Oregon, Texas, and Utah. Questions remain about whether future demand will match the growing supply.

What’s Next

The AI infrastructure boom is still accelerating, so Oracle’s move may pay off. But a demand slowdown could strain its financials.

For now, the company is banking on aggressive expansion to gain market share. But with credit ratings trailing peers (Oracle at BBB vs. Microsoft at AAA), the stakes are significantly higher if projections fall short.