- Major CRE brokerages like CBRE, JLL, and Newmark are rapidly expanding into data center services as traditional asset classes like office continue to struggle.rn

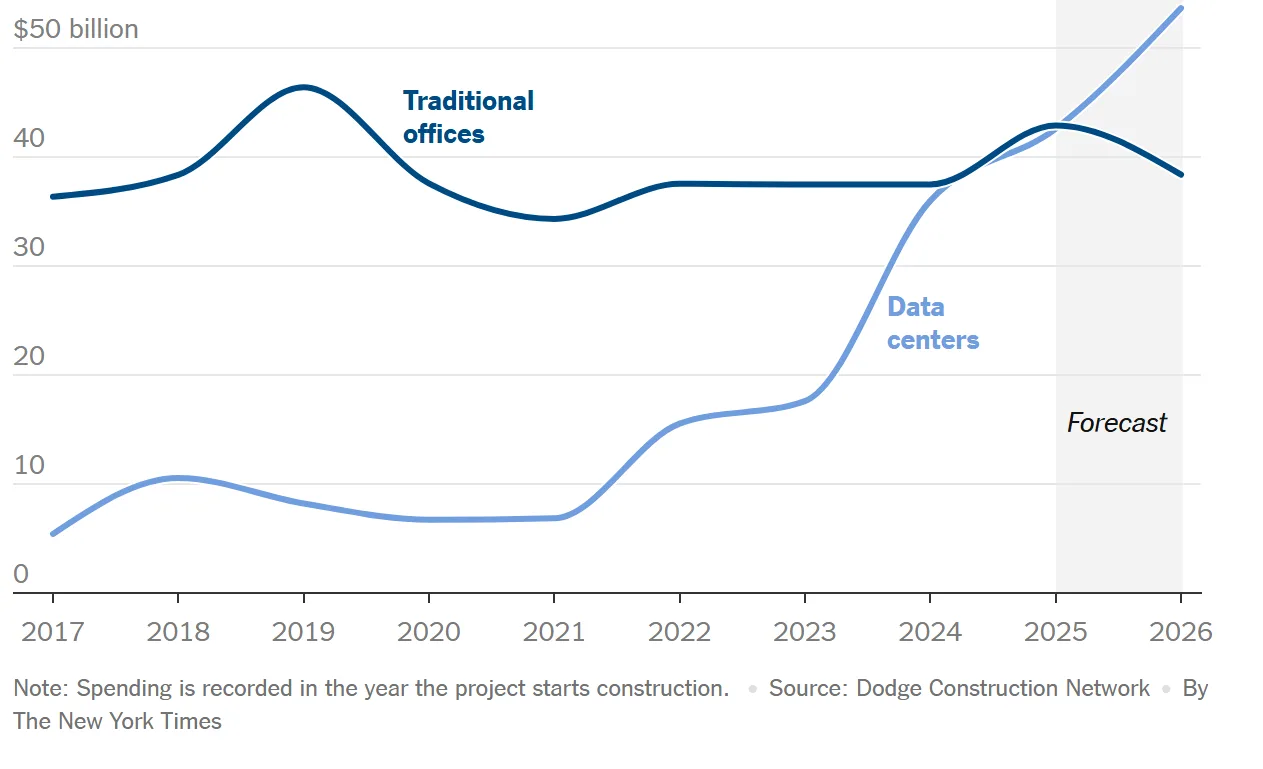

- Data center construction is now outpacing office development nationwide, with $375B in global AI infrastructure spending projected for 2025.rn

- The boom is boosting brokerage revenues across capital markets, project management, and facilities services—CBRE expects over half its 2025 development profits to come from data center site monetization.rnrnrn

An AI-Fueled Shift

According to Bisnow and The New York Times, the rise of artificial intelligence has made data centers the hottest asset in commercial real estate. While office and retail sectors face headwinds, data centers continue to attract massive investment.

“There’s about to be more data center development in process versus office,” said Ryan Dobratz of Third Avenue Management. “That’s where the capital is flowing.”

CRE Firms Pivot to Capture Data Center Demand

Top brokerages are now building new revenue streams by supporting data centers across their life cycle—from site acquisition to long-term operations.

- CBRE increased its data center earnings share from 3% to 10% between 2021 and 2024. The firm completed $9B in transactions for North American data centers last year. It now manages over 700 sites and expects data center site deals to drive more than half its 2025 development profits. Subsidiaries Trammell Crow and Turner & Townsend support land entitlement and construction, while its 2024 acquisition of Direct Line Global expanded its reach with hyperscale clients.

- Newmark arranged a $7.1B data center construction loan in Q2 tied to the Stargate project. This helped boost its capital markets revenue by nearly 40%.

- JLL grew its Real Estate Management Services unit profits by 11% in Q2. Ten percent of that portfolio now includes data center properties. It also acquired data center firm Skae in 2024 and secured major global contracts, including a $300M Arizona deal.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

The Real Economy Feels the Impact

AI-related construction is now driving real economic growth. UBS estimates global spending on AI infrastructure will reach $375B in 2025 and could rise to $500B by next year. In the US, data center development is now eclipsing traditional office projects.

The construction boom is helping contractors, engineers, electricians, and equipment suppliers stay busy, even as housing and warehouse projects slow down. Skanska expects data center construction to grow by 13.2% annually through 2029—far faster than other sectors.

Material suppliers are also cashing in. Amrize, a major cement and concrete company, co-developed a low-emission, AI-optimized mix with Meta. The company called data centers a “bright spot” in a weak quarter.

Sustainability and Power Are the New Battlegrounds

To meet rising energy demands, brokerages are hiring specialists in renewable energy and grid strategy. These teams help hyperscale clients secure power quickly—a critical need for AI operations.

CBRE is leveraging its Trammell Crow unit to acquire land and power entitlements. It also uses its development arm, Turner & Townsend, to build these massive facilities. Meanwhile, other firms are tapping into new energy tech. BioLargo is selling large-scale battery systems, and NANO Nuclear Energy is pitching compact reactors for AI campuses.

Caution Signs on the Horizon

While the market is booming, some experts warn of overheating. OpenAI CEO Sam Altman recently said the sector might be “overexcited.” UBS also mentioned that capital spending could face “indigestion” in the coming months.

Still, current fundamentals remain strong. Data center vacancy rates are near zero, and most upcoming space is already leased. JLL reports that the pipeline continues to expand to meet pre-committed demand.

“If we think about just general data creation and data storage, that has been growing at a rapid pace for decades,” said Andrew Batson, head of data center research for JLL Americas. “That will continue to grow.”

What Comes Next

More than $1 trillion in new data center development is expected by 2030. Brokerages are racing to claim a bigger share of this opportunity.

- CBRE will lean into recurring revenue from project and facilities management.

- Newmark is doubling down on advisory and capital markets work.

- JLL is taking a hybrid approach—mixing management, transactions, and new service lines.

Dobratz summed it up: “Real estate services companies are pivoting fast to participate in that spend.”

With demand strong and capital flowing, data centers aren’t just powering AI—they’re reshaping the commercial real estate industry.