- Median sale price fell 2.29% year-over-year to $199.94 per SF, reflecting investor caution tied to renewed tariff pressures. Grocery-anchored centers remain investor favorites.

- Median prices rose 8.81% YoY to $167.06 per SF, driven by demand for high-quality urban office spaces despite elevated vacancies in suburban markets.

- Sale prices climbed 7.29% to $104.40 per SF. Lease rates softened as speculative supply and tariff uncertainty dampen expansion.

- Prices remained flat at $201.93 per SF. Strong absorption and sustained investor interest in affordable and workforce housing reinforce long-term fundamentals.

Retail: Pricing Softens as Tariff Uncertainty Weighs on Market

According to the CREXi report, retail property values declined slightly in May, with the median price PSF down 2.29% YoY to $199.94. Investor hesitation is growing as proposed tariffs from the Trump administration continue to ripple through the market. Essential-service and grocery-anchored assets, however, remain resilient.

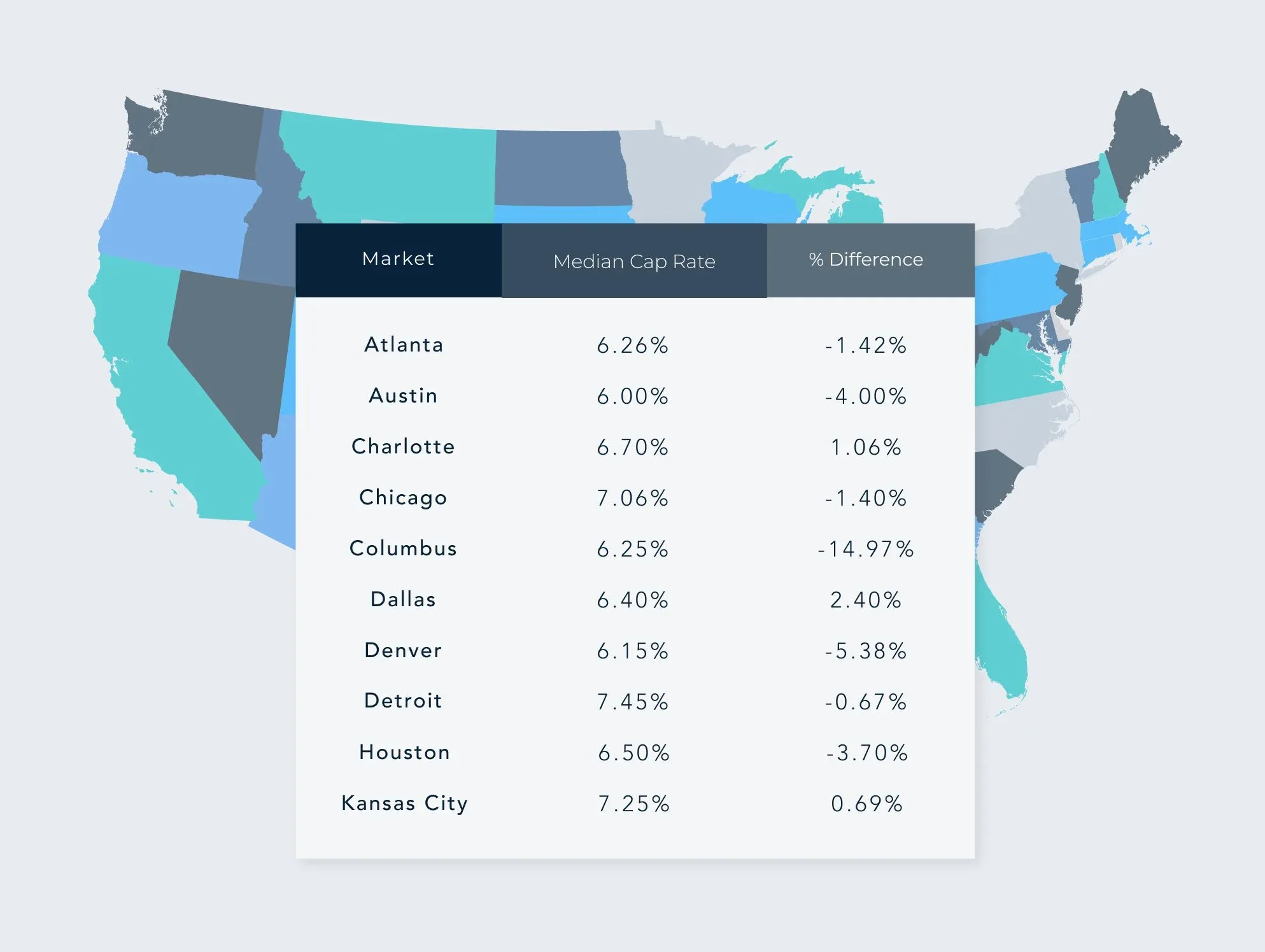

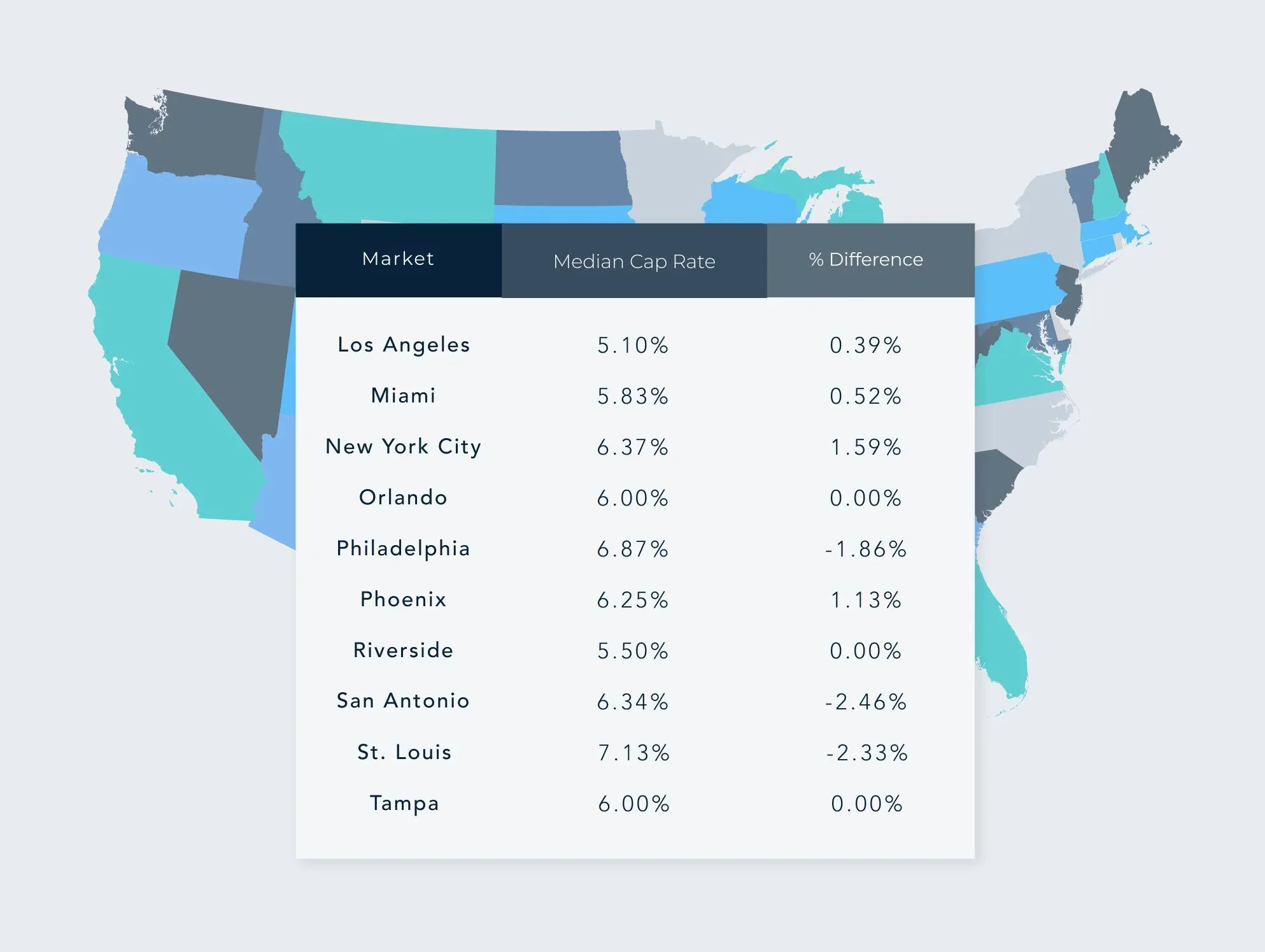

Retail cap rates hovered around 6.60%, in close alignment with asking cap rates, indicating continued investor confidence in core asset types.

Leasing activity is holding up, but tenants are more cautious. Asking lease rates stood at $19.17/SF with effective rates slightly lower at $18.82/SF. The absorption rate slowed to 1.16%, signaling a pullback in tenant expansion amid cost uncertainties.

Office: Central Business Districts See Uptick in Pricing, But Challenges Persist

Office properties posted an 8.81% YoY increase in median pricing to $167.06/SF, with growth concentrated in Class A urban assets. Investors are showing renewed interest despite lingering high vacancy rates, particularly in suburban markets.

Cap rates continued to trend down, hitting 7.16% for closed sales compared to 7.65% in late 2024. Asking cap rates are slightly lower, at 7.02%.

Landlords are increasingly incentivizing tenants. Asking lease rates averaged $19.97/SF, while effective rates trailed at $18.50/SF, reflecting growing lease concessions in softer submarkets.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Industrial: Demand Holds Steady Amid Cost and Policy Pressures

Industrial continued to show strong fundamentals, with median sale prices reaching $104.40/SF, up 7.29% YoY. That said, growth is slowing as tariff-related uncertainties and construction costs curb expansion momentum.

Cap rates remained stable at 7.27%, just above asking levels. Leasing softened, with effective rents falling to $12.05/SF compared to asking rates of $14.10/SF, revealing increased negotiation flexibility.

Absorption stood at 1.11%, slightly down from earlier this year. Tenants and investors remain focused on cost-effective secondary markets with strong logistics infrastructure.

Multifamily: Demand Stable, but Investors Grow Cautious

Multifamily pricing was largely flat YoY at $201.93/SF, but absorption remained strong at 1.44%. The sector continues to benefit from affordability challenges in the for-sale housing market, especially among younger renters.

Cap rates show some divergence: median sales hit 6.45%, while asking cap rates climbed to 7.13%. The gap reflects growing caution as investors adjust pricing expectations in response to broader market risk.

Despite rising financing costs, demand remains strong in secondary and tertiary markets, especially for value-add and affordable housing opportunities.

Why It Matters

Economic and political uncertainty, particularly from proposed tariffs, is affecting key sectors differently. Retail and industrial are showing early signs of adjustment, while office continues a slow rebound, and multifamily holds steady. Investors are responding with more selective underwriting and greater emphasis on flexible, resilient assets.

What Comes Next

CRE professionals should anticipate more pricing pressure and slower leasing in sectors exposed to global trade shifts. High-credit tenants, strategic locations, and adaptable assets will be central to navigating the evolving landscape.

June data from the CREXi report will be closely watched for signs of further divergence—or resilience—across asset classes as the market braces for an uncertain second half of 2025.