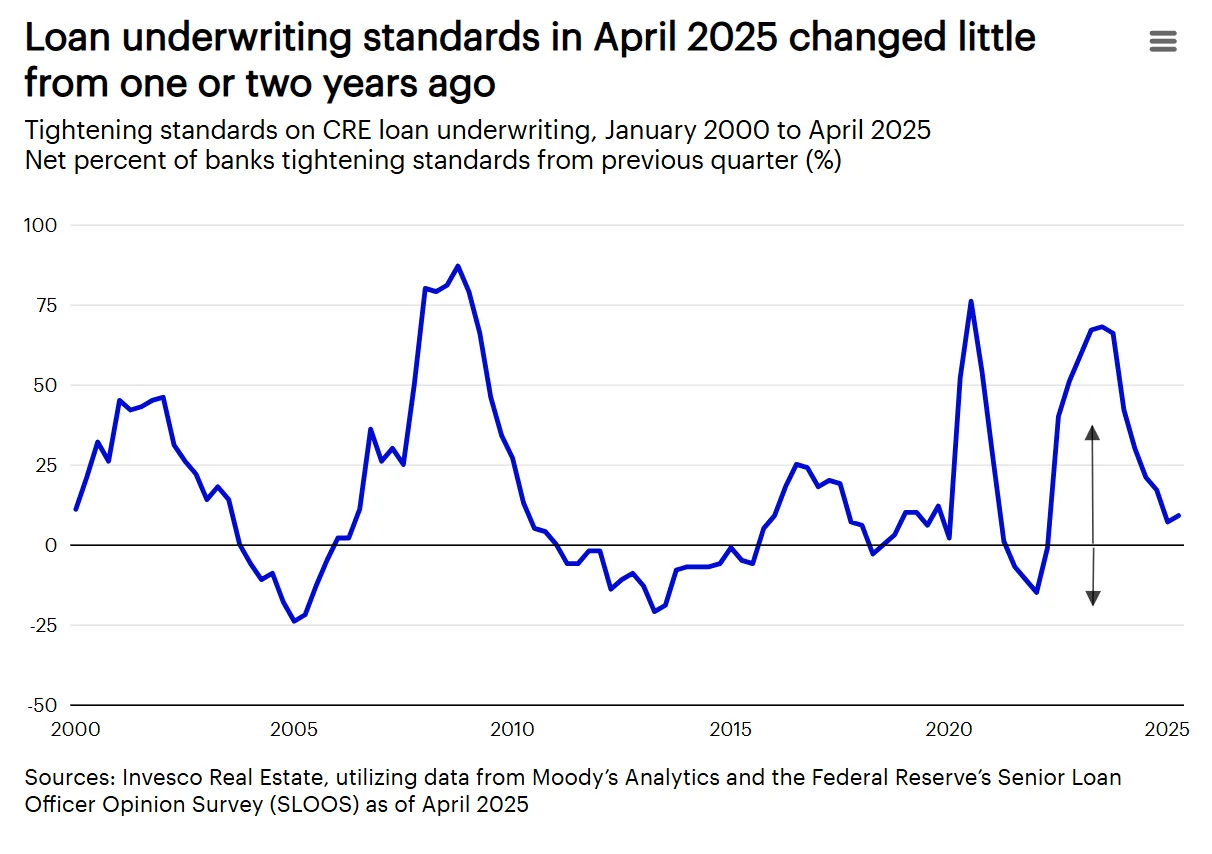

- The Fed’s April 2025 SLOOS shows easing in commercial real estate (CRE) loan underwriting, signaling less risk aversion than in recent years.

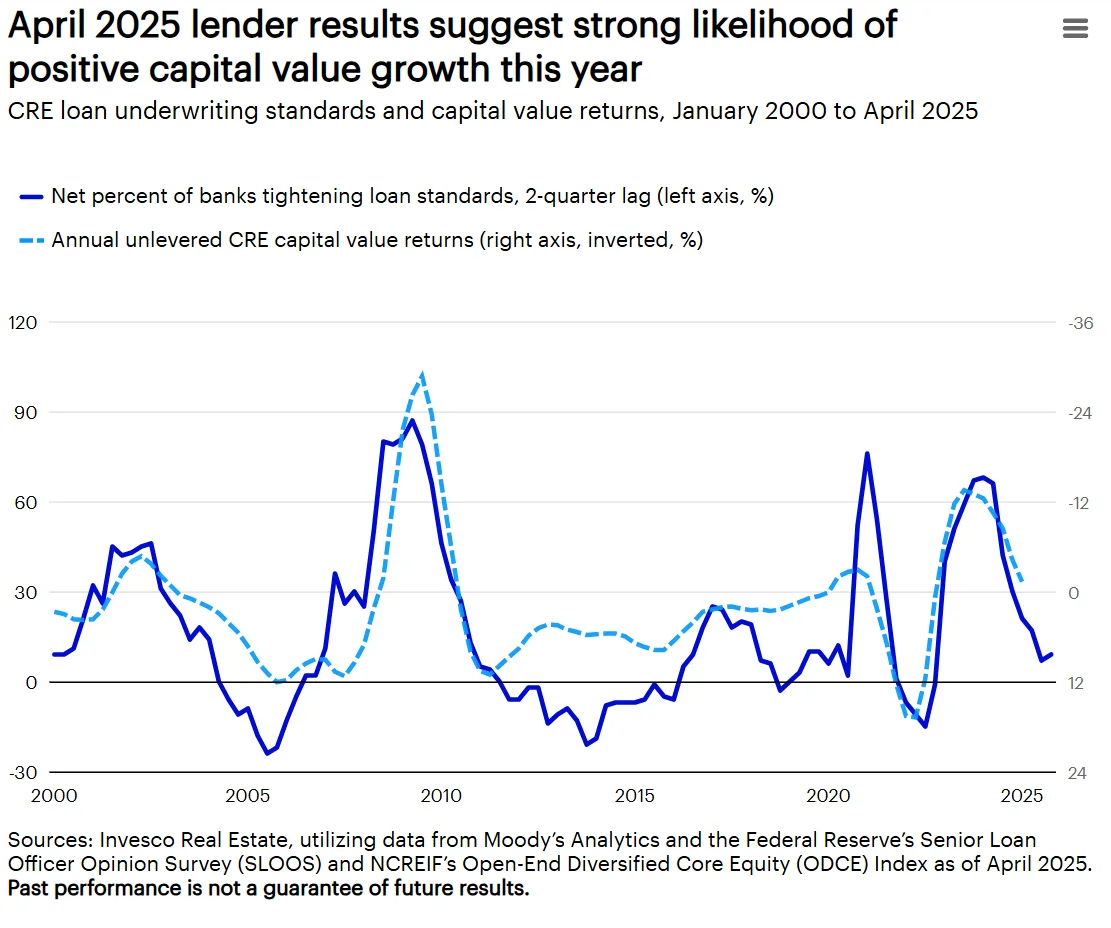

- Historically, relaxed underwriting has been a strong leading indicator of CRE value growth. Current trends point toward modest gains by year-end.

- Despite April’s heightened tariff-related market volatility, banks’ CRE lending posture remained largely unchanged—suggesting confidence in property fundamentals.

A Measured Outlook in a Volatile Market

Invesco reports a subtle but meaningful shift in CRE lending. The April 2025 Fed survey shows fewer banks tightening standards. This signals a higher probability of value growth for the sector in 2025—despite ongoing volatility stemming from US tariff policy changes.

Conducted during one of the year’s most turbulent economic periods—following the Trump administration’s April 2 “Liberation Day” tariff announcement—the survey showed that only 9.0% of banks were tightening lending standards. That’s a notable drop from 20.2% in April 2024 and a dramatic improvement from 67.4% in April 2023.

Why This Matters for CRE Values

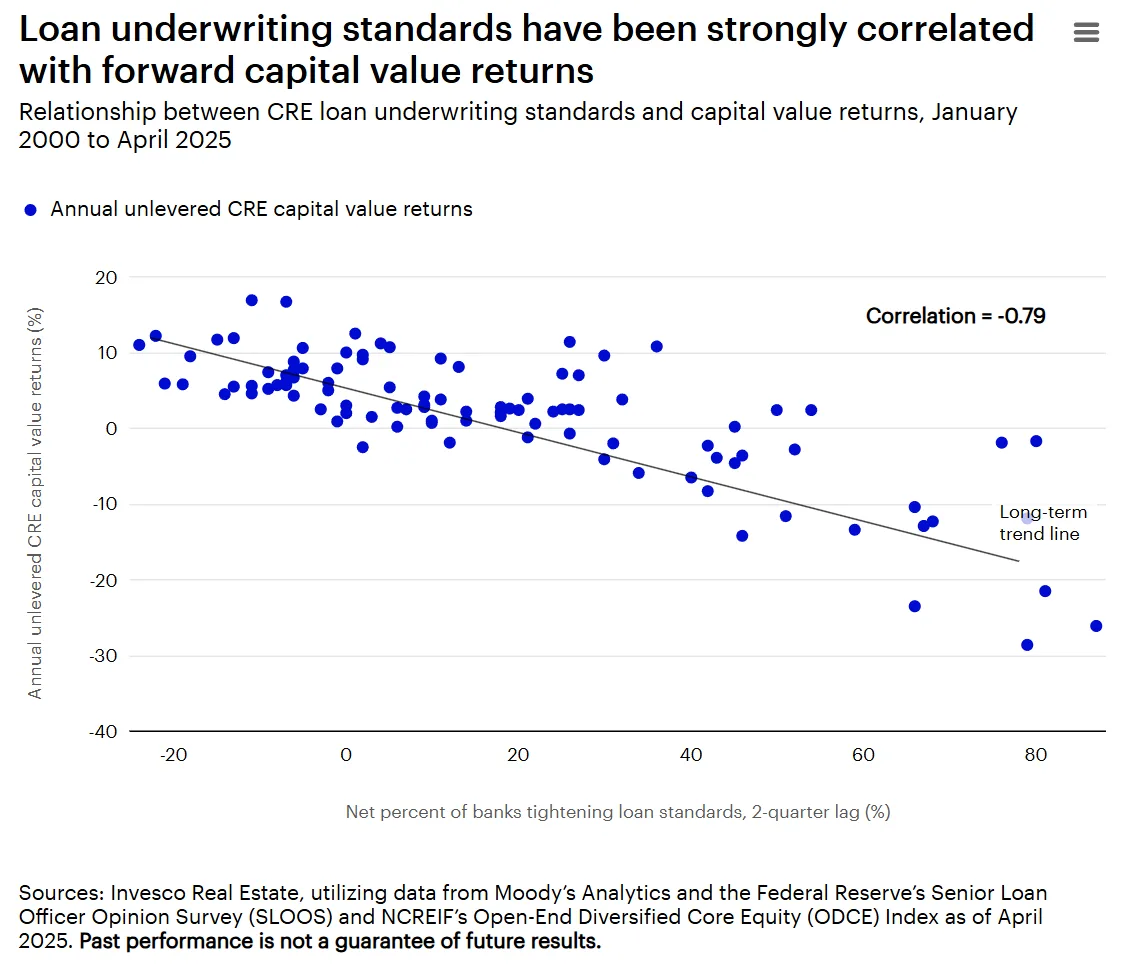

Historically, changes in CRE underwriting standards have shown a strong negative correlation (-0.79) with capital value performance two quarters later. Simply put: when banks tighten less, CRE values often rise.

Applying that historical relationship, the April 2025 results imply a 69% probability that unlevered commercial property values in the ODCE Index will post positive gains in the second half of 2025, with an estimated annual growth of 3.9%.

Tariff Noise vs. CRE Fundamentals

The muted reaction in lending standards amid the tariff-induced volatility suggests that banks are looking past short-term headlines. Rather than a wholesale pullback in lending, the steady posture implies confidence in long-term fundamentals.

Invesco Real Estate, for example, is maintaining a measured stance—recognizing that public market volatility doesn’t always translate into private market disruption.

What’s Next

CRE investors should watch future SLOOS releases closely. As the Fed’s quarterly loan survey remains a reliable early signal of capital value trends, its continued strength will be key for gauging mid- to long-term momentum in the commercial property sector.

Barring a sharp reversal in lending posture or macroeconomic policy, 2025 is shaping up as a year of recovery for CRE capital values—especially within the core property segment.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes