- CRE transaction volumes rose 23% in 2025, hitting $545.3B—marking a second year of growth.

- Data Centers saw a 274% annual jump, but traditional sectors also posted gains.

- Even excluding Data Centers, CRE transactions were up 19% for the year.

- Bounce-back signals a potential inflection point in market sentiment and investor confidence.

Transaction Volumes Rebound

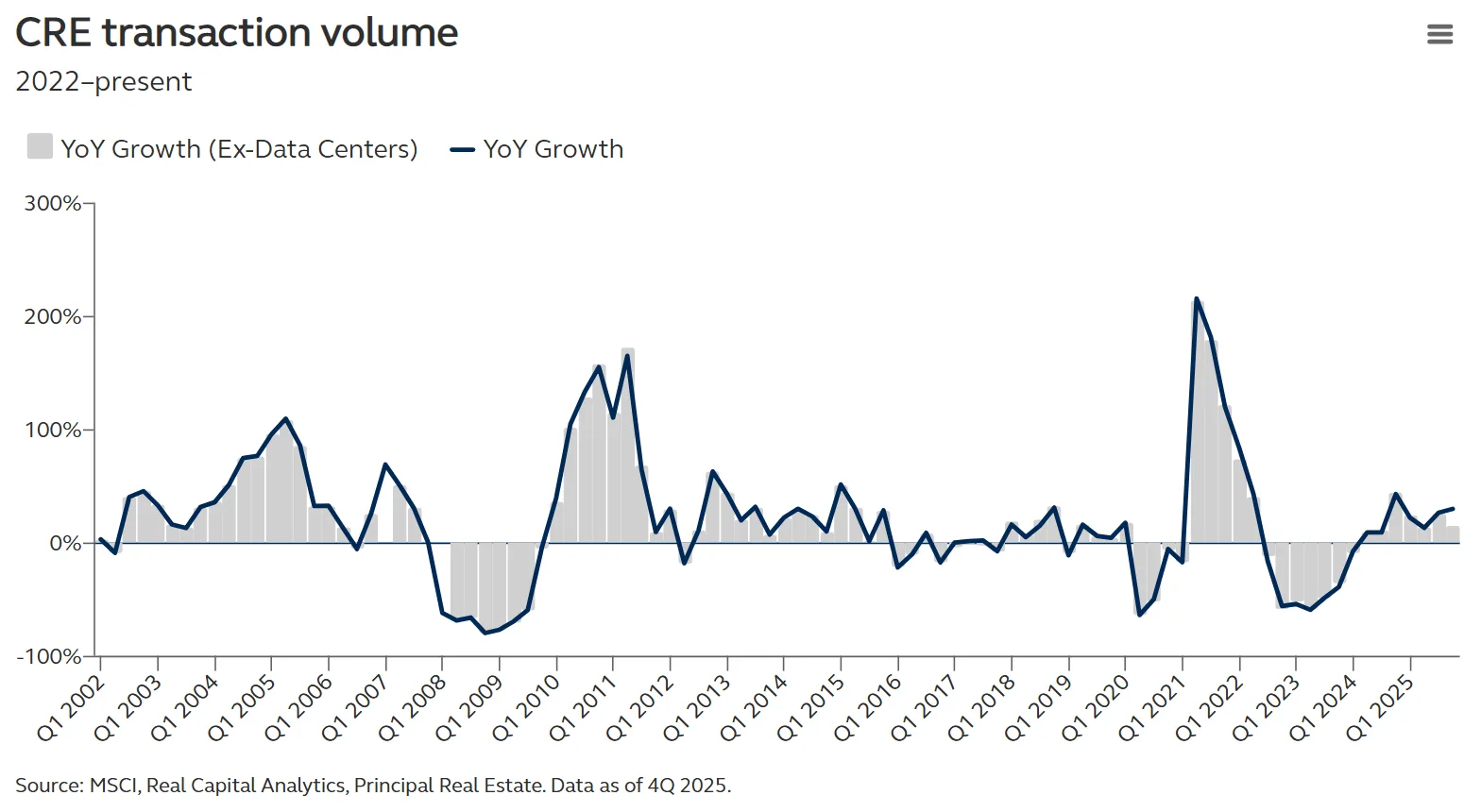

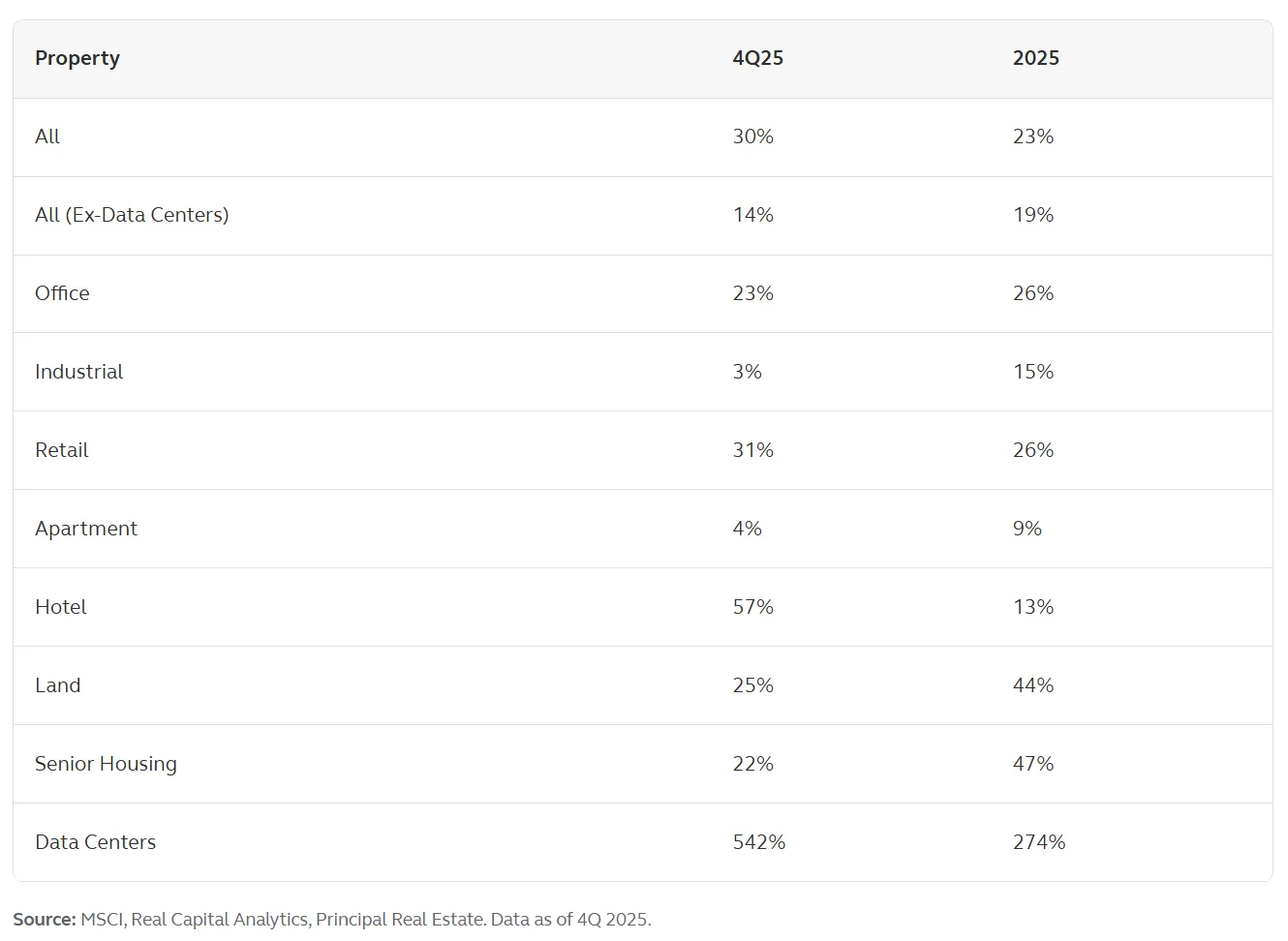

According to the Principal Asset Management, US commercial real estate (CRE) transaction volumes increased sharply in 2025. Total closed deals reached $545.3B for the year, up 23% from 2024. December activity alone climbed 12% year-over-year, while fourth-quarter volumes jumped 30% to $185.8B. This marked the second straight year of double-digit volume growth, following a 14% rise seen in 2024.

Data Centers Lead—But Not Alone

Headline transaction volumes received a significant boost from a major $23B forward sale in the Data Centers sector. Office and retail deals each climbed 26% in 2025, showing broad momentum across sectors. Senior housing led traditional property types with a 47% annual gain, underscoring investor interest in demographic-driven assets.

CRE volumes still rose 19% even without Data Centers, proving that activity extended beyond a single asset class.

Investor Confidence Returns

Rising CRE transaction volumes are widely viewed as a signal of improved market sentiment. The latest data suggest investors are returning to the market, with patterns reminiscent of post-Global Financial Crisis recoveries. Momentum that began building in late Q3 has carried into year-end, supported by a flurry of large-scale closings across asset classes. Despite lingering risks and uncertainty, renewed activity signals that the cycle is moving from broad-based caution to sector and asset-level selectivity.

What to Watch

Looking forward, market experts foresee greater dispersion in returns across property sectors and geographies. The current CRE cycle is now “alpha-driven,” with asset selection and submarket differentiation expected to drive outperformance. As transaction volumes continue to rise, especially in areas like Data Centers and Senior Housing, investors will need to sharpen their focus to capitalize on sector-specific momentum within the evolving US CRE landscape.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes