- CRE deal volume hit $27B in September, marking 2025’s busiest month and a 23% increase in nine-figure deals from August.

- Multifamily, retail, and office assets accounted for 64% of all closings, with investors targeting both stabilized and value-add opportunities.

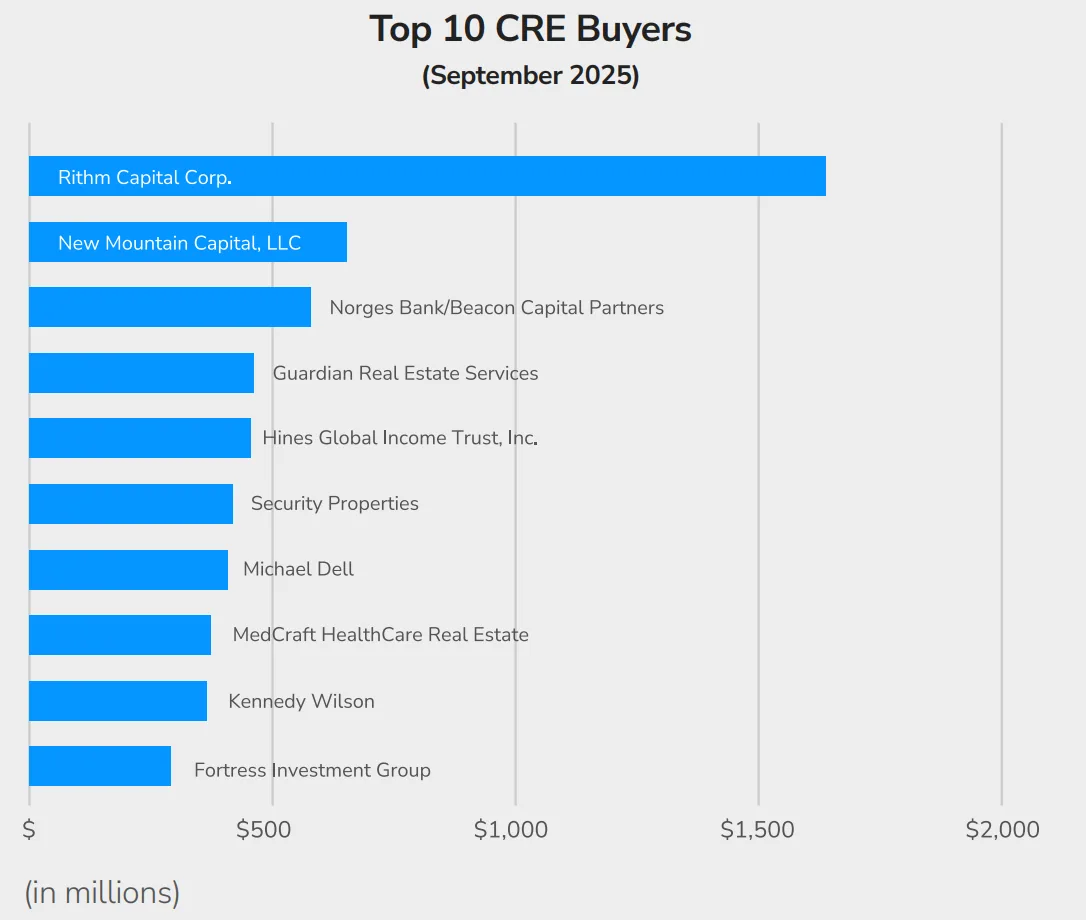

- Mid-cap and nine-figure portfolio deals surged, including a $1.6B office platform buy by Rithm Capital and a $640M net-lease portfolio deal by New Mountain Capital.

- Price discovery continues, 70% of assets sold above their prior purchase price, but sharp markdowns remain for older or underperforming offices.

September Sets a 2025 Benchmark for CRE Activity

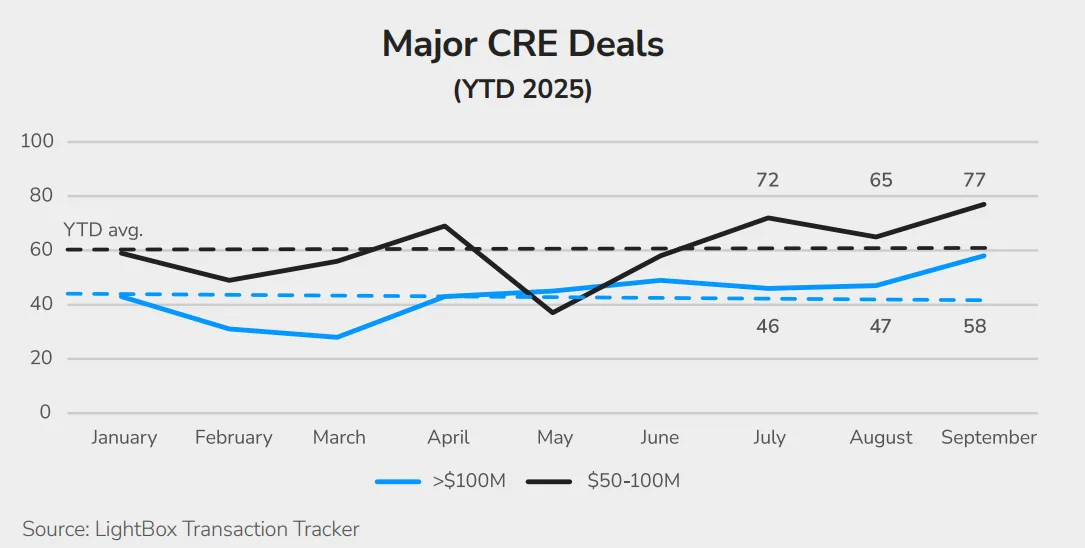

According to LightBox’s September Major CRE Transaction Tracker, the commercial real estate market posted its strongest month yet in 2025, with nearly $27B in transaction volume. The increase was broad-based, spanning asset types and geographies, signaling renewed confidence from investors after a protracted slowdown.

Nine-digit deals above $100M jumped 23% month-over-month, while mid-cap transactions ($50M–$100M) rose 18%, eclipsing July’s totals to set a new yearly high. According to LightBox’s Head of Data Strategy, Manus Clancy, it’s not a breakout rally but a signal that “the market is finding its footing again.”

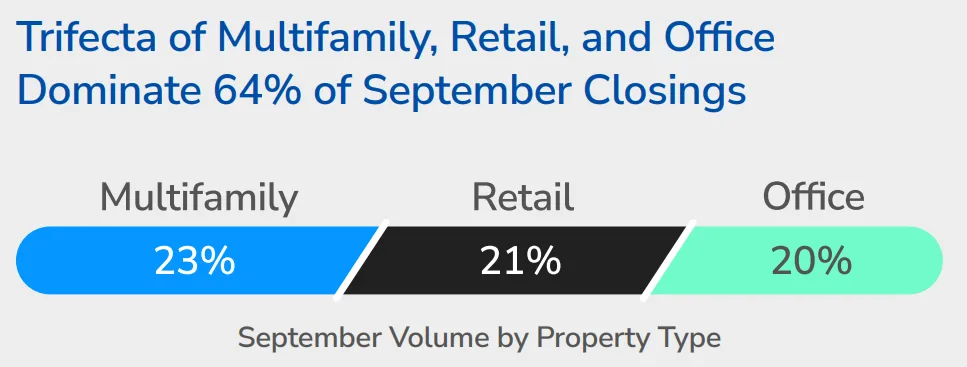

Multifamily, Retail, and Office Dominate

Multifamily assets led the count again, particularly value-add suburban communities with stabilized income potential. Retail followed closely, driven by steady trades in grocery-anchored and open-air centers offering consistent NOI. Office activity remained selective, with capital flowing toward Class A assets or distress-driven recapitalizations.

- Industrial accounted for 17% of September deals, benefiting from stable demand in logistics-heavy markets.

- Land deals doubled from August, as developers looked ahead to pipeline growth across industrial and mixed-use projects.

Portfolio and Platform Deals Lead the Charge

Investors with dry powder pursued scale and efficiency in September:

- Rithm Capital’s $1.6B acquisition of Paramount Group’s 17-asset Class A office portfolio was the month’s largest.

- New Mountain Capital picked up a $640M, 53-asset net-lease portfolio, reflecting growing interest in diversification and speed-to-market.

Mid-cap highlights included:

- LINQ in San Jose ($97.6M) as the largest apartment trade

- Amazon’s Ocala logistics facility ($97.7M) and Ares Management’s Elkton warehouse ($80M) underscored steady industrial appetite.

Pricing Adjustments: Office Discounts, Retail Gains

LightBox noted that among deals with price history, 70% sold above prior sale prices, while 29% traded at discounts, primarily in the office sector. Manhattan’s 1177 Sixth Ave sold for $571M—42% below its 2007 valuation, the clearest signal yet of deep price resets in urban office.

In contrast, retail and multifamily continue to show upside:

- IKEA’s $213M purchase of the former Nike store in Manhattan was 45% above its 2012 price.

- Nuveen’s $100M buy of Algonquin Commons tripled the prior purchase price, following a $30M repositioning.

Looking Ahead: Q4 Outlook Builds on September Surge

The LightBox CRE Activity Index rose to a 2025 high of 116.8 in September, fueled by late-Q3 property listings and due diligence pipelines. Analysts point to potential Fed rate cuts in October and December as catalysts that could widen lending windows and further close the bid-ask gap.

Manus Clancy summed up the sentiment:

“The pipelines are fuller, the bid-ask gap is narrowing, and lenders are getting more comfortable underwriting risk.”

Still, risks remain—from global trade pressures to political instability and labor softness. But if current momentum holds, Q4 is shaping up to be one of the strongest quarters since 2022, particularly for buyers focused on value resets and long-term yield.

Why It Matters

After an extended period of market hesitation, capital is coming back into the market with a more constructive outlook. September’s data suggests that real estate fundamentals—especially in multifamily, industrial, and selectively in retail and office—are strong enough to support a rebound in activity, pricing, and investor sentiment.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes