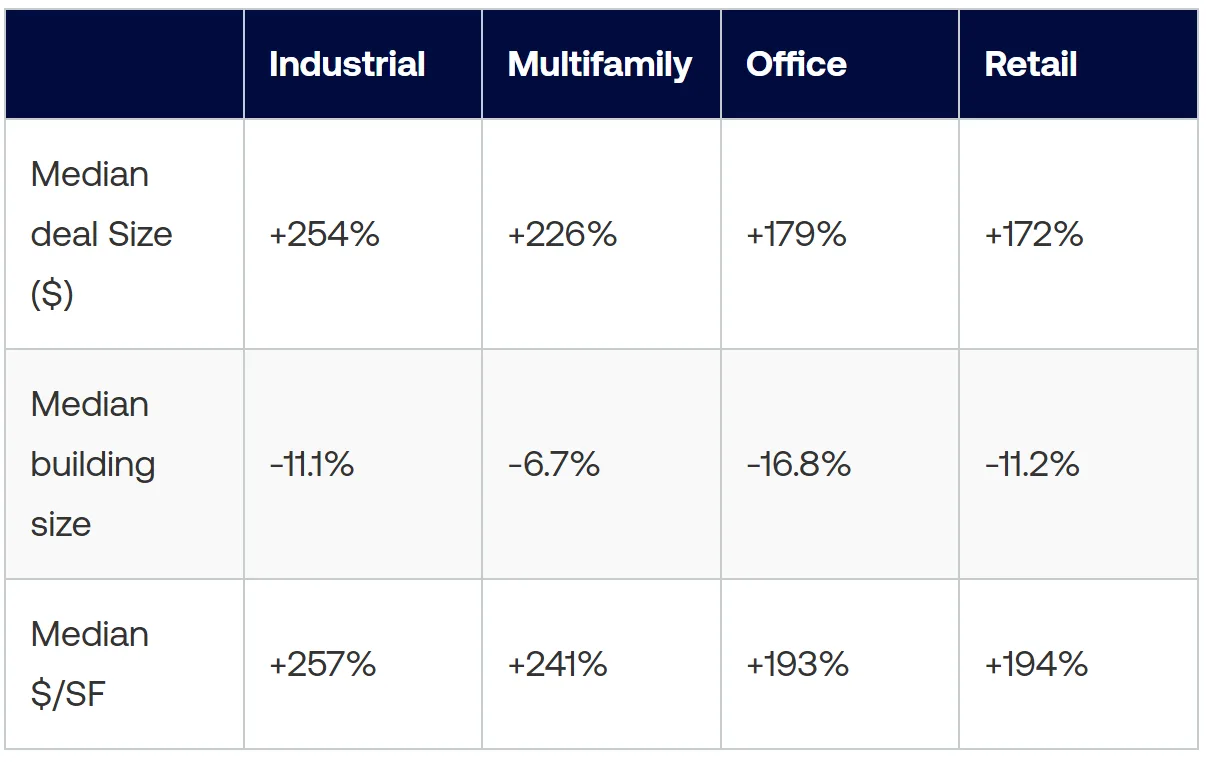

- Median US CRE deal sizes have grown significantly in dollar terms, despite the typical building getting smaller—highlighting a sustained rise in price PSF.

- Industrial and multifamily sectors have led in value growth, supported by structural demand shifts, while office and retail continue adjusting to new usage patterns.

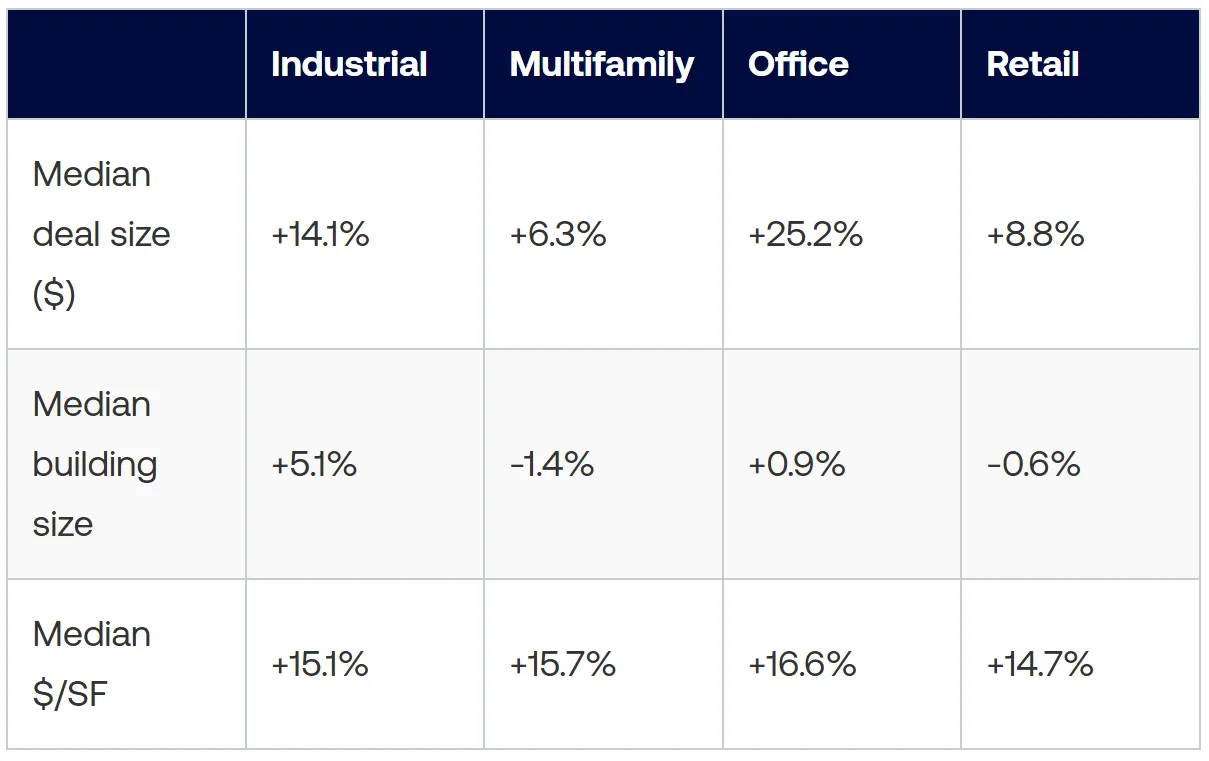

- Recent pricing resilience suggests investor focus is shifting toward higher-quality, more liquid assets that perform well in tight capital markets.

A Quarter Century of Change in CRE

A deep dive into 25 years of transaction data reveals a significant, long-term trend in US commercial real estate: buildings have gotten smaller, but valuations have surged. According to Altus Group’s Q1 2025 US CRE Investment & Transactions Quarterly report, this is not simply the result of inflation—it reflects evolving investor preferences, market fundamentals, and demand-side usage patterns.

The Big Picture

Between 2000 and 2025, median deal size in dollar terms has more than doubled across all major sectors. Industrial leads with a 254% gain, followed closely by multifamily at 226%. At the same time, the median transacted building size declined across the board, most sharply in the office sector (-16.8%). That seeming paradox is explained by pricing: median price PSF increased by over 250% for industrial and 240% for multifamily, underscoring the shift toward higher-value assets in smaller formats.

What the Post-GFC Era Reveals

From Q1 2009 to Q1 2025, industrial saw the strongest gains with a 145% rise in deal size and a rare 1% increase in median building size. Multifamily followed with notable price appreciation (+137%) but a sharp drop in building size (-13.3%). Office and retail lagged behind, weighed down by evolving work habits and changing retail models.

A Resilient 2024-2025

Despite high interest rates and tighter credit conditions, pricing held firm over the past year. Office posted the highest year-over-year increase in median deal size (+25.2%), likely reflecting selective investment in premium properties. Meanwhile, industrial, multifamily, and retail all showed double-digit growth in both price PSF and deal values, underscoring resilience in quality-focused investment strategies.

Why Are CRE Assets Shrinking?

The decline in asset size reflects broader shifts:

- Office and Retail: Downsizing by office tenants and omnichannel strategies in retail have led to smaller, more flexible spaces.

- Industrial: Although once marked by size expansion, the sector has seen recent declines in traded building size as newer, larger facilities often stay off-market or in institutional portfolios.

- Multifamily: Investor focus has shifted toward infill urban developments, reducing the average building size relative to pre-2009 garden-style communities.

The Impact of Portfolio and Entity Deals

As large, complex assets increasingly trade through portfolio or entity-level transactions—rather than single-asset sales—median building sizes in standard transaction data appear smaller. This structural shift reflects both financing realities and strategic asset positioning.

Looking Ahead

The post-pandemic boom briefly pushed deal sizes higher, but long-term trends have since reasserted themselves. Investors today prioritize quality over scale—smaller, more liquid, and better-located properties that match current capital constraints and tenant demand. Unless interest rates decline significantly, this smaller-but-pricier dynamic is likely to persist.

Why It Matters

For investors, understanding the long arc of CRE transactions can clarify today’s pricing dynamics and help anticipate where capital will flow next. The asset that fits the future isn’t necessarily bigger—it’s better.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes