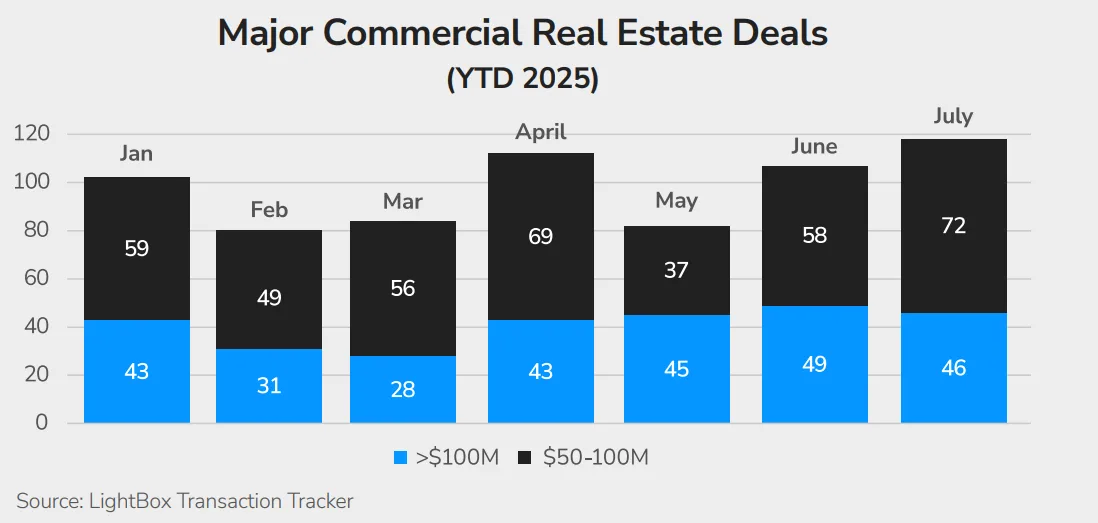

- Deal volume peaked in July 2025, climbing 10% over June to reach the year’s highest level, according to LightBox’s Transaction Tracker.

- Mid-cap transactions ($50–$100M) surged, with 72 deals recorded, up from 58 in June, reflecting investors’ shift toward more manageable assets.

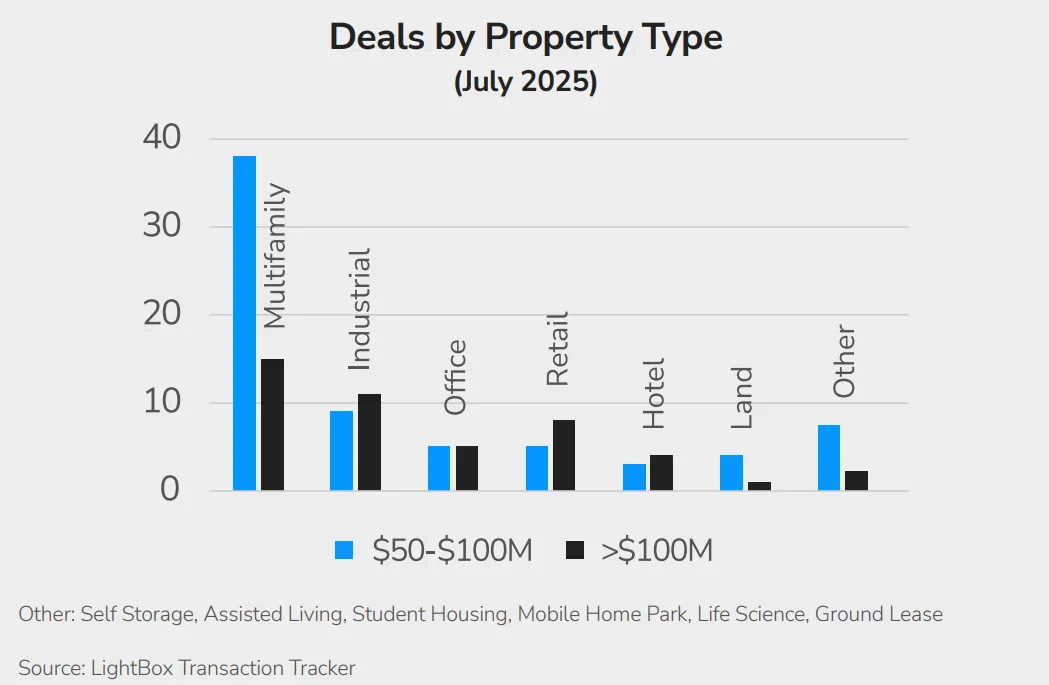

- Multifamily dominated activity, leading both nine-figure and mid-cap transactions, while hotels reemerged with 7 trades after a quiet June.

- Economic headwinds—including a weak jobs report, falling Treasury yields, and renewed inflation—could temper investor confidence heading into fall.

A Market at Its Peak—For Now

LightBox’s CRE monthly transaction tracker showed that July extended the strong pace of 2025 CRE transactions, with total deal volume hitting its highest level this year. Deals already in motion helped buoy closings despite negative economic signals, including disappointing labor data, renewed inflationary pressures, and cautious corporate earnings reports.

Still, buyers showed no hesitation in deploying capital. “There’s still meaningful liquidity in the market, but it’s moving toward asset profiles that feel more manageable in today’s interest rate and risk environment,” said Manus Clancy, Head of Data Strategy at LightBox.

Mid-Cap Surge Keeps Deals Flowing

The standout story in July was the acceleration of mid-cap transactions. Deals in the $50–$100M range rose sharply to 72, compared with 58 in June.

This reflects what Clancy describes as a “flight to precision.” Investors are seeking opportunities where underwriting is easier to defend, financing is more accessible, and cash flow durability is clearer.

Multifamily Still the Favorite

By property type, multifamily properties dominated July’s mid-cap activity with 38 transactions, more than double June’s total. The sector also led in nine-figure trades, posting 15 deals.

Demand remains fueled by high rental demand in growth metros and affordability challenges that continue to sideline many would-be homeowners. “Multifamily continues to offer the combination of liquidity, long-term demand, and deal velocity that capital is chasing right now,” Clancy said.

Sector Highlights

- Industrial: Held strong in nine-figure trades with 11 deals, but slowed in the mid-cap range (9 vs. 17 in June).

- Retail: Posted 8 large deals and 5 mid-cap transactions, showing steady demand for open-air and service-anchored centers.

- Office: Remained weak, with just 5 deals in each category.

- Hotels: Reemerged with 7 transactions, reflecting stabilized travel demand and more attractive pricing.

- Niche assets—including assisted living, student housing, self storage, and mobile home parks—registered steady but modest deal flow.

Who’s Buying

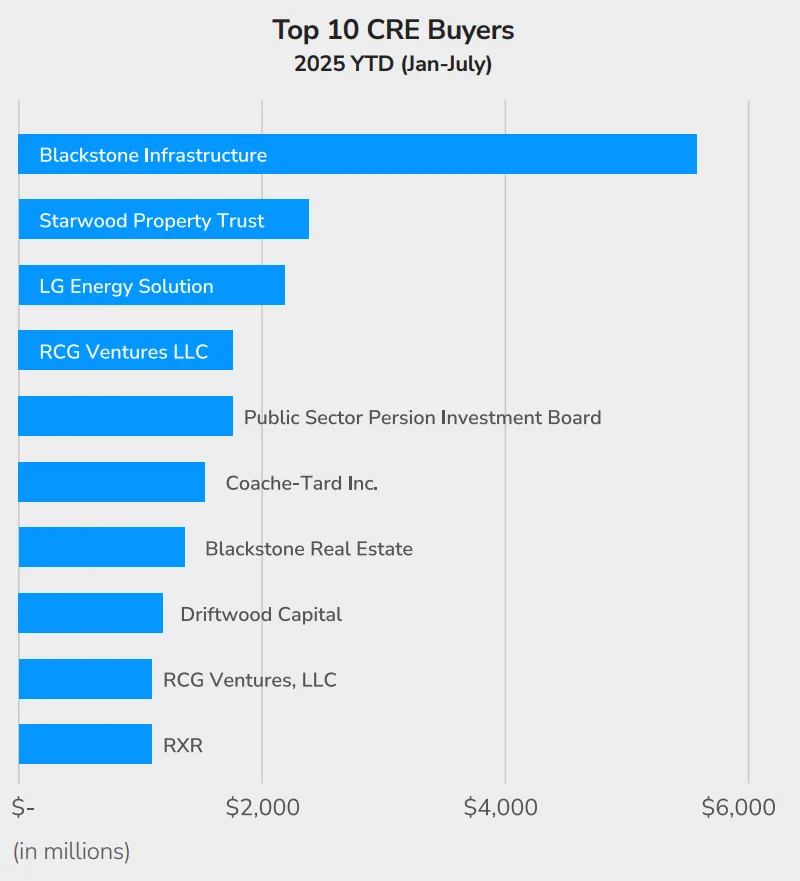

One of the more encouraging signs in 2025 is the breadth of active buyers. LightBox notes relatively few repeat players, suggesting more investors are entering the market.

Through July, more than $160B in CRE transactions have closed year-to-date. The top buyers include Blackstone Infrastructure, Starwood Property Trust, and LG Energy Solution.

Looking Ahead: A Cautious Fall

While July marked a peak for deal activity in 2025, the months ahead could bring more volatility. Markets are watching for clarity on interest rates, tariffs, and consumer demand.

Even so, dealmaking momentum remains intact. “Deals are getting done, capital is moving, and lenders remain active,” Clancy said. “Even modest progress on interest rates or trade clarity could unlock greater momentum in the August and September Index.”

For now, mid-cap trades and multifamily assets appear best positioned to keep the CRE market moving in the second half of the year.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes