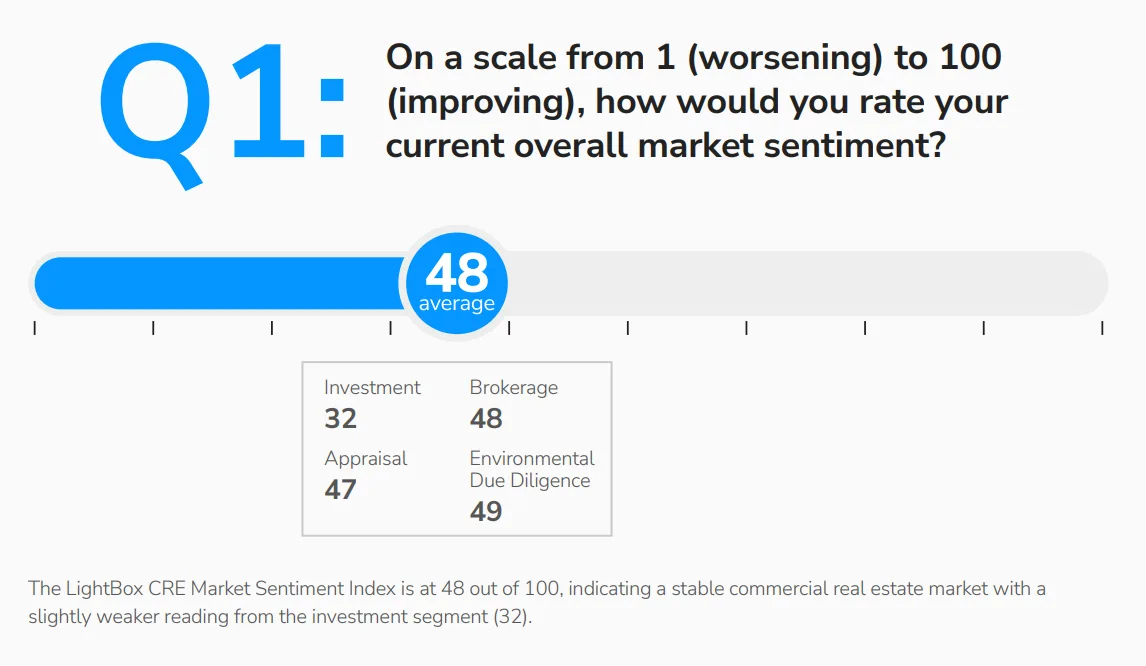

- Market sentiment remains divided, with a LightBox Sentiment Index reading of 48 out of 100—highlighting a cautious but resilient CRE landscape.

- 76% of respondents expect deal activity to increase or hold steady in H2 2025, despite headwinds from high interest rates, tight capital, and tariff uncertainty.

- Distress is localized, mainly in urban office assets, but pricing pressure and loan maturities could trigger a broader wave of distress by year-end.

- Interest rate policy remains the top concern, with 34% citing it as the biggest factor impacting second-half dealmaking.

Sentiment Split, But Market Pushes Forward

According to LightBox’s July 2025 survey of 237 US CRE professionals, CRE sentiment remains mixed. Just 27% described the first half as steady, while another 25% called it “extremely volatile.” The overall sentiment index landed at 48, signaling stability—but with investment professionals reporting a weaker 32 reading.

The top H1 dealmaking headwinds were interest rates, economic uncertainty, tenant demand, and valuation concerns. With anticipated rate cuts failing to materialize, many respondents are recalibrating their expectations, preparing for a “higher-for-longer” environment in the second half of the year.

H2 Outlook: Cautious Confidence Amid Market Noise

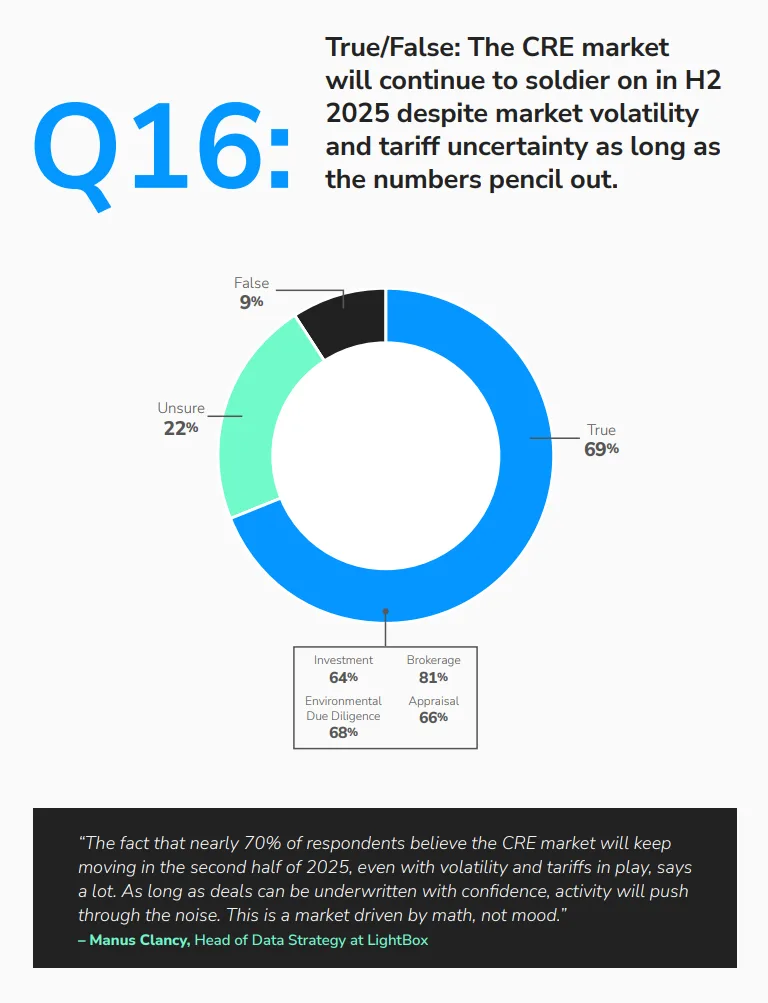

Despite volatility, 69% of professionals believe the market will “soldier on” through the rest of 2025—if deals remain financially viable. More than 70% of brokers and investors report they are likely to pursue new transactions, signaling confidence in a potential rebound.

While capital remains constrained—only 35% called debt capital accessible in H1—many expect modest improvement or stability in lending conditions ahead. Improved pricing clarity and narrowing bid-ask spreads are also helping to restore confidence, particularly in high-activity sectors like multifamily and industrial.

CRE Pricing Appears Near Bottom

After months of suppressed transaction volumes and wide bid-ask spreads, 40% of respondents believe CRE pricing has finally hit bottom, while 60% think values still have room to fall. Most agree pricing is stabilizing, but with a downward bias as tighter credit conditions could still apply pressure later this year.

Distress Is Simmering, Not Surging

Contrary to early 2025 predictions, distress hasn’t yet emerged as a dominant market force. 78% report distress remains isolated to specific asset classes—most notably urban office. However, 40% are starting to see it expand. A backlog of loan maturities and fewer extensions could push more assets into distress by year-end.

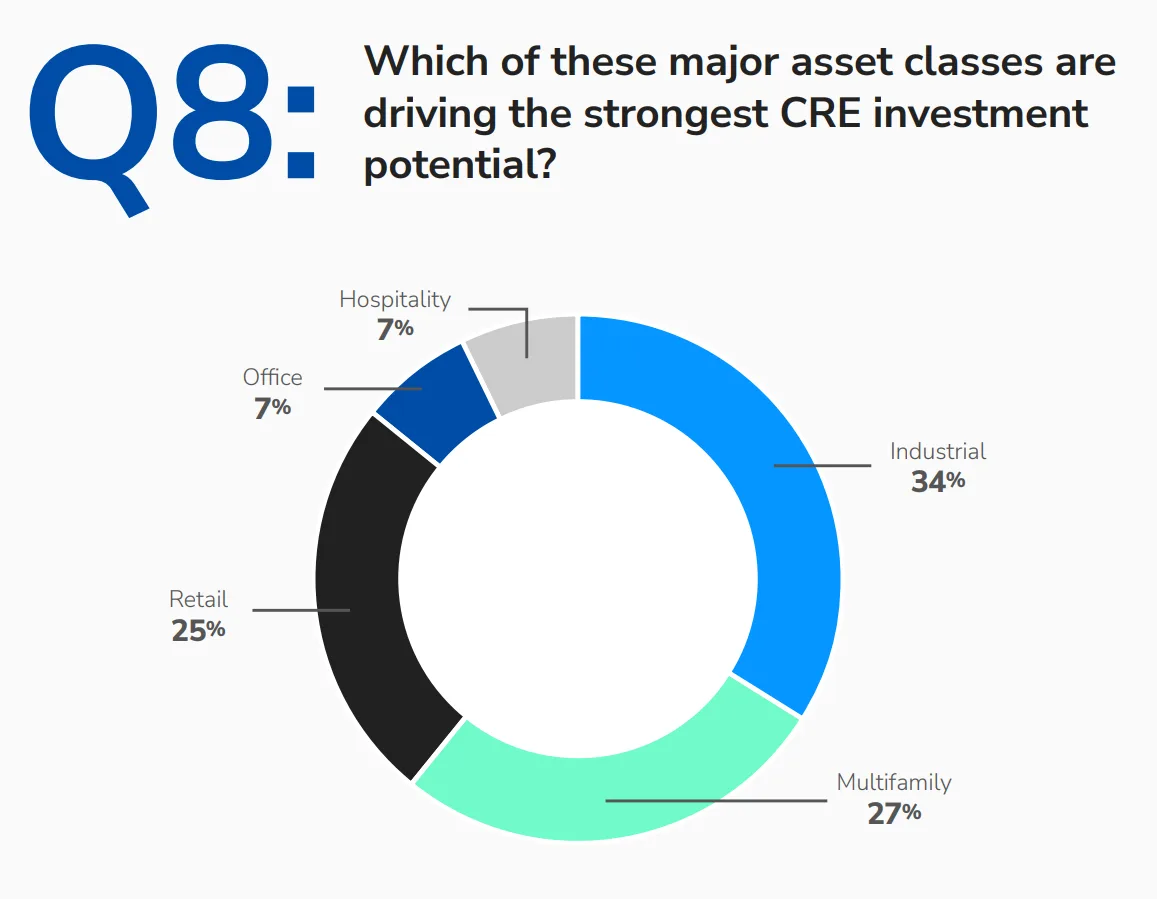

Investment Targets: Industrial Still Leads

When asked about asset class opportunities:

- Industrial (34%) leads investor interest, fueled by reshoring trends and solid fundamentals.

- Multifamily (27%) remains attractive due to ongoing housing shortages.

- Retail (25%) sees stable interest thanks to low vacancies and limited supply.

Data centers are also gaining investor attention as one of CRE’s fastest-growing sectors, driven by large-scale AI infrastructure needs.

Tariffs Add a New Layer of Uncertainty

While high interest rates remain the dominant concern, tariff-related uncertainty is on the rise. Over half of respondents believe tariffs will slow growth and add inflationary pressure in H2 2025. Some worry these trade dynamics could affect both retail expansion and construction costs across multiple sectors.

What’s Next

The second half of 2025 is shaping up to be more active, with professionals adjusting to a new normal of economic uncertainty, higher-for-longer rates, and geopolitical noise. CRE sentiment remains cautiously optimistic, with many in the industry ready to act as long as deals can pencil out.

LightBox Research Director Dianne Crocker summed it up: “Despite ongoing challenges around rates and tariffs, our survey shows a CRE market that’s adapting to uncertainty and gearing up for a more active second half.”

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes