- US CRE sales reached $38B in June. After excluding entity-level deals, volume rose 5.8% year-over-year.rn

- Revisions to April and May lifted total Q2 volume to $109.1B (+17.6% y/y), with a potential upward revision to $120.2B (+29.6% y/y).rn

- Retail (+37.4%), industrial (+15.0%), and office (+11.5%) led transaction growth, while apartments (-46.1%) and hotels (-45.6%) declined.rn

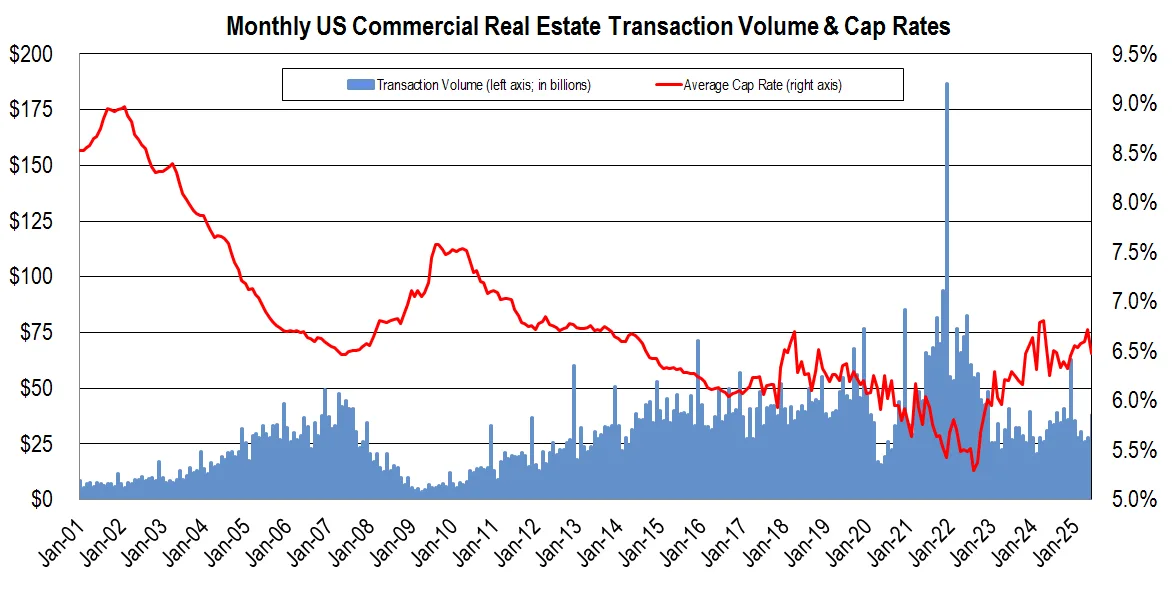

- Average cap rates fell 25 bps month-over-month to 6.48%, led by a 32 bps drop in office and 18 bps in apartments.rnrnrn

Market Momentum Builds

J.P. Morgan reports that US CRE sales hit $38B in June, per MSCI Real Assets. The total was 15.7% below last June, but the drop came from fewer entity-level deals. Those fell to $887M, down from $10B in June 2024.

After removing entity transactions, asset-level deals increased by 5.8% year-over-year. That measure better reflects typical deal flow and investor activity.

Upward Revisions Strengthen the Q2 Picture

MSCI revised April and May volumes sharply higher. April rose 38% to $36.1B (+35.1% y/y), and May climbed 30% to $35.9B (+15.9% y/y). If June follows its usual pattern of a 30% upward revision, total Q2 CRE sales would reach $120.2B. That would mark a 29.6% year-over-year increase.

These numbers far exceed the 8% average growth many analysts had modeled for Q2 capital markets revenue. Though transaction volume doesn’t directly translate to revenue, the strength bodes well for CRE services earnings.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Retail and Industrial Lead Sector Growth

Retail posted the biggest gain among property types, rising 37.4% from last year. Industrial followed at 15%, and office transactions increased 11.5%. Apartments and hotels struggled, falling 46.1% and 45.6%, respectively.

Cap rates fell in most sectors. The overall average dropped to 6.48% (-25bps m/m). Office deals averaged 7.25% (-32bps), while apartments saw rates fall to 5.41% (-18bps). Industrial and retail rates edged up slightly, indicating stable risk premiums in those sectors.

Investor Outlook Turns Positive

JPMorgan analysts said the jump in activity came in well above expectations. Hines Global CIO David Steinbach pointed to falling new construction and better fundamentals as key drivers.

He described the current period as “an uncommon buying opportunity,” driven by constrained supply and improving demand. Cushman & Wakefield’s Kevin Thorpe echoed that sentiment, highlighting renewed interest in Class A central business district offices, where values have dropped sharply.

Looking Ahead

Transaction volumes are gaining strength, and pricing appears to be stabilizing. If current trends continue, the second half of 2025 could see continued growth, especially in retail, office, and industrial sectors.

Bottom Line

Commercial real estate sales surprised to the upside in Q2 2025. Strong sector performance, falling cap rates, and tight supply are drawing investors back into the market. With favorable revisions and improving fundamentals, CRE is showing signs of a sustained recovery.