- Strong consumer spending and low layoffs may reflect delayed responses rather than actual resilience.rn

- Price discovery in CRE markets is stalling, with cap rates and property values not fully reflecting macroeconomic shifts.rn

- Tariffs are causing frictions in pricing, supply chains, and business operations—leading to economic uncertainty that may eventually spill into CRE.rn

- Lodging and retail are most vulnerable to consumer pullbacks, while office and multifamily face risks from layoffs and budget pressures.

The Calm Before the Potential Storm

trepp reports that commercial real estate (CRE) appears relatively stable on the surface. Property valuations are holding up, leasing markets haven’t seen a dramatic pullback, and macro indicators like consumer spending and employment remain solid. But according to recent analysis, this apparent stability may be masking growing CRE risks and vulnerabilities under the surface—especially in the face of new tariffs and economic frictions.

As firms and households grapple with rising costs and uncertain demand, the lag in behavioral response could give way to sharper shifts later in the cycle. This pattern—where macroeconomic shifts unfold slowly and then suddenly—could challenge CRE stakeholders unprepared for nonlinear change.

Sticky Prices, Stalled Transactions

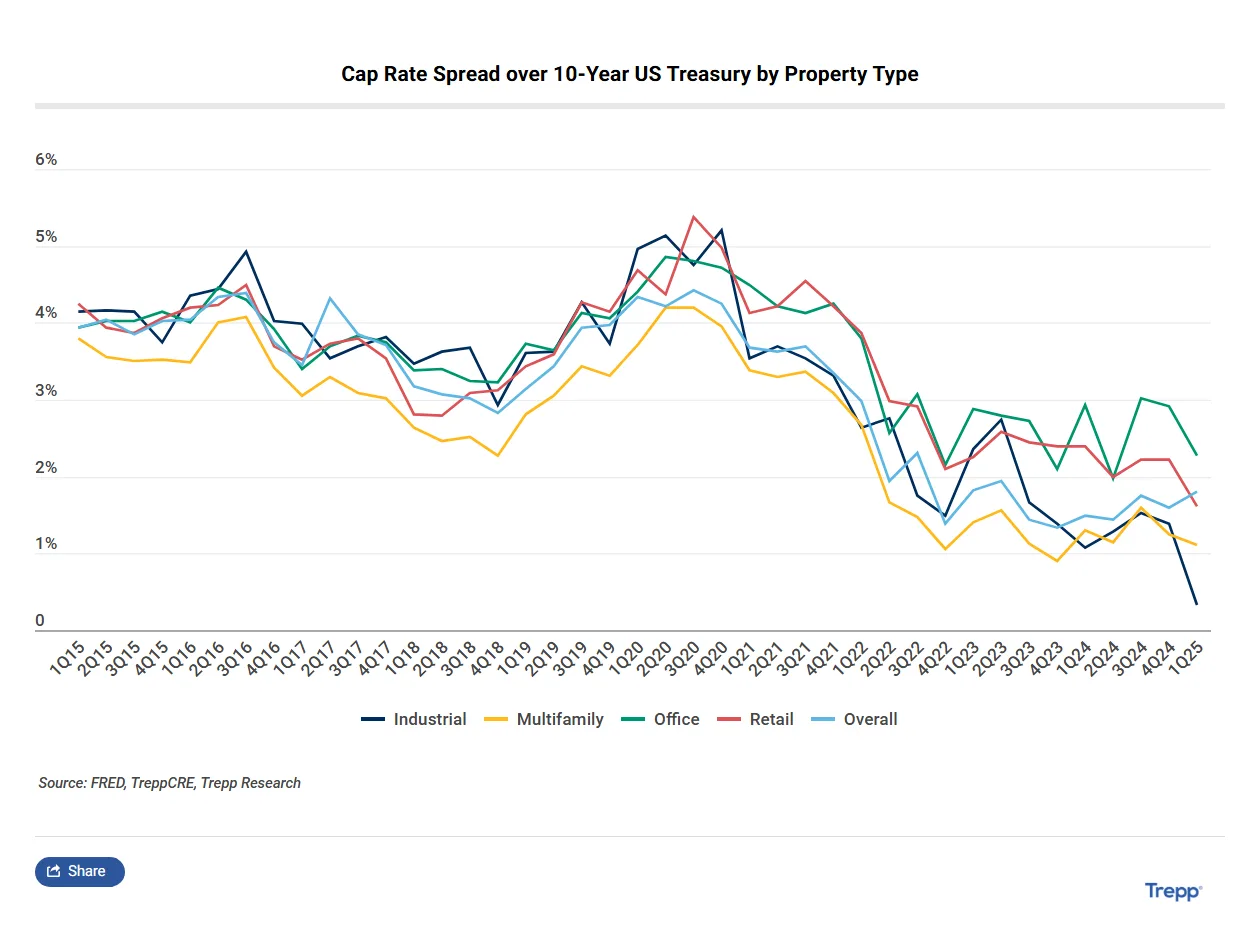

One of the clearest signs of friction is in price discovery. Trepp’s Property Price Index (TPPI) reveals that, outside of the lodging sector, prices across most asset classes remain sticky. This isn’t because fundamentals haven’t changed, but because there’s not enough transaction volume to establish new valuation norms. Sellers are hesitant to lower prices, while buyers are demanding discounts due to rising cap rates and uncertain rent growth.

The result: a standoff that delays critical decisions and masks the true state of market fundamentals.

Consumer Behavior and CRE Exposure

Headline economic data might suggest resilience, but much of it may reflect lagging adaptation rather than true strength. For instance, steady consumer spending could be the result of inertia rather than confidence. When households finally adjust to rising prices or job risks, the spending pullback could be sharp.

This matters directly for CRE risks. Lodging and retail assets are highly exposed to consumer demand shifts. Office properties, meanwhile, are particularly vulnerable to layoffs and delayed tenant absorption, especially as companies slow hiring or reassess space needs. Multifamily isn’t immune either—rising rents may hit resistance as household budgets tighten.

Operating Costs and Loan Stress Rising

Layered onto demand concerns are increasing operating costs. Property taxes and insurance premiums continue to climb, squeezing NOI and pressuring owners—especially for assets already close to breakeven. For maturing loans, any dip in cash flow can push debt service coverage ratios (DSCRs) below lender thresholds, complicating refinancing efforts.

With Trepp’s property- and loan-level performance data, investors and lenders can monitor stress indicators like DSCR, NOI trends, and loan-to-value (LTV) ratios to detect emerging CRE risks and potential distress early.

Three Adjustment Scenarios

Analysts outline three possible adjustment paths to today’s economic shifts:

- Smooth: Firms slowly adapt to tariffs, price increases stay mild, and the economy adjusts without major dislocations.

- Bumpy: Reconfiguring supply chains and retraining labor create drag on investment and hiring, leading to a gradual recession.

- Chaotic: Delays in policy response combine with collapsing demand and investment freezes, triggering a deep, fast-moving recession.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Outlook: Monitor the Underlying Pressures

The primary concern for CRE professionals isn’t the current data—it’s the trajectory of adjustment. If the economy shifts from gradual friction to sudden shock, cre market dynamics could change swiftly. Properties that looked safe could face sudden NOI declines or refinancing challenges.

To stay ahead, investors, lenders, and operators must look beyond headlines and monitor granular asset performance. In a high-friction environment, resilience is about preparation—understanding exposure, tracking the right data, and building flexibility into decision-making.

Conclusion

The risks facing CRE today aren’t just about what’s visible, but about what’s building quietly in the background. Sticky valuations, rising costs, and macro uncertainty from tariffs are setting the stage for a possible inflection point. With the right tools and awareness, CRE stakeholders can better prepare for what may be coming next—whether it’s a smooth adjustment or a sharper disruption.