- Commercial real estate (CRE) returns have now outpaced US home price appreciation for two consecutive quarters—marking a reversal from a trend that began in 2022.

- While national home prices declined -0.8% in Q3 2025, CRE indices like NCREIF and MSCI/RCA posted stronger gains, supported by income performance and early signs of capital appreciation.

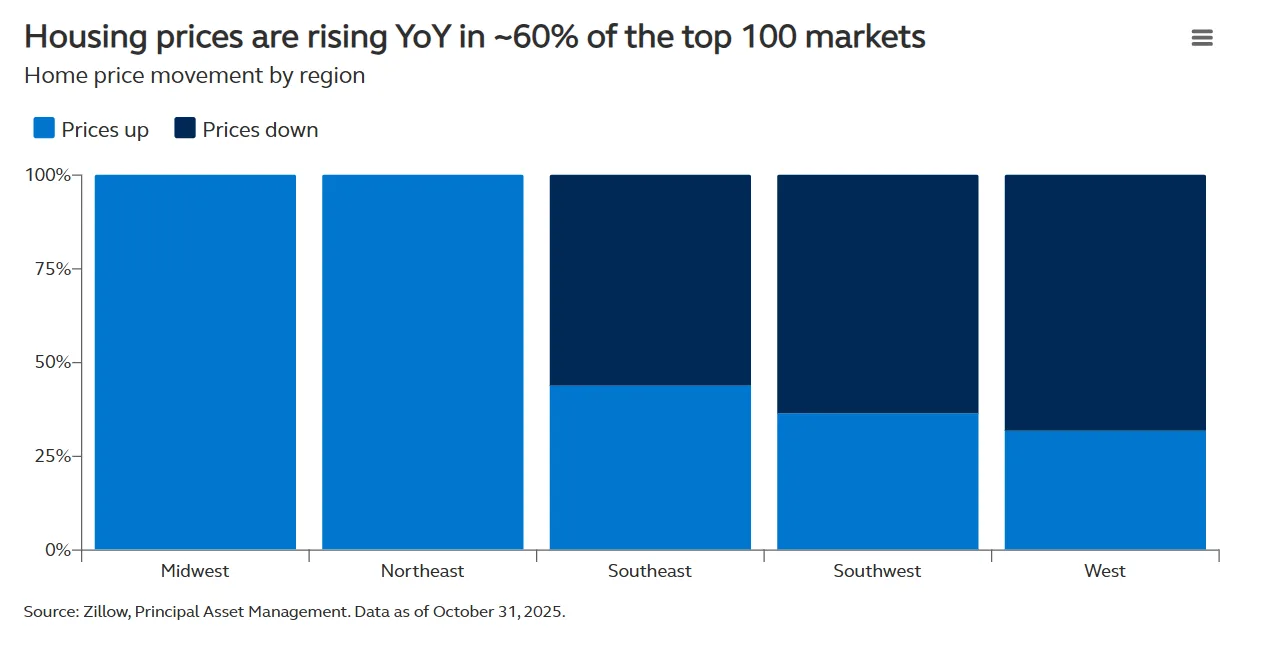

- The once-tight correlation between housing and CRE is starting to re-align, but the housing market remains regionally split, with the Midwest and Northeast outperforming the West and Southeast.

The Shift Begins

For the first time since late 2022, commercial real estate is outperforming residential housing on a total return basis. This is due to stronger income performance and early signs of price recovery, reports PrincipalAM. The NCREIF Property Index rose +1.2% quarter-over-quarter and +4.7% year-over-year in Q3 2025. In contrast, national home prices dropped -0.8% during the same period, according to the latest Case-Shiller release.

CRE Recovery Taking Hold

CRE valuation indices are now showing broader signs of improvement. MSCI/RCA reported a +4% year-over-year increase. Green Street rose +3% year-over-year. Even the Costar Index—still down -1.9% YoY—has increased in four of the past five months. The sector’s total return strength is being driven largely by income, which historically accounts for over 80% of long-term CRE performance.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Housing Cools, But Not Uniformly

National housing data masks an increasingly fragmented market. Zillow reports that while 60 of the top 100 metros are still posting YoY home price gains, 40 are in decline. The West, Southwest, and Southeast are seeing the most softness, with only about a third of markets in each region still appreciating. By contrast, nearly all Midwest and Northeast metros remain in positive territory.

A Historical Correlation, Disrupted

CRE and housing prices traditionally move in tandem, with residential real estate often acting as a leading indicator. But elevated interest rates broke that relationship post-2022—depressing CRE values while housing prices stayed elevated due to limited supply. As interest rate pressures ease and CRE stabilizes, that gap is beginning to close.

Looking Ahead

Expect further normalization between the two asset classes. CRE values appear poised for continued recovery, while housing appreciation is likely to moderate or turn negative in softening markets. The bifurcation in the housing sector will remain a key trend to watch, especially as regional economic fundamentals diverge.