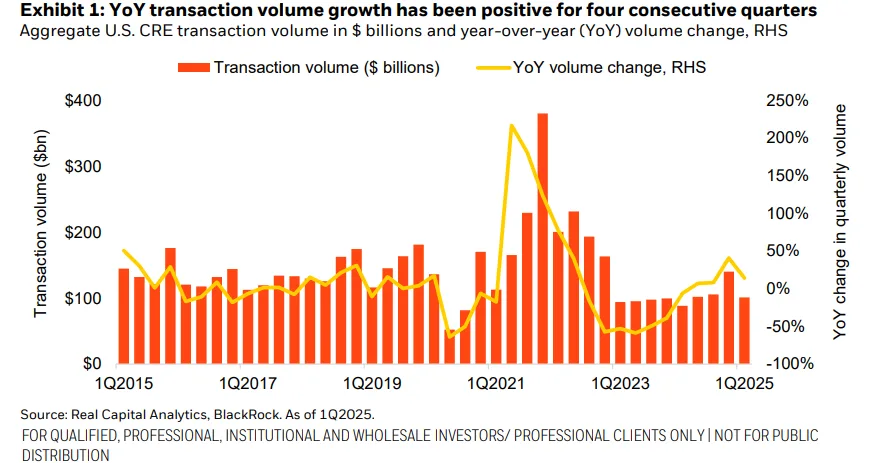

- US commercial real estate transaction volumes grew 14% year-over-year in Q1 2025, marking four consecutive quarters of growth, despite continued macroeconomic uncertainty.

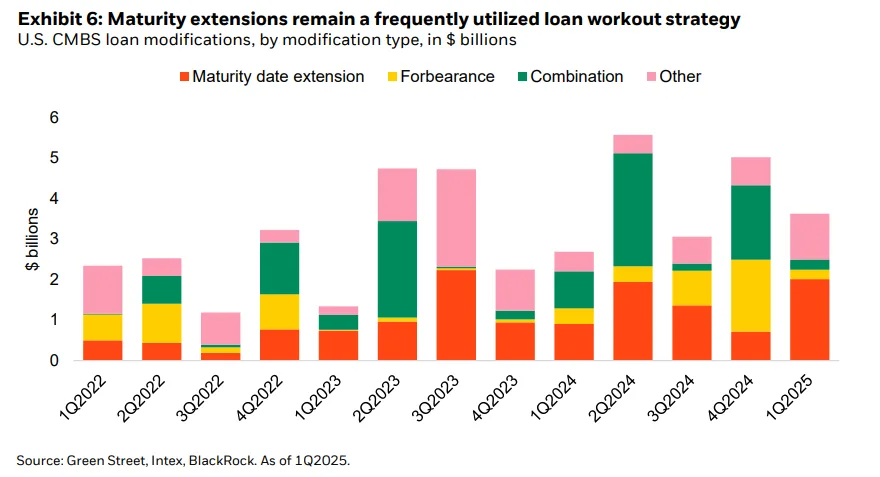

- $625B in CRE loans are set to mature in 2025, on top of $520B previously extended—raising concerns over potential refinancing risks and lender behavior.

- Distressed CRE volumes rose to $116B in Q1 2025, up 31% from the prior year, reflecting ongoing strain, particularly in the office segment.

Momentum Holds—for Now

According to BlackRock, CRE’s recovery extended into early 2025, with Q1 transaction volumes rising for the fourth straight quarter. Volumes in April held steady at $26B, signaling some resilience despite volatile markets.

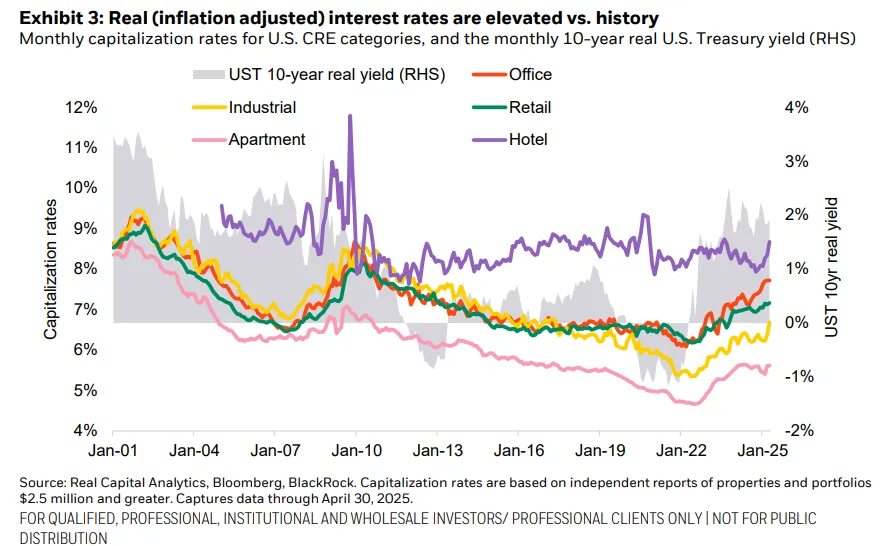

Interest Rates: A Mixed Bag

Market participants have largely adjusted to structurally higher interest rates. However, high real (inflation-adjusted) interest rates are dampening asset valuations. While nominal rates at or above 5% are slowing new loan originations, some investors are still deploying capital, even writing full cash checks.

Distress Rises Again

Distressed CRE assets surged 31% YoY in Q1 2025, driven largely by the office sector. This marks a reversal in the previously moderating trend of net distress, underscoring uneven recovery across property types.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Maturity Wall in Sight

Loan extensions have become common, particularly for office properties. About $625B in loans are maturing in 2025, with banks—who hold 46% of that volume—showing some flexibility. Still, borrower and lender strategies hinge heavily on rate expectations and market conditions.

Why It Matters

While the rebound in transaction volume is encouraging, the rise in distressed assets and looming maturity walls highlight a bifurcated market. Structural discipline and selective credit underwriting will be critical as CRE navigates this late-stage recovery.

What’s Next

Unless interest rates fall sharply or the economy reaccelerates, CRE investors should brace for continued dispersion. Transaction resilience will depend on how quickly the market can work through maturing debt and absorb distressed assets—especially in the office sector.