- CRE values are stabilizing, with major indices showing signs of recovery, but distress remains a lagging issue in select sectors.

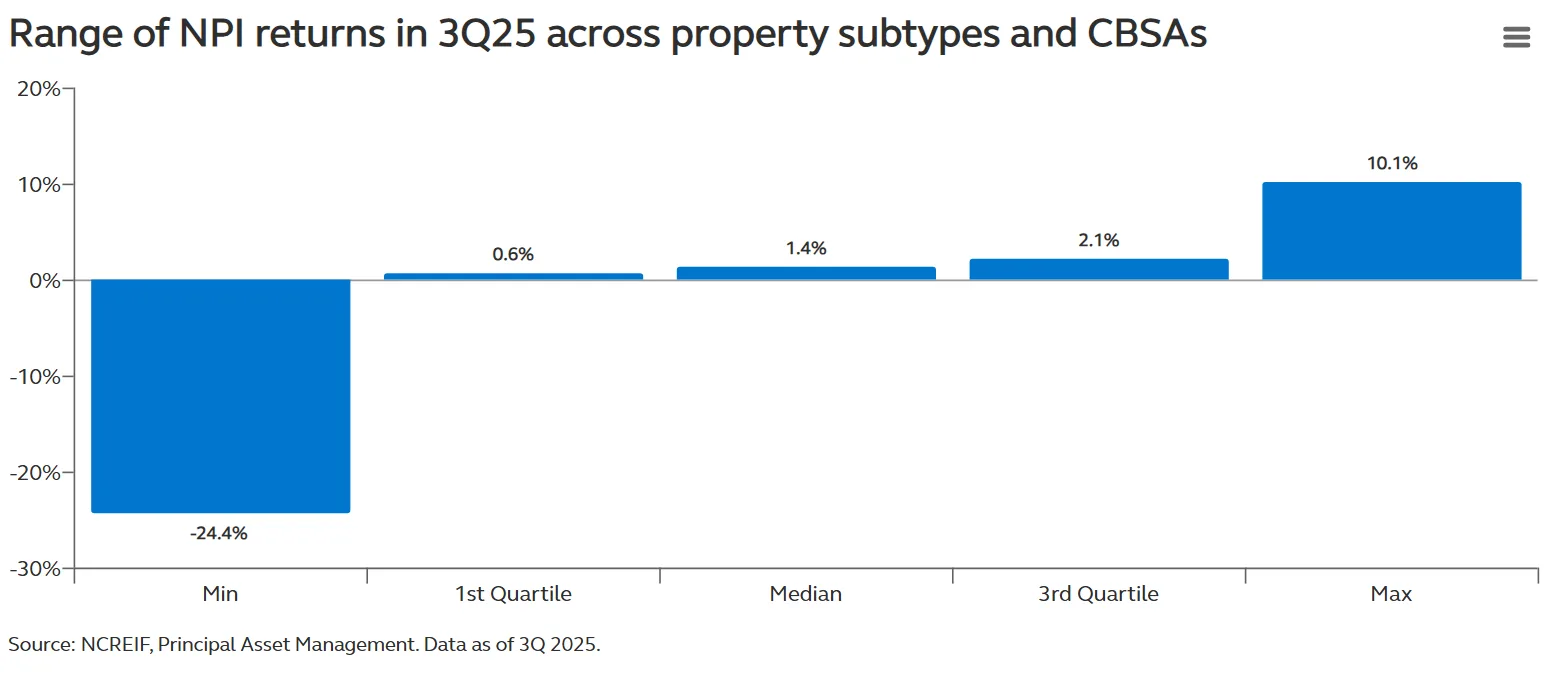

- Return dispersion is widening, with notable performance gaps across property types, markets, and institutional funds.

- Retail and senior housing are outperforming, while office and storage continue to lag amid persistent uncertainty.

- Income, not appreciation, is becoming the primary driver of returns, especially in an era of higher-for-longer interest rates.

A Recovery, but Not a Rising Tide

Commercial real estate is on the rebound, but the upswing is far from uniform, per Principal Asset Management. After two years of price corrections, the CRE recovery is taking shape, with valuations across core indices such as Green Street, RCA/MSCI, and CoStar beginning to rebound. Public REITs have rallied 35% from their 2023 lows, and transaction volumes are climbing again.

Yet, signs of distress continue to edge upward, and asset-level returns remain highly uneven. This dispersion underscores a key theme: the CRE market is transitioning from broad recovery to one where alpha generation hinges on precision.

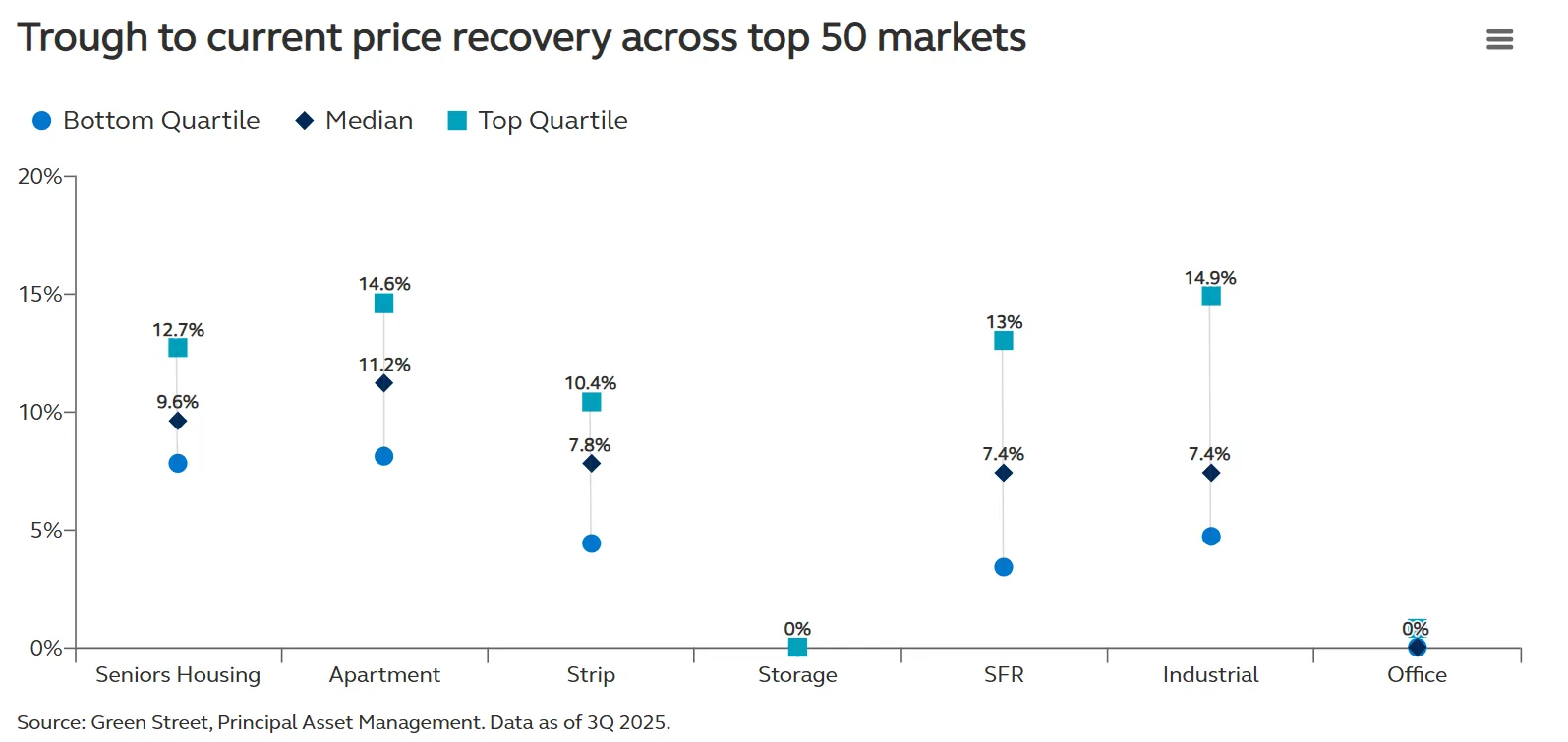

Price Trends Vary by Sector and Market

The four major CRE valuation indices are now off their troughs:

- Green Street CPPI: +6.3% above its low

- RCA / MSCI Index: +2.8% above trough

- CoStar Repeat-Sales Index: +1.7% above trough

- NCREIF Property Index: +5.6% above trough

However, asset performance varies dramatically by geography and property type. Apartments and senior housing are leading the rebound (+11% and +10%, respectively), while office and storage remain at their lows. Across most sectors, price recovery in top-performing markets exceeds +10%, while others continue to stagnate.

A Widening Gap Among Funds

Institutional fund performance is diverging sharply. The NCREIF ODCE Index returned +0.73% in 3Q25, but dispersion between top and bottom quartile funds has more than doubled to over 2%, signaling an inflection point.

One-year trailing returns show:

- Top quartile: +5.7%

- Bottom quartile: +0.3%

The key drivers? Tactical sector allocations and stronger income profiles. Funds that bet early on the retail resurgence and defensive alternatives like senior housing or data centers are outperforming.

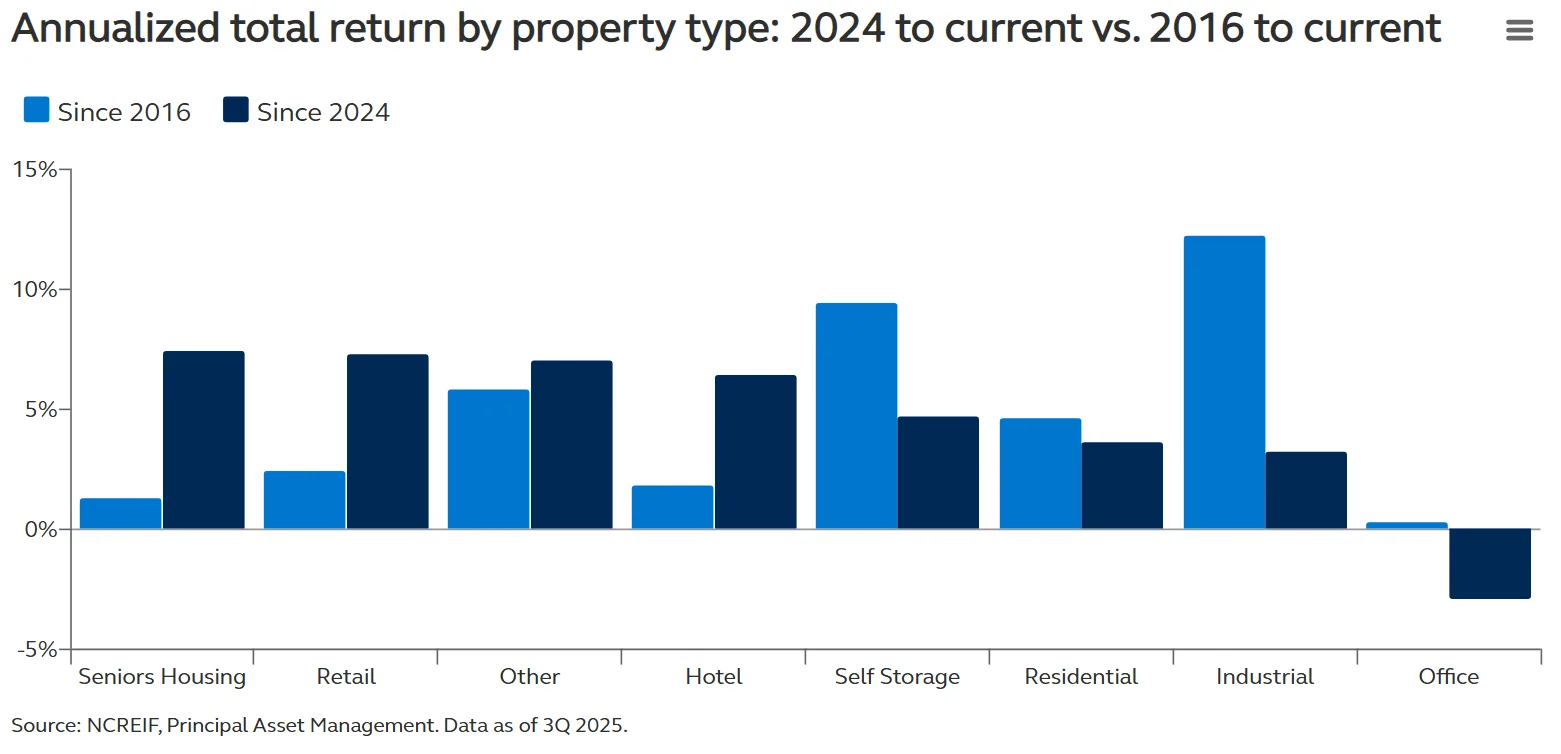

Retail and Alternatives Gain Momentum

While industrial was the dominant sector post-2016, its outperformance is fading. Retail, on the other hand, is staging a quiet comeback, posting +7.3% annualized returns since 2024—outpacing all major sectors.

Data centers and senior housing are also adding meaningful returns, especially in funds that emphasize income over appreciation. However, not all alternatives are equal, with some speculative AI-linked projects underperforming compared to more stable digital infrastructure plays.

Income Is the New Alpha

The days of relying on cap rate compression are over. From 2010–2019, income made up less than half of ODCE returns. Today, it’s becoming the primary driver, as appreciation slows and cash flow stability takes center stage.

Top-performing funds are consistently delivering +1% income per quarter, emphasizing tenant quality, long-term leases, and disciplined asset management. Those unable to match this pace may fall behind.

Why It Matters

The CRE recovery is here—but it’s fragmented. In this new landscape, macro-level tailwinds matter less than asset-level execution. Selectivity, operational strength, and income generation now separate outperformers from laggards.

What’s Next

The shift to income-focused strategies and precise asset selection is likely to persist, especially amid higher-for-longer interest rates. Investors should expect continued dispersion and position accordingly:

- Favor sectors with durable demand: senior housing, retail, and next-gen industrial.

- Target markets showing sustained price momentum, especially in the top quartile of performance.

- Double down on income quality, with emphasis on lease stability, creditworthy tenants, and operational efficiency.

Bottom Line

CRE’s next cycle isn’t being led by rising values across the board—it’s being shaped by investors who can identify value through selectivity, resilience, and conviction. In a market driven by dispersion, alpha is no longer passive—it’s earned.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes