- CRE pricing remains stable, but widening bond spreads and falling liquidity hint at stress building beneath the surface.

- Cap rates don’t move in sync with the 10-year Treasury; other market signals provide better insight into future pricing.

- A sharp drop in hotel deal volume and weakening office liquidity suggest investor caution and pricing risk.

Signs of Strain Beneath the Surface

According to the MSCI, despite steady CRE pricing data, US commercial real estate may be heading for stress. Deal volume in April was flat year-over-year. Cap rates showed little movement. But this stability may be misleading.

CRE is a slow-moving market. Deals often take months to close. That delay can mask emerging risks in real-time data. The real impact of tariff turmoil may surface later this year.

Cap Rate Misconceptions

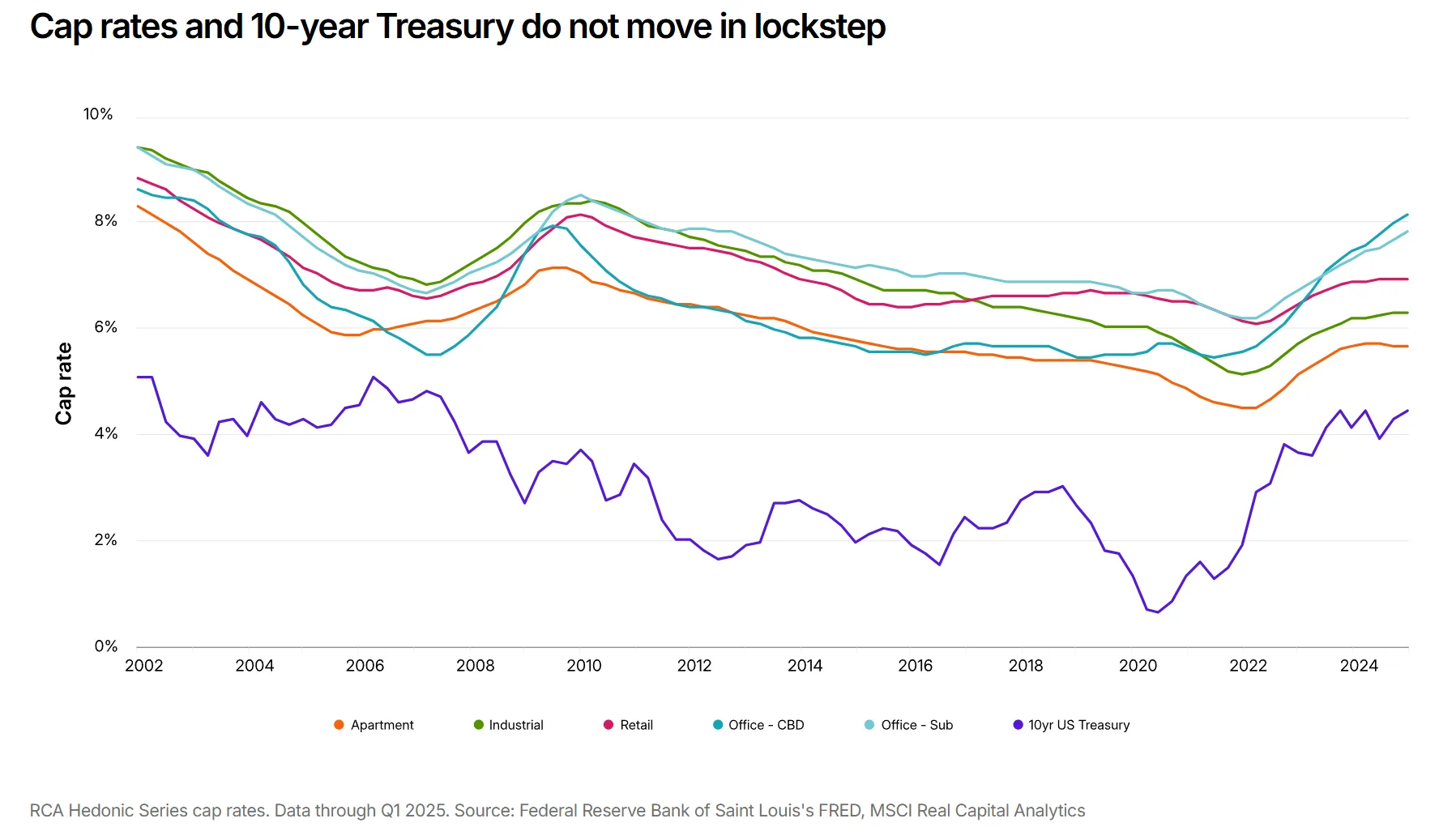

Many investors believe cap rates move in lockstep with the 10-year Treasury. This is not the case. Spreads change based on risk perception, liquidity, and expected income growth.

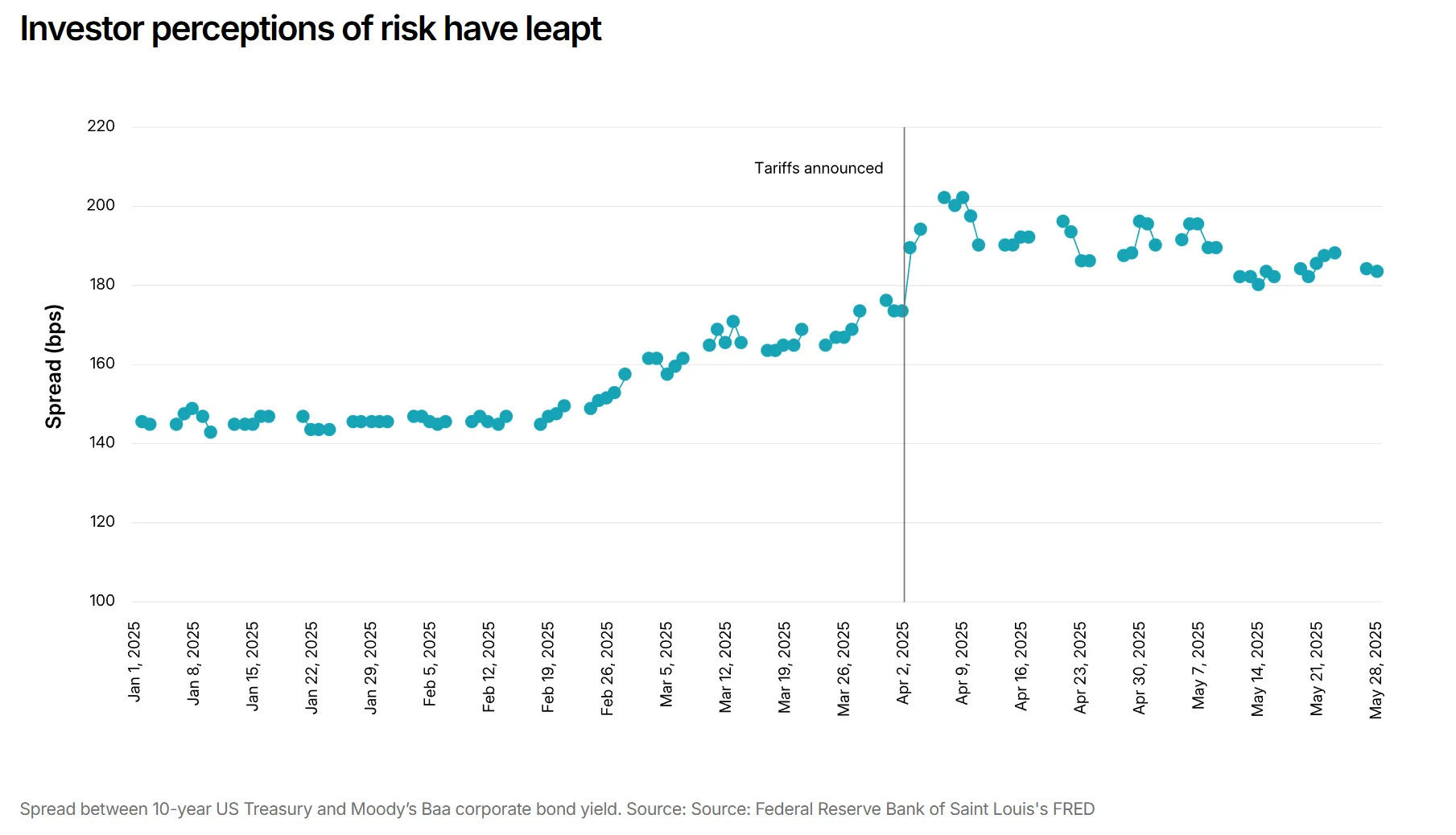

Since April 2, the spread between the 10-year Treasury and Moody’s Baa corporate bond yields has increased by 10 basis points. Year-to-date, the increase is 40 basis points. Historically, when that spread grows, office cap rates tend to follow—rising roughly 85 basis points for every 100-basis-point increase.

Liquidity Warning Signs

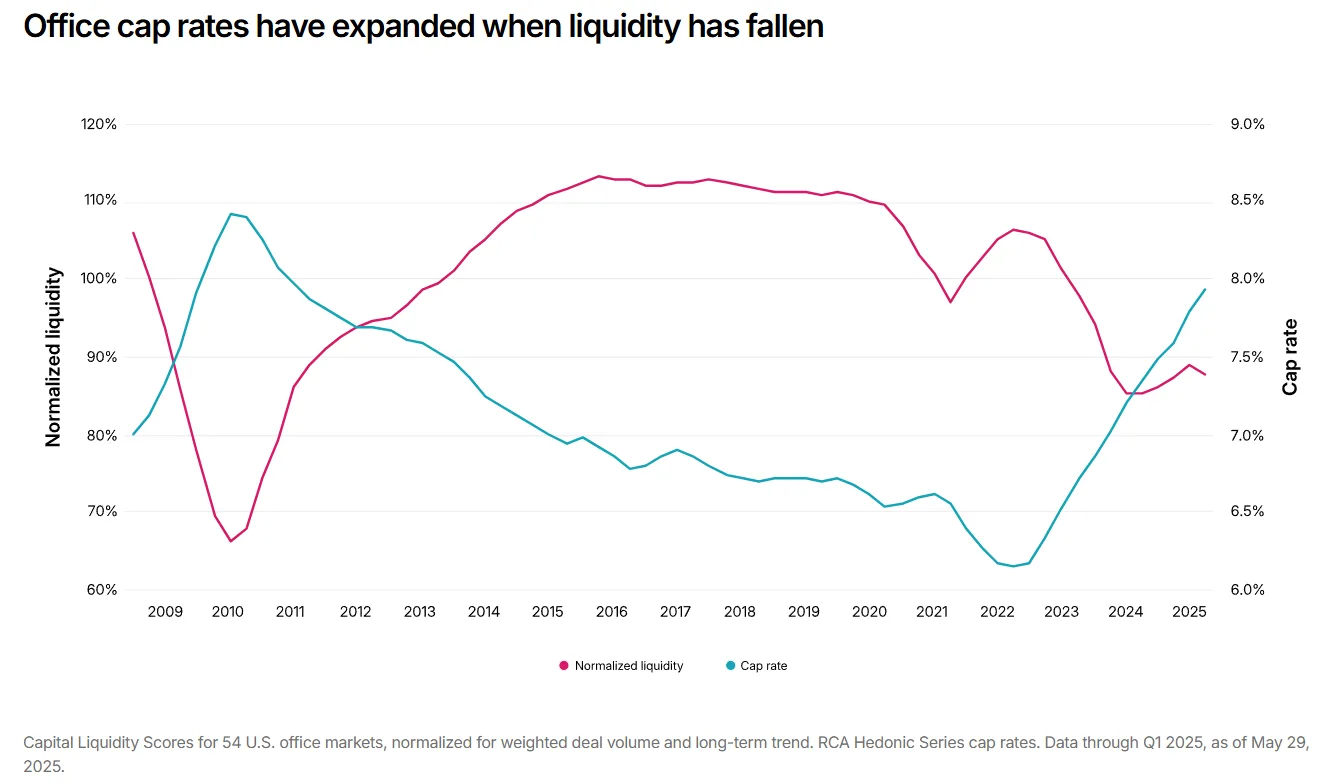

Liquidity is also weakening. Capital markets professionals report that some cross-border investors are pulling back from US deals. Tariffs may be limiting their access to US dollars. That reduces demand for US real estate.

Foreign capital made up 7.2% of all office transactions in 2024. If that dries up, CRE pricing pressure could grow. MSCI data shows that as liquidity falls, cap rates typically rise. The first quarter of 2025 showed a small but notable drop in office market liquidity.

Hotel Deals Plummet

Hotel properties may be the first to feel income pressure. Unlike offices, hotel revenue resets daily. That makes the sector more sensitive to market shifts.

In April, hotel transaction volume fell 52% from a year earlier. That sharp drop could be a warning sign for broader CRE sectors. Recession fears, inflation, and supply-chain issues are raising concerns across the board.

Sentiment Tells a Different Story

CRE data often lags reality. Investors rely on appraisals and infrequent comps. These don’t always reflect current market sentiment.

At recent industry conferences, many professionals expressed frustration. They’re dealing with aftershocks from last year’s rate hikes. Now, uncertainty from tariffs adds to the pressure. Current pricing metrics don’t show it—but sentiment suggests trouble is building.

Looking Ahead

CRE investors should not wait for pricing data to confirm risk. Forward-looking signals—like risk spreads, falling liquidity, and hotel trends—suggest pricing pain could arrive by late 2025.

Now is the time to model different outcomes and prepare for possible declines. Waiting for the data to catch up may be too late.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes