- Office was the top-performing sector in Q3 2025, with prices rising 1.97% quarter-over-quarter.

- Overall CRE prices posted modest gains, with smaller and mid-sized properties outperforming larger institutional assets.

- Multifamily, industrial, and retail saw muted but positive growth, while lodging continues to lag.

- High interest rates, inflation, and tariff uncertainty remain key headwinds. Strong job markets and steady demand are helping to support pricing.

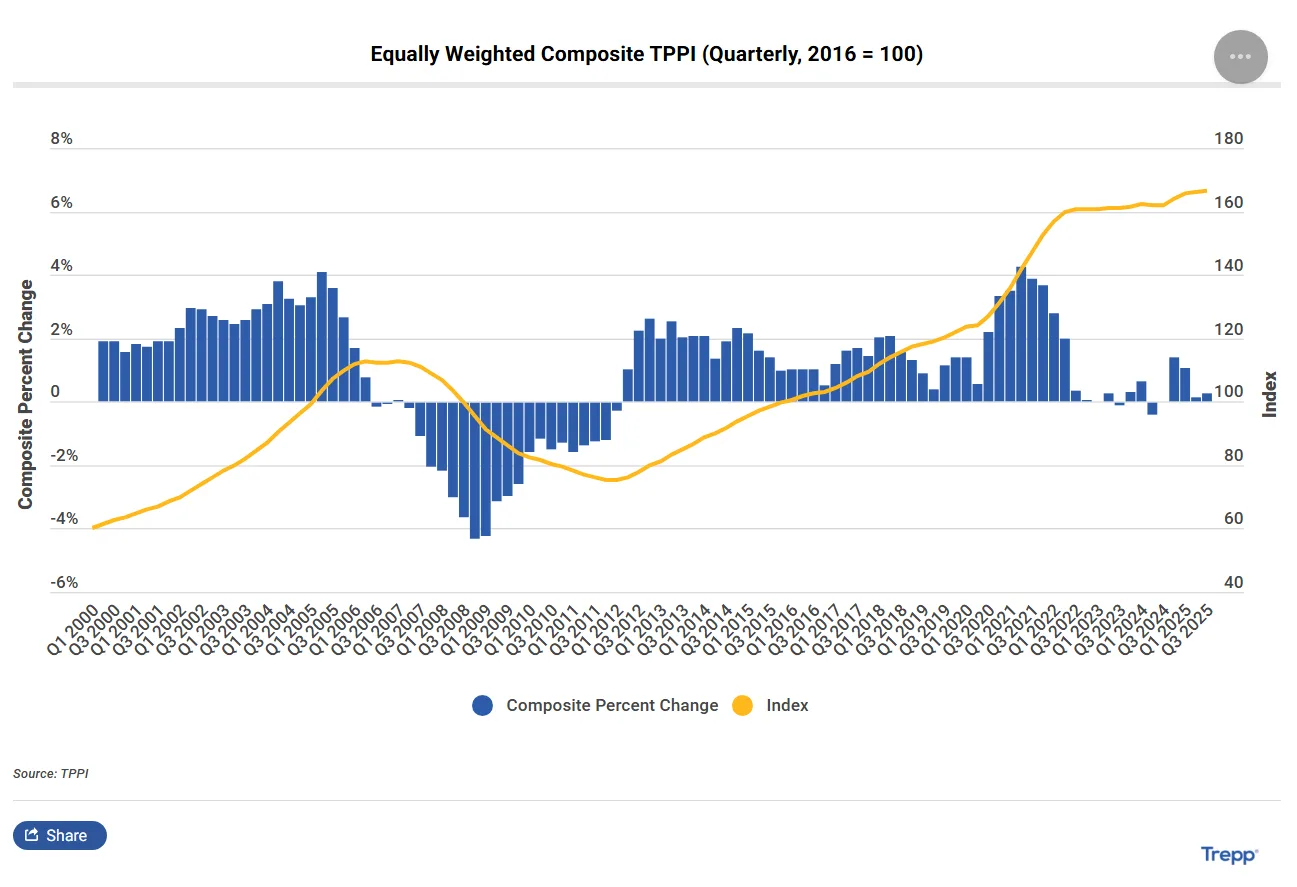

After several quarters of decline, commercial real estate values began to edge higher in Q3 2025. The latest Trepp Property Price Index (TPPI) shows a market starting to stabilize. Early signs of recovery are emerging—especially in the office sector, which posted its strongest quarterly performance in years.

Office Stands Out

Once the most distressed segment, office assets led the market in Q3. The value-weighted office index rose 1.97% from Q2. This marks a rare uptick after extended price declines. Improved leasing activity and firmer return-to-office trends are helping lift valuations. Opportunistic capital is also returning in some markets. Trophy and high-amenity buildings are seeing the most demand. Meanwhile, lower-tier office properties continue to lag.

The Composite View

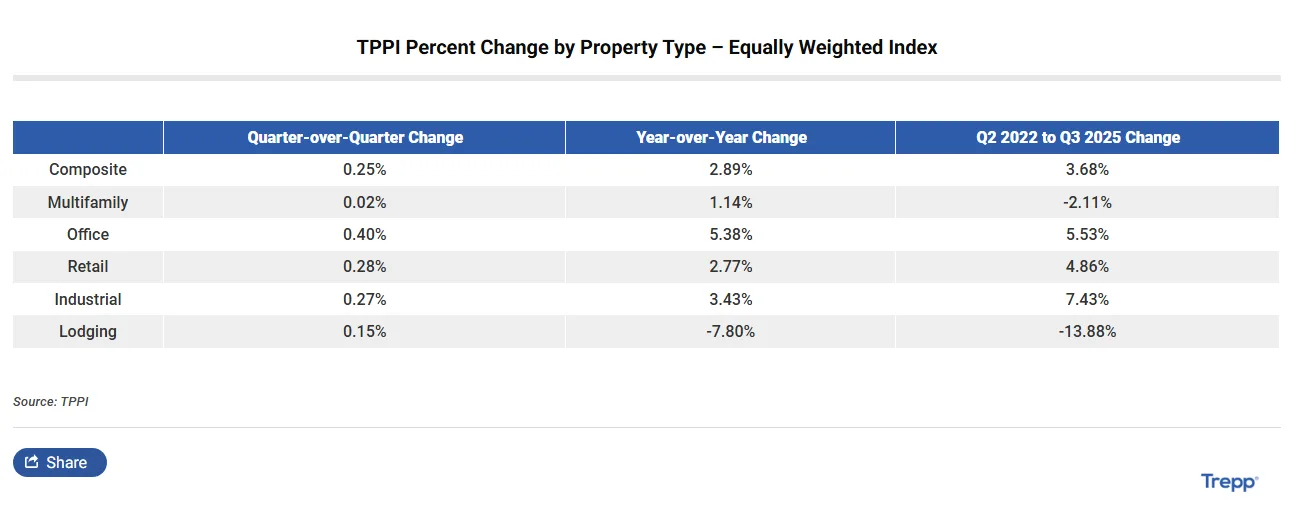

Overall, CRE prices rose slightly in Q3. The equally weighted TPPI index climbed 0.25% from the previous quarter and is up 2.89% year-over-year. The value-weighted index, which tracks larger transactions, increased 0.43% over the quarter and 2.25% over the past year. However, it remains 8% below its 2022 peak. Mid-market and smaller assets are faring better and are now above 2022 levels. Recent market indicators from other indexes also point to early signs of stabilization across CRE.

Sector Breakdown

- Multifamily: Prices were flat in Q3. Smaller assets showed slight gains. Larger deals remained under pressure due to high financing costs and affordability issues.

- Industrial: The sector continued to grow, but at a slower pace. Higher-value assets are starting to soften. Demand remains supported by e-commerce and nearshoring trends.

- Retail: The sector stayed stable. Prices rose modestly, backed by steady consumer demand for necessity-driven retail.

- Lodging: Still the weakest sector. Prices remain nearly 14% below 2022 levels. Urban and business-focused hotels are struggling with soft demand and rising costs.

Why It Matters

The Q3 TPPI data points to a slow recovery across CRE. Growth is uneven and highly dependent on asset quality and sector strength. With capital still cautious and financing costs elevated, properties in prime locations with resilient demand are leading the rebound.

What’s Next

Potential rate cuts in 2026 could speed up the recovery. For now, macro uncertainty—especially around inflation, tariffs, and financing—continues to weigh on the market. Investors are navigating a gradual rebound, with quality assets seeing the biggest gains.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes