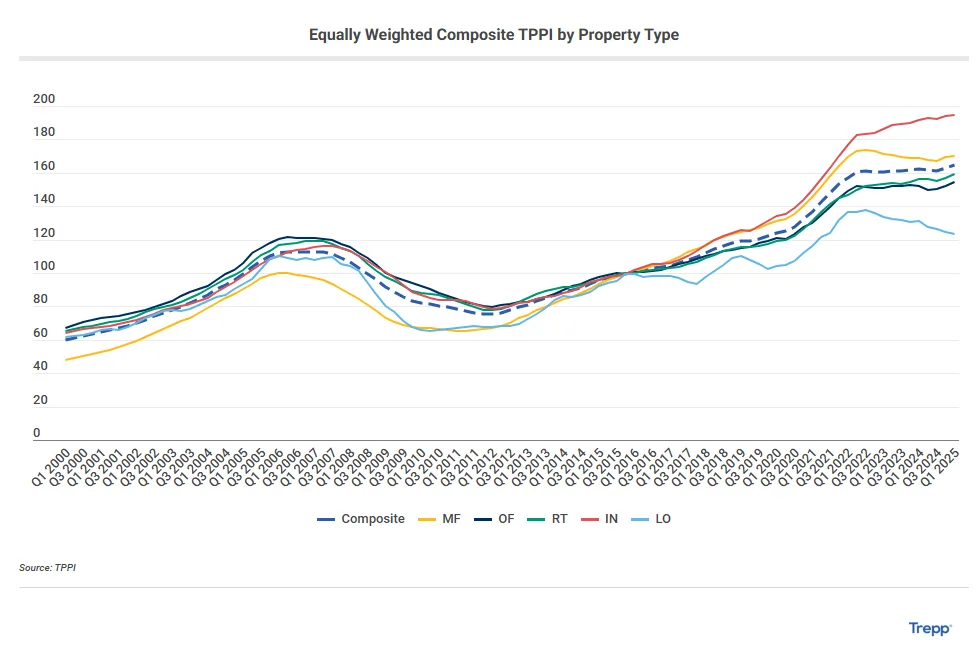

- The Trepp Property Price Index (TPPI) rose modestly in Q1 2025, signaling a slow recovery in commercial property pricing despite a pause in interest rate cuts.rn

- Tariff hikes and policy uncertainty have overtaken rate speculation as the top concerns for CRE investors, with growing caution reflected across most asset classes.rn

- Industrial continues to outperform, driven by data center demand, while lodging and multifamily lag due to weak consumer sentiment and excess supply.

Modest Momentum, Rising Risks

cre prices posted incremental gains in Q1 2025, according to Trepp’s latest TPPI report. The equally weighted index rose 1% quarter-over-quarter, while the value-weighted index was up 0.86%, narrowing year-over-year declines to just 0.19%. Still, both measures remain below 2022 peak levels, with the VW index down nearly 10% from its high.

While price stabilization is a positive signal, the market faces headwinds as the Fed holds off on further interest rate cuts and investor focus shifts to trade policy. A new wave of tariffs introduced late in Q1 has added fresh volatility and prompted portfolio rebalancing across asset classes.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Multifamily

A split market. The EW index rose 0.47%, but the VW index fell 0.60%, suggesting CRE price strength in mid-tier assets but weakness at the top end—particularly in overbuilt Sun Belt metros.

Office

Some signs of bottoming out. Both indices rose modestly year-over-year, though CRE prices in the VW index are still down 20% from peak. Return-to-office trends have helped stabilize values, but fundamentals remain challenged by persistent vacancies.

Retail

Resilient but cautious. Q1 gains of 1.66% (EW) and 0.50% (VW) reflect steadiness in the sector. Still, inflation, e-commerce, and new tariffs pose risks—especially for retailers catering to lower-income consumers.

Industrial

The standout performer. Up 5.89% (EW) and 1.20% (VW) since 2022, the sector is being fueled by AI-related data center growth and resilient warehouse demand. However, tariffs may distort supply chain strategies moving forward.

Lodging

Continues to slide. Q1 saw a 0.55% decline (EW) and a 5.95% drop year-over-year. Ongoing travel softness, both business and leisure, combined with oversupply in key markets, is weighing on pricing.

Why It Matters

The Q1 2025 TPPI data signals that CRE prices may have found a tentative floor. However, a lack of interest rate relief and growing policy risk—especially tariffs—could cap any meaningful price appreciation. As a result, investors are recalibrating expectations and prioritizing risk management over aggressive asset repositioning

What’s Next

Eyes will be on how new trade dynamics and domestic policy decisions influence investor behavior and capital flows in the coming quarters. With interest rate cuts potentially sidelined for the rest of 2025, pricing trends will increasingly depend on how sectors absorb macroeconomic and regulatory shocks.

According to Trepp, future TPPI updates will continue to expand geographic and asset-level granularity as more transaction data is incorporated—providing deeper visibility into evolving market sentiment.