- CRE professionals expect stable or growing leasing and investment activity in H2 2025.rn

- Premium office, industrial, and data center space lead demand; outdated office and retail assets continue to struggle.rn

- AI adoption and US manufacturing growth are driving demand, though tariffs and power issues remain concerns.

Sentiment Strengthens Heading Into H2

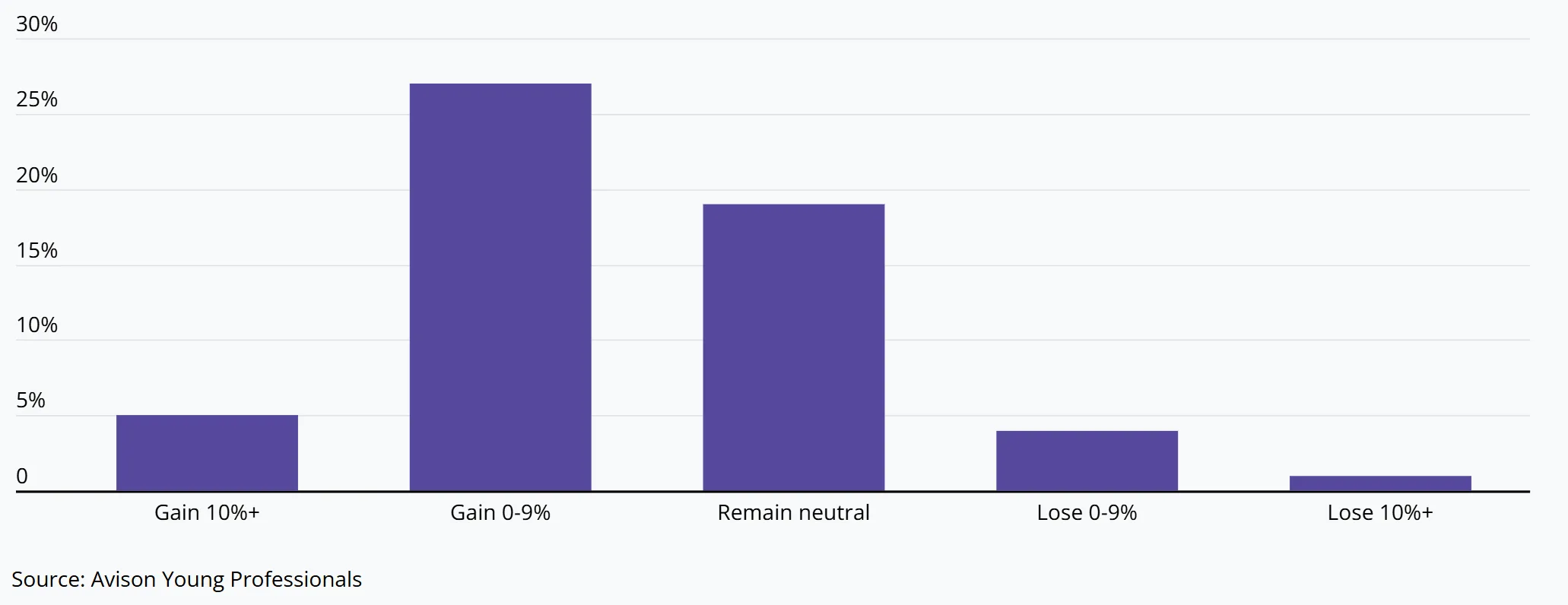

More than 250 Avison Young professionals across the US shared their CRE outlook, and every respondent expects activity to stay the same or increase through the second half of 2025. Although cost pressures and policy shifts still weigh on some decisions, many see opportunity ahead.

Harry Klaff, US President at Avison Young, noted, “While certain challenges will remain, our nationwide sentiment suggests a market that is effectively adjusting to change and actively shaping its next chapter.”

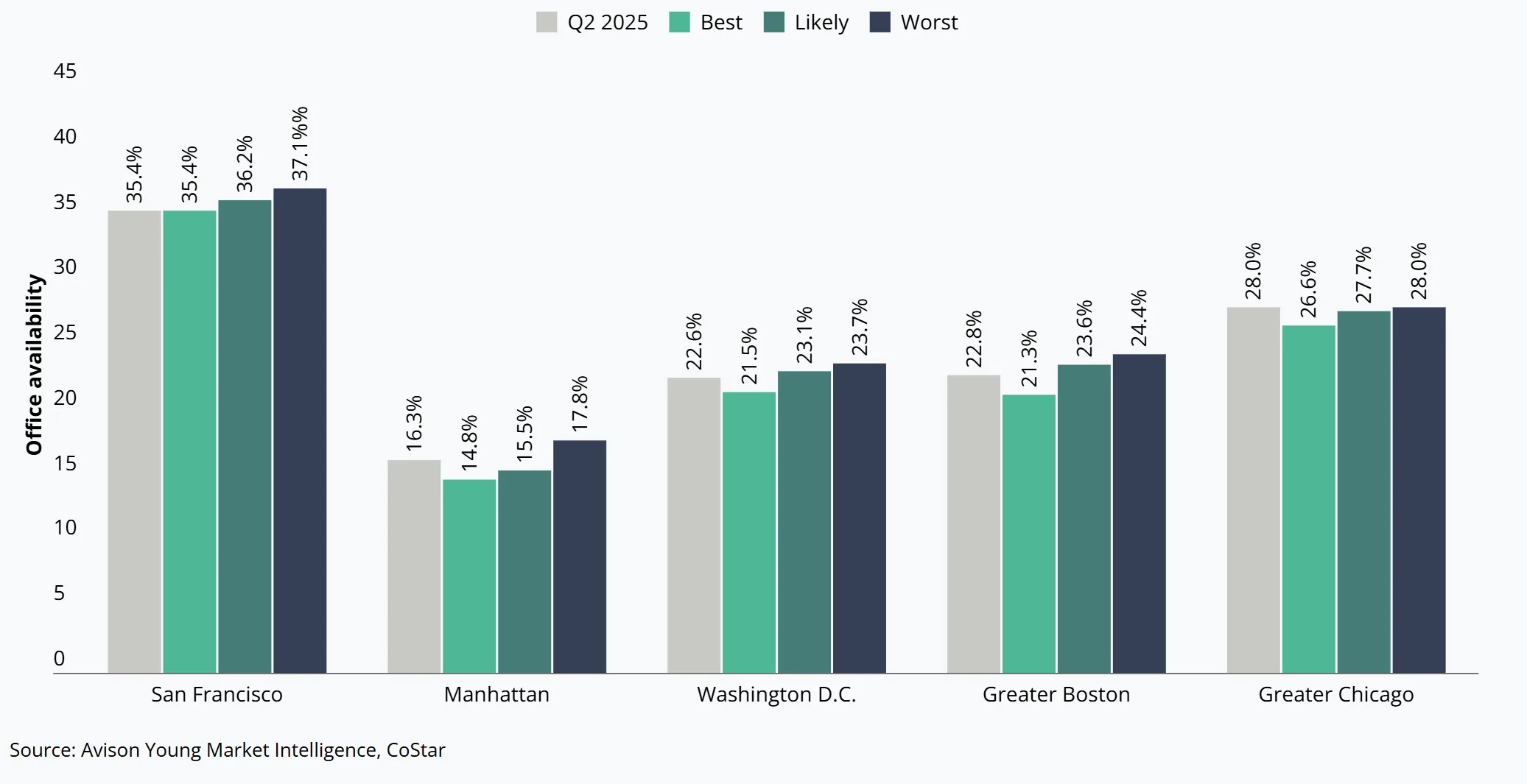

Office: Premium Assets Outperform

office demand remains divided. Trophy and Class A buildings in cities like Manhattan, Miami, and D.C. are seeing the strongest leasing activity, driven by financial firms, law offices, and tech tenants. Return-to-office policies have taken hold in key metros, helping support occupancy.

Meanwhile, older Class B and C offices are falling behind. Many lack the amenities tenants now expect and don’t have access to capital for upgrades. Experts expect a trickle-down effect to boost demand for these properties over time, but many landlords are still holding back on renovations.

Industrial: Growth Centers Around US Manufacturing

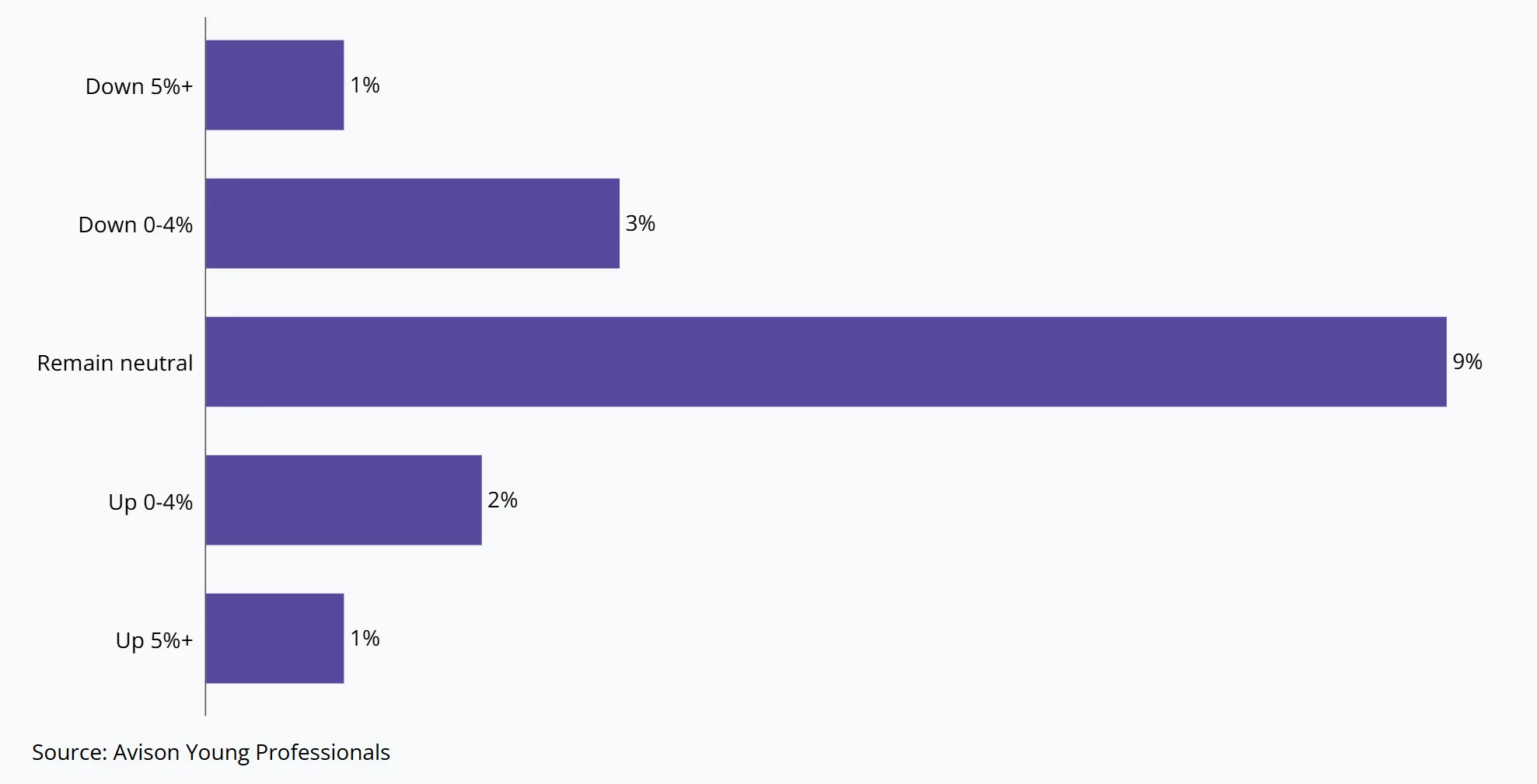

Federal support for domestic manufacturing in sectors like autos and chips is spurring industrial demand, especially near major production hubs. The West Coast expects small gains, while the Northeast could see a slight decline.

However, tariff uncertainty is slowing some expansion plans. Many companies are waiting for clarity on trade policy before committing to new sites.

Retail: Tight Supply, Evolving Demand

Retail remains one of the tightest sectors in CRE, with low vacancy and minimal new construction. Health, wellness, and discount retailers are driving new leases. In many cases, large-format spaces left by traditional retail are being repurposed for medical or experiential uses.

But tariffs and inflation are cutting into margins and delaying growth plans. Many retailers are pausing new store openings while they monitor economic conditions.

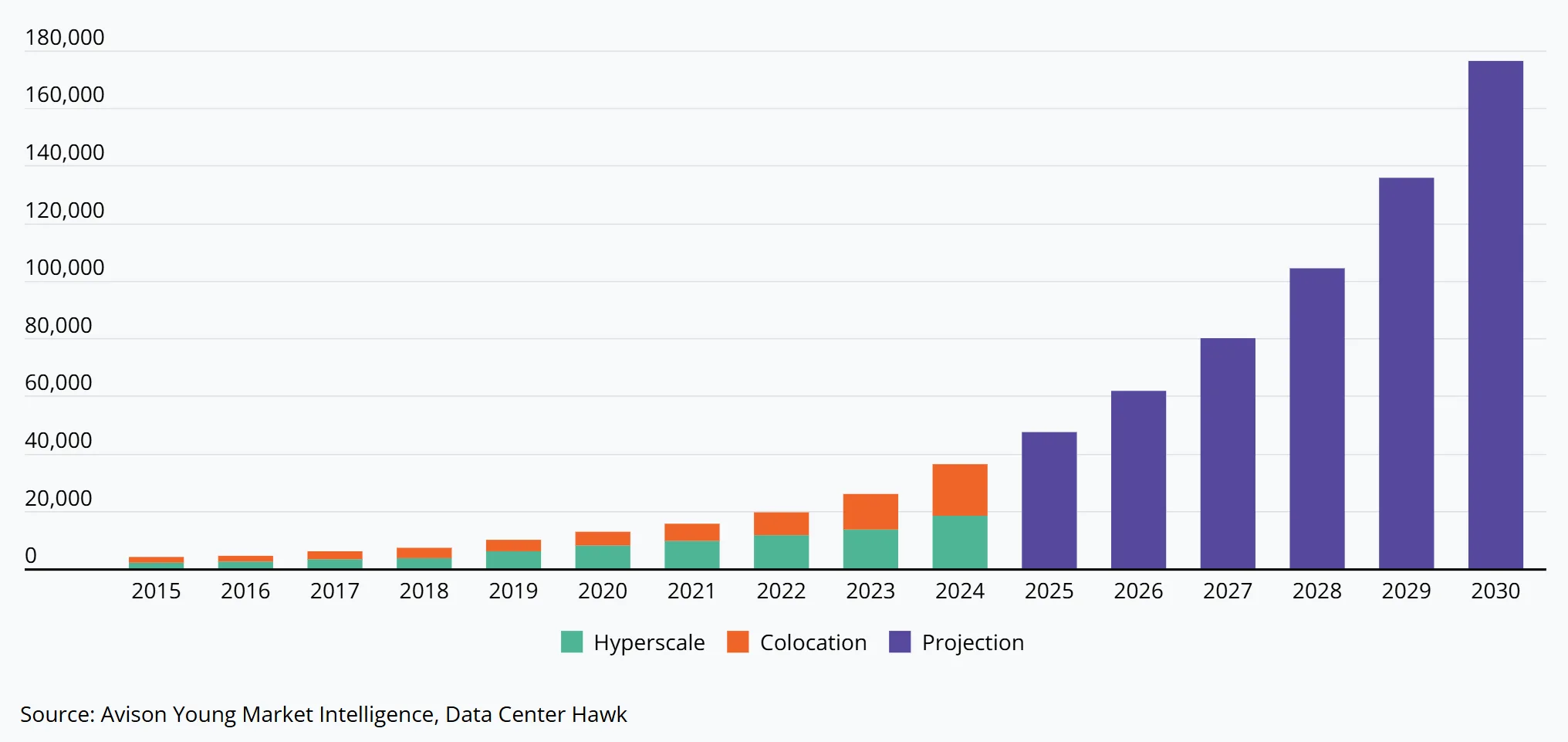

Data Centers: AI Drives Expansion

AI and cloud services are pushing data center demand far beyond supply. Tech giants like Microsoft, Amazon, and Google are investing heavily in physical infrastructure, helping support leasing and investment.

That said, high power use and rising construction costs—made worse by tariffs—are slowing some new builds. US capacity is expected to quadruple by 2030, but growth will depend on how quickly providers can secure land and power.

Multifamily and Healthcare: Resilient, But Shifting

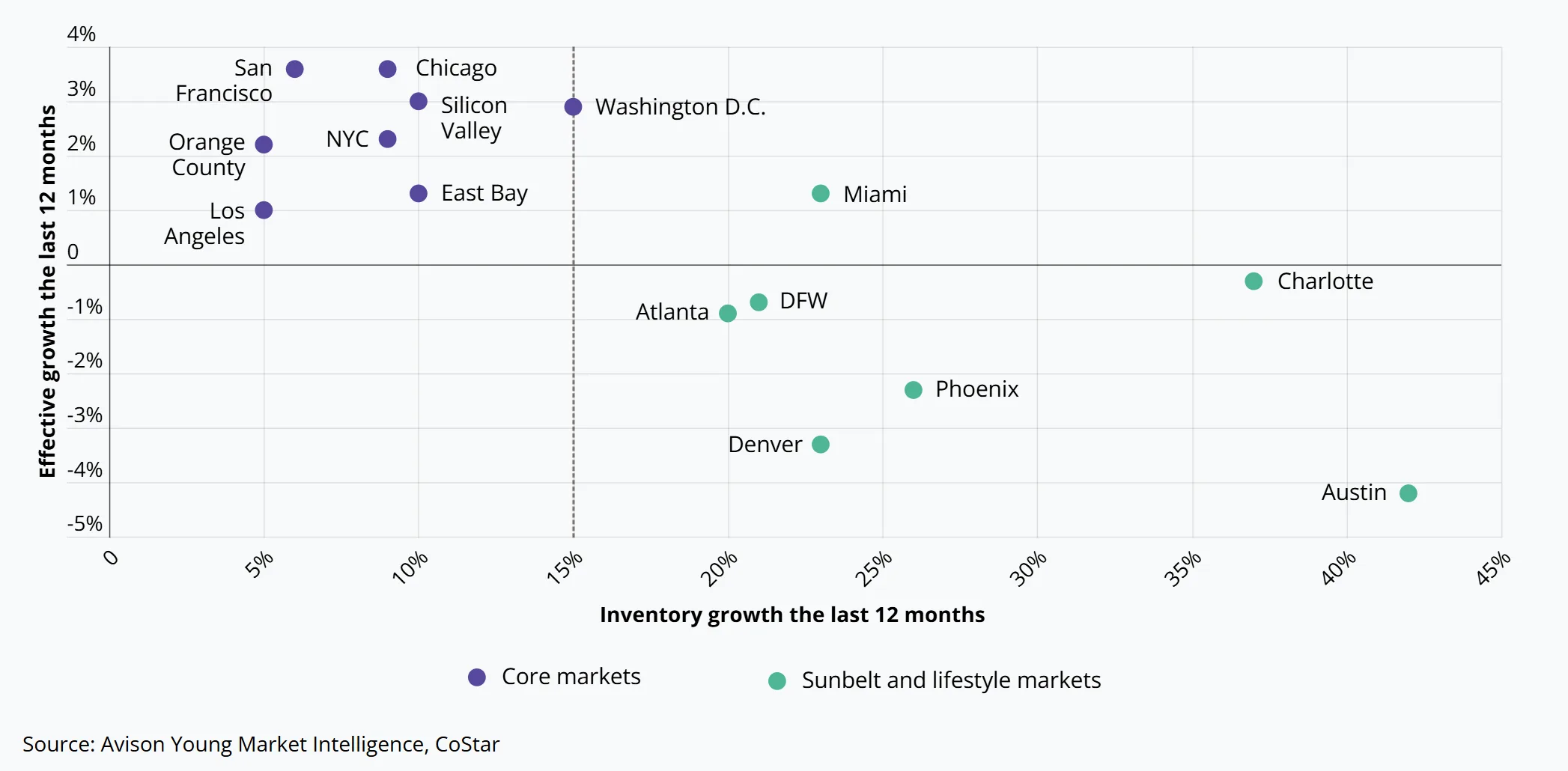

In the multifamily sector, a wave of new high-quality supply is expected to peak this year. Cities like Miami continue to show strong occupancy, but other sun belt markets could see downward rent pressure as supply outpaces demand. Rising construction costs and shifting demographics are making developers more cautious.

Healthcare real estate is benefiting from better site selection technology and strong demand for outpatient facilities. But rising patient costs and slow reimbursement growth are forcing providers to be more selective in their real estate investments.

Looking Ahead

Despite policy risks and regional variations, the CRE outlook remains focused on long-term drivers like technology, location, and asset quality. Investors and developers are adjusting strategies as needed, often taking a more targeted approach to growth.

With AI, reshoring, and demographic shifts shaping future demand, adaptability remains the strongest asset for CRE in the second half of 2025.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes