- Macroeconomic and policy uncertainty have tempered the pace of recovery, but investor optimism remains strong, especially in resilient asset classes and select global markets.

- Debt market bifurcation creates opportunity: Legacy loans face refinancing stress, but new loans benefit from better terms, pricing resets, and renewed lender activity.

- Strategic partnerships and AI adoption are on the rise: CRE firms are increasingly leaning on alliances to scale capabilities, access new markets, and unlock operational efficiencies through targeted AI deployments.

Navigating a Volatile Landscape

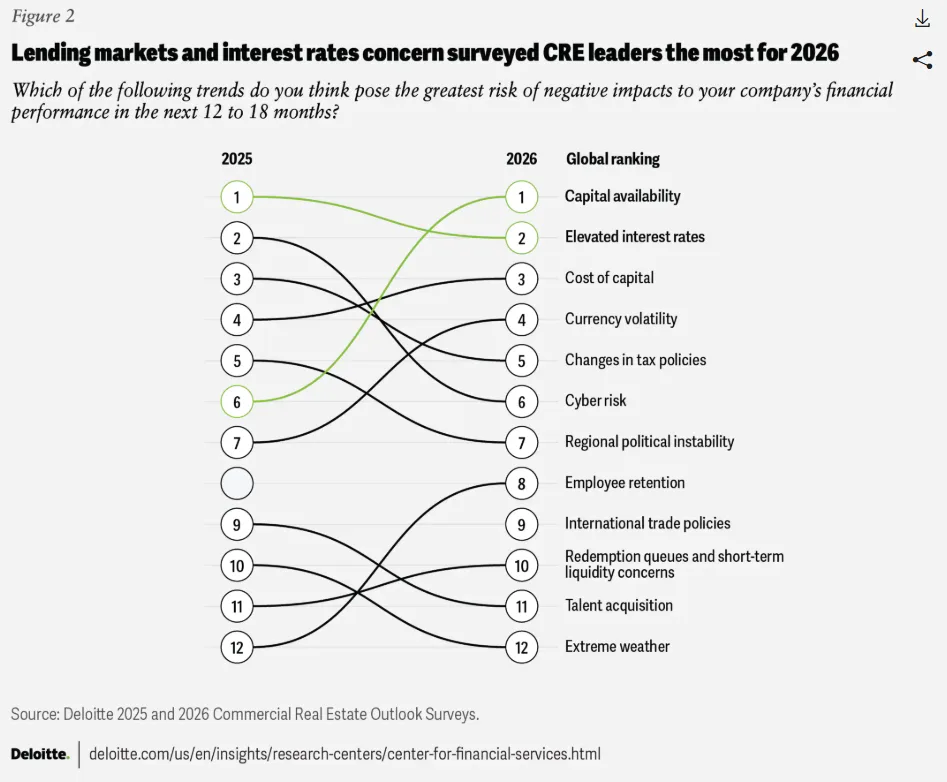

Commercial real estate’s anticipated rebound in 2025 has met mixed results as global macroeconomic conditions—ranging from capital constraints to regulatory uncertainties—have delayed full recovery.

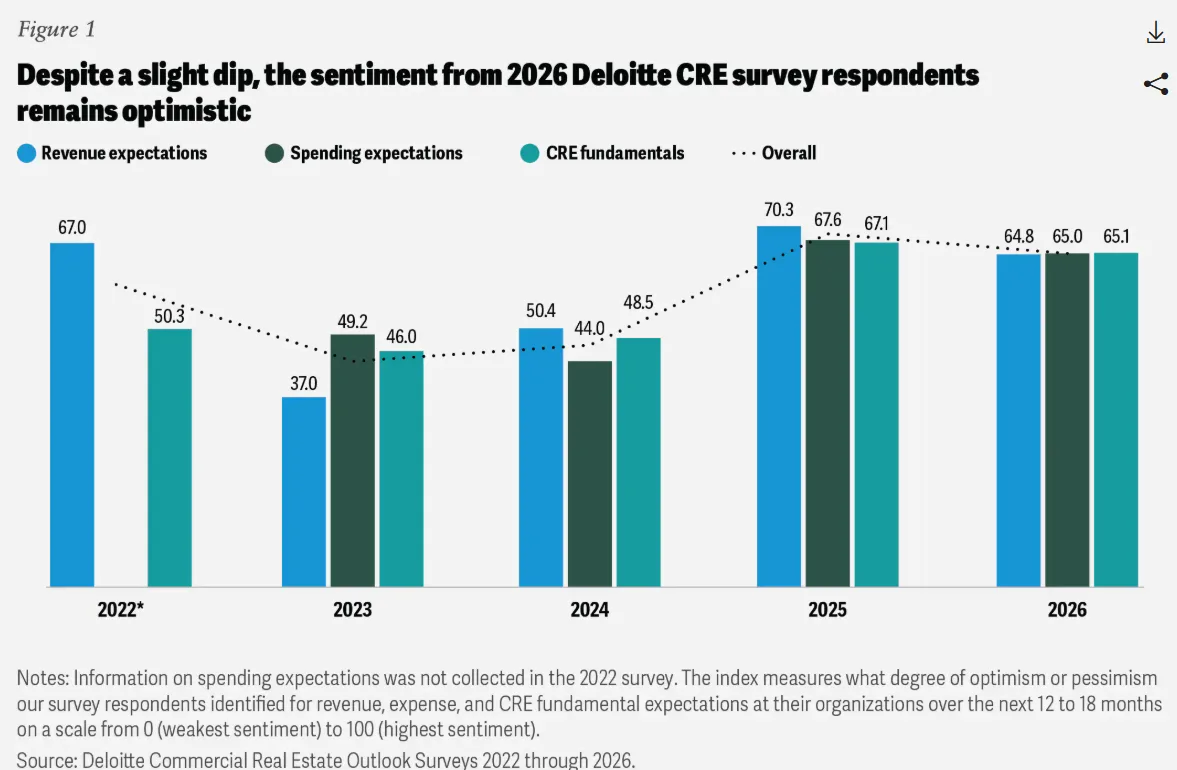

According to Deloitte’s 2026 CRE Outlook, 83% of surveyed leaders still expect revenue increases over the next 12–18 months, albeit with reduced spending plans and rising operating costs.

CRE fundamentals—rental rates, leasing activity, and vacancies—are still expected to improve by most respondents (65%), especially in Europe, though the pace and strength of that growth vary by region.

Returns, Resets, and Resilience

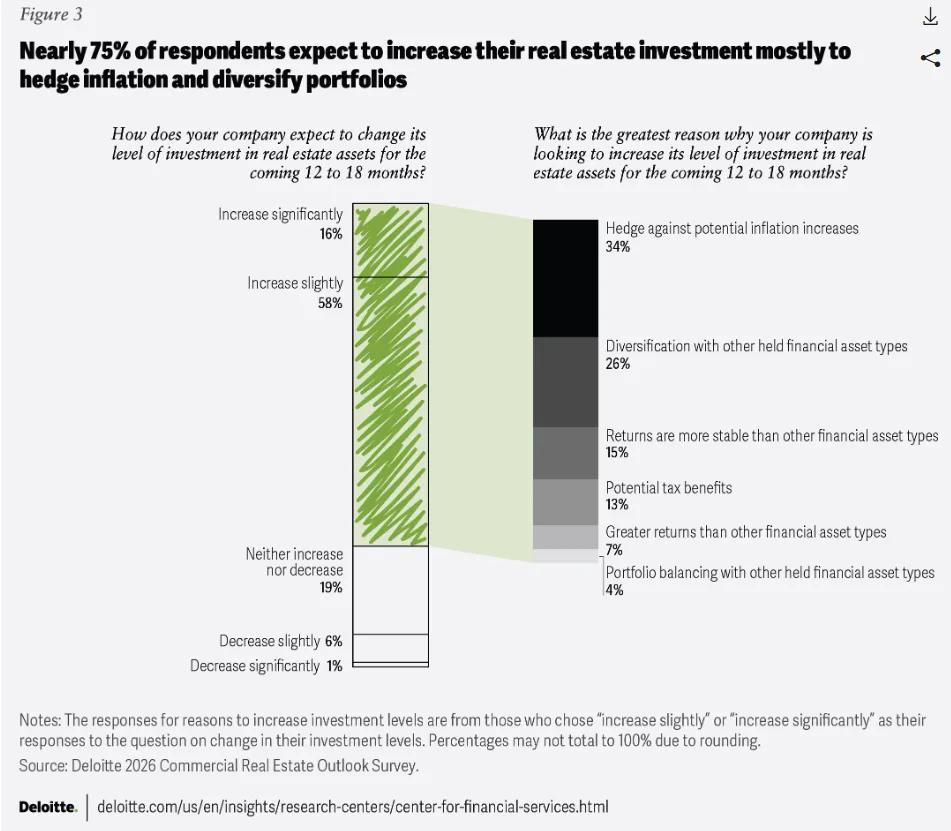

Global investment volumes show signs of recovery, with the first year-over-year growth recorded in early 2025 since mid-2022. The US remains the top destination for real estate capital, while India, Germany, and the U.K. are also top international targets. Private credit continues to gain ground, drawing one-third of all new capital.

Digital infrastructure assets—such as data centers—retook the top spot among preferred property types. Suburban and downtown offices also saw an uptick in investor interest, thanks to improved office-reentry rates and limited new supply.

A Two-Sided Debt Market

The CRE debt market is split. While legacy loans—particularly those originated in 2021–2022—struggle with refinancing amid higher interest rates, new loan originations are increasing, backed by stronger terms and valuations.

Lending volume in early 2025 jumped 13% quarter-over-quarter, and CMBS activity surged 110% year-over-year. Private lenders—now accounting for 24% of US CRE lending—are driving much of this growth. Meanwhile, traditional banks are cautiously re-entering the market as loan loss concerns subside and underwriting standards loosen.

Strategic Partnerships Gain Ground

With M&A activity cooling, strategic partnerships and joint ventures are becoming critical tools for growth. Institutional investors and REITs are aligning with private capital, sovereign wealth funds, and insurers to scale operations and diversify exposure.

These alliances aren’t just about capital—they’re about capability. Larger players are teaming with local operators to access specialized sectors like data centers, healthcare, and affordable housing, where operational complexity demands local expertise.

AI: Moving from Promise to Performance

Real estate firms are becoming more pragmatic in their approach to AI. While 27% report challenges with implementation, most are targeting specific use cases—like lease drafting, tenant engagement, and portfolio management—rather than deploying broad-based solutions.

Smaller, specialized models are gaining traction. Firms are exploring sector-specific tools and synthetic data generation to overcome privacy hurdles. Yet success depends not just on model sophistication, but on data quality, integration, and user adoption.

Actionable Moves for CRE Leaders

- Act before the market consensus shifts: The early-mover advantage is fading. Investors should capitalize on repriced, income-producing assets before competition returns en masse.

- Stress-test portfolios: Evaluate exposure to distressed debt, interest rate volatility, and asset underperformance. Prioritize transparency and contingency planning.

- Be selective with capital: Avoid short-term swings. Reallocate toward sectors with structural growth and long-term demand, such as data infrastructure, healthcare, and logistics.

- Lean into partnerships: Expand access, diversify portfolios, and leverage specialized knowledge through strategic alliances and joint ventures.

- Deploy AI with discipline: Use AI where it improves leasing, underwriting, or asset management—grounding strategies in real business impact, not hype.

Bottom Line

The CRE sector enters 2026 at a crossroads. While macro headwinds persist, underlying fundamentals and capital flows suggest a cautiously optimistic path forward. Success will favor those who remain agile—ready to pivot quickly, act decisively, and build partnerships and tech capabilities that align with a fundamentally changed market.