- CRE loans are growing, showing steady access to capital from REITs, CMBS, and CRE CLOs.rn

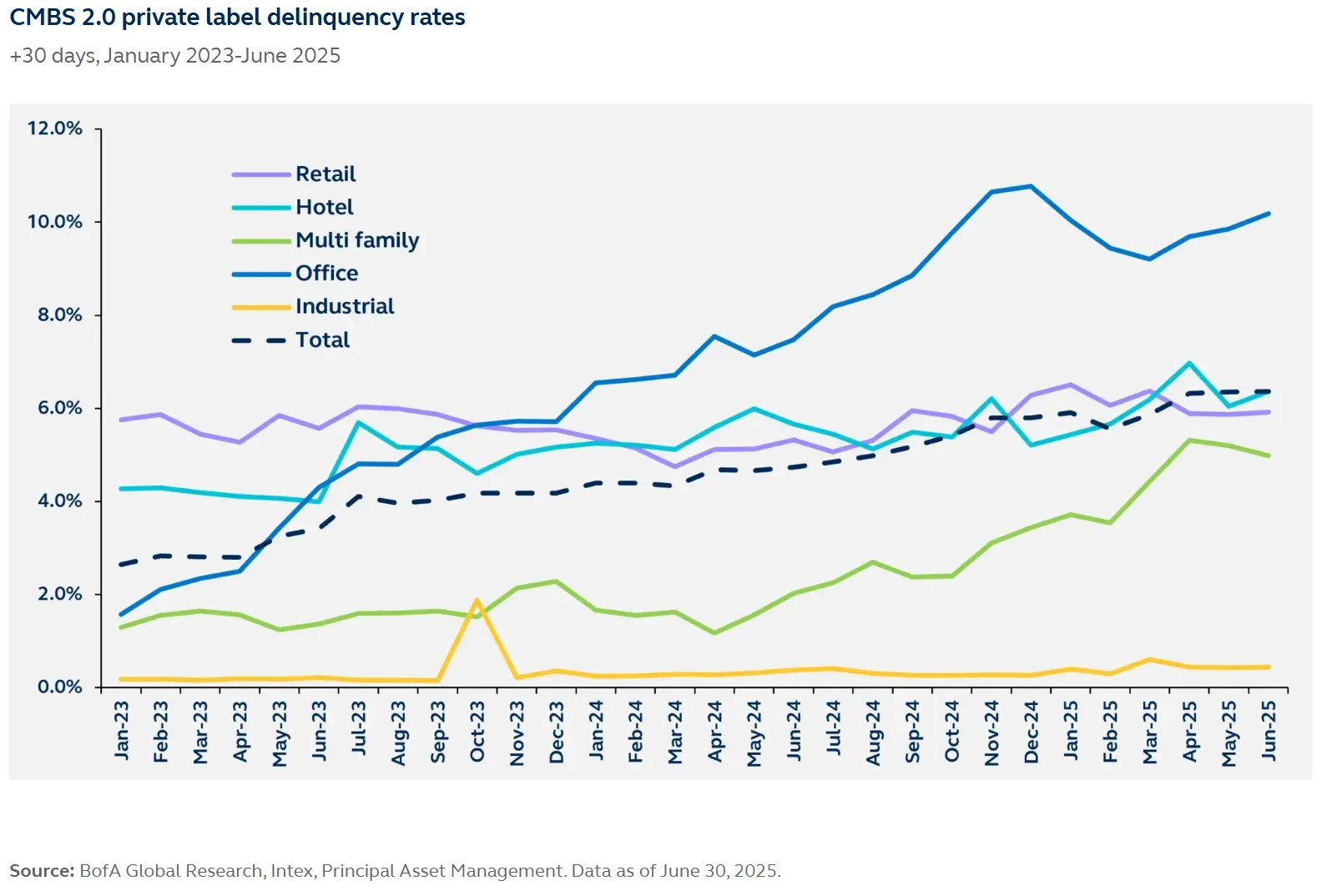

- CMBS delinquencies are rising, but these are lagging indicators and don’t reflect the full market.rn

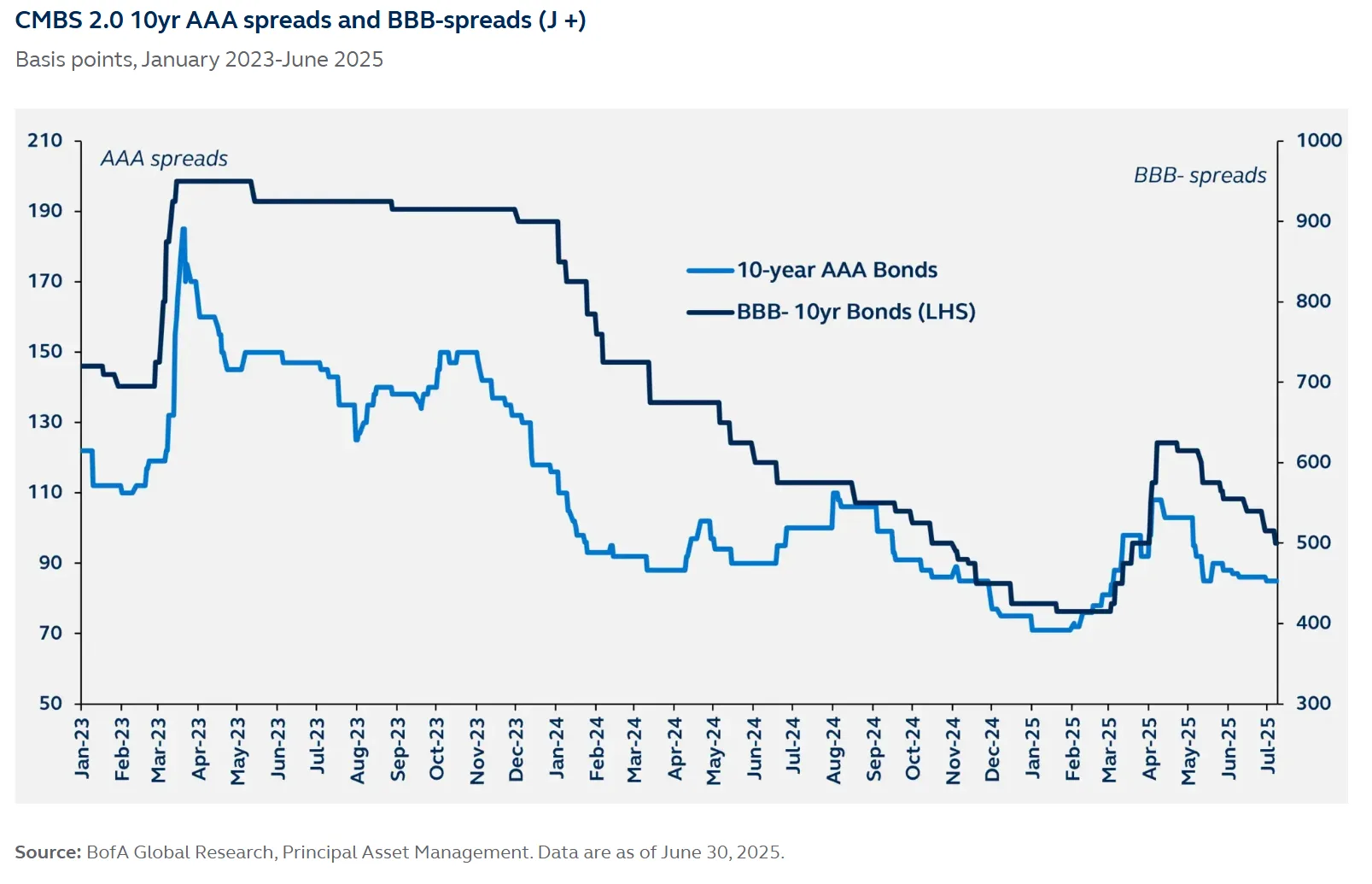

- CMBS credit spreads are tightening, which suggests better investor confidence.rnrnrn

A Sign of Stability

According to the Principal Asset Management, the Fed released minutes from its June 17–18 meeting on July 9. The notes point to a more balanced view of the commercial real estate (CRE) market. While challenges remain, signs of recovery are emerging.

Lending Stays Active

The Fed said CRE loan growth was modest in April and May. Still, recent data from the Mortgage Bankers Association shows a 1% increase in commercial and multifamily mortgage debt in Q1 2025. The total reached $4.81 trillion. Growth came from securitized products like CMBS and CRE CLOs, as well as large banks. That suggests investors still see value in CRE lending.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Office Delinquencies Stand Out

The Fed noted that CMBS delinquencies stayed elevated in May. June data showed a +30-day delinquency rate of 6.36% for private-label CMBS. Office loans were the weakest, with a 10.2% delinquency rate. Other lender types, like banks and life insurers, had much lower rates. These figures show that CMBS struggles don’t represent the whole market. And CMBS delinquencies often peak well after market recovery begins.

Credit Spreads are Improving

The Fed also noted that CMBS yields were mostly flat or slightly lower. AAA-rated 10-year CMBS bonds now trade at 85 basis points—down 20 bps since April. BBB- bonds tightened by 125 bps over the same period. These tighter spreads suggest growing confidence from investors, even with some sector stress.

Why It Matters

The Fed is clearly tracking CRE closely. The tone of the meeting minutes points to signs of recovery. Lending remains active, spreads are narrowing, and overall delinquencies remain under control—outside of a few troubled sectors.

Looking ahead, expect refinancing and deal activity to rise. If credit conditions hold steady, the second half of 2025 could see more momentum for the cre market.