In this webinar, Alex Thomas, Senior Research Manager at John Burns Research and Consulting, presents the latest Fear and Greed Survey results in partnership with CRE Daily. The survey reveals that CRE investors are in their most cautious stance yet, with uncertainty driving record-high “holding tight” behavior.

Download the Full Survey Results

The 28-page survey chartbook provides deeper insights and visuals into investor sentiment, capital trends, and the evolving CRE landscape. Download the complete report for a sector-by-sector breakdown and exclusive investor commentary.

"*" indicates required fields

By downloading, you agree to our Terms and Privacy Policy. You will also start receiving CRE Dailys free newsletter. You can unsubscribe anytime.

Conversation Highlights

The overall Fear and Greed Index stands at 56 out of 100, placing the market just above stagnant levels. This measurement falls well below the healthy market range of 70 to 90 on a scale where zero represents total fear and 100 represents total greed.

Investors Are Holding Tight

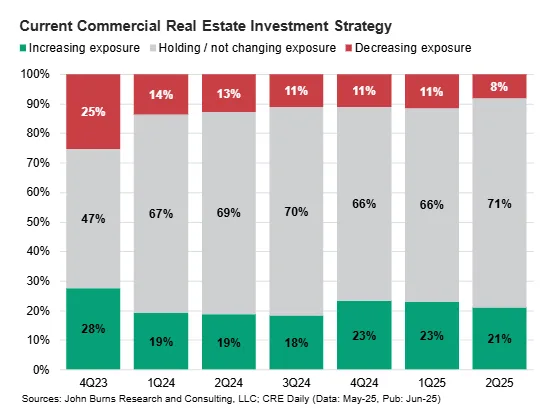

A remarkable 71% of commercial real estate investors reported they are “holding tight” in the second quarter of 2025. This figure represents the highest percentage in the survey’s entire history, signaling an extraordinary level of market restraint.

Uncertainty emerged as the dominant factor influencing investor behavior. Market participants consistently cite this uncertainty as the primary driver behind slower transaction volumes and reduced willingness to expand commercial real estate exposure.

Sector-Specific Impacts and Concerns

The industrial sector shows a consistent pullback following earlier enthusiasm. Fourth quarter 2024 saw a significant spike in industrial investor interest, largely tied to election promises about increasing domestic manufacturing capacity. However, as the scale and implementation speed of these changes become clearer, uncertainty has materialized.

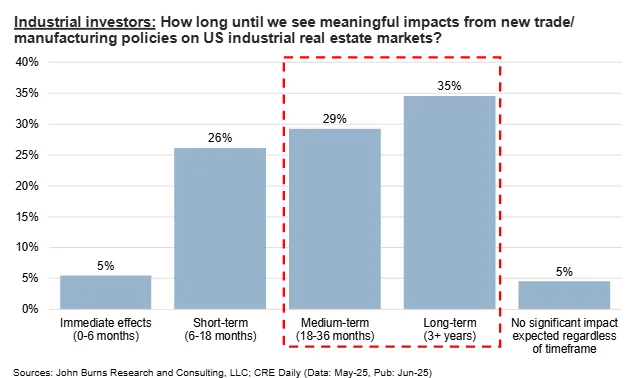

We asked industrial investors how long until we see meaningful impacts from trade policies on US industrial real estate markets. The majority think we’re not expecting to see any meaningful impact over the next at least 18 months. Most expect the most significant impacts over the next three to five years or even longer.

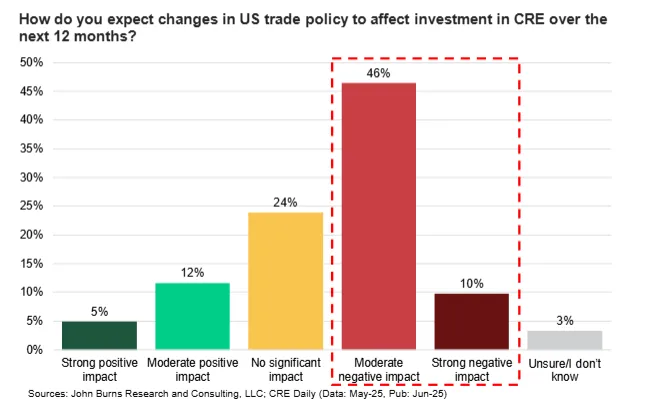

About 56% of investors said that they expect a moderate negative or strong negative impact from new trade policies on commercial real estate investment in their sector.

Retail investors are the most worried about trade policies relative to other sectors.

It’s about twice as expensive to own a home right now on a monthly basis versus renting an apartment. That includes things like taxes, property insurance, maintenance as well. I think that’s supporting some of the strength that we’ve seen in the multifamily side.

The good news for multifamily is that we’ve seen apartment supply hit this peak. We’re essentially at peak apartment completions or we’re a little bit past the peak at this point. That’s strong for rents as starts are falling nationwide.

Capital Access Challenges

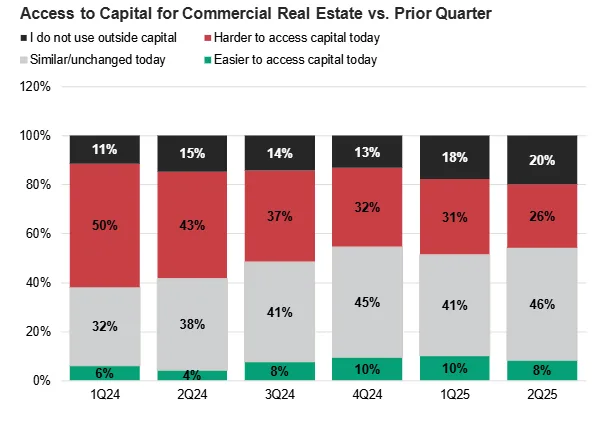

The big barrier to commercial real estate going forward is this access to capital component. About 46% saying access is unchanged today, and the share of investors who aren’t using outside capital is now about one in every five.

CRE investors are still in wait and see mode. We’ve got elevated rates, elevated uncertainty, and in our view things are likely to stay that way through the balance of the year unless we start to see rates fall significantly.

The slides from the webinar are below.