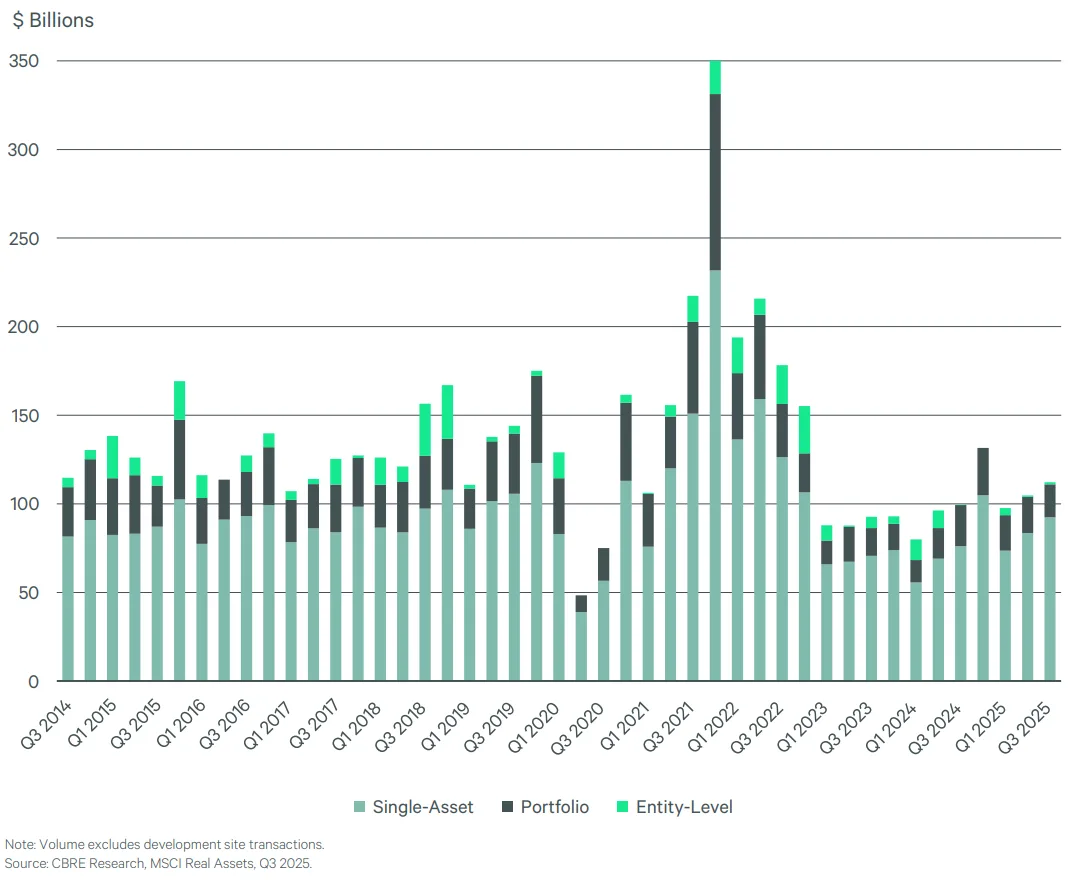

- US commercial real estate investment hit $112B in Q3, up 13% year-over-year. Private investors led the charge.

- Lending momentum improved, with banks and alternative lenders expanding their share of new originations.

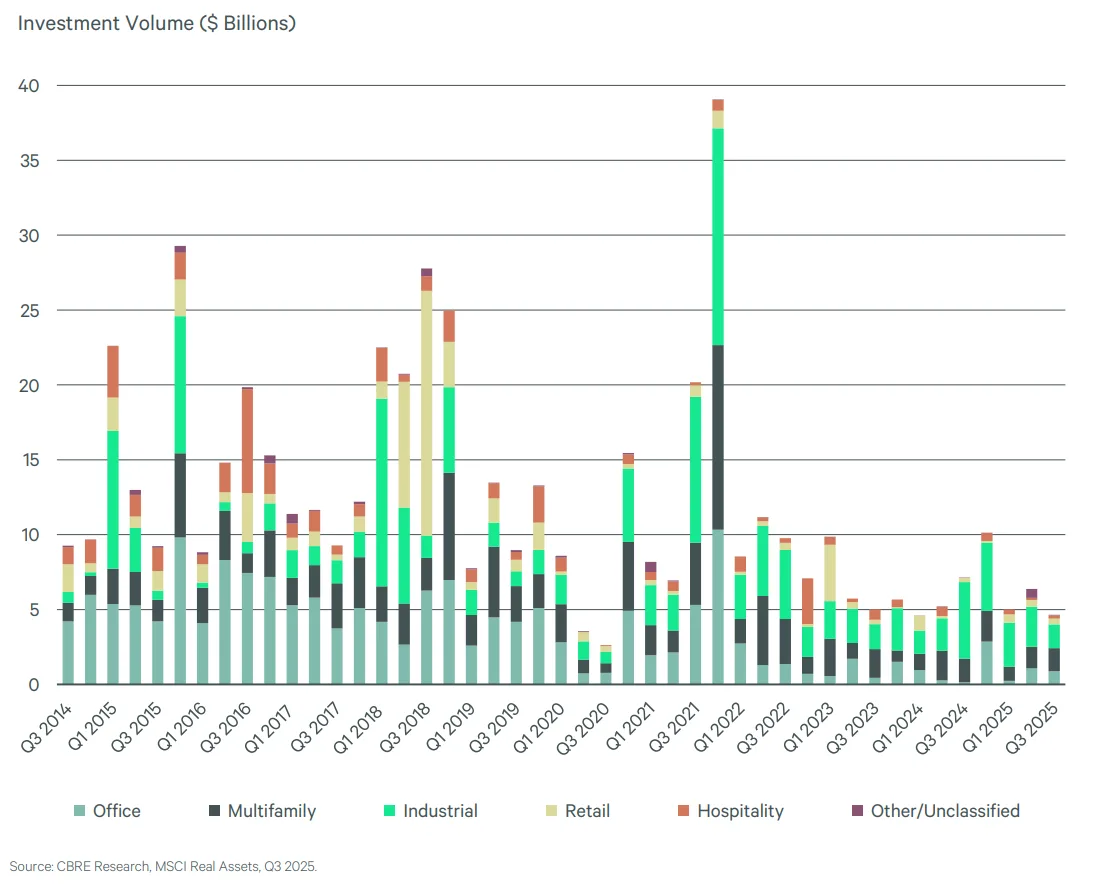

- Multifamily remained the top asset class. Office and retail sectors showed the strongest year-over-year growth.

A Rebound Takes Shape

US commercial real estate investment totaled $112B in Q3 2025, marking a 13% increase from a year earlier. The rise was driven by more single-asset deals and improved lending conditions, according to CBRE.

Who’s Buying

Private investors were the most active, accounting for $68B, or 61% of total investment. Institutional buyers followed with $23B. Public companies also increased activity to $6.8B. Cross-border investment dropped 35% to $4.7B, partly due to large 2024 deals skewing last year’s figures.

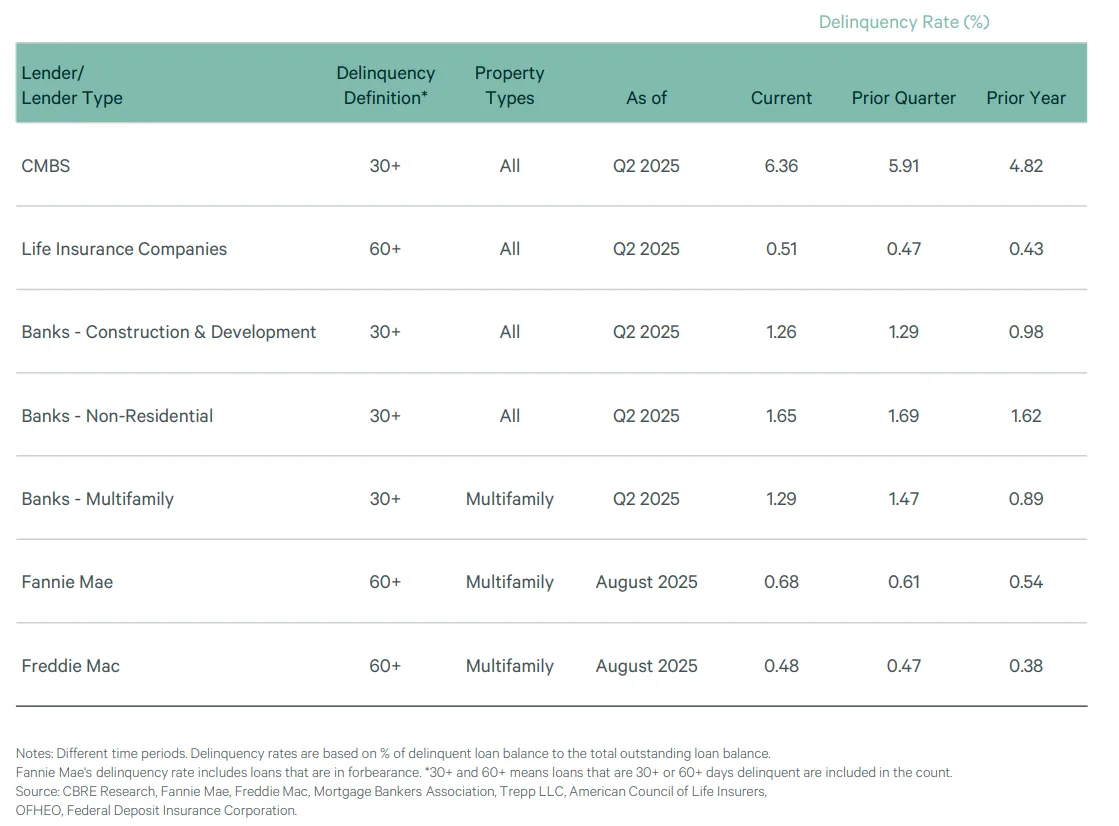

Lending Picks Up

The CBRE Lending Momentum Index rose to 1.04, the highest since 2018. Banks and alternative lenders reentered the market aggressively. Banks accounted for 31% of non-agency closings, and alternative lenders took 37%, with debt funds up 68% year-over-year.

Multifamily Leads, But Office Rebounds

Multifamily led all sectors with $42B in investment, up 10% year-over-year. Office volume jumped 35% to $19B, showing early signs of recovery. Retail followed with $16B, up 29%.

Prices and Returns

The RCA Commercial Property Price Index rose 3% year-over-year. Office properties saw the biggest gains at 7%. Retail rose 5.5%, while multifamily declined slightly by 0.8%. The NCREIF total return reached 4.6%, led by retail (7.0%) and multifamily (5.5%).

Top Metros

New York, Los Angeles, and Dallas had the highest investment volumes over the past four quarters. Seattle (+80%), San Francisco (+63%), and Charlotte (+48%) saw the fastest growth.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Why It Matters

Lending terms are loosening, investor sentiment is improving, and pricing is stabilizing. Multifamily loan spreads narrowed to 141 bps, while commercial spreads rose slightly to 197 bps.

What’s Next

Momentum could continue into Q4. Office and retail sectors are drawing more capital. But rising CMBS delinquency (6.4%) and global headwinds may limit gains in some segments.