- US commercial real estate investment volume (excluding entity-level deals) rose 13% year-over-year in Q2 to $96B.rn

- Private investors led with $60B in acquisitions, while institutional buying fell due to fewer large transactions.rn

- Office and retail sectors posted the strongest growth, signaling renewed investor interest.rnrnrn

Strong Rebound in Deal-Making

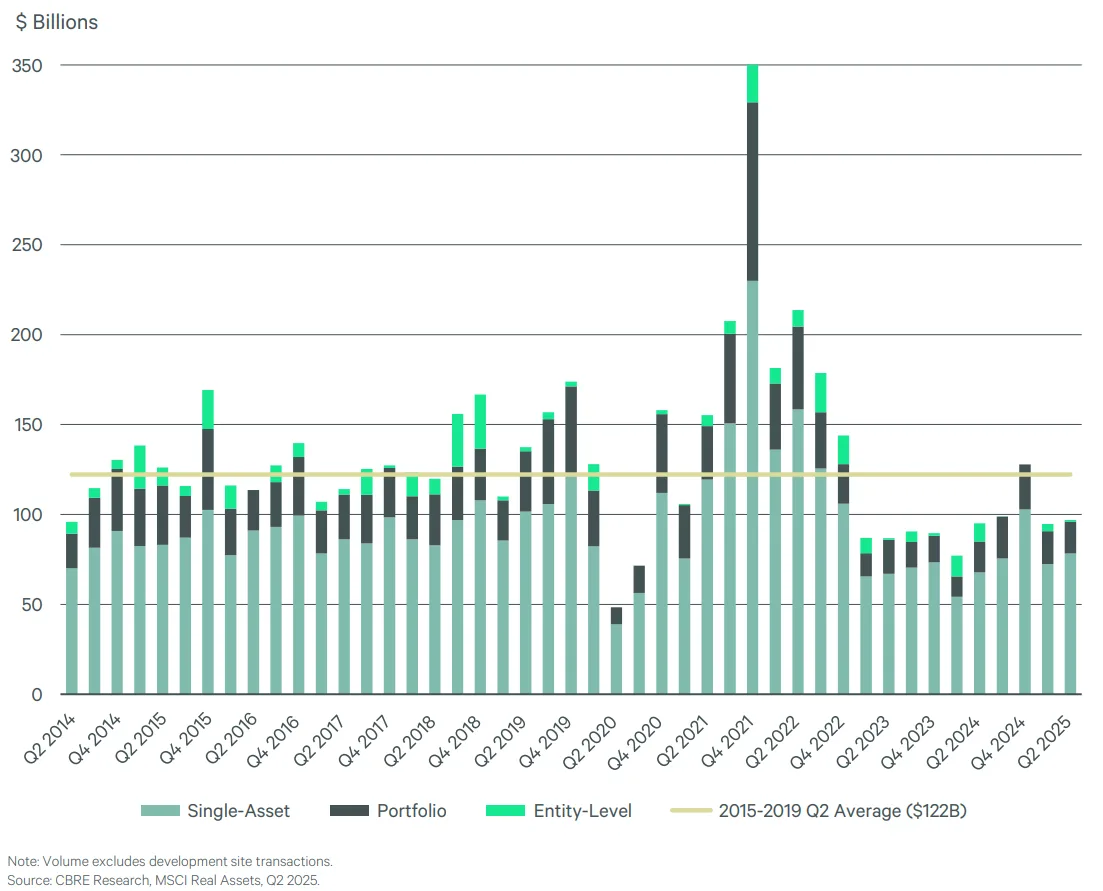

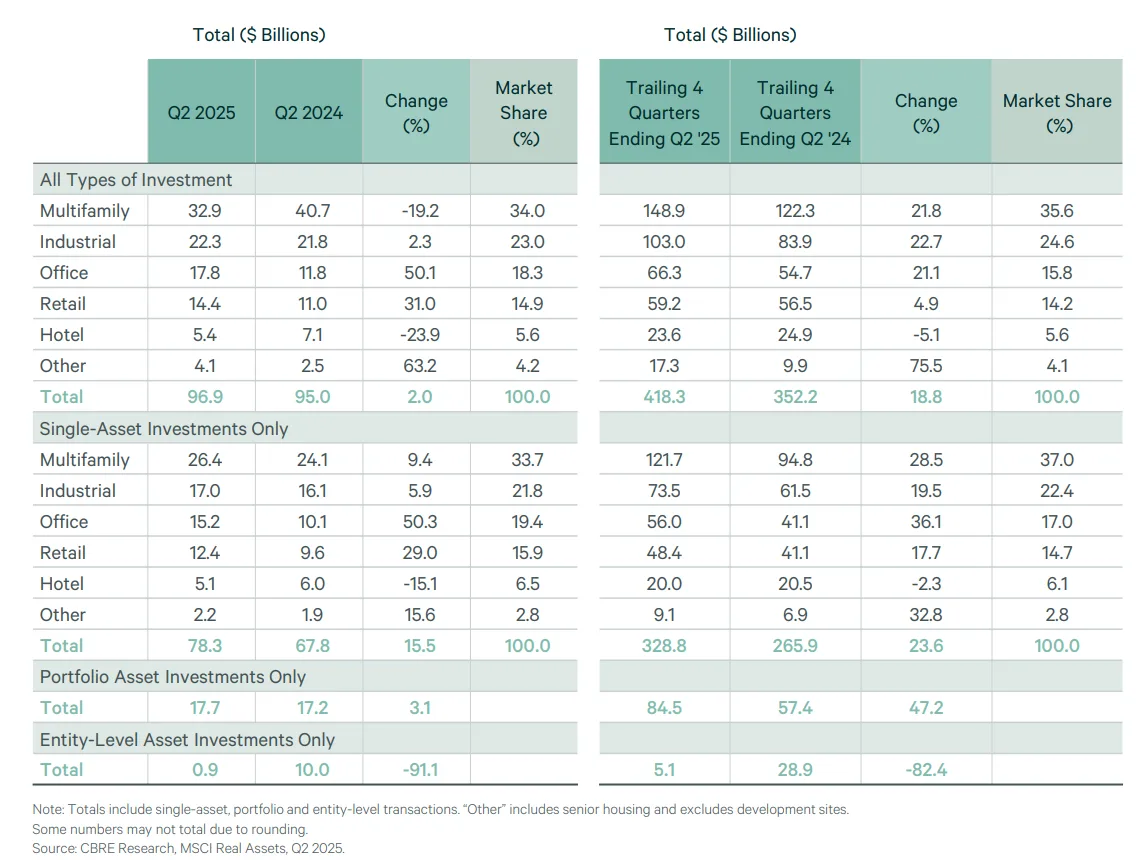

CBRE reports that CRE investment activity gained momentum in Q2 2025. Excluding entity-level sales, volume rose 13% year-over-year to $96B. Single-asset sales increased 15% to $78B, while portfolio deals inched up 3% to $18B.

Trailing four-quarter volume hit $418B, up 19% from last year and the highest in two years. In contrast, entity-level investment plunged 91% to under $1B. This drop reflects the absence of mega-deals like Blackstone’s $10B AIR Communities acquisition in 2024.

Sector Standouts

Multifamily retained the largest share of Q2 volume at $33B. However, the growth leaders were office (up 50% to $18B) and retail (up 31% to $14B). Industrial logged $22B in deals, a modest 2% gain. Hotel investment fell 24% to $5.4B.

Who’s Buying

Private investors were the most active, making up 62% of Q2 volume. Institutional investment fell 39% year-over-year, although the decline narrows to 3% when excluding last year’s large acquisition. REIT and public company acquisitions surged 33% to $7B.

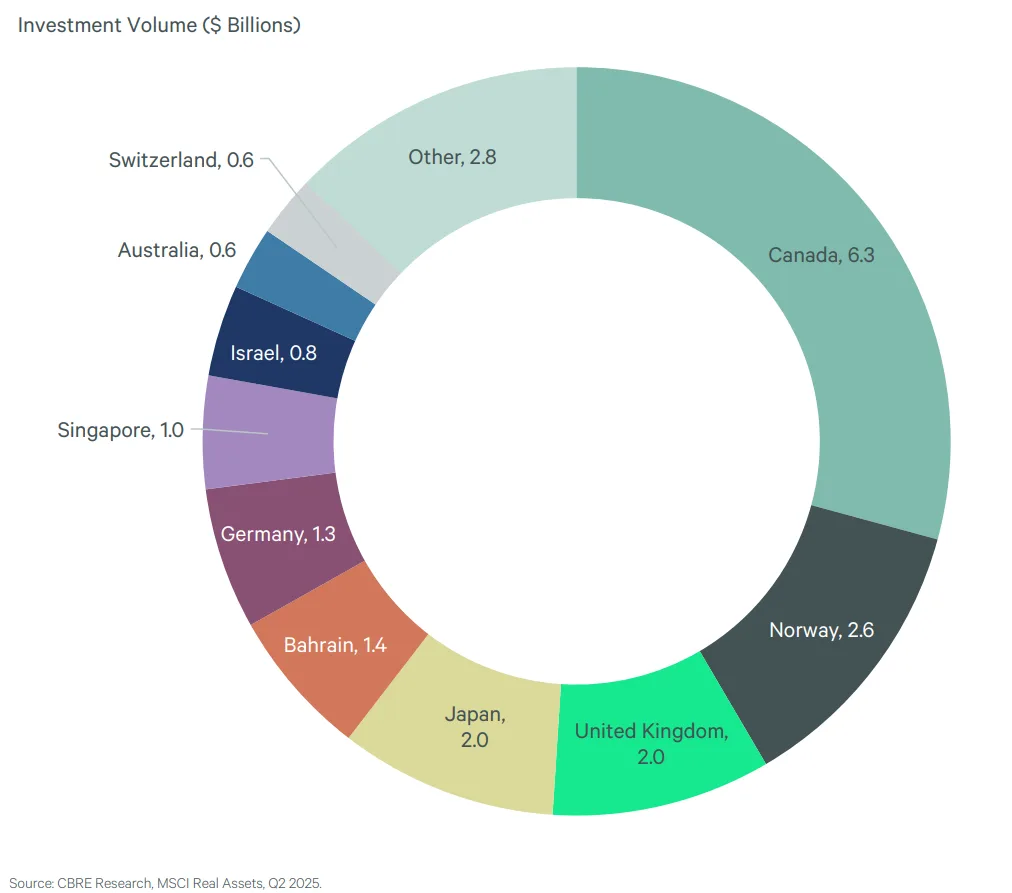

Cross-border inflows slipped slightly to $3.9B, yet Canada remained the top source over the past year.

Lending Momentum

The cbre lending Momentum Index rose 45% year-over-year, showing healthier financing conditions. Alternative lenders took the largest share (34%) of non-agency loan closings, followed by banks (24%) and life companies (23%).

Loan-to-value ratios climbed, underwriting eased, and agency multifamily lending jumped 43% year-over-year to $28.9B.

Why It Matters

The Q2 results indicate a recovering CRE investment market. More capital is flowing, lenders are taking on slightly more risk, and investors are showing stronger interest in lagging asset classes.

What’s Next

If lending remains strong, transaction volumes could stay elevated through the second half of 2025. Still, trade tensions and interest rate uncertainty will be important to watch.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes