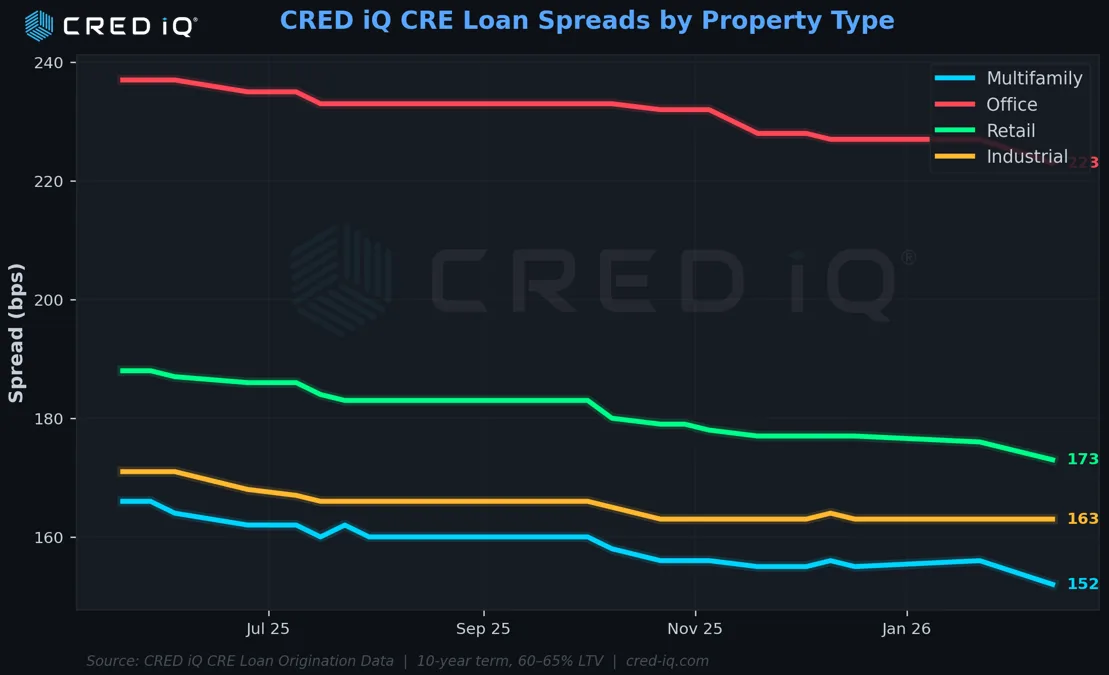

- CRE financing spreads have compressed across all major sectors since May 2025.

- Multifamily leads with the tightest spreads at 152 bps over Treasuries.

- Office spreads remain elevated, maintaining a 71 bps premium over multifamily.

- Institutional CRE loan rates are expected to settle in the low-to-mid 5% range in 2026.

Sector Dynamics Shift

Commercial real estate (CRE) financing spreads are tightening, but the pace differs by property type. According to new data from CRED iQ, loan origination spreads from May 2025 to February 2026 show multifamily properties attracting the tightest spreads at 152 basis points (bps) over Treasuries. This marks a 14 bps reduction from spring 2025, reflecting lender confidence in the sector.

Industrial properties are close behind at 163 bps, buoyed by demand for logistics and warehouse assets. Retail spreads compressed even more—by 15 bps to 173 bps—as lenders grow more comfortable with stable, grocery-anchored centers.

Office Lags Behind

Office properties remain an outlier in CRE financing spreads. While spreads have narrowed from 237 bps to 223 bps since May 2025, the sector continues to carry a substantial risk premium. At 71 bps above multifamily, office spread levels reflect lingering concerns over vacancy, downsizing, and evolving workplace norms. The gradual tightening mirrors broader CMBS market improvement in recent months, as bond spreads have also compressed alongside renewed lending activity.

Recent office originations—such as the Netflix headquarters loan in Los Gatos at 6.03% and 55.4% LTV—underscore that even trophy assets are affected by wider market caution. The spread premium is likely to persist, signaling structural challenges for office through 2026.

Outlook for CRE Spreads

CRED iQ projects continued, gradual spread compression throughout 2026. Multifamily spreads could fall below 150 basis points in 2026. Industrial spreads may also dip under 155 basis points. However, the office premium over multifamily will likely remain above 55 basis points.

Meanwhile, forecasters expect the 10-year Treasury to range between 3.85% and 4.00%. As a result, top-tier CRE loan rates could hold in the low-to-mid 5% range. That marks a clear improvement from rates above 6% in early 2025.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes