- CRE loan distress is rising but remains modest and consistent with a typical market cycle rather than a systemic breakdown.

- Loan modifications are up 66% year-over-year, but still represent only 1.5% of total bank-held CRE loans, according to the St. Louis Fed.

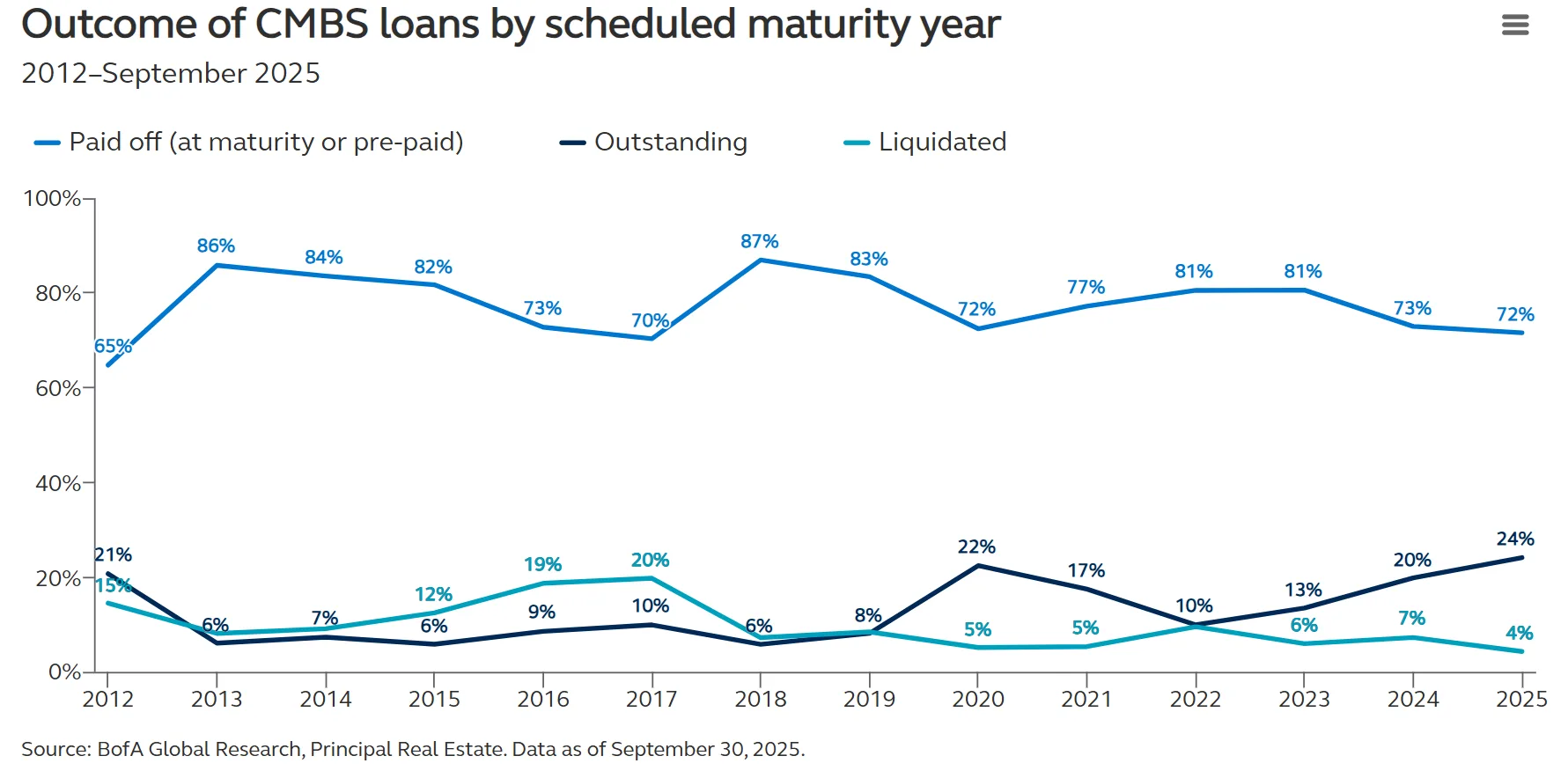

- CMBS loan performance remains near historical averages, with 72% of conduit loans maturing in 2025 already paid off.

- Market indicators suggest the CRE sector is progressing through a normal reset, with public REITs rebounding and private valuations stabilizing.

A Reset in Motion

Commercial real estate credit markets are under renewed scrutiny amid rising loan modifications and looming maturities. But according to recent data from the Principal Asset Management, the story is less about crisis and more about recalibration. As Rich Hill, Global Head of Real Estate Research & Strategy, notes, the current distress appears cyclical, not systemic.

Reading Between the Headlines

While the St. Louis Fed reported a 66% surge in CRE loan modifications over the past year, the absolute scale remains small—just $27.7B across a $1.83 trillion market. That’s only about 1.5% of CRE loans held by US banks. Despite concerns that banks are deferring the inevitable, the data suggests a more measured response rather than widespread forbearance.

Adding context, new FDIC reporting rules may be inflating perceived risks, making historical comparisons more difficult.

CMBS Still Performing

Transparency in the CMBS market shows continued resilience. According to BofA Global Research, 72% of CMBS conduit loans originally scheduled to mature in 2025 have already paid off—only slightly below the long-term average of 77%. That performance, while not perfect, doesn’t support the notion of widespread market failure.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

A Typical Cycle Playbook

Distress in CRE often lags the rest of the market. Historically, REIT prices fall first, followed by declines in private asset valuations and, finally, a rise in loan delinquencies. This cycle is no exception. REITs have rebounded 35% from their 2023 lows, valuations are showing signs of life, and distress is just now catching up.

Bottom Line

Rather than signaling a credit crisis, current CRE distress aligns with a traditional market reset. As fundamentals gradually stabilize, the industry seems to be following a well-worn recovery path—not teetering on the edge of collapse.