- Total outstanding commercial real estate (CRE) debt reached $4.8 trillion in Q2 2025, with banks holding the largest share at $1.83 trillion (38%), followed by GSEs, insurance companies, and securitized lenders.

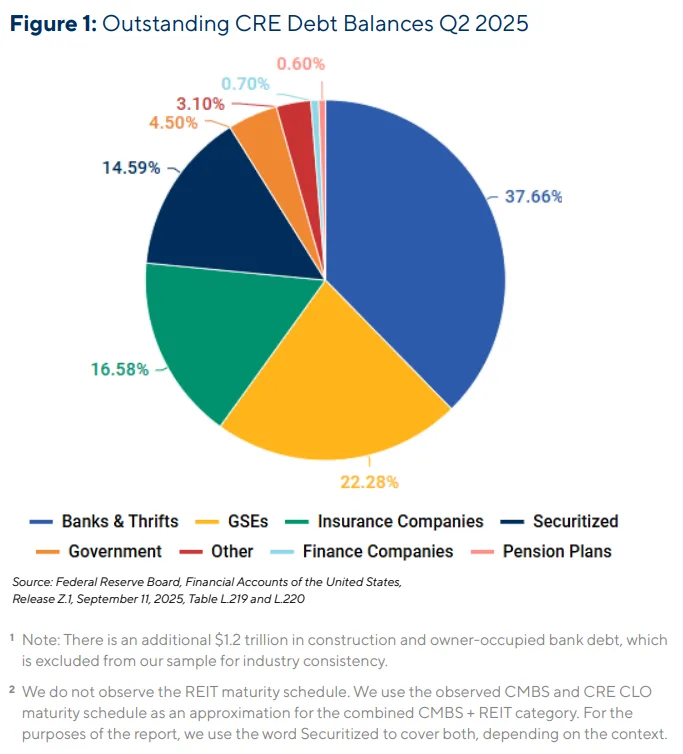

- Life insurers and GSEs saw the biggest year-over-year growth in CRE loan balances, rising 6.1% and 5.8%, respectively—indicating a growing appetite for long-duration, yield-generating assets.

- Refinancing risks loom as $1.15 trillion in CRE loans mature by the end of 2026, with banks and securitized lenders facing the largest near-term exposure.

- Over $1.8 trillion in CRE debt is set to mature after 2030, predominantly held by GSEs and life insurers, reflecting longer-term lending strategies.

A Market in Transition

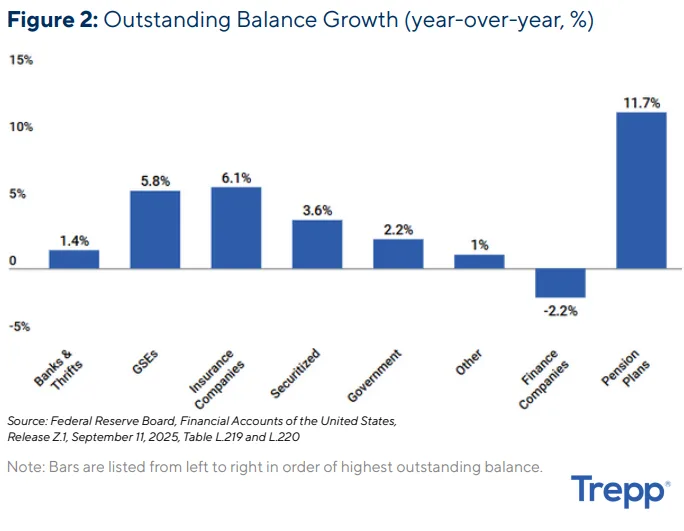

The commercial real estate debt market is adjusting to a higher-rate environment and diverging lender strategies, according to Trepp’s latest analysis of the Federal Reserve’s Z.1 data. As of Q2 2025, the CRE debt market stands at $4.8 trillion, with banks still dominant but showing muted growth.

Insurers and securitized lenders are accelerating their lending activity, capitalizing on higher interest rates and strong investor appetite for stable, income-producing properties. This shift suggests long-term, institutional capital is stepping in where more risk-sensitive lenders, like banks, are holding back.

Who Holds What

Here’s how CRE debt breaks down by lender type:

- Banks & Thrifts: $1.83T (37.7%)

- Government-Sponsored Enterprises (GSEs): $1.08T (22.3%)

- Insurance Companies: $802B (16.6%)

- Securitized Lenders (CMBS & REITs): $707B (14.6%)

While banks maintain the largest share, the most significant growth came from institutions better positioned to handle longer-term risk. GSEs continued to support the multifamily housing market, while life insurers benefited from matching long-term liabilities with long-term loan assets.

Refinancing Pressure Builds

Maturity schedules reveal where future refinancing pressure may arise. Through 2026, over $1.15 trillion in CRE loans will mature:

- Banks: $598B maturing by 2026 (33% of their total)

- Securitized lenders: $169B (38% of total)

These near-term maturities coincide with tighter credit standards and valuation pressures, especially in office and retail sectors. While some lenders may opt for extensions, continued cash flow struggles and valuation resets make these solutions increasingly difficult.

Long-Dated Debt Still Dominates

Despite near-term pressures, the largest share of CRE debt ($1.82 trillion) matures after 2030. These long-dated maturities are concentrated among:

- GSEs: $625B due post-2030

- Insurance Companies: $376B

This reflects the structured nature of their lending—typically fixed-rate and long-term—and their alignment with liability-driven investment strategies. However, it also defers risk further into the cycle, where long-term property performance remains uncertain.

Why It Matters

This lender shift reveals changing dynamics in CRE capital allocation:

- Institutional capital is stepping in to take advantage of yield opportunities.

- Banks are tightening exposures amid regulatory scrutiny and risk concentration.

- Maturity walls are growing, with many borrowers facing refinancing at higher rates.

The coming quarters will test how well borrowers and lenders can adapt. While a potential Federal Reserve rate-cutting cycle may provide some relief, structural challenges in parts of the market—especially office and transitional assets—remain unresolved.

Looking Ahead

CRE debt market participants should prepare for continued bifurcation in lending behavior. Institutional lenders are poised to expand their footprint, while more regulated entities may remain cautious.

As over $1 trillion in maturities loom over the next two years, the question isn’t just whether borrowers can refinance—but who will be willing to lend.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes