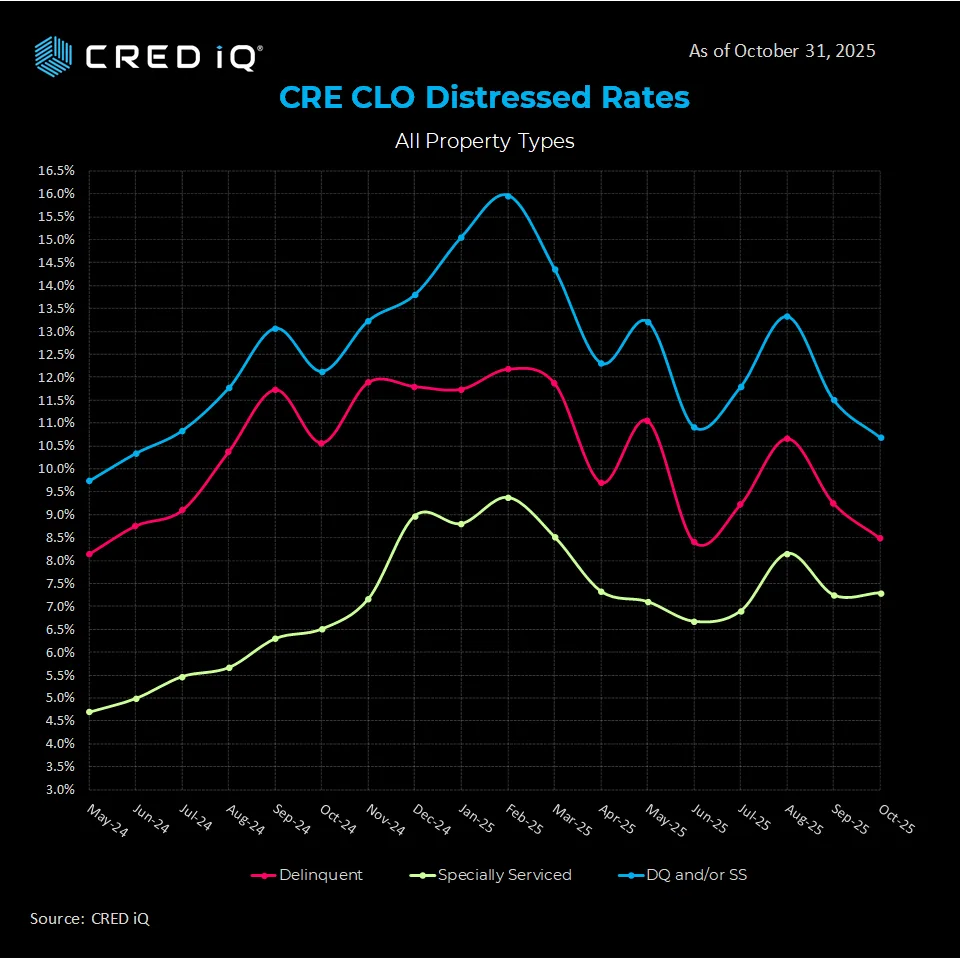

- The CRED iQ CRE CLO distress rate fell to 10.7% in October—its lowest level in 2025.

- Non-performing matured loans jumped 720 basis points to 43.0%, signaling pressure on borrowers to refinance.

- Year-to-date CRE CLO issuance reached $25B, up sharply from $8.7B in 2024.

Market Recovery on the Surface

The CRE CLO market continues to stabilize. In October, CRED iQ found that the overall distress rate fell for a second straight month, landing at 10.7%. That’s down from 11.5% in September and 12.1% a year ago.

Delinquency rates also improved. Loans behind on payments dropped to 8.5%, down from 9.2% the month before. That’s a strong recovery from the February peak of 12.2%.

The special servicing rate, however, rose slightly. It increased by 5 basis points to 7.3%.

Maturing Loans Show Rising Risk

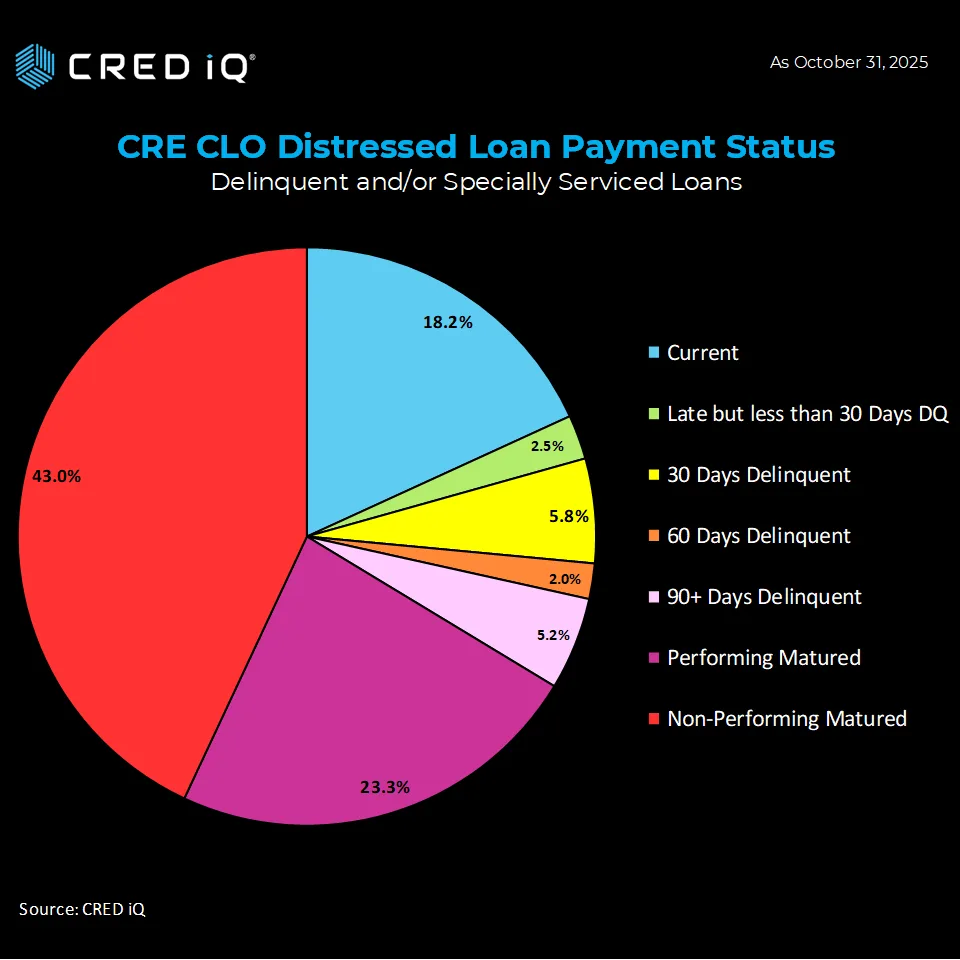

Despite improving averages, many loans are still under stress. Non-performing matured loans jumped to 43.0% of the total, up 720 basis points in just one month.

Of the $3.8B in loans that have passed maturity, only 23.3% remain current. The rest have failed to pay off on time.

Current loans also declined, dropping 100 basis points to 18.2% of the portfolio. Meanwhile, loans less than 30 days delinquent rose to 2.5%, up from just 0.5% in September.

Example: Denver Multifamily Loan in Trouble

A $70.3M loan backed by Outlook DTC in Denver missed its maturity date in October. The 242-unit apartment property has been on a watchlist since August due to weak occupancy and nearing maturity.

Recent occupancy was reported at 79.8%. The debt service coverage ratio was just 0.77, indicating tight cash flow. The loan has now been classified as non-performing.

Why It Matters

Investors are showing renewed interest, and new issuance is strong. But the rise in non-performing matured loans points to bigger issues. Many borrowers still can’t refinance or sell properties when loans come due.

These maturity defaults may signal more distress ahead, especially for lower-quality assets.

What’s Next

If delinquency and distress rates keep falling, issuance may continue to grow in 2026. But lenders remain cautious. Maturing loans with weak performance will stay under pressure.

For now, the CRE CLO market is improving—but far from fully recovered.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes