- CRE CLO delinquencies rose to 10.65% in August 2025, a 143 bps increase from July, while special servicing climbed to 8.15%, driving overall distress to 13.32%.

- Loan maturities continue to weigh on performance, with over 59% of distressed allocated loan amounts tied to matured loans, many struggling to refinance in a high-rate environment.

- Year-over-year comparisons show distress levels climbing, as the market grapples with office vacancies, multifamily oversupply, and retail softness.

- Despite elevated risks, distressed assets may present workout and value-add opportunities for investors able to navigate volatility.

Tracking Distress in CRE CLOs

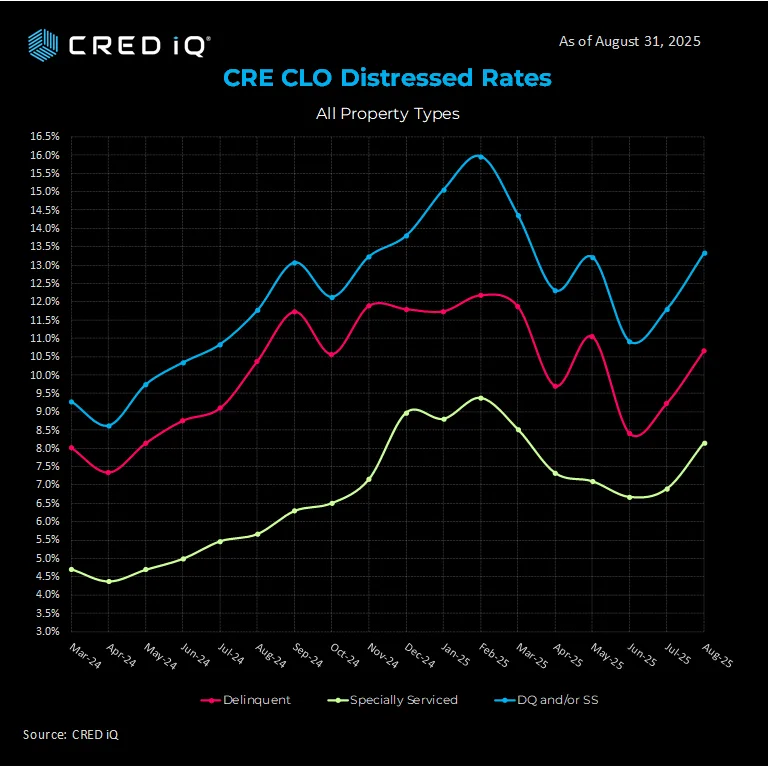

The CRE CLO market is showing signs of mounting strain. According to data from CRED iQ, the delinquency (DQ) rate hit 10.65% in August 2025, up from 9.22% the prior month. This jump represents the largest month-over-month increase in 2025, with 30-day delinquencies making up 14.43% of distressed loan allocations.

At the same time, the special servicing (SS) rate climbed 125 bps to 8.15%, underscoring the growing need for workouts and restructuring. Taken together, the overall distress rate (DQ and/or SS) reached 13.32%, a 153 bps rise from July.

Recent Volatility and Long-Term Trends

Monthly data highlights sharp fluctuations:

- July 2025: DQ up 82 bps from June, SS up 23 bps.

- June 2025: DQ fell 264 bps from May, suggesting temporary relief.

- March 2025: DQ peaked at 11.86% amid a wave of maturities.

Year-over-year, the picture is clear: delinquencies are up 28 bps and special servicing is up 149 bps compared to August 2024, pushing the overall distress rate higher by 155 bps.

Maturity Walls Driving Distress

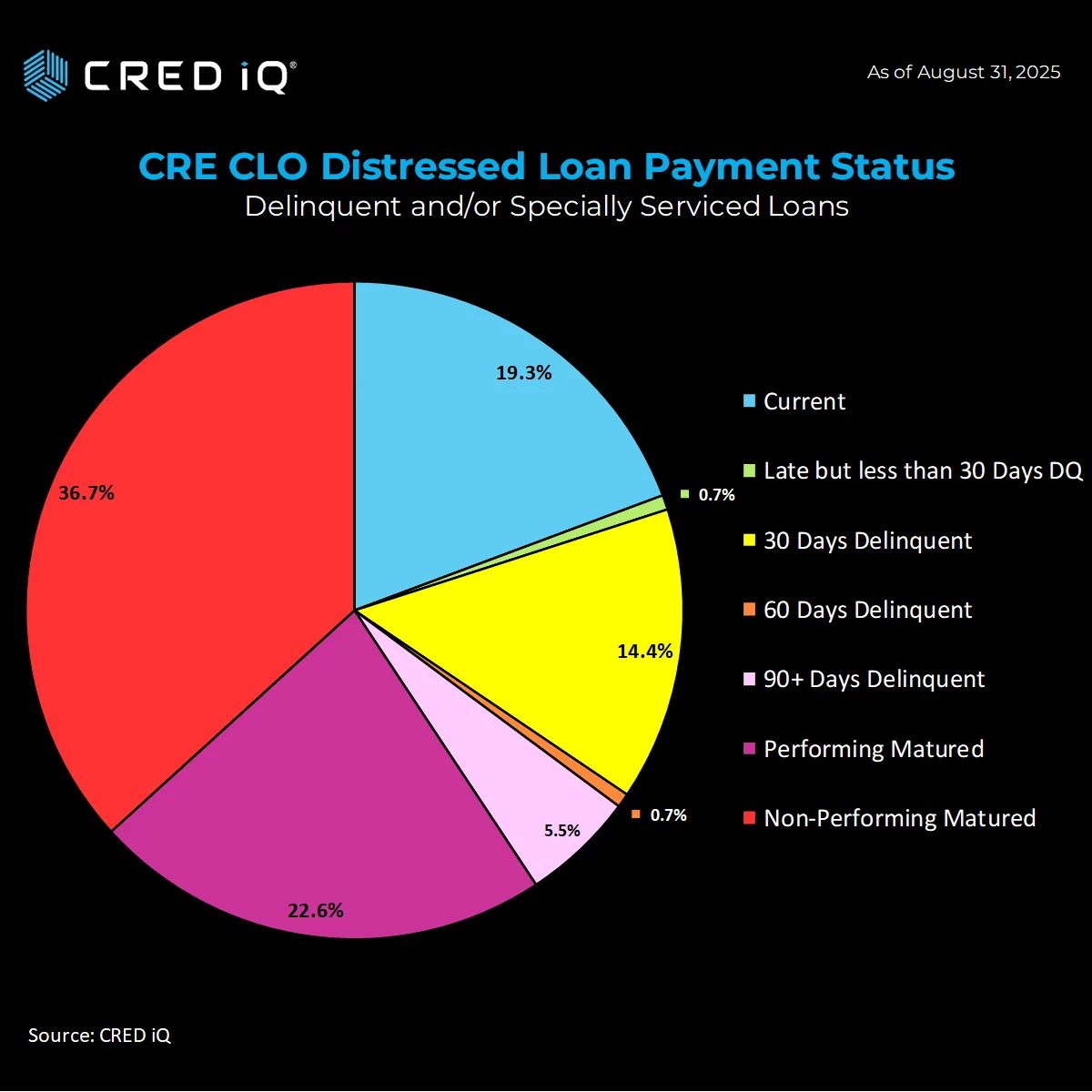

Loan maturities remain a central challenge. In August, 59.3% of distressed allocations came from matured loans, divided between performing (22.56%) and non-performing (36.74%) categories. Difficulty refinancing in today’s higher interest rate environment is leaving many borrowers with limited options, particularly in office and retail assets.

Further breakdowns show:

- 90+ day delinquencies: 5.54% of distressed loans.

- Non-performing matured loans: 36.74% of distressed exposure.

Why It Matters

The rising tide of distress in CRE CLOs mirrors broader pressures across commercial real estate. Persistent office vacancies, multifamily oversupply, and retail softness are compounding refinancing risks. While these dynamics pose threats for lenders and investors, they also create opportunities for those with capital and restructuring expertise to execute workout and value-add strategies.

Looking Ahead

With interest rates likely to remain elevated in the near term, CRE CLO distress metrics could climb further. For stakeholders, granular data analysis from platforms like CRED iQ will be essential to track risk exposure, identify opportunities, and respond to shifting market dynamics.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes