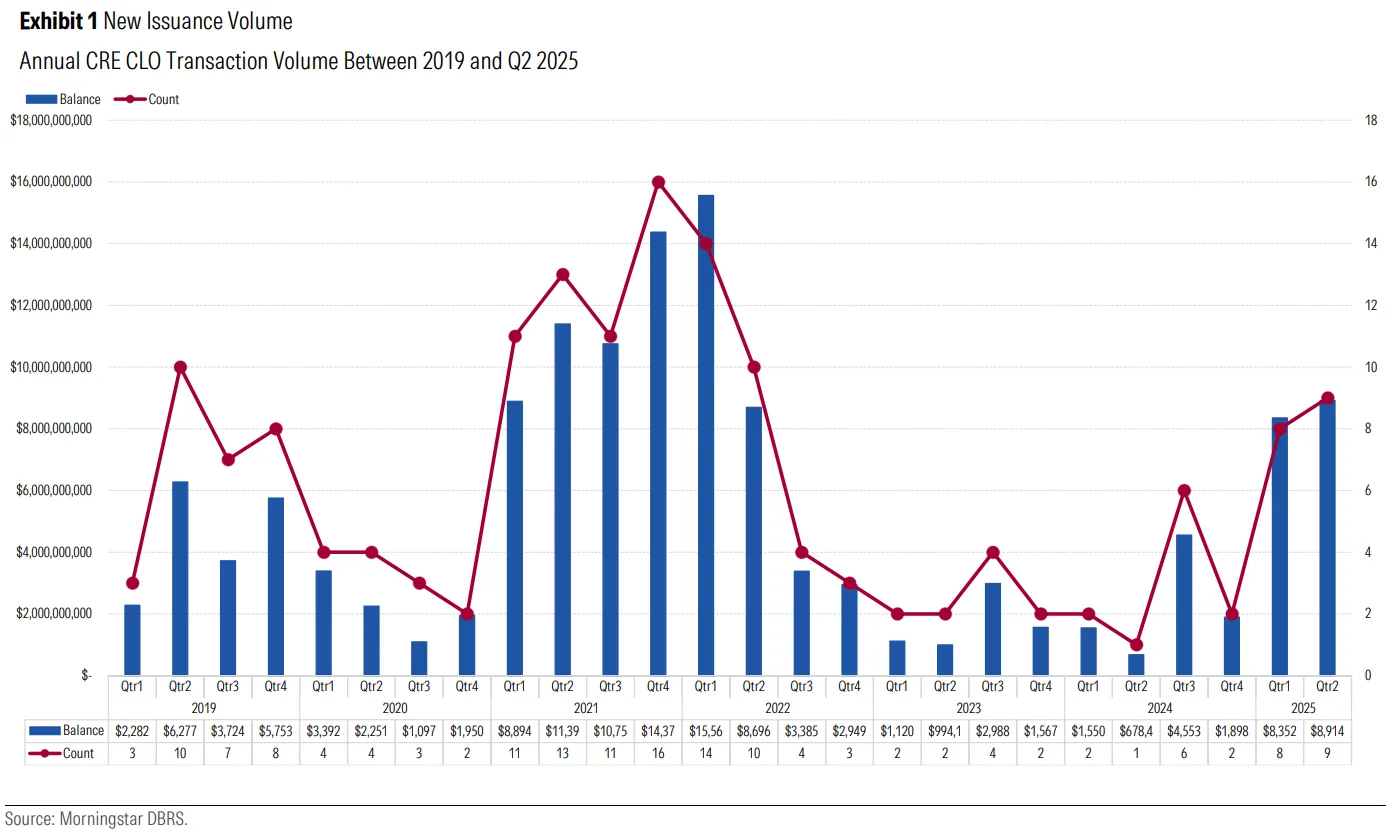

- CRE CLO issuance volume surged to $8.91B in Q2 2025, surpassing Q1’s $8.35B and marking the highest level since mid-2022.

- Multifamily remains the dominant asset class, making up over 81% of total collateral, while office and retail exposure declined significantly.

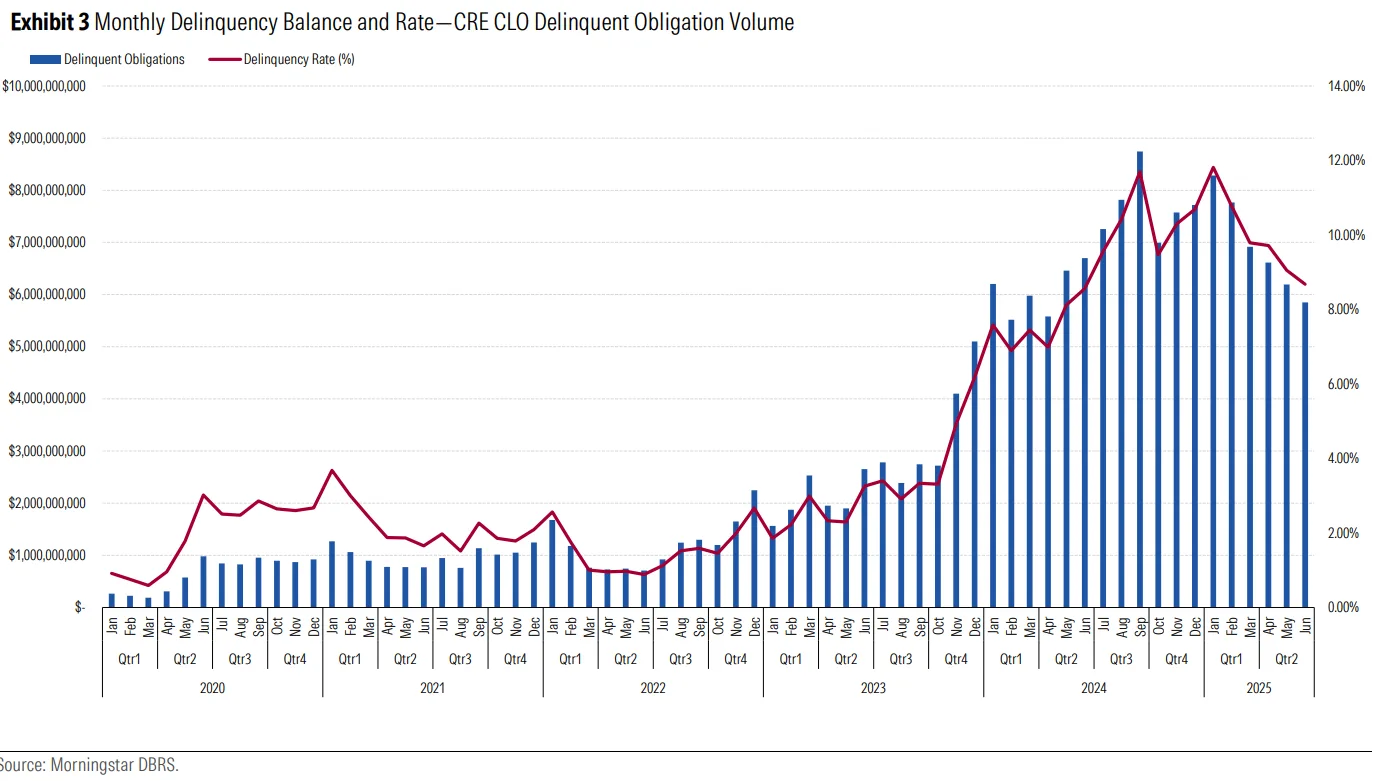

- Delinquency rates fell 111 bps to 8.68%, driven by fewer new delinquencies and improved multifamily performance.

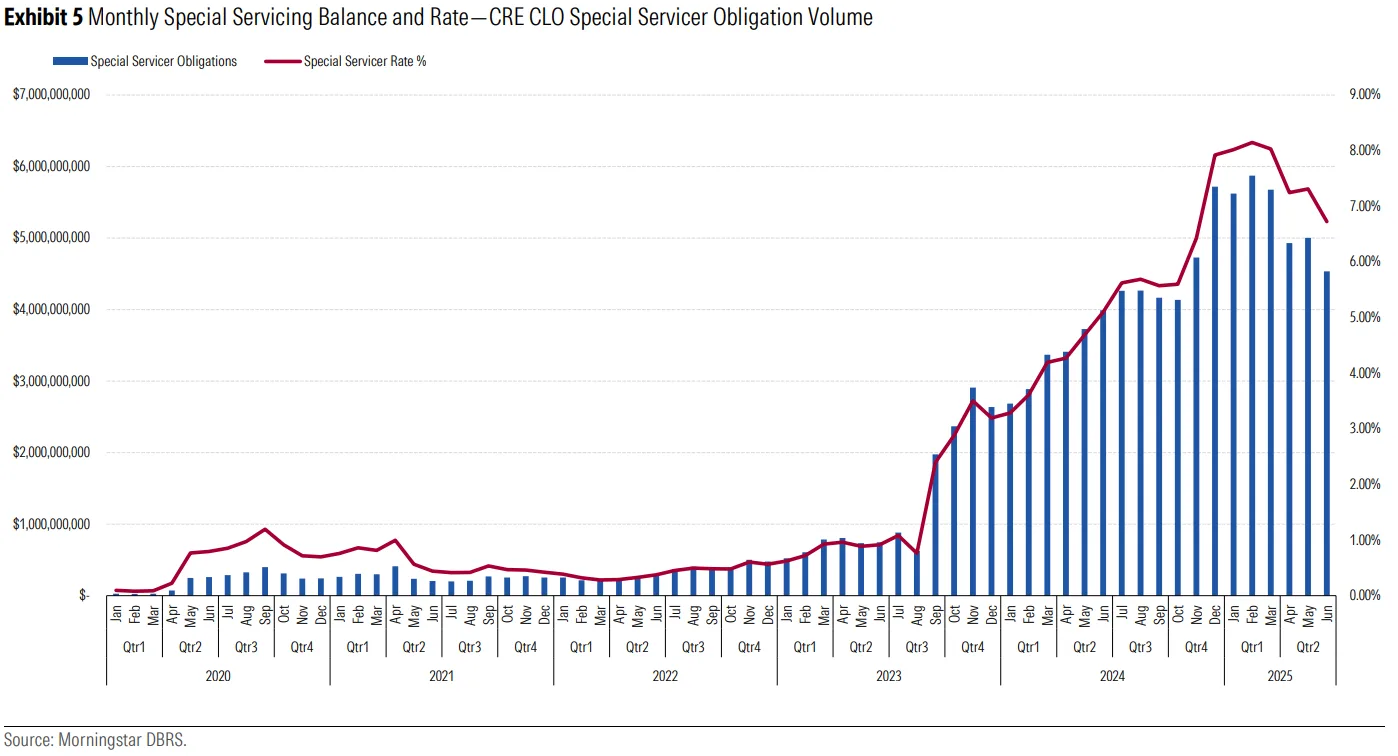

- Special servicing rate dropped to 6.72%, with the multifamily and office sectors accounting for over 90% of specially serviced loans.

Issuance Rebounds

According to a report by the CMBS Research, CRE CLO issuance in Q2 2025 reached $8.91B across nine managed deals, continuing a strong recovery trend. This marks a slight uptick from the previous quarter’s $8.35B and the highest quarterly volume since Q2 2022. Multifamily loans were again the primary driver, making up 81.81% of contributed collateral, up from 67.98% in Q1. Lodging and industrial loans made up 5.45% and 7.73%, respectively, while office exposure dropped to just 0.14%.

Notable transactions included:

- MF1 2025-FL19: $1.25B, 100% multifamily

- INCREF 2025-FL1: $1.22B, with the highest share of industrial loans (43.57%)

- Dwight 2025-FL1: $925M, 100% multifamily

Credit Performance

Delinquency rates improved, falling to 8.68% in Q2, down 111 bps from 9.79% in Q1. Multifamily loans saw a 72 bps drop in delinquency to 8.72%, while the office sector saw a larger improvement, falling to 15.28% (down 346 bps). Despite improvements, multifamily and office loans account for nearly 90% of all delinquent loan balances, with unpaid principal balances (UPBs) of $4.26B and $994.8M, respectively.

Special Servicing Trends

The CRE CLO special servicing rate dropped to 6.72%, down from 8.03% in the prior quarter. The total specially serviced loan balance declined by $1.14B quarter-over-quarter to $4.5B. Multifamily loans represented the majority of specially serviced loans (75.5%), though their special servicing rate fell to 7.00%. Office loans also saw a decline in their special servicing rate, from 14.19% to 11.42%.

Modification Activity Persists

While still elevated, loan modification activity dipped slightly, with the overall modification rate decreasing from 29.41% in Q1 to 29.05% in Q2. The most common changes involved maturity date extensions (34.39% of modified UPB) and combination modifications (33.75%). Multifamily loans continued to dominate this category, comprising 71.11% of total modified loans, although their total modified UPB fell to $13.92B.

Office loan modifications rose notably, with 48.52% of office loans modified, up from 42.37% in Q1. Lodging also saw an increase in modification activity to 21.54%, signaling ongoing efforts to support struggling hospitality properties.

Outlook

Despite ongoing macroeconomic uncertainty and refinancing difficulties, the CRE CLO market showed signs of resilience in Q2 2025. Record issuance volumes and improving credit metrics suggest investor confidence remains strong, especially for multifamily-backed deals.

However, with modification and extension requests still elevated, and office sector stress persisting, market participants will remain focused on asset performance and borrower execution heading into the second half of the year.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes