- The CRE CLO distress rate dropped to 10.9% in June, down from 13.2% in May, according to CRED iQ.

- Delinquency and special servicing rates also declined, reflecting short-term market improvements.

- Over 59% of loans are past maturity, with many borrowers using extensions to delay defaults.

- A notable example is the $91.4M Harmon at 370 Apartments loan in Las Vegas, which is now considered “performing matured.”

Distress Rate Sees Rare Improvement

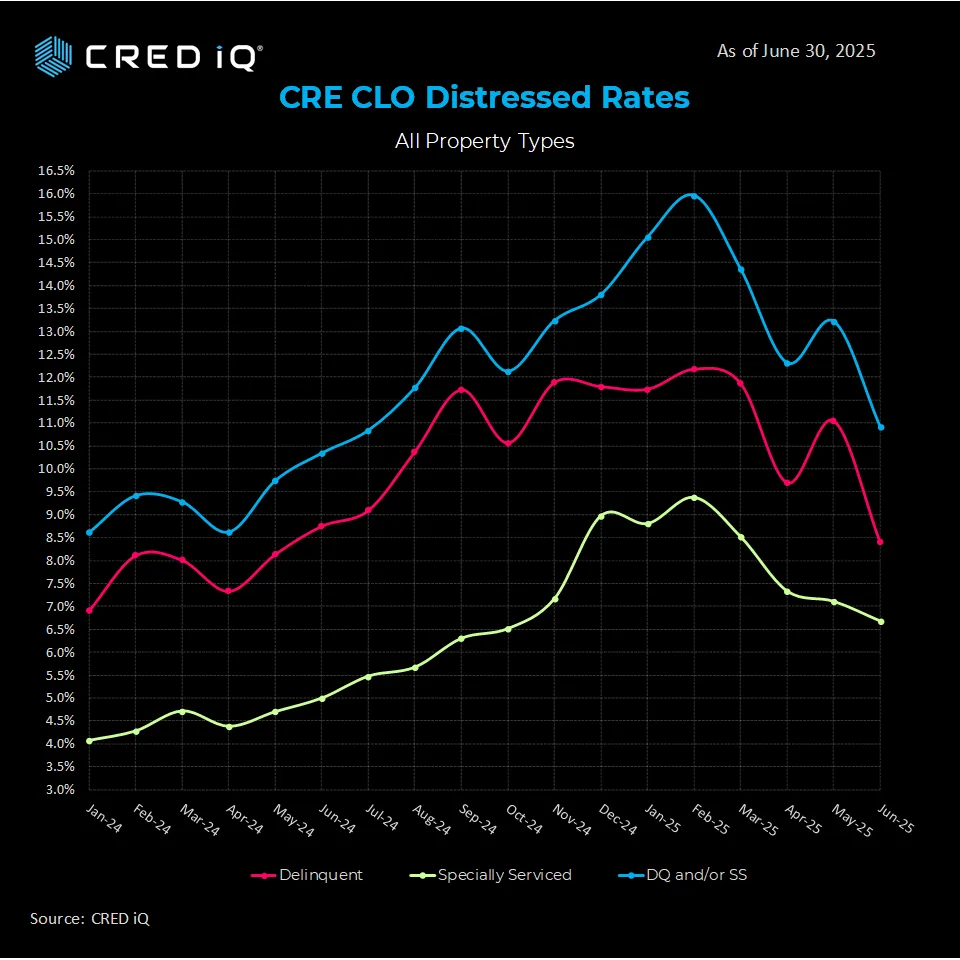

After months of mixed results, June brought a brief recovery. CRED iQ reported a 230 basis point decline in the CRE CLO distress rate, which now stands at 10.9%. This comes after an 80 BPS increase in May, highlighting the market’s continued instability.

Delinquency and Servicing Metrics Improve

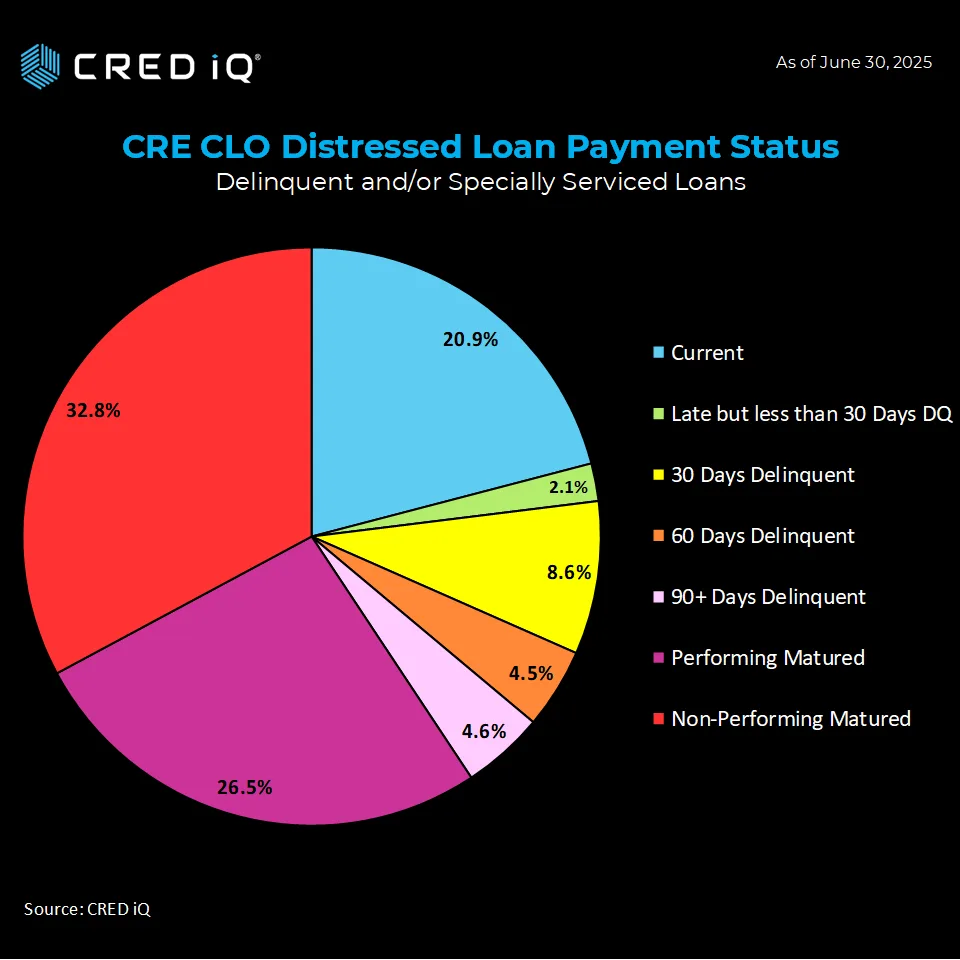

The delinquency rate fell 260 basis points to 8.4%, while the special servicing rate dropped 40 basis points to 6.7%. In addition, 20.9% of CRE CLO loans are current, up from 14.3% in May. That shift represents a $420M increase in current loan volume.

Even so, 59.3% of loans remain past their maturity dates. Of these, 26.5% are labeled “performing matured,” up from 14.4% in May. Meanwhile, “non-performing matured” loans dropped to 32.8%, down from 50%.

Maturity Challenges Continue

The market’s volatility ties back to loans issued in 2021–2022. During that period, lenders took advantage of low rates and rising property values. Now, those short-term, floating-rate loans face higher borrowing costs, making refinancing more difficult.

For example, the Harmon at 370 Apartments loan in Las Vegas is a $91.4M multifamily deal. It includes a $12.9M future funding piece. In June, it moved to “performing matured” status after missing its payoff deadline. The borrower is relying on short-term extensions to avoid default.

Recent Trends Reflect Past Risks

CRED iQ data shows how distress has risen over time. In January 2024, the CRE CLO distress rate was 8.6%. By January 2025, it had climbed to 15.1%. The main drivers were loan maturities and rising interest rates.

Why It Matters

CRE CLOs remain a key financing tool, especially for transitional multifamily assets. However, as more loans mature in today’s high-rate environment, distress levels may rise again. Investors and lenders must stay alert.

What’s Next

The second half of 2025 will be critical. Market players should track whether recent improvements hold or reverse. Tools like CRED iQ provide valuable insight into loan performance and risk exposure.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes