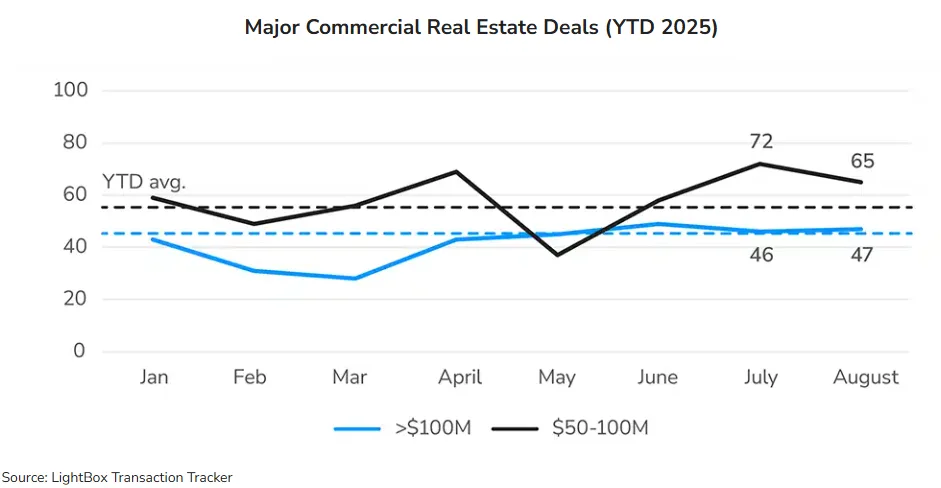

- August saw a slight dip in CRE activity compared to July’s record-setting pace, though deal flow remains above the 2025 year-to-date average, especially in nine-figure transactions.

- Multifamily assets continue to dominate, making up 45% of deals over $50M. Office, industrial, and retail also attracted selective investment.

- Institutional buyers, including REITs and private equity firms, are driving major portfolio acquisitions, signaling confidence in select sectors.

CRE Activity Holds Strong Despite Seasonal Dip

Commercial real estate transaction volume slowed in August but stayed well ahead of the 2025 monthly average, as reported by LightBox.

The LightBox CRE Activity Index dipped from 111.8 in July to 104.8, reflecting seasonal caution and macroeconomic uncertainties. Still, the index remains above the 100-point benchmark for the seventh straight month, signaling continued market health.

Nine-Figure Deals Stay Resilient

Large-scale transactions remained steady at 47 in August, with strong representation from multifamily portfolios, trophy retail, and industrial assets. Key trades included:

- A $1.6B multifamily portfolio by Cortland Partners

- A $740M New England apartment acquisition by Harbor Group

- A $344M industrial logistics deal by Artemis Real Estate Partners

These transactions were spread across markets from Beverly Hills to Dallas and Honolulu, emphasizing widespread investor activity beyond coastal hubs.

Mid-Cap Market Shows Selective Strength

Deals in the $50M–$100M range slipped slightly to 65, down from 72 in July, but remain 12% above the 2025 monthly average. Multifamily again led the way, followed by industrial logistics, office, and retail. Notable buyers in this tranche included AvalonBay, Kennedy Wilson, and J.P. Morgan’s REIT, which acquired a $95M industrial outdoor storage portfolio.

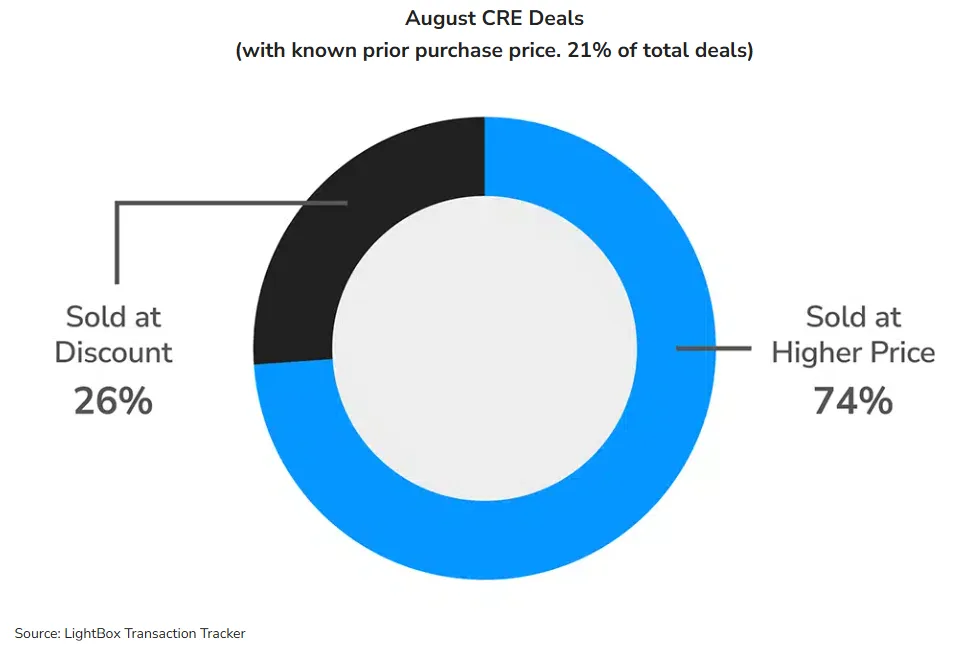

Distress vs. Trophy

Of the 21% of August deals with prior sale data, 74% sold at a gain. However, office assets led 26% of sales at a loss, including a $164M markdown on a New York property. In contrast, luxury retail like Rodeo Drive’s $400M sale recorded significant appreciation.

This highlights a bifurcated market where well-located, high-quality assets continue to attract capital, while weaker properties face deep discounts.

The Rate Cut Factor

With the Fed delivering its first 25 bps rate cut of the year, market observers expect a potential rebound in deal activity. As Manus Clancy of LightBox notes, “Rate relief is the catalyst everyone has been waiting for… capital gets even slightly cheaper, we’ll see lenders lean in.”

A seasonal uptick in September, combined with improved borrowing conditions, may set the stage for stronger momentum heading into Q4.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes