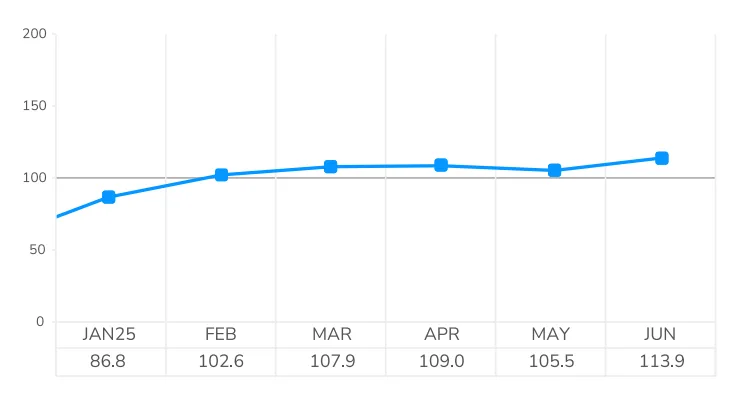

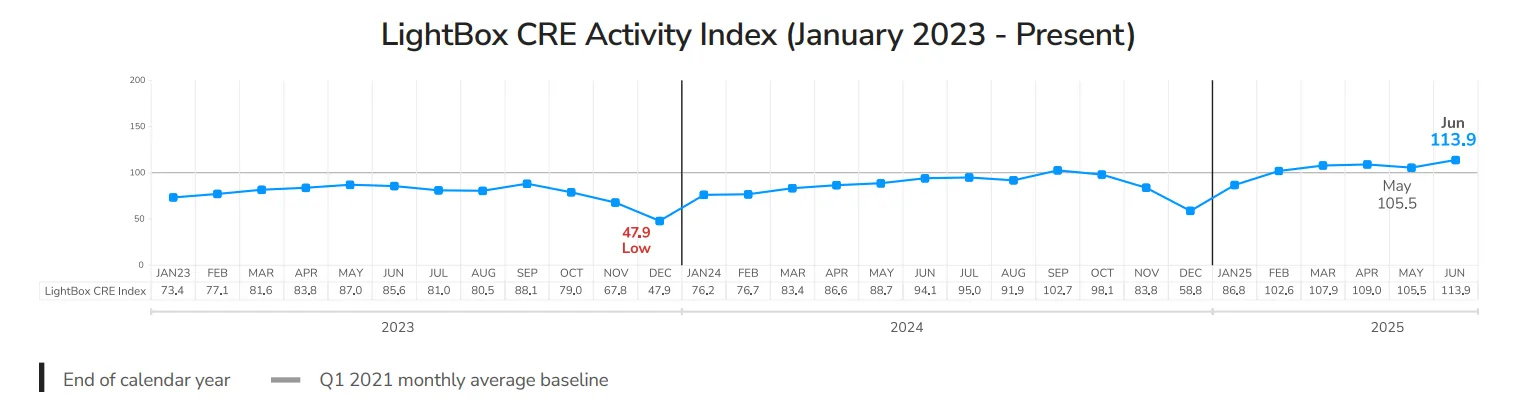

- June CRE Activity Index surged to 113.9, the highest level in over three years and an 8% month-over-month jump.

- Activity levels reflect renewed momentum across all three CRE deal components: appraisals, listings, and Phase I environmental site assessments.

- The market is 21% stronger than this time last year, underscoring improving sentiment and growing investor confidence despite economic headwinds.

- Tariff tensions, Fed rate policy, and global uncertainty continue to challenge the outlook, but investor engagement remains strong.

A Market Rebounding: CRE Activity at 3-Year High

LightBox’s June 2025 CRE Activity Index surged to 113.9—the highest reading since May 2022—marking a significant mid-year rebound in commercial real estate activity. The sharp gain follows a modest 3% decline in May, which analysts now interpret as a brief pause rather than a turning point.

The index captures over 30,000 data points across commercial property listings, Phase I environmental site assessments, and lender-driven appraisals. The 8% monthly increase signals that activity is gaining traction despite ongoing concerns around tariffs, interest rate policy, and global economic instability.

Momentum Builds Across CRE Fundamentals

- Listings: Commercial property listings rose for the sixth consecutive month, with volume up 2% from May and 31% higher year-over-year. Sellers are increasingly returning to the market, driven by clearer pricing expectations and renewed buyer interest.

- Appraisals: Lender-initiated appraisal activity jumped 19% in June, fully reversing May’s decline. The rebound suggests renewed confidence from lenders and a steady pipeline of underwriting activity.

- Environmental Due Diligence: Phase I ESA volume rose 10% from May, a notable turnaround from the sluggish pace seen in spring. This signals more early-stage deal flow and investor diligence ahead of expected closings.

Capital Re-Engagement: Lenders, Investors Regain Ground

Lending activity is no longer dominated by just banks—debt funds and CMBS lenders are increasingly stepping in to provide liquidity. These alternative capital sources have been key in helping the market absorb upcoming loan maturities and new originations.

Meanwhile, investor appetite remains strong, especially in multifamily, industrial, and select office assets. While deals are taking longer to close due to stricter underwriting, LightBox data shows a rise in non-disclosure agreements and bidding activity.

Office leasing volumes are ticking upward in several metros, and retail, despite pressure from tariffs, is drawing new investor interest as supply chain dynamics evolve.

Looking Ahead

The LightBox Index indicates that the CRE market is not just weathering current economic storms—it’s recalibrating. Though risks remain—from tariff fallout to Fed rate indecision—the index points to robust deal activity in the months ahead.

If the Federal Reserve moves ahead with a rate cut in July or September, it could provide a tailwind for further CRE momentum, echoing a similar post-cut surge seen last fall.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes