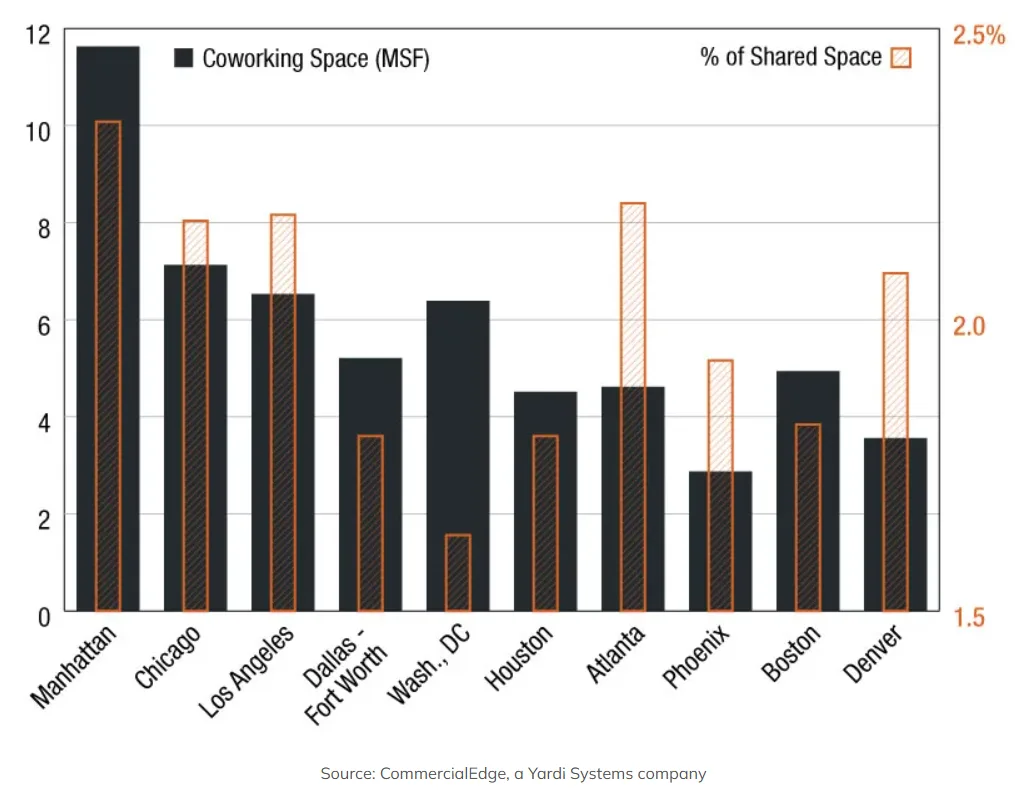

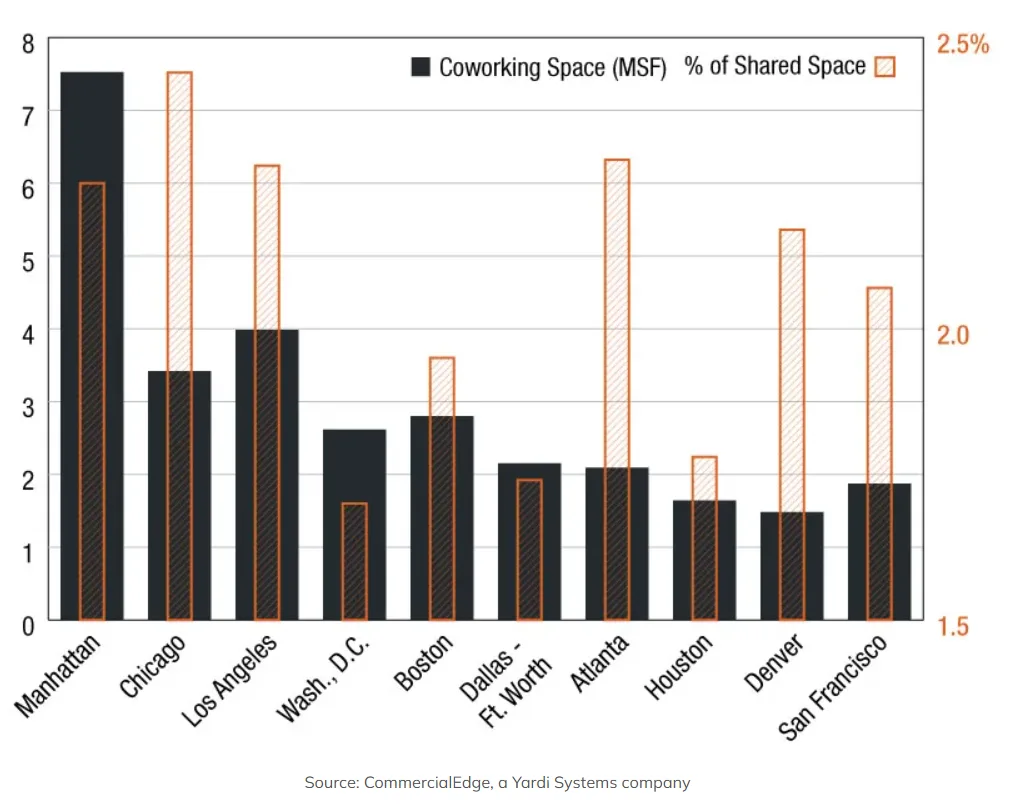

- Nationally, coworking space accounts for 2% of the total US office inventory, totaling approximately 59.2M SF across 7,823 locations.

- Manhattan leads in SF, with 7.5M SF of coworking space—2.3% of its total office stock.

- Chicago boasts the highest market share, with 2.4% of its office space dedicated to coworking, closely followed by Los Angeles and Atlanta at 2.3% each.

- Other top coworking markets include Denver, San Francisco, Boston, Dallas–Fort Worth, Washington, DC, and Houston, all with above-average coworking footprints.

The Big Picture

As the US office market evolves in response to hybrid work models, coworking remains a resilient and growing segment. Total national coworking space reached nearly 59.2M SF in May, holding steady at 2% of the country’s leasable office supply, reports Commercial Search. The data reflects a sustained appetite for flexibility, especially in major metropolitan hubs.

Top Markets By Coworking Share

Chicago took the lead in the market share, with 2.4% of its office space—or 3.4M SF—dedicated to coworking across 280 locations. Los Angeles holds a 2.3% coworking share with 4M SF across 303 sites, the highest location count nationwide.

Manhattan leads in coworking square footage with 7.5M SF across 278 locations, making up 2.3% of its total office inventory. Atlanta mirrored that percentage with just over 2M SF spread across 244 locations.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Other Strongholds

Several other markets are outperforming the national average:

- Denver: 2.2% (1.5M SF, 239 locations)

- San Francisco: 2.1% (1.9M SF, 135 locations)

- Boston: 2.0% (2.8M SF, 221 locations)

Markets like Dallas–Fort Worth (1.7%), Washington, DC (1.7%), and Houston (1.8%) remain important hubs, despite slightly lower shares compared to national leaders.

Why It Matters

Flexible office space has moved from a niche option to a mainstream asset class. Cities with strong coworking ecosystems better support startups, remote teams, and enterprises needing flexibility in today’s shifting office landscape. The continued growth of coworking demonstrates its strategic value in enhancing urban office market resilience.

What’s Next

Expect the sector to keep growing in major metros, especially as office landlords seek new leasing strategies and occupiers demand flexibility. Markets like Chicago, Los Angeles, and Manhattan are likely to continue leading the way, but secondary markets with growing tech and startup scenes could emerge as coworking’s next frontier.