- Coworking consolidation led to a 1% drop in US location count—the first post-pandemic decline.

- Operators favored fewer, larger spaces with a 2% rise in average location size.

- Emerging markets like Long Island and Birmingham drove most of Q2’s coworking growth.

- Regus and HQ led operator expansion, focusing on high-efficiency, high-demand areas.

A Market Defined By Efficiency, Not Expansion

After two years of rapid post-pandemic growth, the US coworking sector slowed dramatically in Q2 2025, signaling a new era of strategic recalibration. Nationwide, coworking space expanded by just 0.3%—a stark contrast to Q1’s 3% gain, reports Coworking Cafe.

This pivot from aggressive expansion to focused refinement comes as operators adapt to shifting hybrid work patterns and rising operational costs. For the first time since the pandemic, the number of coworking locations nationwide fell, down 1% to 7,748.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Major Cities Contract, Secondary Markets Surge

While top-tier markets like Manhattan saw their footprint contract by 4%, neighboring Brooklyn grew by 5%. This contrast reflects a broader shift away from dense urban cores. Operators and occupiers are increasingly favoring neighborhood-adjacent locations that offer more flexibility and accessibility. Other urban markets like Chicago (+2%) and Washington, DC (+1%) remained relatively stable, while Dallas-Fort Worth (-2%) and Phoenix (-3%) pulled back.

By contrast, high-growth activity concentrated in emerging markets:

- Long Island, NY: +11% SF

- Birmingham, Ala.: +10%

- West Palm Beach–Boca Raton, Fla.: +9%

- Central Valley, Calif.: +8%

- San Diego and Detroit: +6% each

These gains are driven by affordability, proximity to residential areas, and talent migration patterns—making them prime targets for expansion.

Bigger Spaces, Fewer Places

Operators are moving away from smaller satellite spaces in favor of larger, amenity-rich hubs. Nationally, the average coworking site grew to 18,236 square feet—up 2% from Q1.

Top markets by average size include:

- Manhattan, N.Y.: 40,859 SF (+1%)

- Chicago, Ill.: 28,671 SF

- Brooklyn, N.Y.: 22,430 SF (+6%)

Significant growth in average space was also observed in Long Island (+11%), West Palm Beach–Boca Raton (+9%), and Detroit (+8%), pointing to a trend of scaling up in growth regions.

Flexible Office Pricing Holds Steady At The Top

Despite consolidation, pricing remained strong in key metros:

- Manhattan: $339/month

- Brooklyn: $330/month

- Boston, San Francisco, L.A., Seattle: ~$235/month

Suburban and virtual office rates also saw growth, with New Jersey ($215) and Central Valley, Calif. ($204) leading, as remote-first companies seek affordability outside major hubs.

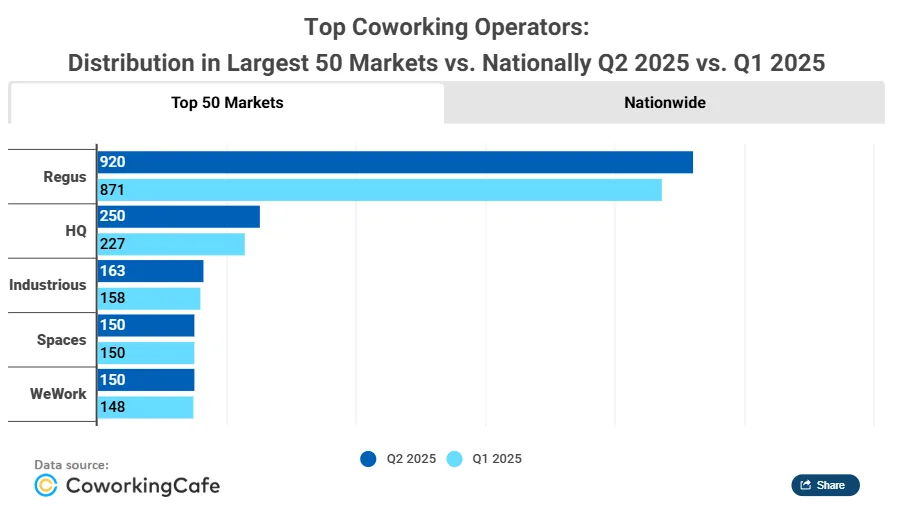

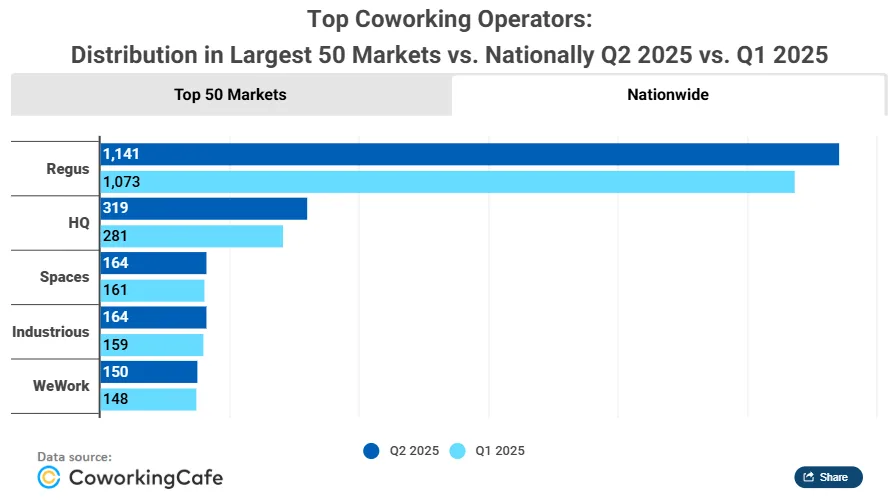

Top Operators Double Down On Core Strategy

The five largest coworking brands—Regus, HQ, Industrious, Spaces, and WeWork—grew their collective footprint by 6% to 1,938 locations.

- Regus: Added 68 locations in Q2, totaling 1,141, with strong penetration in both major metros and secondary markets.

- HQ: Expanded by 14% to 319 locations, focusing on suburban and mid-sized city demand.

- Industrious and Spaces: Continued steady growth.

- WeWork: Stabilized with a 1% uptick amid ongoing restructuring.

These shifts highlight a maturing industry where strategic positioning and operational optimization now outweigh sheer expansion.

Coworking Matures Into A Smarter Growth Phase

Q2 2025 marks a critical turning point in the coworking industry. No longer in hypergrowth, operators are consolidating, optimizing, and targeting sustainable markets. From premium hubs in Manhattan to rising stars like Birmingham and Long Island, the future of flexible office space is all about right-sizing and regional smarts.

Market conditions remain in flux, and hybrid work trends continue to evolve. As a result, further strategic shifts are expected in the coming months. Operators will likely redefine how they approach value, location, and long-term resilience.

Looking Ahead

As demand recalibrates, look for:

- More strategic mergers and exits by smaller operators

- Increased investment in amenity-driven design and tech-forward spaces

- Continued shift toward commuter-friendly, regional markets with scalable potential

The coworking race is no longer about who has the most space—it’s about who has the right space.