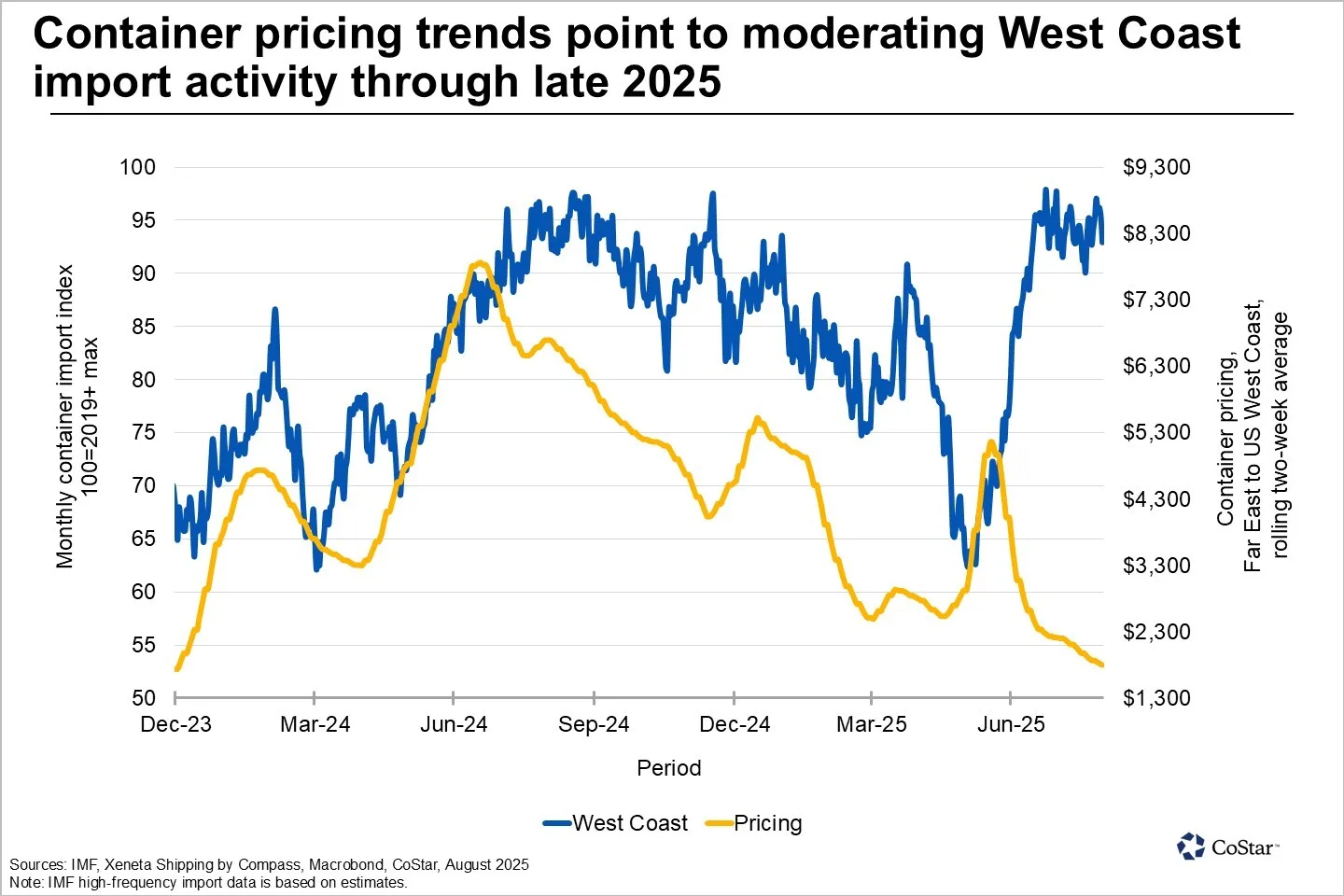

- Container shipping prices from Asia to the US West Coast have dropped over 60% from their June 2025 highs, signaling a likely slowdown in import activity.

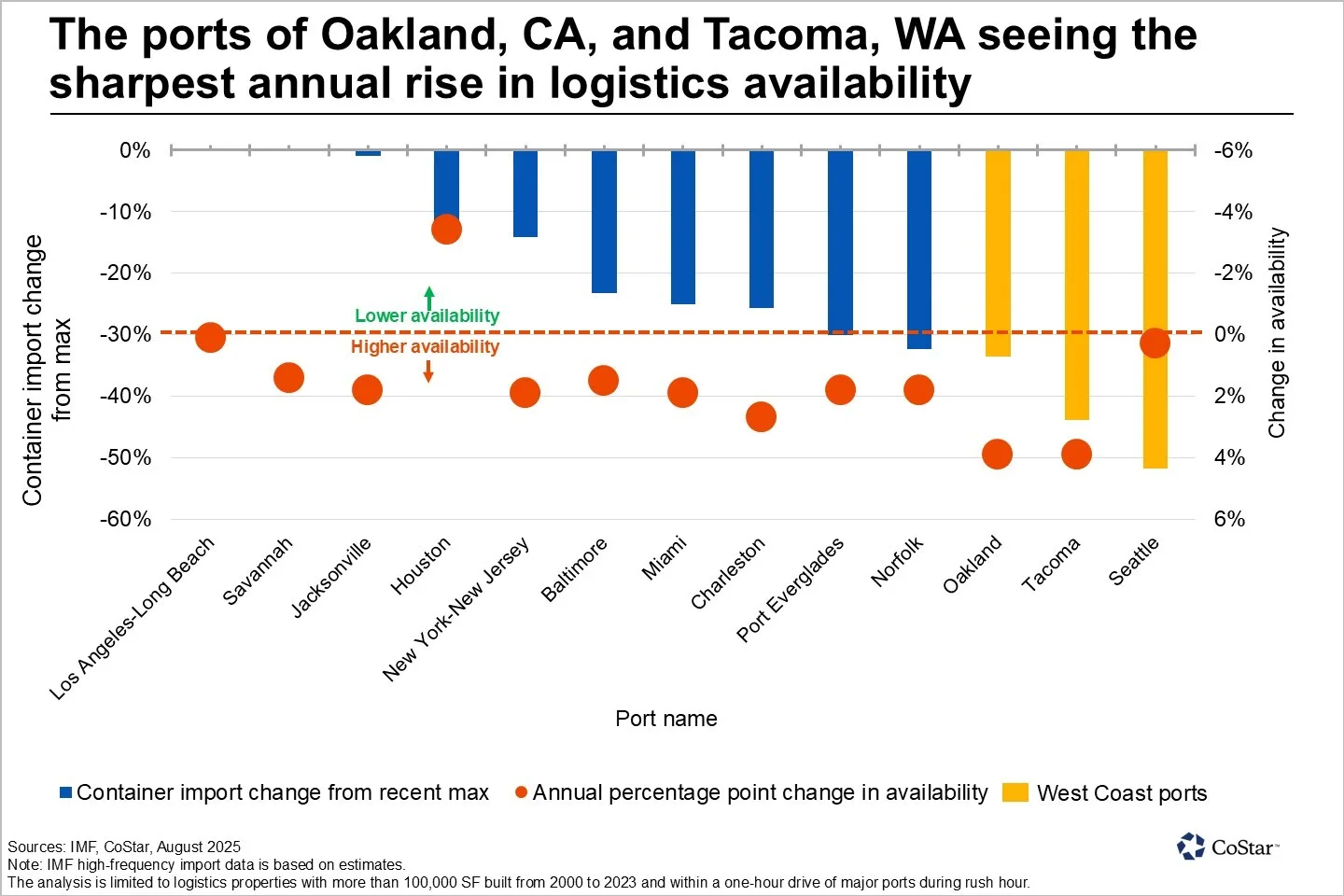

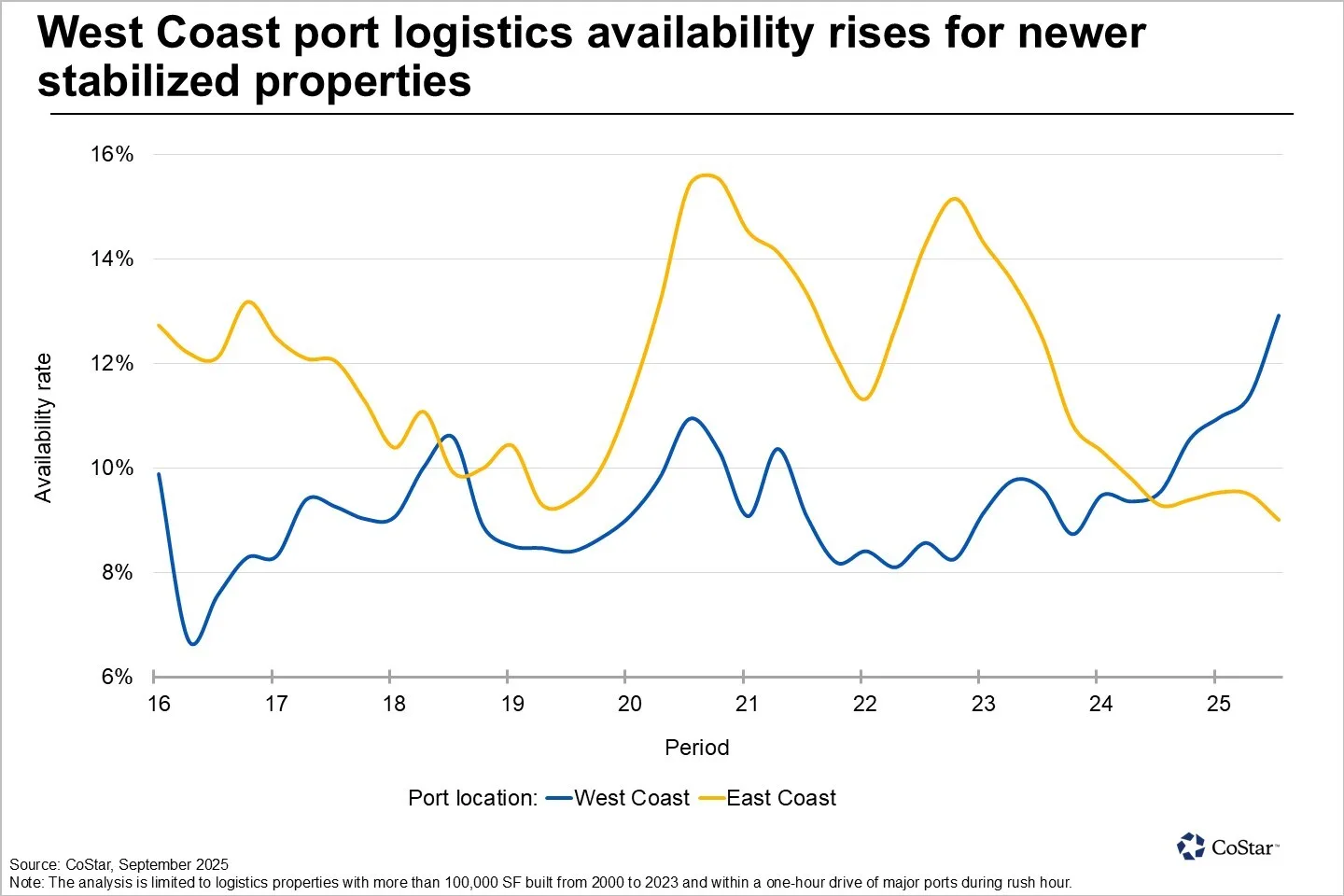

- Availability at logistics properties near key West Coast ports is rising, indicating a pullback in demand following the inventory frontloading earlier this year.

- The current shift mirrors previous tariff-driven slowdowns, suggesting further weakening in demand for port-adjacent logistics space into early 2026.

Cooling Momentum

Shipping container pricing is trending downward after peaking in June 2025, reports CoStar. This marks a potential end to the recent import wave that pushed volumes to record levels. The ports of Los Angeles and Long Beach, in particular, saw their busiest month ever in July.

The Xeneta Shipping Index shows rates from Asia to the West Coast have declined by over 60% since those summer highs. Because container pricing tends to lead import volumes by several weeks, these pricing shifts point to slower traffic ahead for the rest of 2025.

Inventory Frontloading Fades

Recent high import activity was largely driven by retailers rushing to get ahead of tariffs imposed in April—labeled “Liberation Day” by the White House. But that burst of demand is fading. Container traffic has not yet dropped significantly, according to real-time IMF PortWatch data. However, the forward-looking nature of container pricing suggests a correction is imminent.

The National Retail Federation forecasts total US import cargo volume for 2025 to end lower than 2024 levels.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Logistics Space Reflects The Slowdown

The effects are already being felt in the industrial real estate market. Availability at large, stabilized logistics properties near West Coast ports—especially Oakland, Tacoma, and Seattle—has risen sharply since late 2024. These markets, more reliant on imports from China and Southeast Asia, are showing early signs of softening demand.

A recent CoStar report noted that West Coast port markets are particularly exposed to shifting trade flows and policy changes.

Broader Implications

While the slowdown is most visible on the West Coast, subdued import activity is affecting major logistics hubs nationally. Properties in the Inland Empire and Lehigh Valley—key distribution corridors tied to port activity—are seeing muted tenant demand.

Meanwhile, East Coast ports have been less affected by the tariff-related pullback but still face challenges. Markets like Houston, Norfolk, Miami, and Jacksonville continue to have elevated construction pipelines. This could delay rent growth if leasing activity doesn’t keep pace.

Outlook

The container market is once again serving as an early signal of weakening demand for logistics properties. While imports haven’t yet dropped across the board, rising vacancy near ports and falling container rates suggest caution is warranted heading into 2026.

Watch for continued volatility in trade flows and its ripple effects across US logistics markets. The impact will be felt especially in port-centric and distribution-heavy regions.