- Retail and dining traffic now exceed pre-COVID levels, driven by value and premium demand.

- Consumers prioritize product quality and perceived value over convenience.

- Mid-tier brands struggle as spending concentrates at budget and luxury ends.

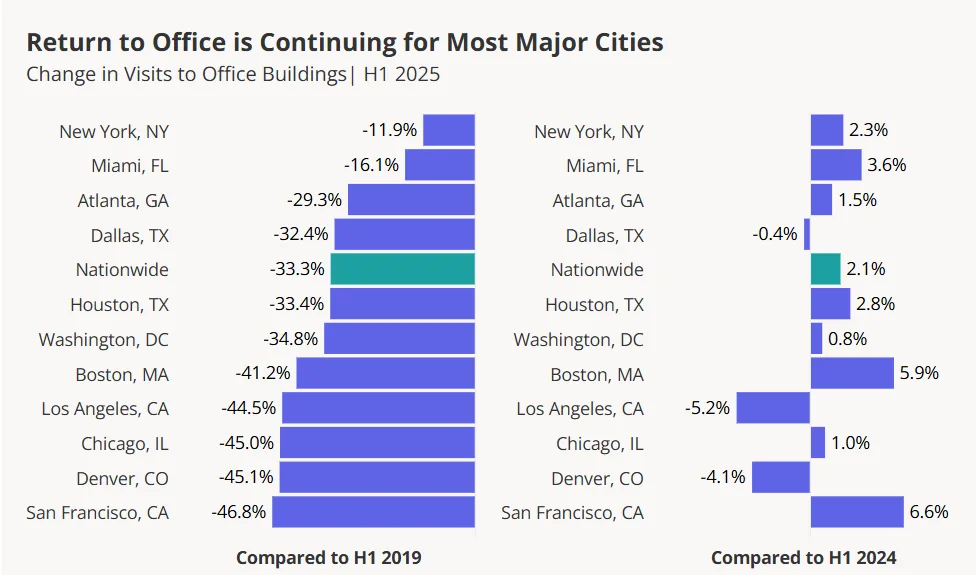

- Hybrid work keeps office visits 33% below 2019, despite return-to-office mandates.

A Post-Pandemic Snapshot

The first half of 2025 marks five years since the COVID-19 outbreak began reshaping every aspect of consumer life. While some categories have rebounded and even exceeded pre-pandemic levels, others are still adjusting to new behavioral baselines. Across sectors, a defining pattern has emerged: consumers are prioritizing either extreme value or premium experiences—often at the expense of the middle, per The Anchor.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

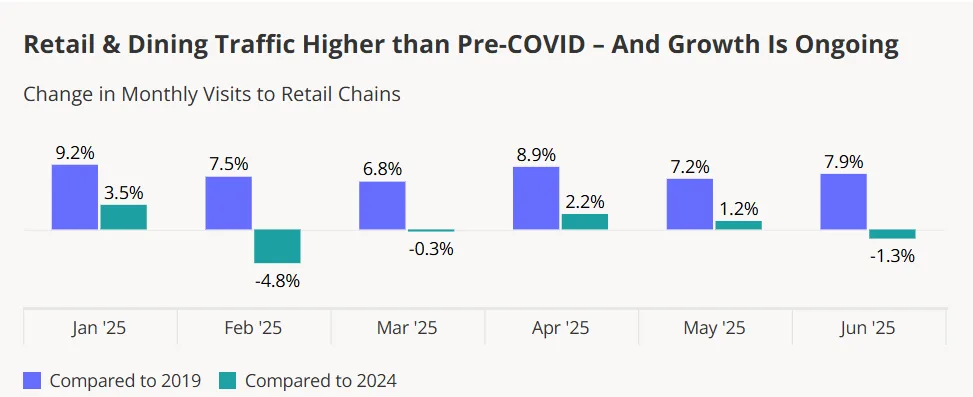

In-Person Retail And Dining Remain Strong

Both retail and dining visits were higher in H1 2025 than in 2019, defying expectations of a permanent online takeover. Chains like Costco, Chick-fil-A, and Raising Cane’s have expanded their footprints, helping offset closures from the pandemic era. This growth reinforces consumers’ ongoing desire for in-person shopping and dining.

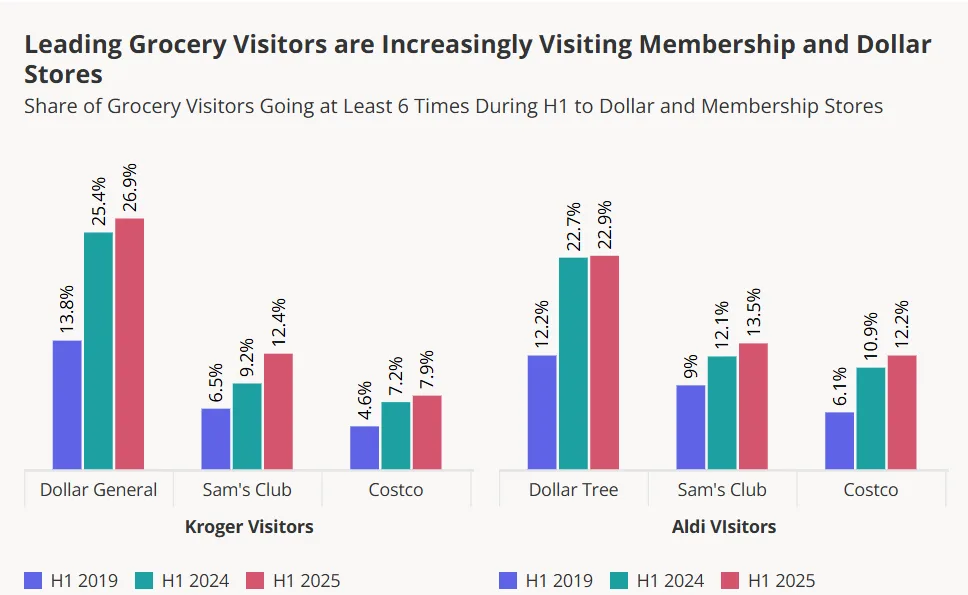

A Shift From Convenience To Product Perfection

Retail traffic outpaced dining in H1 2025, in part due to a growing consumer willingness to visit multiple chains for specific products. This fragmentation of shopping habits has benefited niche and limited-assortment grocers. Value-first stores like Aldi and Dollar Tree are also gaining as shoppers piece together their ideal cart across multiple stops.

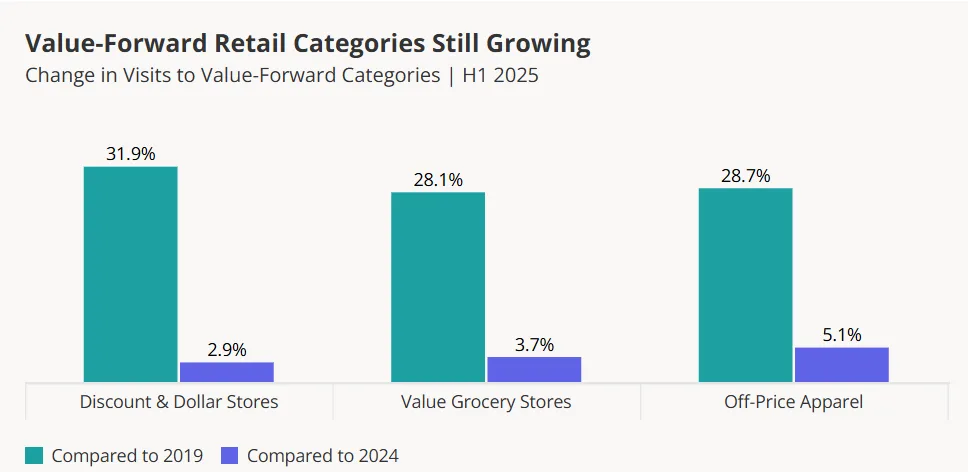

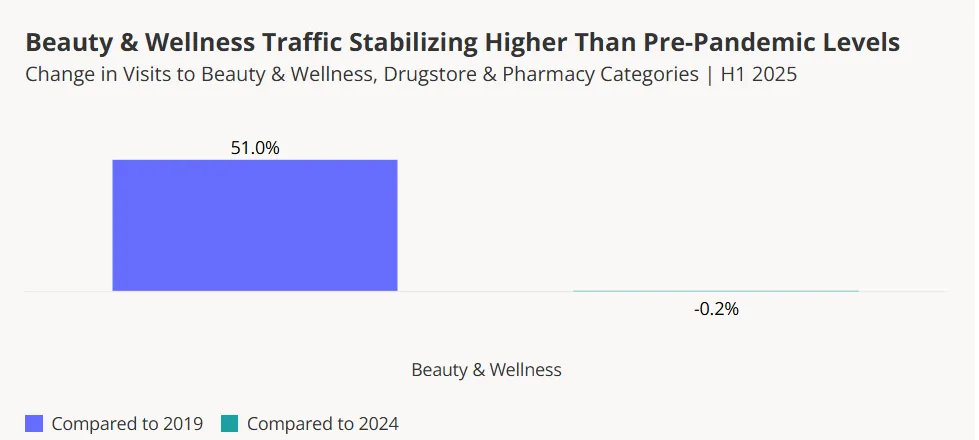

Value Perception Drives Growth – And Differentiation

Discount retailers, dollar stores, and off-price apparel have seen traffic growth of roughly 30% since 2019, with YoY growth still climbing. But value alone doesn’t guarantee success. Chains like Ulta and drugstores have seen visits plateau, suggesting that clear value positioning—not just low prices—is essential to drive continued consumer engagement.

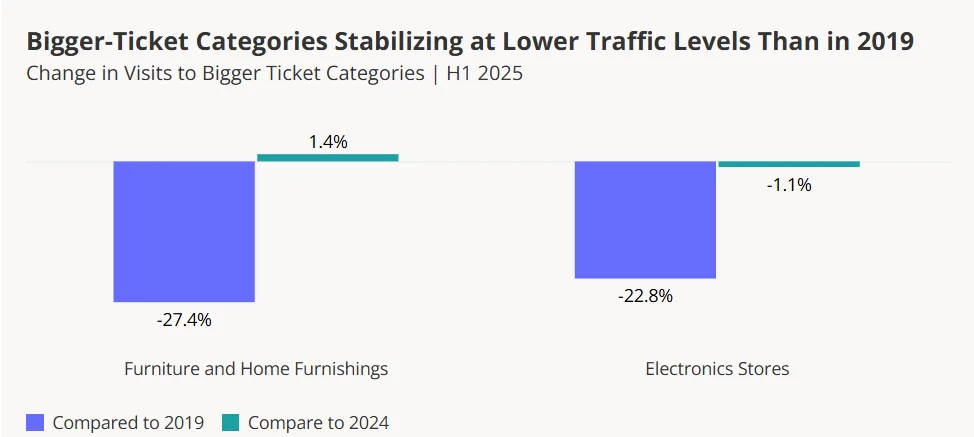

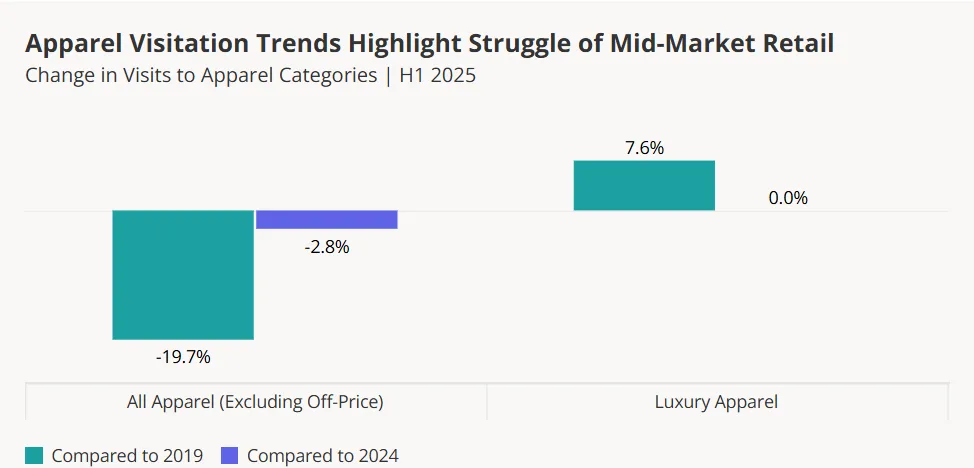

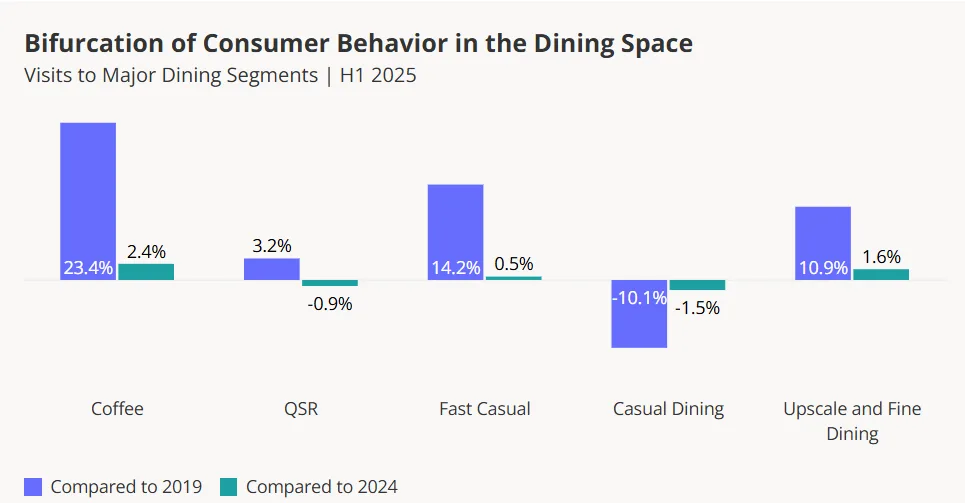

High-End And Low-End Thrive, Mid-Market Struggles

This bifurcation is reshaping categories:

- Apparel: Luxury and off-price chains are gaining ground, while mid-market players like department stores lose share.

- Dining: Quick-service and upscale restaurants are both growing, but full-service casual chains are shrinking—except for brands like Chili’s that have effectively doubled down on value.

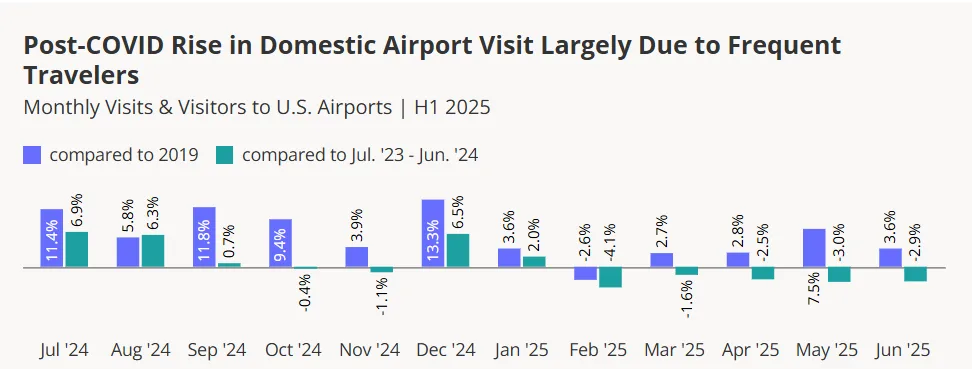

Experiences Take A Back Seat

While travel has rebounded among frequent flyers, casual airport visits remain below 2019 levels. This suggests many Americans are choosing to spend on retail and dining over discretionary experiences.

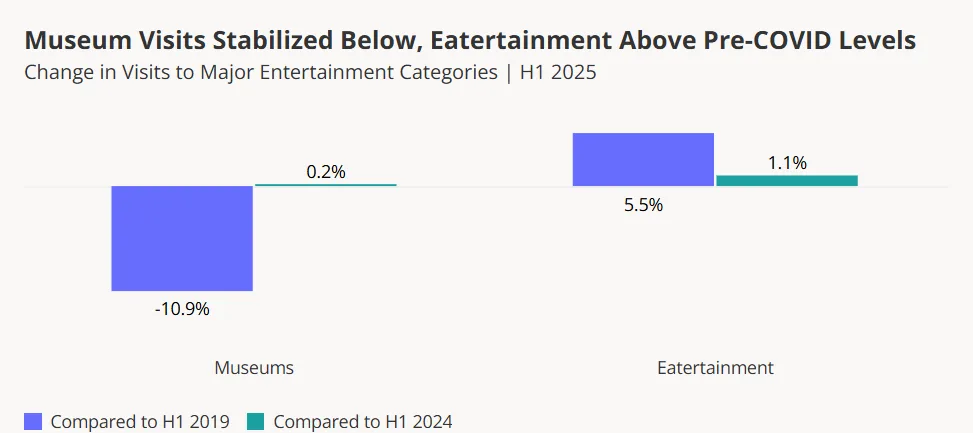

The entertainment landscape is similarly divided:

- Eatertainment venues like Top Golf have surpassed pre-pandemic traffic levels.

- Museums have stabilized at ~11% below 2019 visits.

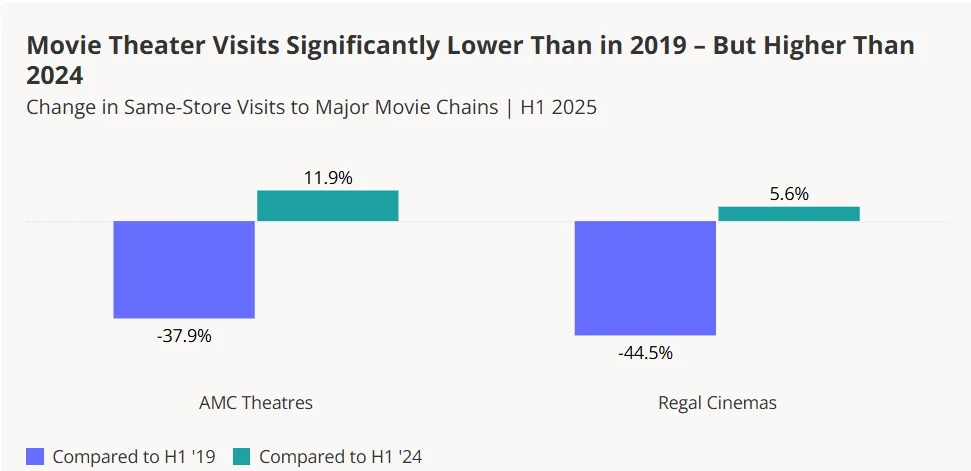

- Movie theaters remain volatile, with box-office hits driving temporary spikes, but overall traffic still lags.

The Office Is Still Quiet

Despite modest YoY growth (+2.1%), visits to office buildings remain 33.3% below 2019 levels. Even in return-to-office strongholds like New York and Miami, traffic gaps persist, underscoring the structural shift to hybrid work.

Value, Premium, Or Bust

The post-COVID consumer landscape is no longer defined by temporary disruption—it’s a restructured reality. Winners in today’s market are brands that clearly signal value or deliver elevated experiences. Those stuck in the middle face an uphill battle as consumer priorities—shaped by years of economic uncertainty—have crystallized into new spending norms.