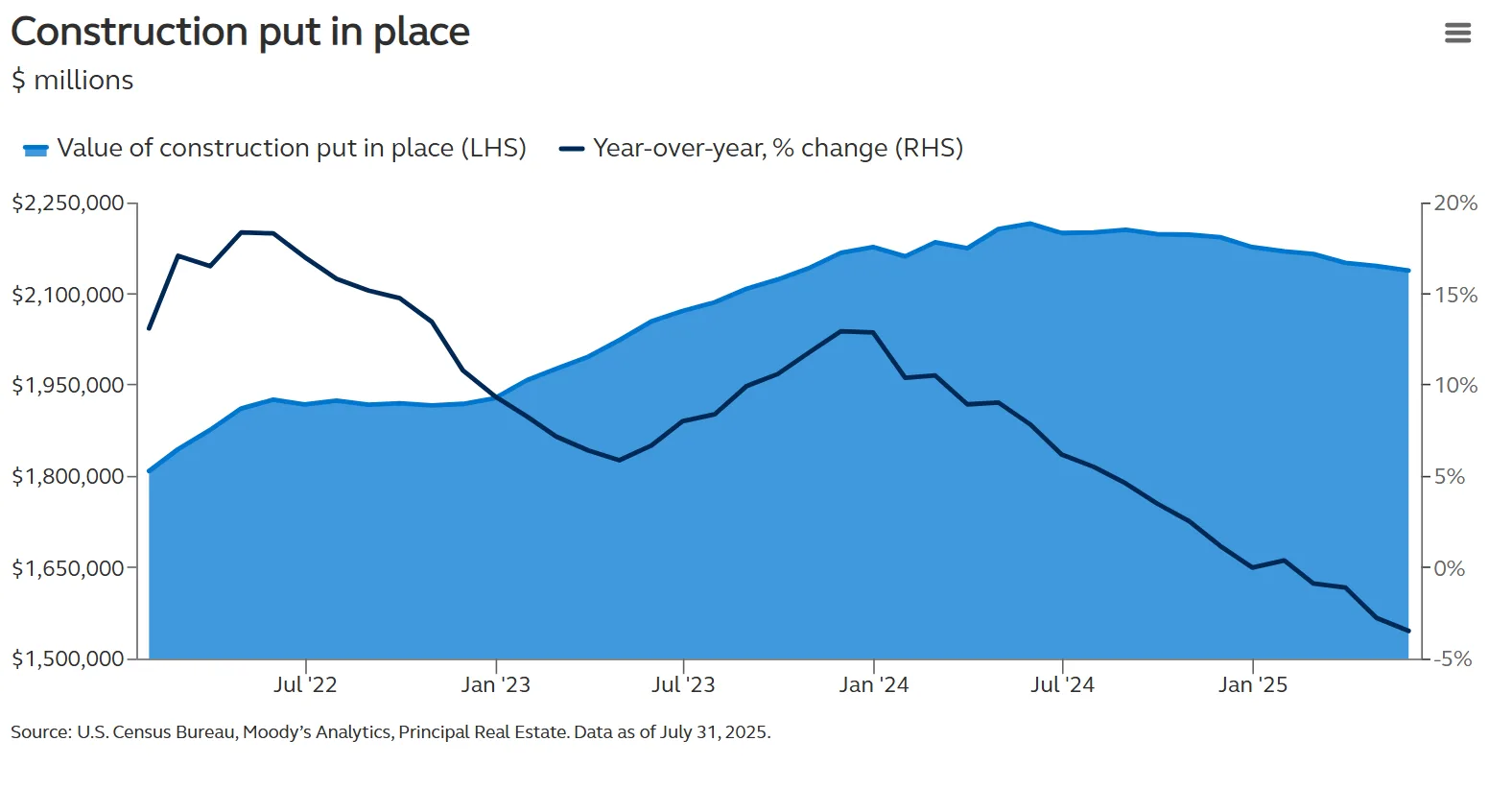

- US construction spending fell 0.3% in May, the ninth consecutive monthly decline since September 2024, and is down 4% year-over-year.rn

- The slowdown reduces future supply pressures, potentially supporting stabilization in commercial real estate (CRE) values.rn

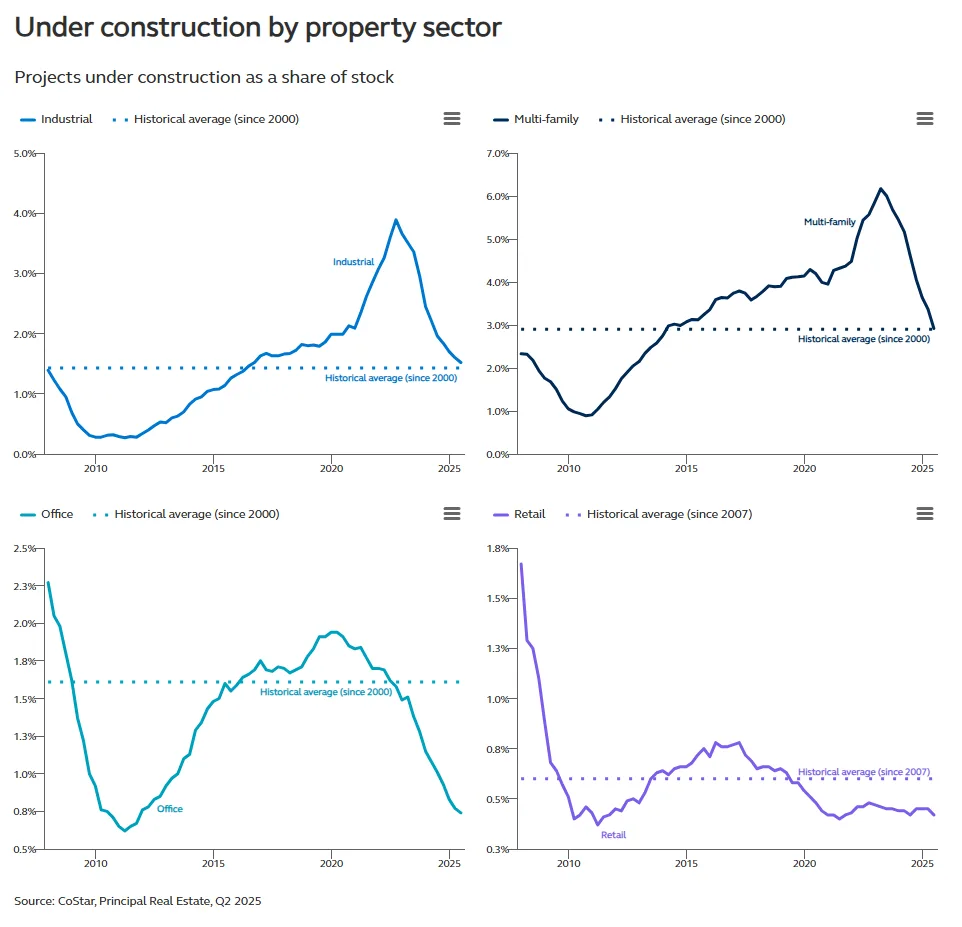

- Industrial and multifamily sectors are seeing benefits from the pullback, while office and retail remain structurally challenged.rn

- Lower development activity may open new opportunities for investors amid easing competition and moderating job growth.rnrnrn

A Development Dip That Could Benefit CRE

The latest US Census Bureau data shows construction spending declined by 0.3% in May 2025—marking nine straight months of contraction. On a year-over-year basis, total spending is down 4%, reflecting a broader trend of reduced development amid high borrowing costs and uncertain macroeconomic conditions.

While this decline raises questions about the health of the construction pipeline, it may be good news for CRE stakeholders, per Principal Asset Management. With less new product coming online, existing properties face less future supply competition, allowing the market to absorb current inventory and stabilize fundamentals.

Sector by Sector: Where the Slowdown Is Helping

Multifamily and industrial have been among the most active sectors in recent years, but also saw pockets of overbuilding. The current drop in construction activity—down 50–60% for both sectors—has helped rebalance the market. Occupancy rates are stabilizing, and net operating incomes are showing resilience, particularly in markets that had faced elevated vacancy.

Office and retail, on the other hand, remain in slower recovery modes. Office construction continues to lag due to persistent hybrid work trends and underused inventory. Meanwhile, retail development—already muted since the Global Financial Crisis—has shifted to retrofitting outdated space, rather than building new.

The Bigger Picture: Supply Reset and Investor Implications

This construction slowdown reflects broader challenges—higher interest rates, rising carry costs, and diminished returns on new development. But it also offers a reset for CRE markets. With fewer new projects in the pipeline, existing assets may benefit from stronger fundamentals and less competition.

For income-oriented and core investors, the environment could support more stable returns as property values begin to recover. And while high borrowing costs may constrain speculative activity, they could also usher in a more disciplined, fundamentals-driven cycle of growth.

What’s Next

As construction slows, CRE could be entering a more investor-friendly phase marked by supply discipline and stable operating performance. Look for long-term opportunities in sectors where demand remains strong—and where new development is no longer outpacing absorption.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes