- New York City leads globally with an average commercial construction cost of $534 PSF, according to Turner & Townsend.

- San Francisco, Los Angeles, Chicago, and Philadelphia round out the top five most expensive US cities for commercial building.

- Construction costs are climbing nationwide, driven by rising material prices, skilled labor shortages, and regional permitting differences.

- While Sun Belt cities like Dallas and Houston offer lower costs, they’re facing labor shortages and rising inflation forecasts.

Construction Costs Hit New Heights

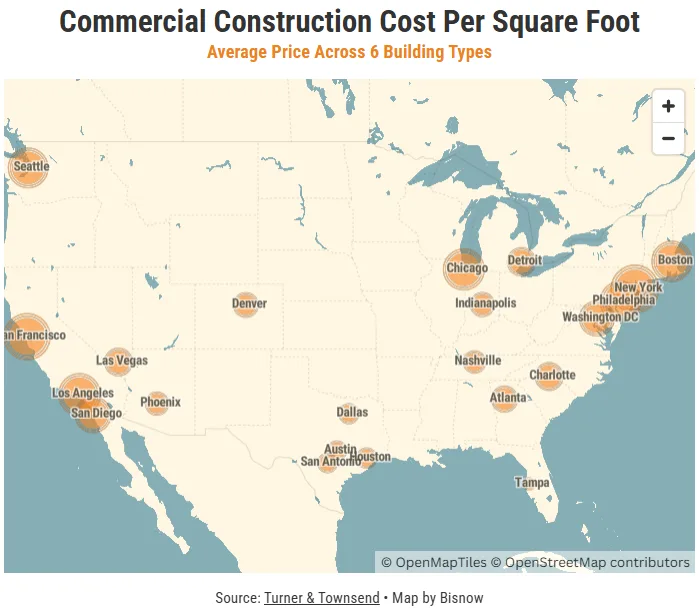

It now costs more to build commercial real estate in New York City than anywhere else on the planet, per Bisnow. At $534 PSF, NYC ranks as the most expensive construction market globally, according to a new Turner & Townsend report. San Francisco follows at just over $500 PSF, making it the only other US city to cross that benchmark.

These cities far outpace the national average and signal a growing divide between major coastal metros and other regional markets.

Top US Construction Markets by Cost

Los Angeles ($445/SF), Chicago, and Philadelphia round out the top five most expensive commercial construction markets. Seattle, Boston, and Washington, D.C., also land in the top 10, with costs driven by high labor wages, local building standards, and increasingly stringent environmental regulations.

Nine US markets now exceed $400 PSF, highlighting how localized factors—like permitting delays and sustainability targets—are reshaping development economics.

Material Costs and Labor Shortages Fuel Price Pressure

Construction material prices are still climbing. June saw a 0.2% monthly increase in overall material costs, while the past year has brought steep hikes for key inputs: aluminum is up 17%, copper 9.5%, and concrete pipes 7%.

Simultaneously, a labor shortage is weighing on builders nationwide. More than two-thirds of US construction markets report a lack of skilled workers, and wages—averaging $70/hour—are the third-highest globally. Turner & Townsend found that only 17% of industry respondents expect labor availability to improve in the near future.

Sun Belt Markets: Cheaper, But Heating Up

While building costs in New York and California dominate the headlines, construction is still relatively affordable in the Sun Belt. Cities like Houston, Dallas, Austin, and San Antonio—all ranked 18th or lower—remain cost-effective due to lower labor rates and looser regulations.

However, that affordability may not last. These cities are forecast to experience some of the highest construction cost inflation in 2025. And with labor pools thinning even in traditionally cheaper markets, developers are already absorbing higher costs to import skilled workers from surrounding regions.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Why It Matters

Despite high costs, commercial development continues to climb. The US logged $1.24 trillion in nonresidential construction spending in May—just shy of the all-time high—demonstrating the sector’s resilience. Still, the growing divergence in construction affordability could reshape where and how developers pursue projects in the coming years.

What’s Next

Expect cost pressures to persist through 2025, with tight labor markets and geopolitical trade shifts driving further material price volatility. Sun Belt cities will likely remain go-to destinations for cost-conscious developers—but rising inflation and labor shortages could challenge even these relatively affordable markets moving forward.