- Community banks saw double-digit earnings growth in H1 2025, fueled by margin expansion from asset repricing and lower funding costs.

- The delayed economic impact of tariffs is expected to slow loan growth, increase delinquencies, and push up credit loss reserves by year-end.

- Despite ongoing credit normalization, strong funding bases and stable credit performance may spur renewed bank M&A activity.

Community banks in the U.S. have posted solid earnings in the first half of 2025, thanks to widening net interest margins and strategic balance sheet management. But as new tariffs begin to ripple through the economy, headwinds are emerging that could soften results going forward.

A Strong First Half

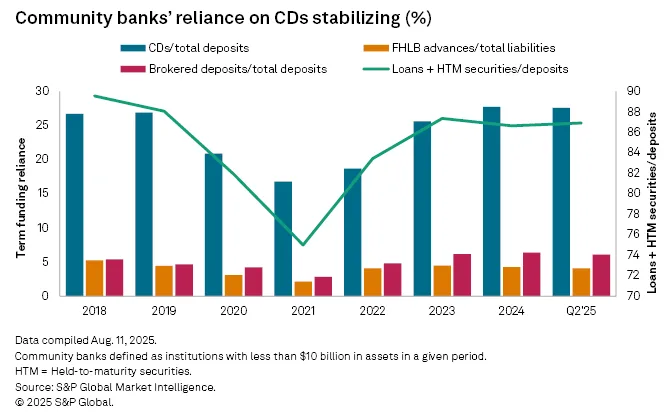

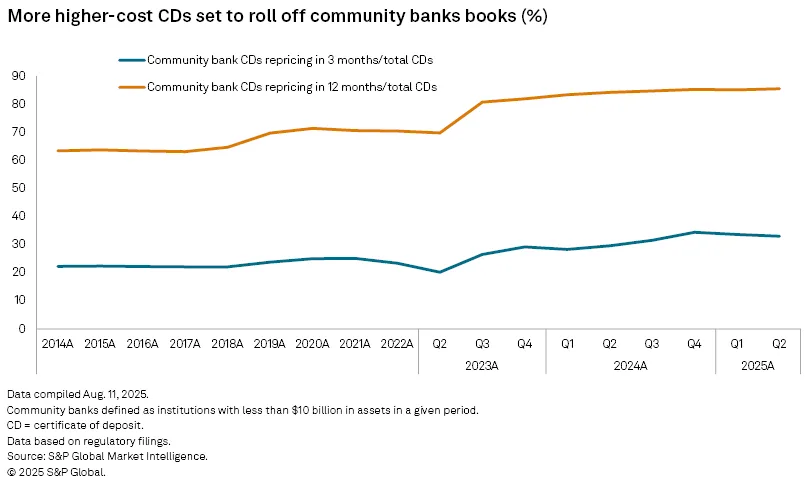

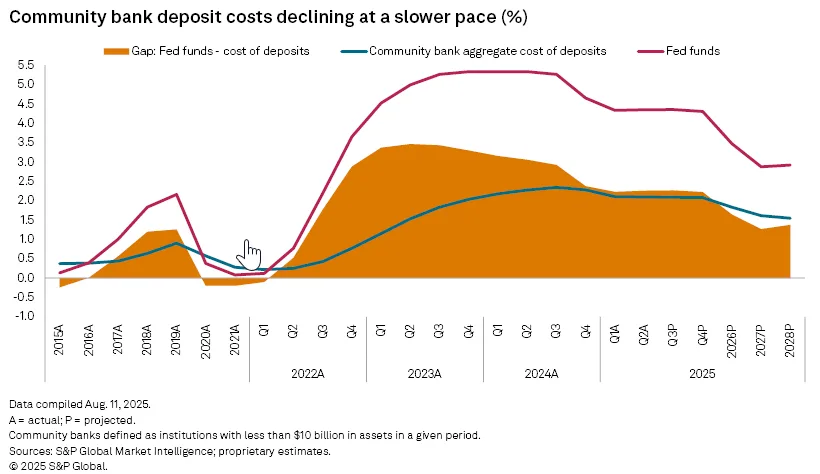

Margin expansion has been the key driver of earnings, supported by a favorable repricing cycle as low-yield pandemic-era assets are replaced with higher-yielding instruments. Despite a slowdown in the decline of deposit costs, community banks have managed to maintain profitability.

The Tariff Effect Looms

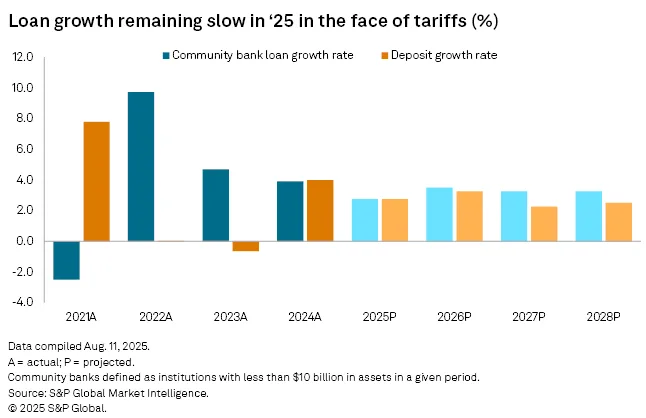

Although borrowers and businesses have so far cushioned the impact by stockpiling inventory, analysts expect trade-related disruptions to weigh on loan growth and push credit costs higher in the second half of the year.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Credit Quality Normalizing

Delinquencies have risen modestly from historical lows, with nonaccrual loans ticking up to 0.67% in Q2 2025. Commercial real estate (CRE) remains a key concern, as hybrid work reduces cash flow while higher interest rates increase debt servicing costs.

Reserve Building Begins

Anticipating future stress, banks are increasing reserves—up to 1.30% of loans in Q2—with expectations of further builds into 2026. Provisions are projected to rise to nearly 15% of net revenue, compared to 10.4% on average between 2014 and 2019.

Strategic Shifts Ahead

With slower loan demand, analysts recommend that banks tighten lending standards, prioritize high-quality borrowers, and focus on building stronger funding bases. A more cautious approach now could pay off in the next downturn.

M&A Outlook Brightens

While M&A activity has been muted, improving valuations and a more favorable regulatory backdrop may bring buyers and sellers back to the table. Slower growth and rising credit costs could motivate more institutions to consider consolidation.

Why It Matters

The resilience of community banks in 2025 highlights their adaptability, but emerging risks from trade policy, consumer strain, and CRE stress suggest that performance may soften. Positioning for long-term stability—rather than near-term growth—could define winners in the next cycle.