- For the first time in decades, commercial real estate (CRE) returns are outpacing housing prices during a non-recessionary environment.

- While CRE values dropped nearly 20% through late 2024, returns turned positive in 1Q25, driven by steady income and improving lending conditions.

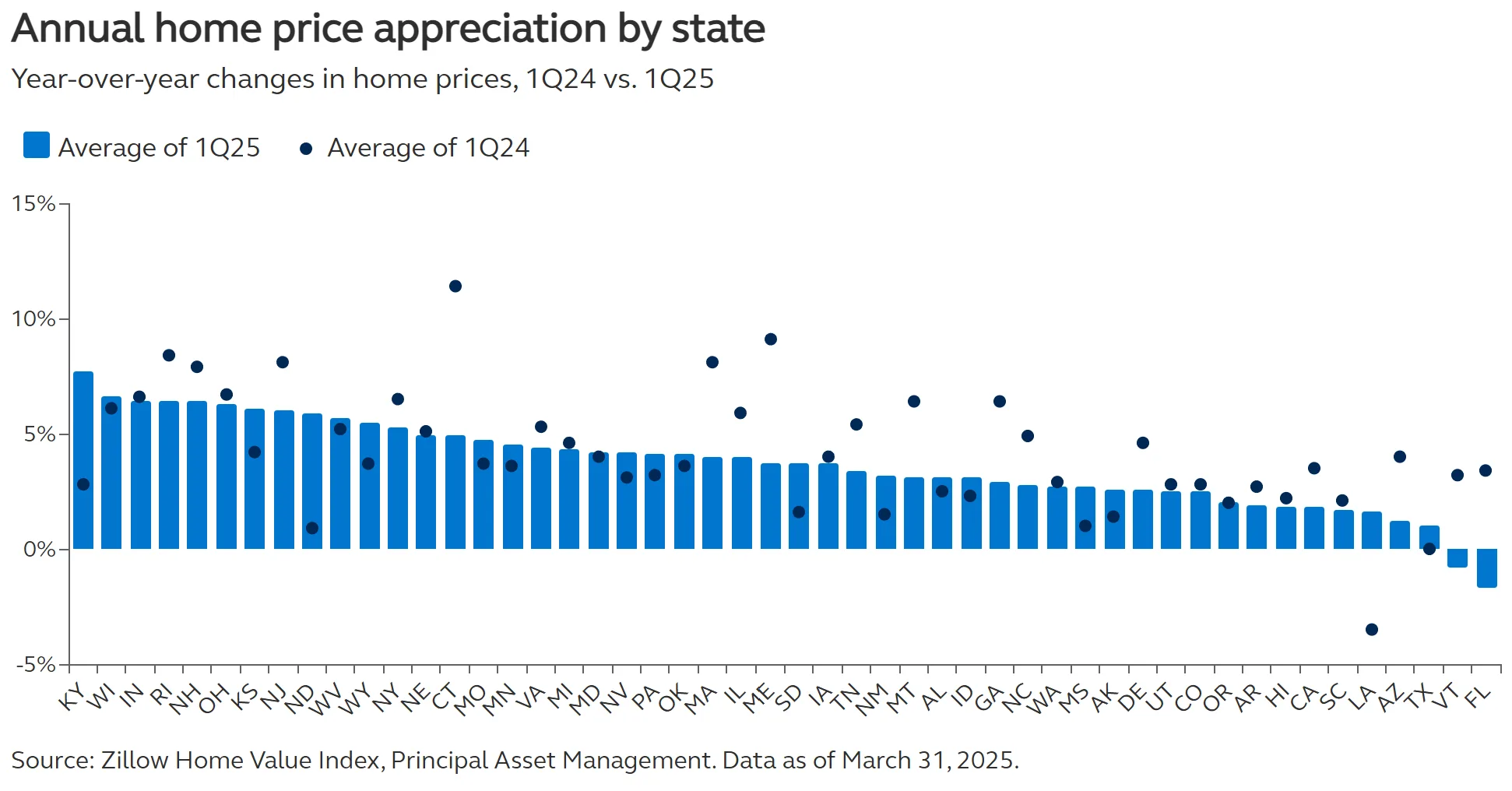

- Residential home prices are beginning to cool, particularly in overheated Sunbelt markets, as affordability pressures and regional supply shifts reshape the landscape.

- CRE returns are projected to continue climbing, with annualized total returns expected to hit 7% over the next five years.

A Rare Market Divergence

As reported by the Principal Asset Management, commercial and residential real estate markets typically move in sync—but not this time, as a commercial rebound takes shape following years of underperformance. Since 2023, housing prices have remained surprisingly resilient, even as CRE values fell sharply due to higher interest rates and tighter credit. Now, that trend is reversing: CRE total returns, which bottomed in 3Q24, turned positive in 4Q24 and accelerated to +2.8% in 1Q25. Meanwhile, housing price appreciation slowed to +3.4%, a steep drop from its +21% peak in 1Q22.

This kind of divergence is rare—occurring just 20% of the time since the late 1980s. What makes this instance unique is that it’s unfolding outside of a recessionary environment, a historical first.

CRE Bounces Back Despite a Rocky Start

The earlier drop in CRE was stark: unlevered valuations fell by nearly 20%, and levered valuations by over 30%. But fundamentals never faltered. Net operating income growth averaged 5% in 2023 and 3.2% in 2024—well above historical norms. As rates ease and credit conditions stabilize, those income streams are driving a rebound in total returns.

Forecasts for 2025 suggest a +5% total return for CRE, with income gains offsetting flat capital values. Looking further out, CRE returns could annualize at 7% over the next five years, eventually reaching 8–9% over a 10-year horizon.

Housing Prices Hit a Ceiling

While CRE is gaining momentum, housing is showing signs of fatigue. High mortgage rates and limited inventory have driven prices to record highs—but also locked many homeowners in, suppressing transaction volumes. As mortgage rates ease, more listings could enter the market, potentially softening prices.

Regionally, the housing market is fragmenting. In 1Q25, 60% of the markets with the slowest appreciation were in Florida and Texas, while the Midwest—led by Indiana, Kentucky, and Ohio—saw the strongest gains.

Investment Implications: CRE Enters a New Cycle

The current shift—and accompanying commercial rebound—suggests a reversion to pre-Global Financial Crisis norms, where real estate returns were more income-driven and less reliant on interest rate tailwinds. Investors should prepare for continued CRE outperformance, especially in high-quality income-generating assets.

As the disconnect between CRE and housing prices unwinds, expect the historical spread—CRE outperforming housing by an average of 300 basis points—to reassert itself. The rebound may still be in its early innings.

Bottom line

In a market cycle marked by surprises, CRE is emerging as a quiet outperformer. While housing cools under the weight of affordability and supply constraints, income-driven commercial assets are well-positioned to lead in the years ahead.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes