- As costs rise, companies are under pressure to run leaner and smarter operations.

- Quality space is in short supply. New construction is down, creating shortages in top-tier office, industrial, and housing stock.

- User experience matters more. Tenants now value comfort, wellness, and location more than ever.

- Real estate firms that fail to move beyond pilot programs risk falling behind.

What’s Changing in 2026

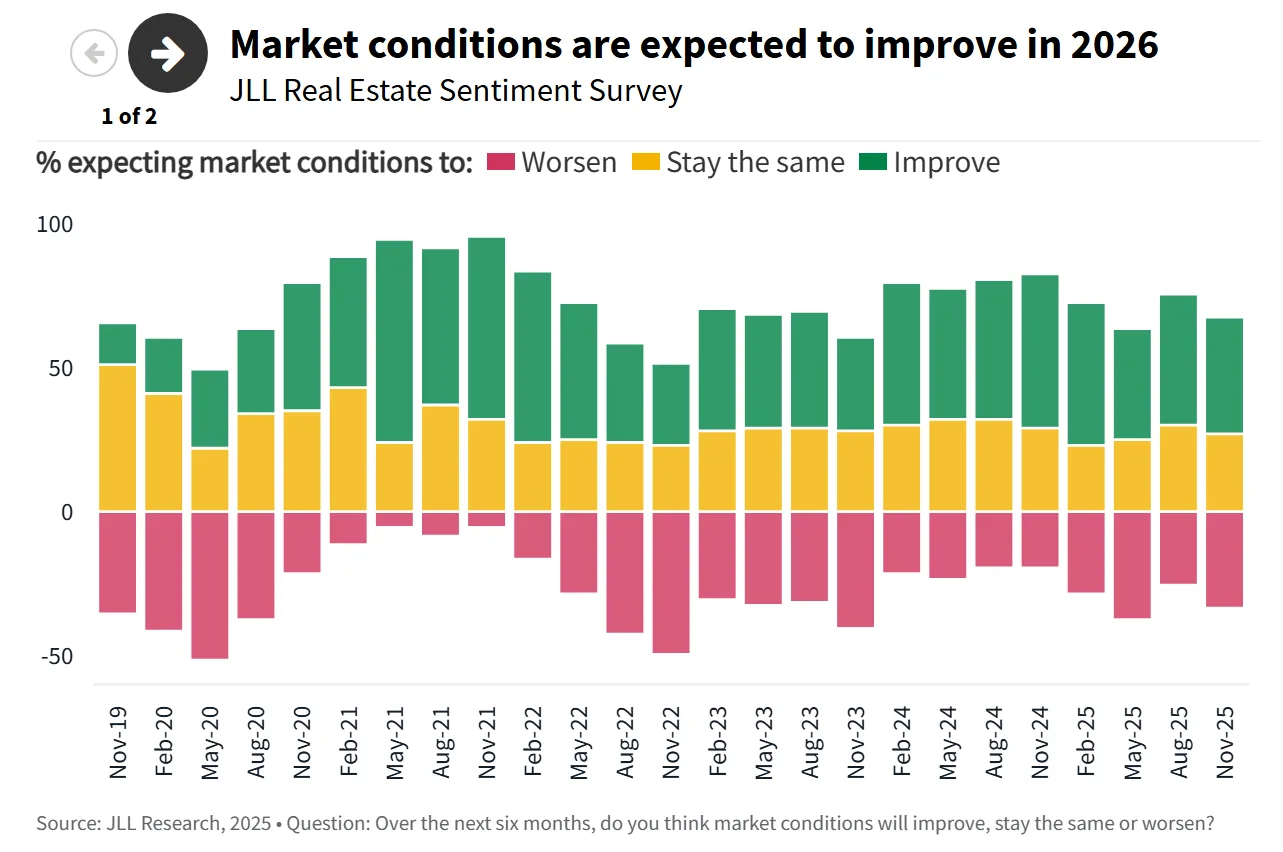

After a challenging 2025, the global real estate outlook for 2026 is looking more stable. According to JLL, interest rates are easing, inflation is cooling, and leasing activity is picking up. Even so, businesses are navigating a new landscape shaped by a mix of economic, technological, and social pressures. As a result, six powerful trends are changing how investors, developers, and tenants interact with real estate.

Rising Costs Are Driving Efficiency

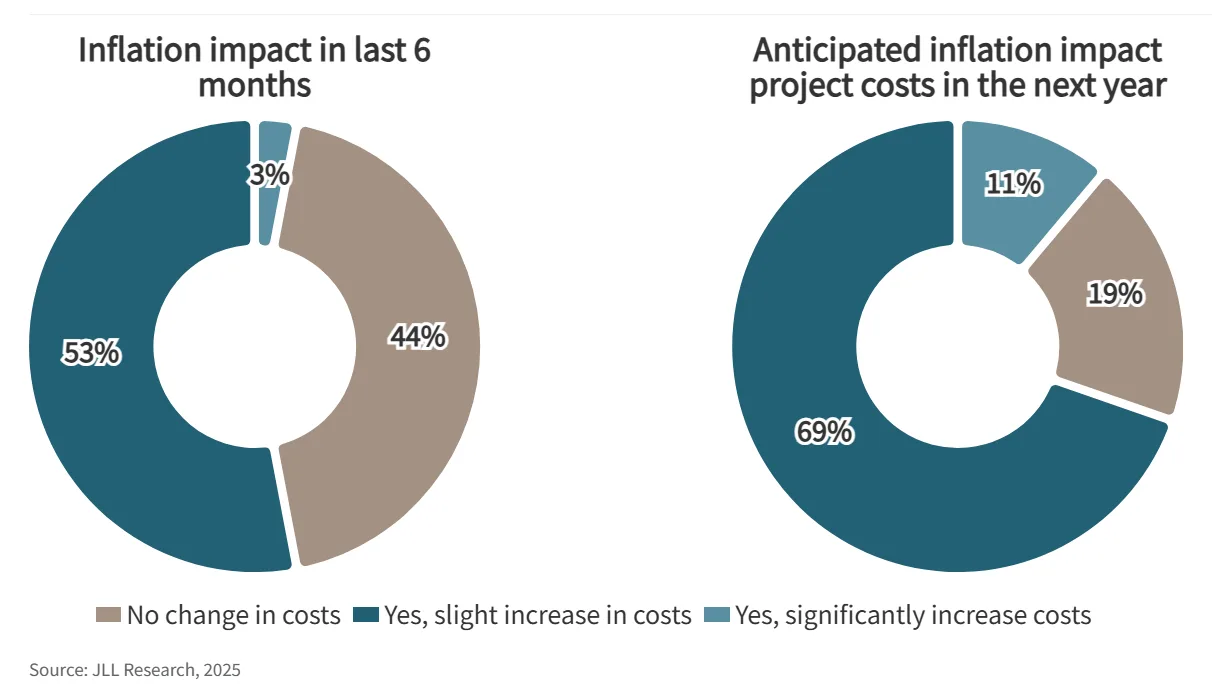

Real estate teams are under pressure. Higher borrowing costs, rising wages, and expensive construction materials are squeezing budgets worldwide. For example, in 2026, construction costs are expected to rise by up to 6% in places like Singapore and Australia.

Because of this, cutting costs has become the top priority for both owners and tenants. Companies are rethinking how they use space, trimming underused areas, and investing in smart building tech to reduce daily operating expenses.

Moreover, partnerships and outsourcing are becoming more common. Many organizations are choosing to work with outside experts to improve service delivery and lower costs. Still, every cost-saving decision must consider its impact on employee satisfaction, productivity, and long-term goals.

High-Quality Space Is Running Low

Due to economic uncertainty and high development costs, new construction has slowed. In fact, office completions in the US will drop by 75% in 2026, and many planned buildings are already leased.

This shortage is not limited to offices. Industrial, housing, and retail development is also declining. At the same time, demand continues to rise, especially for newer, energy-efficient buildings. As a result, rents are climbing, and competition for top-tier space is growing—especially in cities like London, New York, and Tokyo.

In response, building owners are looking to upgrade existing properties. Retrofitting older buildings can be faster and more cost-effective than new builds. Additionally, energy upgrades early in a building’s life can increase returns by over 50%.

Experience Is the New Standard

Today, people expect more from the spaces they use. Offices, homes, and stores all need to offer better comfort, wellness, and design. Simply put, people don’t reject the office—they reject a bad office experience.

Because of this shift, experience is now a major value driver. Research shows that when employees feel good about their workspace, they are more likely to show up and perform well. Features like natural light, plants, flexible layouts, and easy access to amenities all make a difference.

Importantly, location is key. Offices in lifestyle areas with nearby restaurants, entertainment, and outdoor spaces can charge 30% more in rent. Younger workers especially want to work in vibrant neighborhoods.

Therefore, smart real estate strategies now include place-making—creating spaces that feel connected, enjoyable, and worth the commute.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

AI Must Scale or Stall

Last year, most real estate firms tested out AI tools—from energy tracking to portfolio management. However, only a small number actually reached their goals. In 2026, many of these companies will face a hard choice: scale AI or stop it altogether.

Right now, a lack of planning and technical talent is holding many firms back. For example, 70% of occupiers still don’t have a change management plan for AI, and half lack the needed digital skills.

As AI moves from test runs to core business tools, companies that take a structured, long-term approach will gain a big advantage. These leaders will use AI to improve decision-making, streamline operations, and uncover new market opportunities. Meanwhile, others may fall behind.

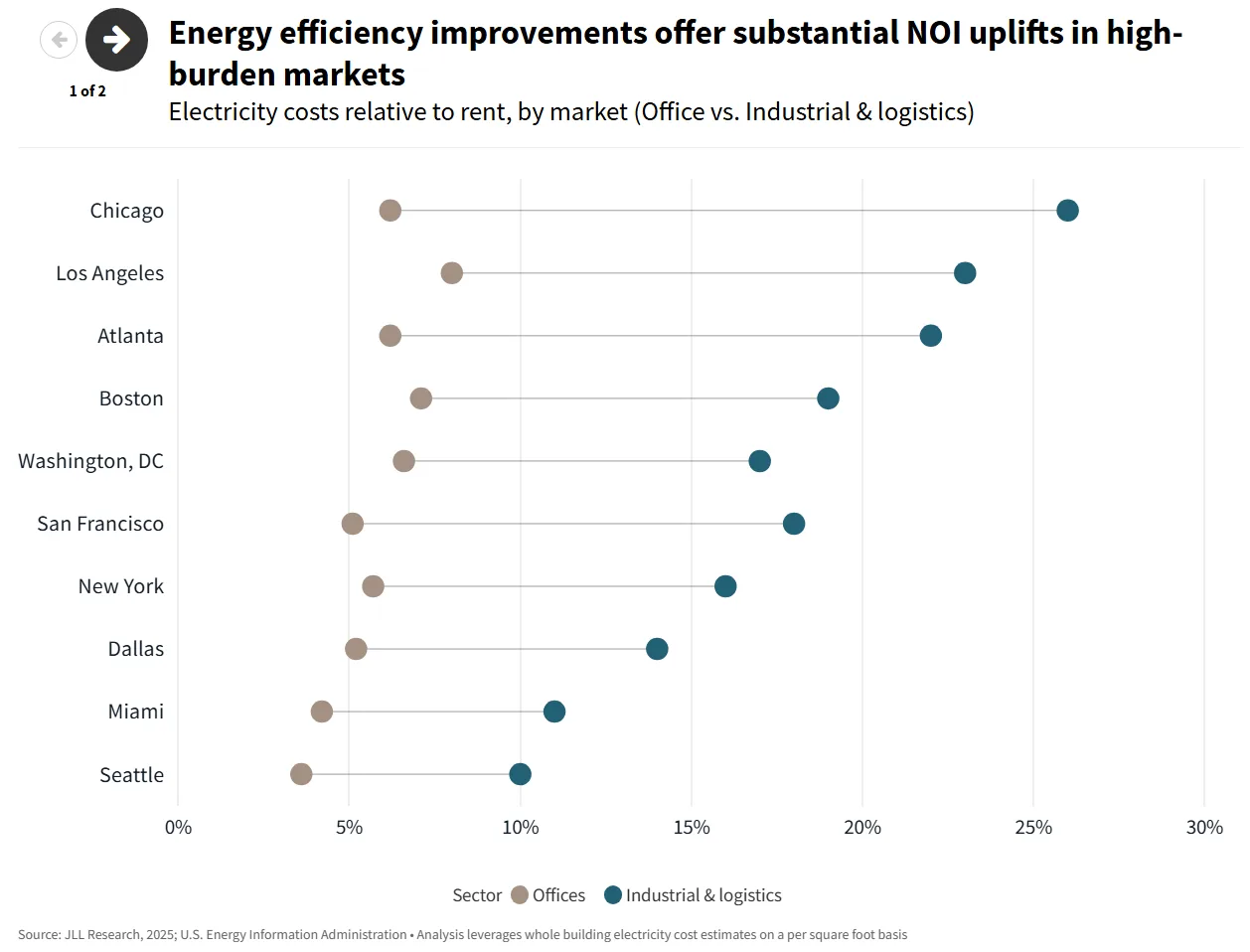

Energy and Real Estate Are Now Interconnected

Another major shift is how buildings and energy systems interact. In the past, buildings simply used power. Now, they are starting to produce and manage it as well.

Rising demand from industries like data centers is straining power grids. In some regions, this has led to electricity price spikes of over 250% in a single month.

Therefore, more building owners are turning to solar panels, energy storage, and smart power systems. In markets like California, Germany, and China, these solutions are helping reduce costs and boost reliability.

In fact, properties with built-in energy solutions can now earn up to 50% more than those without. As energy becomes more expensive and less predictable, these features are no longer optional—they’re a competitive edge.

In fact, properties with built-in energy solutions can now earn up to 50% more than those without. As energy becomes more expensive and less predictable, these features are no longer optional—they’re a competitive edge. Some investment firms are already shifting capital toward energy assets that support AI-related infrastructure, further blurring the lines between power and property strategy.

Real Estate Investment Is Becoming More Accessible

Finally, the way people invest in commercial real estate is changing. Traditionally, it was limited to large institutions and wealthy individuals. Now, that’s shifting.

New laws in the US and UK are allowing retirement funds to include private real estate. At the same time, tech platforms are making it easier for individuals to invest smaller amounts—even buying fractional shares of high-value properties.

Additionally, blockchain is making real estate investing faster and more transparent. Recent examples in Japan and Europe show how tokenized properties are gaining traction.

As a result, more people can now participate in commercial real estate, bringing new capital and broader investor diversity into the market.

Looking Ahead

The real estate industry of 2026 will reward those who think beyond the basics. It’s not just about location anymore—it’s about how well a property performs, how much value it brings to users, and how future-ready it is.

For investors, success will come from integrated strategies that link cost control, energy use, digital tools, and tenant experience. For occupiers, real estate must support growth, culture, and innovation—not just operations.

Bottom Line

The six forces reshaping commercial real estate in 2026—cost, supply, experience, AI, energy, and access—are interconnected. Companies that adapt with focus and flexibility will lead the next era of the global property market.